The Trump Media & Technology Group (TMTG) is merging with a California-based company focused on development of nuclear fusion in a $6-billion deal. The all-stock transaction announced December 18 would create one of the first publicly traded fusion companies.

TMTG’s deal is with TAE Technologies, which is developing fusion technology for commercial applications. Sarasota, Florida-based TMTG, founded by Donald Trump in 2021, is the parent company of social media group Truth Social.

Shareholders of Trump Media and TAE would each own about 50% of the combined company, those familiar with the deal said Thursday. The announcement immediately sent TMTG’s share price higher. The company’s value has plunged this year as Truth Social has struggled; the platform is a much smaller competitor to larger, more-established social media platforms. The company has said it wants to diversify into artificial intelligence, crypto, and asset management.

For more insight into the Trump Media—TAE Technologies deal, read “Trump Media—TAE Merger: Fusion’s Public Market Leap“.

TMTG earlier this year raised $2.5 billion in support of a bitcoin treasury to buy digital currency. The group also entered a partnership with Crypto.com, the leading digital currency trading platform in the U.S.

TAE on Thursday said that as part of the transaction, TMTG agreed to provide up to $200 million of cash to TAE at signing, with an additional $100 million available upon initial filing of the Form S-4.

Executive Branch Support for Nuclear Energy

Trump in May of this year issued executive orders in support of nuclear energy, including streamlining the permitting process for new technologies and nuclear power plants. Trump’s moves followed on initiatives from the previous Biden administration, which in 2024 moved forward the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act, a law that supports the development of advanced nuclear reactors by reducing licensing times and cutting processing fees.

