Household electricity use is set to climb sharply through 2035 as electrification expands, shifting power system costs toward capital-intensive grids, renewables, and storage and making affordability increasingly sensitive to policy and financing choices. POWER’s monthly print infographic breaks down the forces reshaping electricity bills worldwide.

In its November 2025–released World Energy Outlook, the International Energy Agency (IEA) warns that electricity affordability is becoming a defining concern for households and businesses. As electricity’s share of daily energy use increases, rising consumption—from cooling, appliances, electric vehicles (EVs), and electric heating—is poised to make households increasingly sensitive to price changes. The outlook projects that global household electricity demand will climb sharply through 2035, even as power systems undergo a structural shift toward capital-intensive grids, renewables, and storage. Source: International Energy Agency, World Energy Outlook 2025.

Household Electricity Use Could Climb Sharply as Electrification Expands

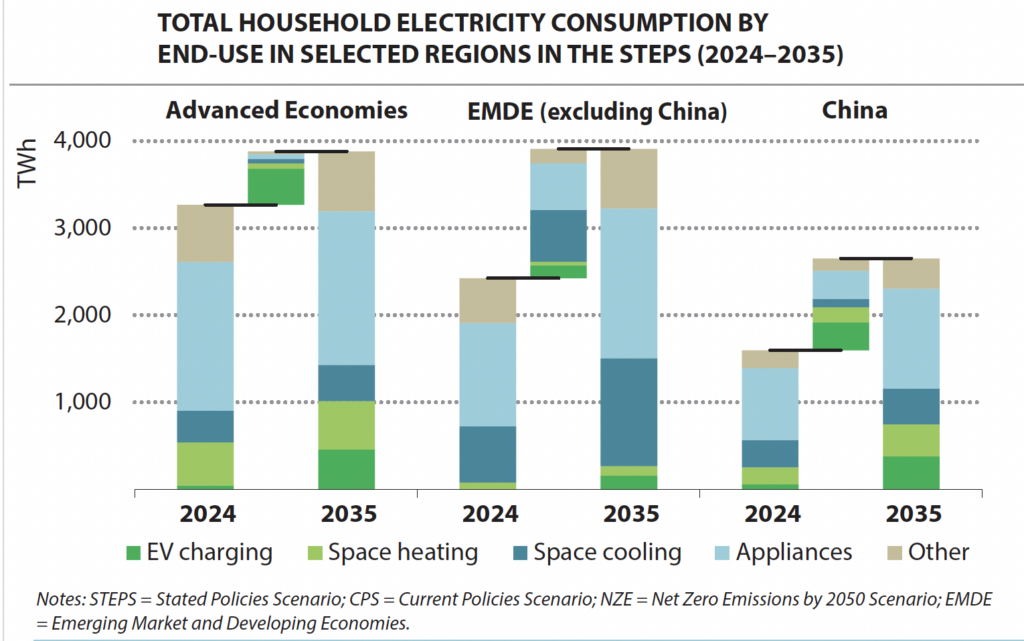

Household electricity use is rising worldwide as electrification expands across end uses. In the International Energy Agency’s (IEA’s) Stated Policies Scenario (STEPS)—which reflects today’s stated policy commitments—global average household electricity consumption could increase by about 25% by 2035. Growth is driven primarily by rising use of air conditioning, household appliances, electric vehicle (EV) charging, and electric space heating.

In advanced economies, household electricity demand could rise by roughly 15% by 2035 after years of stagnation, largely due to transport electrification. In emerging market and developing economies (EMDEs), demand growth is even faster—around 30% by 2035—as rising incomes and higher temperatures push cooling demand sharply upward.

Electricity System Costs Are Shifting Toward Upfront Investment

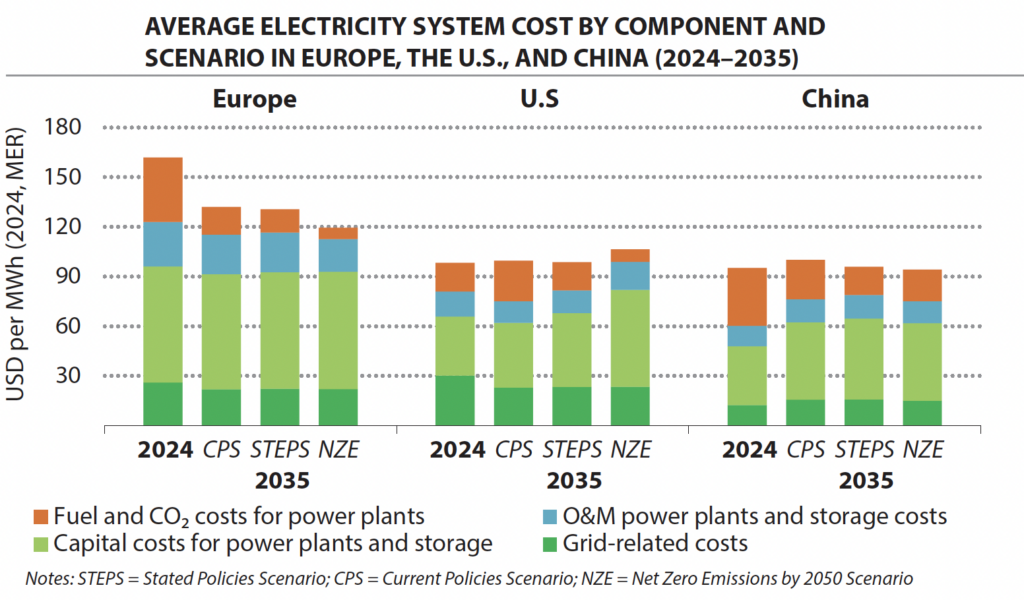

Electricity systems are undergoing a structural shift in how costs are distributed. Fuel and operating expenses are expected to make up a declining share of total system costs, while upfront capital investment in clean generation, transmission and distribution grids, and energy storage becomes increasingly dominant across scenarios.

Expanding renewable capacity, rapid battery deployment, and higher grid spending all contribute to rising capital intensity. At the same time, supply-chain constraints and carbon pricing could add cost pressure in some markets. However, declining natural gas prices, a more diversified generation mix, and rising electricity demand could moderate averag

Electricity Spending May Rise as Total Household Energy Bills Diverge

Household electricity spending is projected to rise across most regions as cooling demand grows and EVs and electric heating become more widespread. However, total household energy bills could diverge by region and scenario.

In advanced economies, efficiency improvements and reduced spending on oil and natural gas could lower total household energy bills under the STEPS—and even more so under the Net Zero Emissions by 2050 (NZE) scenario, which assumes rapid electrification, major efficiency gains, and large-scale deployment of clean energy technologies.

In emerging markets, rising electricity use and appliance ownership could push total household energy bills higher, although efficiency improvements and fuel switching may help limit increases. Under well-designed policies, real energy costs could remain stable or decline.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).