The POWER Interview: American Battery Factory Ramps Up U.S. Manufacturing

Support for battery energy storage, and manufacturing of equipment for the electrification of transportation, is spurring construction of battery factories across the U.S.

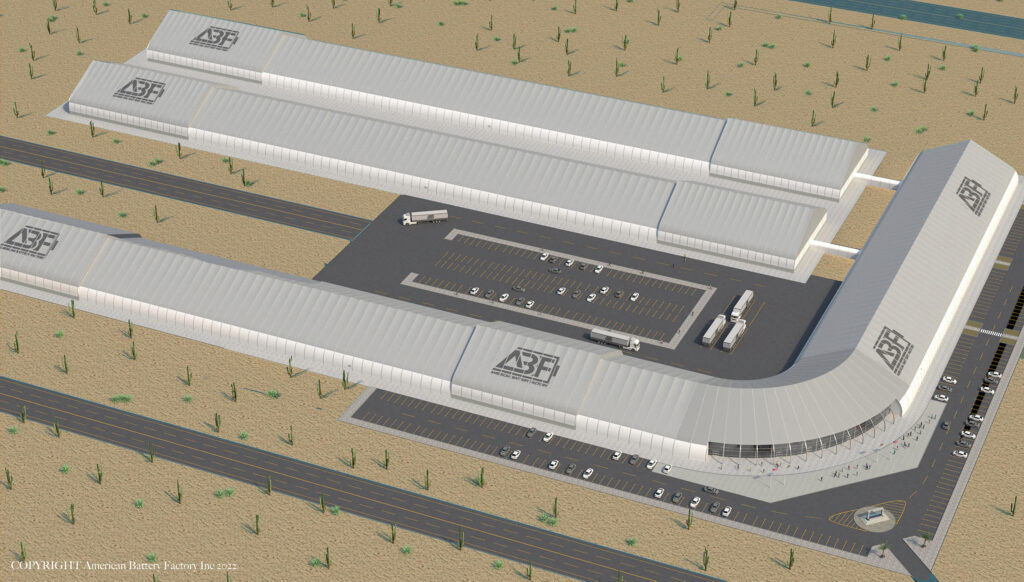

American Battery Factory, a leader in development of lithium iron phosphate (LFP) battery cells, recently announced a partnership with Lead Intelligent Equipment (LEAD) to secure custom automation equipment and machinery that will be used in ABF’s first gigafactory in Tucson, Arizona.

Arizona is a popular spot for battery manufacturing. LG Energy Solution in early April announced it would complete a $5.5 billion complex in that state, featuring two manufacturing facilities, which would be the company’s first standalone cylindrical and energy storage system (ESS) battery plants in North America.

KORE Power, meanwhile, is opening its KOREPlex battery factory in Maricopa County, Arizona. Construction of that project began in 2022.

ABF held the groundbreaking for its facility in October of last year, and in March of this year said its gigafactory would produce battery cells for numerous applications. The factory will feature a fully automated production line, built from the ground up to provide a tailored solution for assembly. The manufacturing process will have equipment to cover every key step of making battery cells, from mixing and coating to stacking and packaging. Machinery will include the slurry system, cathode and anode laser chamber, and turnkey line equipment. LEAD will initially provide onsite support including system installation, commissioning, and training.

ABF is working with U.S.-based companies to secure additional equipment, building controls, software, programmable logic controllers, cyber systems, construction and more. The company has previously announced partnerships with Honeywell, First Phosphate, Anovion, Celgard, FNA Group, and Lion Energy to provide an array of solutions including digital platforms, lithium sourcing, anode and separator materials, and battery pack integration.

The gigafactory is expected to be completed in 2025. It will include ABF’s headquarters, a research and development center, along with the initial 2×2 GWh factory module. The company said the LFP battery cells produced onsite “will be distinct from other lithium battery chemistries, incorporating the safest chemistry and environmentally friendly design while lasting up to 10,000 life cycles/30 years.”

“In order to be fully cost competitive, we need a leading edge, fully automated process, and through our collaboration with LEAD we can achieve this,” said John Kem, president of American Battery Factory. “This is truly essential in our drive to utilize precision scanning and artificial intelligence to enable next-generation, smart manufacturing in Pima County, Arizona. By developing a domestic LFP battery cell supply chain, we will improve U.S. economic competitiveness, create high-paying quality jobs and help meet national security and sustainability goals.”

ABF has said its U.S.-made LFP battery cells are designed for deployment by battery pack integrators and energy storage solution providers across a range of markets, including utilities, data centers, telecommunications, commercial/agricultural equipment, power tools, specialized markets and national defense requirements.

Kem recently provided POWER with insight into his company, its manufacturing plans, the Arizona factory, the outlook for battery manufacturing, and the market for battery energy storage.

POWER: Can you speak to your background and how that impacts your role as president of ABF?