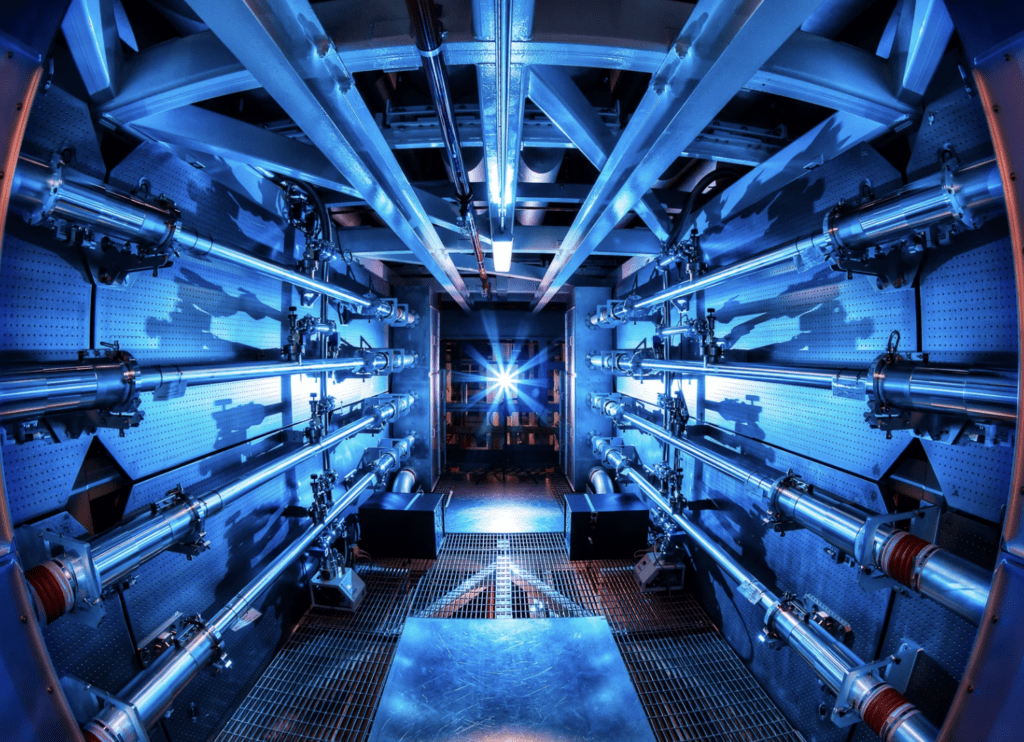

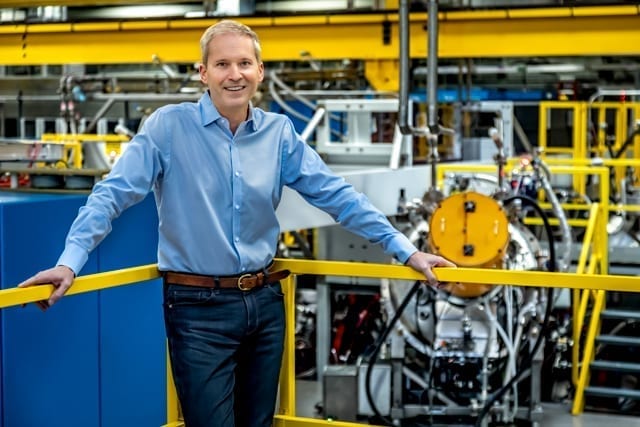

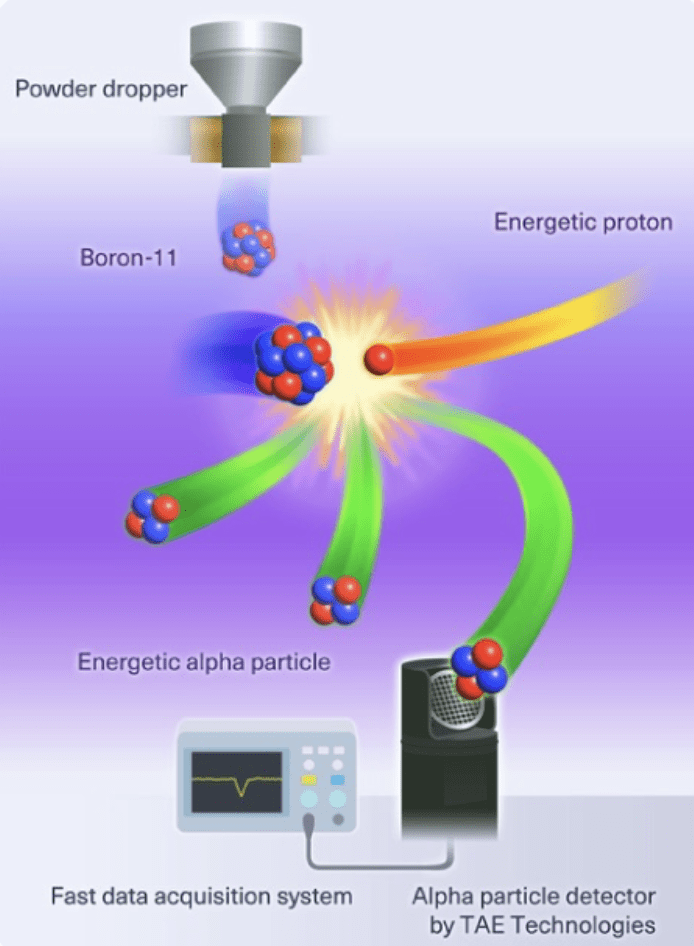

TAE, founded in 1998, is among several companies working on fusion energy technology, which promises a near limitless supply of energy and does not create nuclear waste, unlike nuclear fission. POWER featured the company in 2023 after TAE said it had completed the first-ever hydrogen-boron fusion experiments to produce a sustainable fuel for utility-scale fusion power. The firm’s CEO, Michl Binderbauer, was the subject of a POWER Interview in 2021.

The Fusion Industry Association said fusion groups raised more than $2.6 billion for research and development in the first seven months of this year. Several companies, such as Commonwealth Fusion Systems in Massachusetts, are working on pilot projects.

50-MW Fusion Power Plant

Reports Thursday said the combined companies expect to start work next year on a fusion power plant with as much as 50 MW of generation capacity, later scaling up to 500 MW.

Dan Ives, a tech analyst with Wedbush Securities, in a note Thursday wrote: “TAE has more than 25 years of R&D in the lab and safely built and operated five fusion reactors and importantly proven major energy and fusion breakthroughs over the years, putting TAE at the top of the mountain in the fusion global scene in our view.” Ives added, “TAE will also clearly have major political support from President Trump in our view and this importantly will create a major nuclear fusion U.S. energy domestic bet over the coming years.”

