Distributed energy resources are advancing the cause of a more resilient and reliable power supply for utilities, homes and businesses, and more.

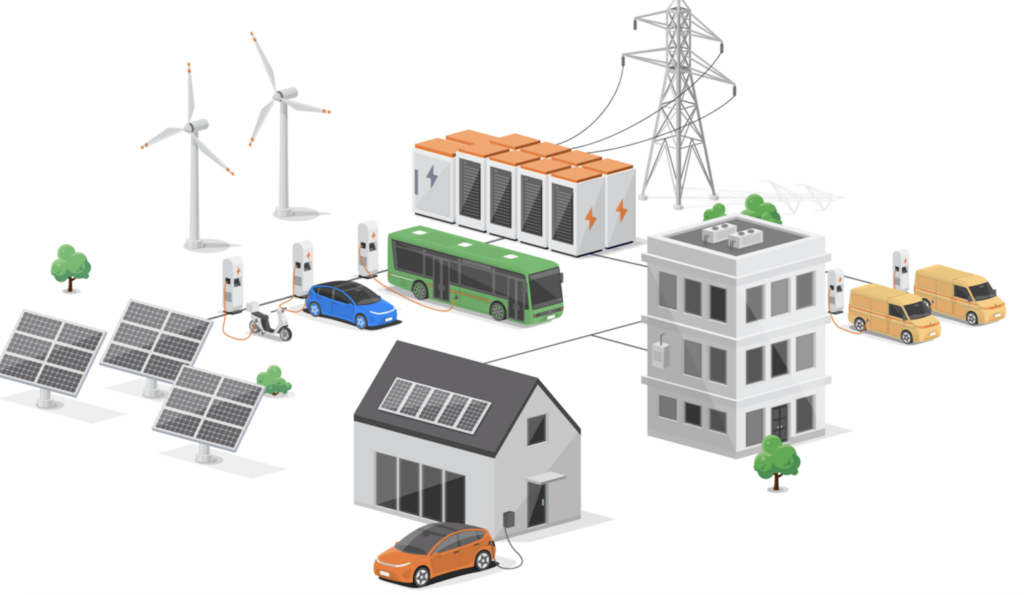

Distributed energy resources (DERs) have become a major part of the power generation landscape, particularly in support of a more reliable and resilient grid. Generating electricity from a variety of sources, including fossil fuels and renewables (Figure 1), using smaller-scale installations is now a key element of demand response and energy efficiency.

|

|

1. Wind turbines and rooftop solar arrays can provide on-site power generation for commercial and industrial enterprises, lowering energy costs for businesses. Source: Envato Elements |

Utilities and independent power producers realize that DERs can provide needed capacity during system load peaks, which reduces the risk of brownouts and blackouts. Microgrids, now a major contributor to the power supply in many locations, offer reliability and resilience for generation, both for remote, off-grid sites, and in areas that need power for critical infrastructure. DERs also offer the opportunity to lower energy costs for customers, by providing power and services close to where they are used—an important consideration at a time when high prices for power are a major topic of discussion.

Energy industry experts who spoke with POWER listed several reasons DERs are taking a larger role in power generation. These include:

- Backup Power. DERs can provide power during outages, keeping homes, businesses, and critical infrastructure operating even when the main grid is down.

- Microgrids. These installations, essentially groups of DERs, can operate independently from the main power grid, supporting reliability for a small business or a larger neighborhood.

- Reduced Transmission Losses. A major topic of discussion at POWER’s recent Experience POWER event was how producing electricity at or near the point of consumption minimizes energy lost during long-distance transmission.

- Lower Costs. DERs can reduce energy bills by lowering the amount of electricity consumers need from the utility. DERs also can optimize energy use, charging batteries when energy is cheap and discharging them during hours of peak demand.

- Revenue Opportunities. Electricity consumers in some areas can sell their excess power back to the grid, and also can be part of aggregated systems such as virtual power plants (VPPs).

- Reduced Infrastructure Costs. Utilities and other power producers can use DERs to reduce the need for costly upgrades to grid infrastructure.

“Absolutely utilities can benefit [from DERS],” said Hal Corin, director of Development at Viridi, a battery energy storage provider. Corin was a speaker at POWER’s recent Experience POWER conference in October of last year in Denver, Colorado. “Demand response [DR] benefits utilities by avoiding the use of most costly peaker plants or less-desirable rolling blackouts,” said Corin. “They benefit from DSM [demand-side management] by lowering relative cost of operations through reduced generation while achieving the same regulated return on assets. Customers are generally best served where benefits flow to them and potentially offer possibilities for equity ownership.”

“Utilities can extract real value from DERs and price-responsive demand resources. These tools can support peak-shaving and improve overall reliability,” said Ken Irvin, a partner at Sidley Austin and co-leader of Sidley’s global Energy and Infrastructure practice. “We’re already seeing successful virtual power plants composed of load resources that dial back consumption when grid conditions or prices call for dispatch. Viewing demand as static and inelastic is an outdated mindset. With the ability to curtail load quickly and precisely under specific conditions, DERs, VPPs, DSM, and DR programs are central to the future of a reliable, efficient, and cost-effective electric system.”

Irvin continued, “From our vantage point, an ‘all-of-the-above’ strategy is what today’s energy markets require to ensure reliable supply that can keep up with growing demand. Thermal units must manage their emissions, but doing so is entirely feasible—and these units remain valuable sources of reliability. Spinning mass [a large synchronous generator at a thermal plant, for example] is still extremely helpful for maintaining grid frequency. In addition to energy and capacity, the grid needs a wide array of ancillary services that thermal generators are often well-suited to provide. At the same time, technologies such as microturbines, fuel cells, and CHP [combined heat and power] systems offer flexible, localized generation that can be highly effective.”

