In its quest to drive down costs while boosting safety, the nuclear industry has ramped up efforts to streamline operations and maintenance (O&M). New approaches target efficiency and resilience.

If there is an underreported trend in nuclear, it has been the global sector’s dramatic reduction in generating costs over the past decade. In 2022, the average total generating cost for U.S. nuclear energy hovered at $30.92/MWh—0.8% lower than in 2021 but as much as 40% below 2012 costs, according to the Nuclear Energy Institute (NEI). Cost reductions have been driven by “a 41.4% decrease in fuel costs, a 50.9% decrease in capital expenditures, and a 33.4% decrease in operating costs,” the trade group said. “Prior to the 2012 peak, nuclear total generating costs had increased steadily over the previous decade,” it noted. The recent figures are the lowest since the Electric Utility Cost Group (EUCG) Nuclear Committee, a cooperating group of nuclear plant representatives, started collecting industry-wide detailed data in 2002.

In the U.S., at least, the sharp cost reductions over the past decade can be pegged to a concerted effort, “Delivering the Nuclear Promise,” a strategic, multi-year, industry-wide collaboration kicked off in 2016. The initiative rolled out a comprehensive suite of targeted efficiency measures to transform nuclear operations and maintenance (O&M). Efforts focused, for example, on the standardization of design processes to streamline upgrades across plants, the integration of machine-learning diagnostics to predict equipment maintenance needs, and the implementation of online monitoring systems that allowed real-time operational adjustments. The program has also focused heavily on workforce improvement, spearheading innovations like virtual reality training programs to attract new talent and empower supervisors.

Across the world, nuclear O&M costs remain varied, with significant regional differences driven by factors such as labor costs, material availability, and regulatory requirements. A 2024 analysis for the Net Zero World Initiative estimates that variable O&M costs—expenses directly tied to a plant’s operational output—range between $9.25/MWh and $17/MWh. In contrast, fixed O&M costs—expenses necessary to maintain a plant’s readiness regardless of output—span from $4/kWe to as high as $223/kWe annually, depending on the country and economic conditions.

|

|

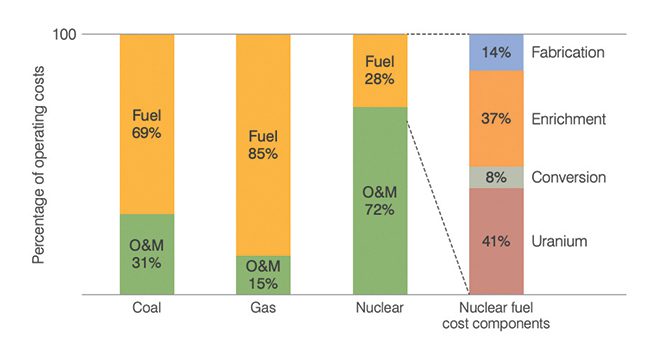

1. Ratio of fuel costs to operating and maintenance (O&M) costs for nuclear, coal, and gas generation. Courtesy: World Nuclear Association, Nuclear Power Economics and Structuring (2024 Edition) |

Generally, “nuclear fuel costs have fallen over time due to lower uranium and enrichment prices together with new fuel designs allowing higher burn-ups, while O&M costs tend to be somewhat higher than for other thermal modes of generation,” notes the World Nuclear Association (WNA) in a report published in April 2024 (Figure 1). A major component of this has involved a dramatic shortening in the length of refueling outages. While in 1990, these averaged 107 days, the average duration dropped to 40 days in 2000. In 2023, in the U.S., nuclear plant refueling outages averaged 35 days, but plants have reported outages of as short as 16 days.

A Set of New Drivers Emerging for Nuclear O&M

Despite regional cost variations and persistent challenges, nuclear plants globally have also achieved remarkable performance improvements over the past few decades. Since the 1990s, global nuclear capacity factors—a key measure of operational efficiency—have surged from 70% to 82%, driven largely by advances in operational practices and plant upgrades. In some countries, the improvement is even more dramatic—for example, in the U.S., from 66% to 90%. Levels greater than 90% have also been achieved by plants in Europe and Asia, the WNA reports. As Sama Bilbao y Leon, WNA director general, underscored, these achievements are playing an overlooked part in bolstering the current energy system. “Nuclear reactors helped avoid 2.1 billion tonnes of carbon dioxide emissions in 2023 from equivalent coal generation—that’s more than the annual emissions of almost every individual country, with only China, India, and the USA having higher national CO 2 emissions,” she said.