Industry analysts have said nuclear power could be key to providing the amount of energy needed to supply the massive demand from artificial intelligence (AI) and data centers in coming years. Several major tech companies, including Microsoft and Alphabet, the parent of Google, are investing in nuclear power. Alphabet is an investor in TAE.

‘America’s Answer to Fusion Energy’

Daniel Newman, CEO of Futurum, a data intelligence and technology research group, in a statement emailed to POWER said, “This morning’s news announcement is no less than America’s answer to Fusion Energy and its role in AI Dominance. We spent the past few weeks advising on today’s merger deal announced between TMTG and TAE. At the conclusion of the process, we walked away absolutely blown away by the vision, leadership, and innovation of TAE and we see it as one of the most promising paths to achieving abundant clean fusion energy while powering Americas AI boom and supporting Americas critical path to energy independence.”

Newman added, “AI is currently in an all-hands-on-deck moment and every part of the data center supply chain is constrained. It isn’t just compute, memory, and networking—energy is our biggest risk and while we fell behind China and shelved nuclear for decades, it is clearly our best route to accessing the energy needed to enable the U.S. to lead the world in the AI revolution and deliver more affordable energy to our citizens. n an era where the U.S. is bringing critical suppliers to the forefront to solve manufacturing, critical resources, and rear earths, we believe there is a need a U.S. energy champion and this deal between TMTG and TAE has the potential to deliver that outcome.”

Devin Nunes, CEO of TMTG, will be a co-CEO of the combined company along with Binderbauer of TAE. The companies said Nunes and Donald Trump Jr. will be two members from TMTG to join the nine-member board of the combined company. Nunes on Thursday said the merger was a “big step forward towards a revolutionary technology that will cement America’s global energy dominance for generations.”

“Fusion power will be the most dramatic energy breakthrough since the onset of commercial nuclear energy in the 1950s—an innovation that will lower energy prices, boost supply, ensure America’s A.I.-supremacy, revive our manufacturing base and bolster national defense,” said Nunes. “TMTG brings the capital and public market access to quickly move TAE’s proven technology to commercial viability.”

TAE Investors

Investors in TAE include Chevron Technology Ventures and financial services company Charles Schwab, along with several venture capital firms. Investors also include Goldman Sachs and Sumitomo Corporation of Americas. TAE said Michael B. Schwab, founder and managing director of VC firm Big Sky Partners, is expected to be named chairman of the newly formed company.

“Through my involvement with TAE over the two decades, I’ve watched first-hand their commitment to science and the promise of applying fusion power to help solve the world’s demand for clean, abundant, affordable energy,” said Schwab. “With the infusion of TMTG’s significant capital, TAE is on the precipice of scaling its leading technology to usher in a new era of energy abundance. The world needs energy, and fusion is the clear answer.”

Binderbauer in an investor call on Thursday said TMTG had a “fortress balance sheet.” Binderbauer said the merged companies were moving toward “first power in 2031.”

Binderbauer added, “Our talented team, through its commitment and dedication to science, is poised to solve the immense global challenge of energy scarcity. At TAE, recent breakthroughs have prepared us to accelerate capital deployment to commercialize our fusion technology. We’re excited to identify our first site and begin deploying this revolutionary technology that we expect to fundamentally transform America’s energy supply.”

TAE earlier this month announced a joint venture with the UK Atomic Energy Authority to commercialize its fusion energy technology, including for non-energy uses such as medical applications.

Futurum on Thursday released a report detailing its review of the fusion technology involved in the merger. The company said the deal “follows an extensive review of technical and peer-reviewed milestones—including the achievement of plasma temperatures exceeding 75 million C. Futurum has validated TAE’s Field-Reversed Configuration (FRC) as a fundamentally distinct and scalable approach to fusion.”

Futurum in its report said that “unlike legacy designs, TAE’s roadmap utilizes commodity supply chains and a ‘dual-path’ strategy that offers a robust economic fallback, effectively de-risking the path to commercialization.”

—Darrell Proctor is a senior editor for POWER.