In a stark departure from the zero-nuclear future proposed by a previous administration, the cabinet of Japan’s Prime Minister Shinzo Abe Friday endorsed restarting the country’s idled nuclear reactors as it develops more renewables.

The cabinet on Friday officially adopted the first Basic Energy Plan since the Fukushima disaster, a 78-page document (in Japanese) that lays out the basic direction of energy policy over the next two decades so Japan can achieve what it calls the “3E+S“: energy security, environment (or climate change mitigation), economic efficiency (or lowering costs for energy), and—newly introduced to the basic policy “equation”—safety.

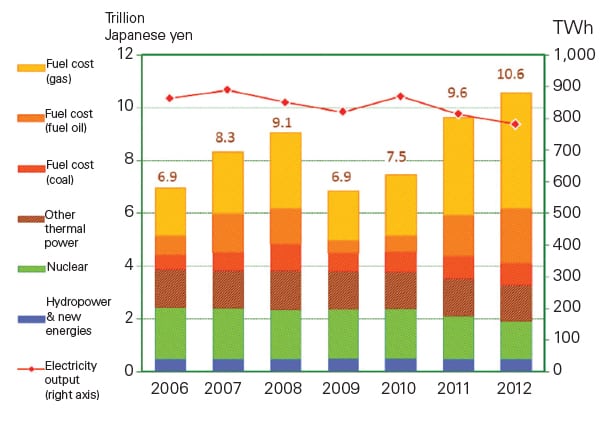

The new plan recognizes Japan’s precariousreliance on imported fossil fuels, which almost doubled in the two years from 2010 to 2012, and calls instead for a “stable, low-cost, and balanced” power supply mix, to include hydropower, nuclear power, and coal as baseload sources. However, it avoids setting specific percentage goals for each energy source that will be achieved over the next two decades. Economy and Trade Minister Toshimitsu Motegi told reporters at a news conference on Friday that those goals would be set “as soon as possible.”

Significantly, the plan reasserts safety’s important role when restarting nuclear plants with the national safety regulator’s approval, and it calls for the country’s reliance on nuclear power to be diminished with more energy efficiency and increased renewable and thermal power production.

The plan requires the acceleration of renewables capacity additions over the next three years, prioritizing small and medium-sized solar installations that are close to customers, wind power, geothermal power, and small and medium hydropower projects. It also calls for the promotion of cogeneration and renewable energy heat.

At the same time, the plan advocates more research and development to advance coal power technologies, and calls for their deployment to replace aging plants. Greenhouse gas emissions could be lowered by the increased use of integrated gasification combined cycle plants, it notes.

And while it supports the use of natural gas because of its lower emissions profile compared to coal, the plan also cautions that Japan must diversify its fuel sources to avoid “excessive” dependence on liquefied natural gas imports, and cites a number of risks related to procurement and transportation.

A Departure from the Past

Japan’s Basic Energy Plans are revised every three years. The first, developed in October 2003, promoted nuclear power generation to enhance efforts to secure a stable oil supply and lead the formulation of an effective international framework for enhancing energy conservation and coping with climate change.

The current Basic Energy Plan, approved in 2010, foresaw a substantial change to Japan’s energy mix, calling for shares of renewables and nuclear power to more than double by 2030. Generation from renewables was to increase from 9% in 2007 to 20%, while nuclear power generation would increase from 26% in 2007 to about 53%—meaning Japan would need to build nine more nuclear plants by 2020 and more than 14 by 2030.

But since the March 2011 Fukushima disaster, all 48 of Japan’s existing reactors have been shut down. Applications for restarts, which must be approved by the newly established Nuclear Regulation Authority (NRA) are pending for just 17 reactors, and there is no consensus on how long the approval process could take.

Utility Coalition: Supply Is Tight, Companies Are Making Losses

Meanwhile, Japan’s power supplies are still dangerously tight, says Makoto Yago, who chairs the coalition of Japan’s 10 privately owned, vertically integrated utilities, the Federation of Electric Power Companies of Japan (FEPC). Yago in March noted that this winter, customers in Hokkaido were asked to cut consumption by at least 6%. Though power companies are working to increase their capacity, with nuclear plants yet to be restarted, “we continue to barely manage to secure a sufficient supply of electricity by operating our thermal power plants at full capacity, even the aged ones,” he said.

The effect on the finances of Japan’s power companies has been devastating, Yago warned. Despite improvements in the balance of payments by increasing the electricity tariffs and improved business efficiency, with no prospects for restarting the nuclear plants, the fuel cost of thermal power has risen higher than 2012’s record ¥7.3 trillion. “Among the nine companies that had released an outlook for this year’s financial results, six companies [Hokkaido, Chubu, Kansai, Chugoku, Shikoku and Kyushu Electric] expect losses, with five expecting their third consecutive year of losses,” he said.

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)