FirstEnergy Entreats DOE to Save Coal and Nuclear Plants

A day after FirstEnergy Corp.’s competitive arm notified PJM Interconnection it would close four uneconomic nuclear units—a total of 4 GW—in Ohio and Pennsylvania between 2020 and 2021, it urged Energy Secretary Rick Perry to issue an emergency order directing the regional transmission organization (RTO) to secure nuclear and coal capacity for long-term reliability.

FirstEnergy Solutions (FES) told PJM on March 28 it will close the 908-MW Davis-Besse Nuclear Power Station in Oak Harbor, Ohio, by 2020; the twin-unit 1,872-MW Beaver Valley Power Station in Shippingport, Pennsylvania, in 2021; and the 1,268-MW Perry Nuclear Power Plant in Perry, Ohio, in 2021. The closures are subject to review by PJM for reliability impacts. FirstEnergy has also notified the Nuclear Regulatory Commission (NRC), the Institute of Nuclear Power Operations, and the Nuclear Energy Institute (NEI) of its plan.

“The two-year-plus lead time is needed to make the complex preparations for a potential plant deactivation, including preparing a detailed decommissioning plan and working with the NRC to amend plant licenses,” the company said in a statement e-mailed to POWER on March 29.

In the interim, the plants are expected to continue normal operations as FES seeks legislative policy solutions as well as seeks potential buyers as another alternative, it said.

A Cry for Help

But on March 29, FES stepped up its tactics, filing an application for an emergency order with the Department of Energy (DOE) under Section 202(c) of the Federal Power Act, a clause that gives the energy secretary extraordinary authority to order temporary connections of facilities and generation, delivery, interchange, or transmission of power to mitigate a power emergency, such as a shortage.

In a letter to Perry, FES specifically urged the DOE to “find that an emergency condition exists” in PJM’s footprint that requires immediate intervention by the the energy secretary in the form of a Section 202 (c) order. The order should direct “certain existing nuclear and coal-fired generators in PJM … to enter into contracts and all necessary arrangements with PJM, on a plant-by-plant basis, to generate, deliver, interchange, and transmit electric energy, capacity, and ancillary services as needed to maintain the stability of the electric grid,” it said. FES also asked the DOE to direct “PJM to promptly compensate at-risk merchant nuclear and coal-fired power plants for the full benefits they provide to energy markets and the public at large, including fuel security and diversity.”

FES said the regional market suffered a reliability threat that was posed by accelerating premature retirement of plants. The company cited a DOE study released on March 27 that said retirement of aging coal and nuclear generation infrastructure may be underestimated and required more study, but that gap in knowledge about impacts could give rise to reliability concerns and an inability to meet projected electricity demand.

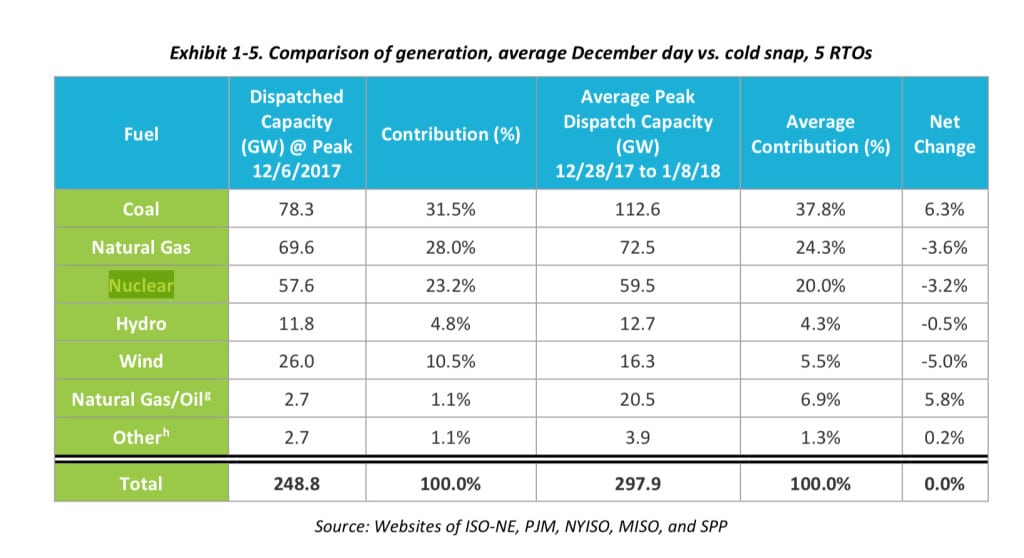

Notably, however, that report was clearly focused on highlighting coal’s contribution during the “Bomb Cyclone” this winter. In a comparison of total generation during the weather event, which took place between December 28 and January 8, in five RTOs—PJM, ISO-New England, NYISO, MISO, and SPP—the DOE noted that coal generation increased 6.3%, and gas and oil increased 5.8%, but nuclear fell 3.2%. In PJM, the report noted, nuclear’s share rose only 1% while coal generation soared 74%, and oil generation surged 22%.

On Thursday, FES said that coal and nuclear are “uniquely capable of coping with natural and man-made disruptions to power generation fuel supply because both can store fuel onsite for more than a year, unlike natural gas or alternative energy sources.” The company went on to lambast PJM and the Federal Energy Regulatory Commission (FERC)—the regulatory body that rejected the DOE’s controversial rule on grid reliability and resilience pricing this January—for their failure to acknowledge the “critical extra value” that storing fuel onsite can offer to grid reliability and energy security.

