The Solar Energy Industries Association (SEIA) and Wood Mackenzie's recent report on solar power installations said the U.S. installed a record 32.4 GW of new solar generation capacity in 2023,…

The Solar Energy Industries Association (SEIA) and Wood Mackenzie's recent report on solar power installations said the U.S. installed a record 32.4 GW of new solar generation capacity in 2023,…

Recent events in the wind power industry, all occurring on a single day, provide a snapshot of the sector's challenges and opportunities heading into 2024. Ørsted, the world's largest developer…

COMMENTARY With the passage of the Inflation Reduction Act (IRA) in December, the U.S. put some real financial muscle behind efforts to combat climate change and incentivize renewable energy with…

The future of transportation and energy storage will be powered by a range of carbon-neutral technologies, and batteries will play a major role. As part of the effort to reduce…

President Joe Biden last year signed the Inflation Reduction Act (IRA) that, in addition to a number of other actions, extended and enhanced a number of green energy tax opportunities.…

The Inflation Reduction Act of 2022 (IRA) includes the largest clean energy incentive effort in U.S. history. It builds on the energy initiatives included in 2009’s American Reinvestment Recovery Act,…

It’s an enthusing time in the energy world. The signing of the Inflation Reduction Act (IRA) has brought terms like “heat pumps” and “photovoltaics” into the national spotlight and homeowners’…

Under current law, there are significant tax benefits for renewable energy projects in the United States. These benefits include nonrefundable ITC and PTC tax credits and depreciation deductions. From the perspective…

“Energy transition,” “energy evolution,” “energy reimagined,” and a host of similar terms have dominated the energy market headlines this year. While these terms can have varied meanings, they generally focus…

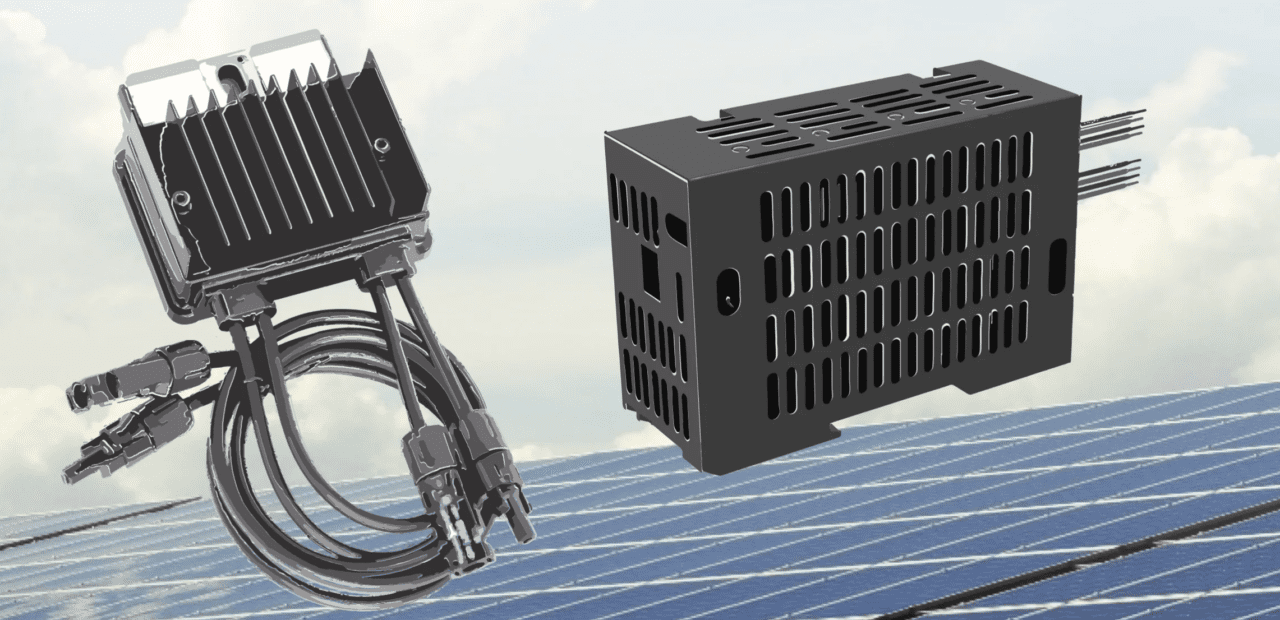

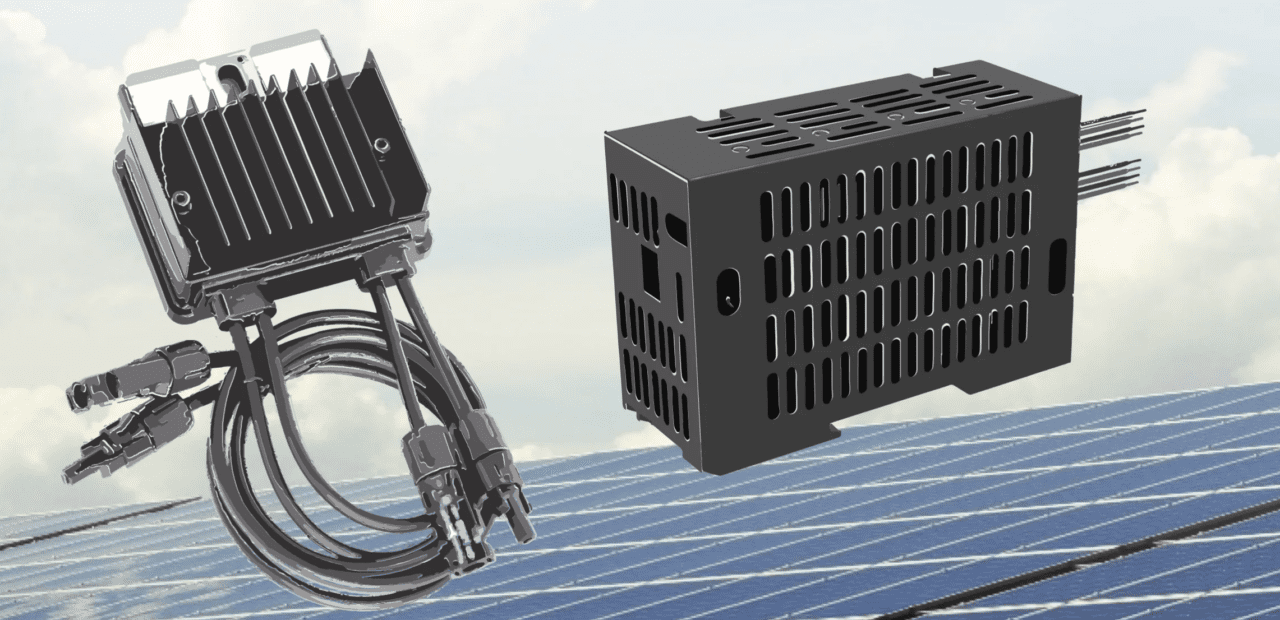

Growth in the solar power sector is coming from many angles, with utilities building ever-larger solar arrays, and more homeowners and building owners putting panels on their rooftops. Many utilities…