Artificial intelligence (AI) also is impacting DERs in a variety of ways. Those who spoke with POWER noted that AI enables grid optimization through better forecasting and real-time load balancing. It also supports the creation of VPPs from connected DERs, along with the grid integration of renewable energy.

“AI-driven optimization will accelerate adoption. Smarter automation and easier installs will make energy independence more accessible to mainstream homeowners,” said Rex Liu, vice president of Product Management, Clean Energy, at Generac.

Microgrids and Energy Storage

Microgrids are an important tool for deployment of DERs, with utilities recognizing how microgrids offer real-time monitoring and a more rapid response to events impacting the power grid. Installations with energy storage can support grid resilience and improve overall performance.

San Diego Gas & Electric in California offers a utility-based example. The group launched four microgrids (Figure 2) in its service territory to enhance grid reliability and support resiliency. Energy storage is an important piece of the microgrids, which serve schools, fire stations, and other enterprises across four communities.

|

|

2. The Paradise microgrid in California is one of four such installations built by San Diego Gas & Electric (SDG&E) to support grid reliability in the utility’s service territory. It is a self-contained energy system with battery storage that can operate independently from the larger regional grid. Courtesy: SDG&E |

“Fueled by the data center boom, microgrids will evolve to be more than basic SCADA [supervisory control and data acquisition] control,” said Sally Jacquemin, vice president of AspenTech Digital Grid Management. Jacquemin told POWER, “In 2026 and beyond, microgrids will be called upon in new ways, such as advanced load management of data center processes and optimization of multiple, varied on-site generation sources such as batteries and renewables. They’ll also be expected to interface with regional utilities and system operators to ensure a balanced grid with coordinating actions. With this in mind, microgrids will become an essential tool not only to support grid reliability, but to enable power-hungry AI applications reliant on data centers.”

Jacquemin added, “Large-scale power generation will become a competitive differentiator. Utilities or commercial/industrial companies that are eager to participate in energy markets with large-scale power generation, including renewables and batteries, will continue to need robust software to model, control, and optimize generation fleets across global energy markets. Digital automation, such as DERMS [distributed energy resource management systems] and REMS [renewable energy management systems], will not only mitigate the unpredictability of renewable energy so market participation is possible, but also help utilities remain compliant with new regulations like FERC [Federal Energy Regulatory Commission] 901 aimed at maintaining grid reliability.”

Many energy sector analysts have said the industry is still in the nascent stages of deploying energy storage, a technology that is supporting the integration of DERs along the power grid.

“The statement that we’re only scratching the surface of battery energy storage potential is absolutely correct. The sector is poised for continued, significant investment and deployment in both the near term and over the next decade,” said George Koutsonicolis, managing director of SOLIC Capital. “The overall global market for battery energy storage systems [BESS], primarily utility-scale, is projected to grow to over $120 billion to $150 billion by 2030, with more than $30 billion in the U.S. alone.

“Today, we’re seeing investment dollars are flowing from corporate strategics, venture capital [VC], and private equity [PE]. Additionally, the segment continues to attract debt financing, especially for large utility-scale projects with offtake contracts that provide the necessary economics,” said Koutsonicolis. “Looking a decade out, we expect this growth to persist, driven by the industrial logic of co-locating storage with renewables for greater economies of scale and efficiency. The sector’s expansion, which is typical of any developing industry like AI, aviation, or electric vehicles [EVs], will undoubtedly have both winners and losers.

“One of the most exciting aspects will be the development and potential commercialization of new technologies like solid-state batteries. Given their energy density possibility and potential to alleviate current supply chain issues, solid-state and other non-lithium-ion chemistries [such as vanadium and iron-oxide] are likely to attract more investment as they evolve and compete for business,” said Koutsonicolis. “We will certainly see more investment dollars focused on this area.”

Corin said the solar energy market will benefit from energy storage deployment. “More and more we will see BESS deployed with solar behind the meter, making the generation dispatchable key to interacting positively with power grids. The good news is that BESS [which work with all forms of generation] provide benefits to their owners, benefits to grid operations, allay or delay costly grid infrastructure upgrades, make intermittent generating assets more valuable thru firming, and in addition to these cost-lowering results, can orient grid operations toward generation with lowest marginal cost of operations while they enhance system reliability.”

Advanced Technologies Supporting Adoption

Advanced technologies, including many for homes and businesses such as smart thermostats and electric water heaters, have become important tools for the adoption of DERs, managing energy consumption based on grid conditions or price signals. EVs and their charging infrastructure also are part of the equation, providing the ability to send power back to the grid through vehicle-to-grid (V2G) technology.

“As self-professed car guys, we’re big believers in V2G,” said Terence Healey, a partner at Sidley Austin who represents clients on matters involving the U.S. wholesale electricity and natural gas markets. “Vehicle-to-grid technology offers mobile distributed energy that can respond where it’s most needed. A battery-powered school bus that plugs into the grid and sends power back during peak demand—essentially a big yellow battery on wheels—is a terrific concept.

“V2G works best for vehicles with large batteries and predictable return-to-base schedules: school buses, city buses, delivery vans, and similar fleets fit the bill,” said Healey. “While U.S. federal support for EVs has cooled recently, slowing near-term V2G growth, we expect fleet-scale V2G to become a valuable grid resource over time.”

—Darrell Proctor is a senior editor for POWER.