“PJM has demonstrated little urgency to remedy this problem any time soon—so immediate action by the Secretary is needed to alleviate the present emergency,” FES President Donald R. Schneider said. Continued inaction could lead to “significant, negative outcomes for the approximately 65 million people living and working within the PJM footprint,” he said.

For Schneider, the emergency order was necessary as a “quick and decisive intervention.” It could avoid “a crisis point where such baseload generation will cease to exist in competitive markets, and to ensure that nuclear and coal-fired generators operating within PJM are compensated fairly for their costs and the benefits that they provide such that they can continue to operate and ensure a dependable, affordable, safe, secure, and clean supply of electricity,” he said.

The NEI, an industry trade group that has aggressively backed the DOE’s reliability and resiliency overtures, on Thursday meanwhile noted that over the past five years, 18 nuclear reactors at 14 sites across the nation have either closed or their premature closings have been announced. “These early shutdowns are not isolated events; they are evidence of a larger systemic problem: The full value of nuclear power plants is not recognized in the price of electricity, and policymakers are failing to act,” it said.

Maria Korsnick, NEI’s president and CEO, in a statement stressed the economic and environmental contributions of nuclear plants. “We are no longer in a moment of modest market correction—our nation’s electricity grid is enduring unprecedented tumult and challenge, scores of communities across the country are confronting dramatic economic upheaval, and our broad environmental goals collapse when you remove thousands and thousands of megawatts of carbon-free, fuel-secure generation that nuclear plants represent,” she said.

Losing the plants could mean they will be replaced with fossil fuel plants, prompting a rise in both carbon emissions and electricity prices, she added.

Contentions Are Brewing

In a statement to POWER on Thursday, however, PJM plainly refuted the argument that the FES plant closures threatened reliability. “This is not an issue of reliability. There is no immediate emergency,” it said.

“Diversity of the fuel supply is important, but the PJM system has adequate power supplies and healthy reserves in operation today, and resources are more diverse than they have ever been,” it added. “Nothing we have seen to date indicates that an emergency would result from the generator retirements. The potential for the retirements has been discussed publicly for some time. In anticipation, PJM took a preliminary look at the effect of the retirements on the system. We found that the system would remain reliable. We have adequate amounts of generation available.”

PJM also pointed out that it has established a 90-day process to review generator retirement requests, a period during which it conducts a full analysis to determine if there would be any local effects on the grid. “Competitive wholesale power markets have produced a reliable grid at the least reasonable cost. That is an important benefit for the people in our region that helps the regional economy thrive. In Ohio alone there is approximately 10,000 megawatts of generation under construction or in the review process to connect to the grid,” it said.

Meanwhile, FES’s request for an emergency order immediately and predictably incited criticism from competitors. David Gaier, spokesperson for NRG Energy—a company that produces and sells all its power in competitive wholesale markets, and which has fiercely opposed state intervention in markets via nuclear subsidies—on Thursday characterized FES’s request for an emergency order as a “solution in search of a problem.

“There is absolutely no reliability crisis in PJM—they’ve said that clearly—and PJM would study the reliability impacts of any announced retirements and would facilitate a Reliability-Must-Run agreement if it found a need,” Gaier said. “The only crisis here is for FirstEnergy’s shareholders, because its management can’t figure out how to operate its plants profitably in a competitive market. Ohio ratepayers shouldn’t be forced to pay for that.”

Environmental groups, too, chastised FES’s effort. John Moore, director of the Sustainable FERC Project housed within the Natural Resources Defense Council, told POWER in a statement on Thursday: “[FirstEnergy] is desperate to pad its bottom line at the expense of its customers. The region is awash in cleaner and cheaper resources, and [FirstEnergy] can’t compete in the market. This move is stunning given that the Federal Energy Regulatory Commission, the Department of Energy, and the state of Ohio have all rejected these bailouts.”

A Competitive Market Exit

The nuclear units FES wants to retire provided about 65% of FES’s generating fleet production in 2017. According to Don Moul, president of FES Generation Companies and chief nuclear officer, “Though the plants have taken aggressive measures to cut costs, the market challenges facing these units are beyond their control.”

The decision to deactivate the facilities “is very difficult and in no way a reflection on the dedicated, hard-working employees who operate the plants safely and reliably or on the local communities and union leaders who have advocated passionately on their behalf,” he added.

Moul called on elected officials in Ohio and Pennsylvania to consider policy solutions to recognize the importance of the plants and their 2,300 employees. “We stand ready to roll-up our sleeves and work with policy makers to find solutions that will make it feasible to continue to operate these plants in the future,” he said.

FES has faced stiff financial headwinds exacerbated by market volatility. The merchant generator is inching closer to its April 2 deadline to repay $98.9 million in senior unsecured bond maturity. Some industry observers expect that the company is likely to default on the payment.

Meanwhile, Akron, Ohio–based FirstEnergy, which suffered steep losses in 2017, has sought an exit from competitive markets. In January, as the company received a $2.5 billion equity injection from four private investment groups to boost its transition to a fully regulated utility company, it agreed to form a restructuring working group to maximize value and certainty, and “minimize the timing” to exit competitive generation.

FirstEnergy on Wednesday said that a strategic review of FES’s two remaining coal plants and one natural gas plant, totaling 5,245 MW, will continue as part of plans to exit competitive generation due to weak power prices, insufficient results from capacity auctions, and weak demand forecasts.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)