Kem: I spent 35 years in the U.S. Army and retired as an Army two-star general, with my final position as the commandant of the U.S. Army War College. I was fortunate to lead several large, complex organizations, including the Northwestern Division of the Army Corps of Engineers, which runs the largest hydropower production system in the U.S. (Columbia River and Missouri River systems). I hope I bring leadership, perspective and an ability to create a positive climate and culture to drive to success.

POWER: What updates can you provide about the construction of the gigafactory in Arizona?

Kem: In Phase 1, ABF is building a 4-GWh lithium iron phosphate battery cell manufacturing facility and an adjacent 0.5-GWh innovation-foundry line just south of Tucson, Arizona, in Pima County. For Phase 2, ABF will build three additional 4- to 5-GWh factories to bring the complex to ~18 GWh on a total of 267 acres in Pima County, that has already been acquired in a lease-to-buy arrangement.

We have done the initial groundbreaking in Tucson and have agreements and plans in place for the key infrastructure. Tucson Electric Power has established an agreement for initial 46-kV transmission lines by February/March 2025. We have an agreed-upon site plan that accesses the nearby Raytheon Parkway for main road access, and a nearby railhead for Phase 2 levels of production.

The main building is not complex construction. It will be more than 1,500-feet long, and about 160 feet wide. But the main manufacturing line is highly automated equipment and warehouse management.

POWER: What unique battery chemistry will be utilized in manufacturing?

Kem: The chemistry (LFP and synthetic graphite) is not unique to the industry, but our advanced cell design including Z-folding structure can improve the power density and safety, charging/discharging rate, and obtain long cycle life. The cell chemistry will also evolve with some of the new chemistries (like LMFP with 20% more energy) as we experiment with how to bring new lab results to scale manufacturing. (Editor’s note: LMFP is a type of lithium-ion battery that is made based on LFP, but replacing some of the iron used as the cathode material with manganese.)

ABF will take advantage of currently utilized state-of-the-art manufacturing equipment and will work closely with established U.S. partners like Honeywell, Lead Intelligent Equipment and more to be announced, all of whom have depth of knowledge, expertise, and capabilities in sensing and controls, precise measurements and manufacturing, robotics, and automation. As a result, ABF will establish a new generation of cell manufacturing lines with high energy efficiency, high reliability and quality control due to the implementation of new energy, digital technology, and precise and robotic controls. These efforts will reestablish the capability and economic competitiveness of U.S. manufacturing, at scale, and expand U.S. skilled manufacturing workforce development.

POWER: What design will these battery cells implement? How close are we to production?

Kem: ABF owns the whole engineering package of cell design and production. We have just selected the main equipment manufacturing equipment and are working to finalize the tens of millions of dollars of auxiliary and supporting equipment. Production won’t commence until late 2025.

POWER: How many cells have been manufactured to date?

Kem: Until the main production line is built south of Tucson we don’t have any U.S. production. We do have a small pilot line (a few hundred MWh of cells per year) in China that we own. We are using it to let us experiment with input materials from U.S. and North American suppliers to validate the material as we work on U.S.-centric material inputs.

POWER: What is ABF’s current production capacity? What does the future look like for the company?

Kem: LFP prismatic cells are among the most attractive candidates for energy storage because they are lower cost, use abundant elements, have lower toxicity, are safer, offer stable cycling performance, and have a lower carbon footprint. For these reasons, ABF’s main production will be LFP cells.

POWER: How will ABF battery cells be used?

Kem: Unfortunately, private sector corporate efforts have almost exclusively focused on electric vehicle (EV) batteries for automotive purposes, and mostly U.S. final assembly of EV battery packs and limited U.S. up-the-chain supply efforts. That is why ABF can make a tremendous difference in the nation’s manufacturing efforts. Additionally, we are confident that this effort to support ‘specialized and small markets’ (like non-heavy-duty vehicles, agricultural, mining and military applications) will result in significant gains for the U.S. as domestic electrification efforts over the next five years are expected to dramatically increase demand from U.S. firms at a CAGR (compound annual growth rate) of 28.0% from 29 GWh in 2020, to 1,151 GWh in 2035.

POWER: Can you give me an update on raw material sourcing and next steps for ABF?

Kem: ABF has been working with North American suppliers for both future key materials supply and critical bulk minerals, and has signed alliance agreements or MOUs (memorandums of understanding) with several suppliers in the U.S. or Canada. ABF is also in conversation with many North American suppliers for cathode/anode materials, separators, electrolytes and cell enclosures to further secure the materials supply.

POWER: Can you speak to plans for ABF’s recycling process?

Kem: In cooperation with Pima County, we anticipate the development of a Nevada Technology Corp. battery recycling center on or adjacent to our property. ABF is also partnering with a couple of U.S. recycling partners to directly recycle manufacturing scraps and recover the cathode and anode materials that can be used in cell manufacturing.

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).