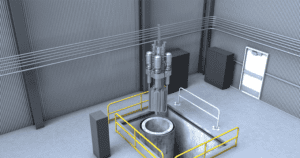

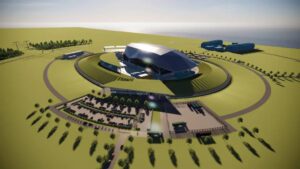

The 59-MW Gyeonggi Green Energy fuel cell park (Figure 1) in South Korea’s Hwasung City—one of the world’s largest fuel cell facilities—began operation in February. The five-acre facility built by South Korea’s largest private energy producer, POSCO Energy, consists of 21 FuelCell Energy DFC3000 power plants rated at 2.8 MW each to provide continuous baseload power to the power-strapped South Korean grid and heat for a district heating system.

Completion of the project—begun in November 2012—took only 13 months, according to project developers. And though it is the first fuel cell project of its scale for stationary power, several more are in the pipeline, evidence of an emerging trend for the fledgling alternative energy source. UK-based market intelligence firm Fuel Cell Today posits that overall shipments of fuel cell systems for stationary power in 2012 soared 50% compared to 2011, with more than 24,100 units shipped worth a total 125 MW.

Proton exchange membrane fuel cells (PEMFCs) dominated a stunning 88% of the market in 2012, because that technology is well-suited to applications from the small, sub-watt scale to the megawatt scale and can be used with different fuel types. PEMFCs are expected to continue their growth because the technology is the preferred choice in automotive applications.

But the firm also noted exceptional growth for five other specific fuel cell technologies. Molten carbonate fuel cells (MCFCs) are rising to “an equal footing with PEMFC in terms of megawatts shipped,” largely due to adoption of large stationary power plants in South Korea—like the Gyeonggi Green Energy fuel cell park—and the U.S., says Fuel Cell Today. The firm forecasts that more megawatts of MCFC will be shipped in 2013 than any other fuel cell type. Then, there are solid oxide fuel cells, which are showing increasing penetration of residential micro–combined heat and power in Japan and megawatt-scale installations in the U.S. by Bloom Energy, it said. The other three technologies are direct methanol fuel cells, phosphoric acid fuel cells, and alkaline fuel cells.

FuelCell Energy, maker of the Direct FuelCell power plant, says Asian markets, in particular, are accelerating market demand for stationary power plants. The company in October 2012 agreed to supply modules worth 122 MW to POSCO, which is pursuing a number of combined heat and power applications as well as a demonstration project at a liquefied natural gas terminal to convert boil-off natural gas to power.

Meanwhile, in Seoul City, 26 miles to the north of Hwasung City, FuelCell Energy is putting up seven DFC3000 plants for the 19.6-MW Godeok Rolling Stock Management Office fuel cell park, a project that could counter power disruptions to a nearby railroad depot when it becomes operational later this year. And in the U.S., the 14.9-MW Bridgeport fuel cell park, owned by Dominion, has been completed and is delivering power to the grid under a 15-year power purchase agreement.