IEA’s World Energy Outlook 2025 shows the global power system entering the “Age of Electricity,” with demand accelerating faster than grids, reshaping fuel mixes, investment flows, and energy security priorities.

The world has firmly crossed into the “Age of Electricity.” That is a unifying finding in the International Energy Agency’s (IEA’s) 2025 edition of the World Energy Outlook (WEO), which shows a global power sector being reshaped simultaneously by surging demand, a geographic pivot in consumption, record solar manufacturing capacity, a wave of liquefied natural gas (LNG) export development, heightened energy security concerns, and a widening gap between generation deployment and grid readiness.

1. The Age of Electricity. As IEA Executive Director Dr. Fatih Birol observed at the report’s launch, the shift reflects the sector’s rapid pivot away from a period dominated by fossil fuel price volatility and post-pandemic overcapacity toward structurally accelerating electricity demand. For years, “IEA has been saying that the electricity demand is growing very strongly among all the fuels, and recently we said the world may enter the age of electricity, and looking at the data today in the WEO I think we can comfortably say that the age of electricity has arrived,” Birol said.

Global electricity demand is now rising far faster than overall energy consumption. Demand has already increased near 3% per year over the past decade, almost twice the growth rate of total energy demand, and accelerated to more than 4% in 2024. Under the IEA’s Stated Policies Scenario (STEPS)—which reflects current and announced government policies (without assuming future targets are achieved)—electricity consumption expands by nearly 1,000 TWh annually through 2035, driven by growing industrial electrification, rising appliance ownership, expanding cooling demand, electric vehicles (EVs), and data center growth. As Birol noted, electricity demand growth, rooted for decades in household appliances, industrial processes, and air conditioning, is now being accelerated by “artificial intelligence, air conditioners, and electric cars driving further the global electricity demand growth.”

However, the scale of the shift is unprecedented. While electricity still accounts for roughly 20% of global final energy use, it already “supplies energy to more than 40% of the global economy,” he said. IEA Director of Sustainability, Technology, and Outlooks Laura Cozzi further underscored the cumulative magnitude: “Electricity demand growth from now to 2035 is nearly identical in our STEPS and [Current Policies Scenario (CPS)],” which sets out a pathway for the future of the energy system in which there is no change in energy-related policies scenarios, she said. “The electricity demand growth is 10,000 TWh—the electricity that is consumed today in the U.S., Canada, all of Europe, Japan, Korea, Australia, all advanced economies, combined. That’s added in just 10 years. This is a very, very big shift that will demand a lot of investment and planning.”

2. Geographic Pivot—China to India, Southeast Asia. However, the report suggests the global center of electricity demand growth is shifting decisively away from China toward India and Southeast Asia, driven by stark demographic divergence and evolving consumption patterns. “China has reached a peak in population, and we are expecting that by 2035, China will have around 50 million people less than today, reaching the type of demographic structure that we see in advanced economies such as Japan or Italy,” Cozzi said. At the same time, she noted, “We are seeing this passing of the baton to other emerging economies—to India and Southeast Asia, where we receive 230 million more people living there.” The consumer transition is already evident: “Over 50% of car sales in the next decade will happen in emerging and developing economies outside of China—a very profound shift compared to the past decade where this was happening in China.”

Investment flows, however, remain uneven. In the U.S., enactment of the One Big Beautiful Bill Act has tightened foreign-content rules and revised tax credits affecting clean power, carbon capture, EVs, efficiency programs, and critical minerals. Globally, total energy investment reached $3.3 trillion in 2025 (more than 20% greater than 2015 levels) and is now roughly two-thirds directed toward low-emissions technologies, primarily driven by energy security concerns. Yet most capital remains concentrated in China, the U.S., and Europe, while Africa and Latin America continue to lag despite accelerating demand. Southeast Asia, notably, stands out as a fast-emerging growth pole, with electricity consumption rising 7% to 1,300 TWh in 2024 and projected to reach 2,100 TWh by 2035, driving new generation additions across natural gas, coal, wind, solar, and storage.

|

|

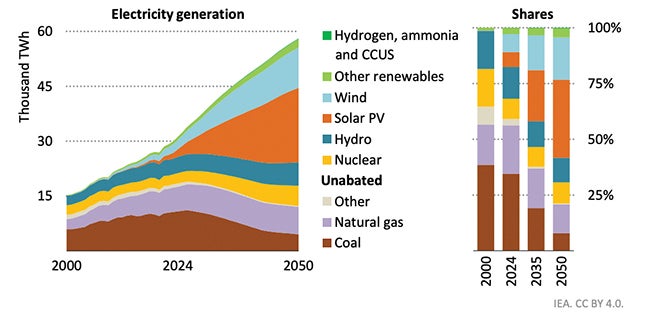

1. Global electricity generation by source in the International Energy Agency’s (IEA’s) Stated Policies Scenario (STEPS) to 2050. The electricity mix shifts steadily away from fossil fuels toward solar photovoltaic (PV) and wind, with renewables surpassing fossil generation by 2035 and continuing to expand through 2050, while nuclear maintains a stable contribution across the period. Source: IEA, World Energy Outlook 2025 |

3. Reshaping the Electricity Mix—All Fuels in Transition. The global power-generation mix is undergoing a rapid structural shift across all fuel types. Under the IEA’s STEPS (Figure 1), the share of fossil fuels in electricity is slated to fall from about 60% in 2024 to below 40% by 2035, and to just 20% by mid-century. Renewables, now roughly one-third of global generation, surpass 50% by 2035 and exceed two-thirds by 2050, driven primarily by wind and solar, whose combined share rises from 15% today to 40% by 2035 and 55% by 2050.

Nuclear will maintain a steady share—just under 10% of global generation—supported by uprates, plant restarts, and new construction, particularly in the U.S., France, and Japan. After two decades of stagnation, global nuclear capacity is projected to expand by at least one-third by 2035, with more than 70 GW currently under construction worldwide, among the highest build rates in 30 years. In advanced economies, nuclear accounts for nearly 10% of incremental electricity demand growth to 2035, while generation in emerging market and developing economies is expected to roughly double over the same period as countries look to firm low-emissions supply alongside variable renewables.

The report suggests, crucially, that in advanced economies, low-emissions power generation could grow about 50% faster than electricity demand through 2035, while in emerging economies (where power demand is slated to climb roughly 50% over the period), low-emissions sources could expand even faster. China accounts for two-thirds of the increase. Coal remains the most significant single power source in developing markets by 2035, despite declining utilization, while gas-fired generation continues to grow to provide flexible capacity.

Still, solar is slated to remain the dominant growth technology within that transition. “Solar is going to play a pivotal role here,” Birol said. “Big growth coming from solar. It is also important to see that the bulk of electricity demand growth will come from countries where we see a huge amount of solar radiation—solar-rich countries.” Solar supplies about 60% of incremental demand growth across emerging economies, but integration challenges are mounting. “Curtailment of wind and solar output is on the rise, as are incidences of negative pricing in wholesale markets, but slow permitting is holding back grid projects,” he said. At the same time, supply chains are outpacing deployment: “In 2024, there was sufficient manufacturing capacity to have produced more than twice as many solar PV modules as were actually deployed, and almost three times as many battery cells.”

4. Gas Power’s Resurgence—and the LNG Wave. The global natural gas market, meanwhile, is being reshaped both by record LNG investment and by a sharp rebound in gas-fired power generation across fast-growing electricity regions. As IEA Chief Energy Economist Tim Gould noted, “2025 has been a really remarkable year for approvals of new LNG export facilities. This year we’ve seen almost 100 billion cubic meters [Bcm] worth of new export projects approved—just short of the all-time record we saw in 2019.” He added, “If we stack up all of those existing and new projects from the U.S., Qatar, Canada, and elsewhere, we have 300 billion cubic meters of new capacity coming onto the market.”

Bolstering the build-out is rapidly rising demand for gas-fired electricity. In emerging Asia alone, about 35% of incremental natural gas demand through 2035 comes from the power sector, supporting nearly 270 GW of new gas generation capacity—an increase of about 70% over current levels. China is slated to add roughly 200 Bcm of new demand, while India could nearly double it to 140 Bcm by 2035, driven largely by power generation and city-gas expansion. The Middle East contributes another 240 Bcm of demand growth linked primarily to electricity and industrial use. LNG has already overtaken pipelines as the dominant mode of long-distance gas trade, with supply flows increasingly aimed at these growth markets.

Lower prices will help to bring gas into markets like India, where imports double to 2030, and Southeast Asia, where they triple, Gould said. Still, “That is not enough to absorb all of the new LNG that’s coming to market in the STEPS,” Gould warned. He added, “There’s really ample potential for more coal-to-gas switching, but the sorts of prices you would need to make that switch an economic proposition are very difficult for LNG exporters to match.”

5. Energy Security & Critical Minerals. The WEO finds energy security now extends beyond fuel supply to the mineral and technology supply chains essential to modern power systems. In 2024, 91% of rare earth element refining occurred in a single country, and even if all planned projects are completed, that share would fall only to 75% by 2035. China remains the dominant refiner for 19 of 20 strategic energy minerals, while the top three producers control an average 86% of global refining capacity, creating growing vulnerability across clean-energy supply chains.

“Even if we assume that all projects that are planned or under construction are implemented successfully, this 91% goes only to 75% in 10 years—still a very big concentration in one country,” Birol warned. As electrification accelerates worldwide, he added, “Energy security is now similar at the same level as economic security and national security in many cases.”

6. System Integration & Flexibility. Finally, as generation capacity surges worldwide, grid investment and system flexibility are struggling to keep pace. “Investments in electricity generation have charged ahead by almost 70% since 2015 to reach $1 trillion per year, but annual grid spending has risen at less than half the pace to $400 billion,” the WEO notes. Operational friction is mounting, it suggests. Growing curtailment and negative pricing signal widening system integration constraints, while accelerating battery deployment addresses short-term needs but remains insufficient to meet rising seasonal flexibility requirements.

And, while storage is scaling rapidly, it remains only a partial solution. “Battery storage additions rose to more than 75 GW in 2024, but batteries cannot provide all the answers—especially where seasonal flexibility needs rise alongside short-term ones.” Additional flexibility is expected from consumers: “Demand response activation grows more than threefold by 2035, driven by participation from buildings and transport sectors through smart air conditioners, heat pumps, and EVs.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).