However, the future of nuclear demands even more boosts to performance, cost-efficiency, and reliability. “We see several trends reshaping nuclear O&M,” global nuclear O&M services leader Trillium told POWER. “The primary trend, or more specifically, objective, is achieving net zero by 2050. According to the International Energy Agency (IEA), global nuclear capacity would need to increase to 916 GWe by 2050 to limit global temperature increase to the 1.5C target. This is more than twice the current global capacity,” it noted.

Currently, however, only about 66 GWe worth of projects are under construction, with 84 GWe planned. And while there are 365 GW of proposed projects, several are advanced nuclear or small modular reactor (SMR) designs, Trillium said. “Very few are at a mature stage. The ramp-up in resource levels and skills required to operate these plants will be significant, and there will also be a demand for the same resources and skills to extend the lifetimes of the current operating fleet.”

Addressing Aging Infrastructure

The most urgent initiative facing the world’s nuclear industry, for now, is to sustain stellar operations (Figure 2) at its 415 nuclear reactors across 31 countries. As the International Atomic Energy Agency (IAEA) noted in its September 2024–released Nuclear Technology Review, 295 reactors, or about 67% of global operational reactor capacity (261.8 GWe), have been in operation for more than 30 years, and 142 of those (29%) are over 40 years. “The aging fleet highlights the need for new or updated operating nuclear capacity to offset planned retirements and contribute to sustainability and global energy security and climate change objectives,” the report notes. So far, governments, utilities, and other stakeholders are investing in long-term operation (LTO) and aging management programs for an increasing number of reactors to ensure sustainable operation and a smooth transition to new capacity.

|

|

2. As of December 2023, the world’s nuclear fleet’s capacity was 371.5 GWe, provided by 413 reactors across 31 countries. About 67% of global operational reactor capacity (261.8 GWe, 295 reactors) has been in operation for more than 30 years, while about 29% (112.2 GWe, 142 reactors) has been in operation for over 40 years, and 4% (17.5 GWe, 28 reactors) for over 50 years. Courtesy: World Nuclear Association |

Modernization and life-extension strategies embraced by nuclear plant operators around the world are so far showing immense gains, leveraging new approaches, digital tools, and advanced diagnostics. Finland’s Olkiluoto plant recently achieved a 30 MW power uprate through targeted turbine and generator upgrades, while in Canada, Bruce Power’s Major Component Replacement project is expected to add approximately 2,400 MW to Ontario’s grid while supporting safe operations for another 30 years. In France, EDF’s 900-MW reactors have seen consistent 40 MW boosts per reactor following control system and turbine upgrades, all while meeting modern safety standards.

In the U.S., initiatives like the Inflation Reduction Act, along with actions at the state level, have encouraged several utilities to seek licenses to extend plant lifetimes to up to 80 years. Constellation is investing $800 million to increase the output at its Braidwood and Byron nuclear plants in Illinois by 135 MW—part of planned upgrades that could add up to 1,000 MW of additional capacity to its 21-reactor nuclear fleet—alongside recommissioning a shuttered reactor at Three Mile Island and seeking lifetime extensions for its Dresden units.

Long-term operation, however, presents critical technical and operational challenges mainly linked to materials aging, replacement of critical components, and modernization needs. Because their replacement can be unfeasible and costly, key life-limiting components, such as reactor pressure vessels and containment structures, require focused aging management. Often posing more complexity is component obsolescence, extended lead times for components, and sub-suppliers no longer operating, Trillium noted. “These challenges often require a revised or modified safety case, leading to a lengthy process, additional delays, and increased costs.” To address these issues, Trillium aims to proactively manage lifetime spares/repair demands and adopt a full lifecycle approach.

Digital Transformation and Automation in Nuclear O&M

As in other power industries, the nuclear sector has also embraced digitalization to provide new options to slash O&M costs. A focus has been on automation—which the Electric Power Research Institute (EPRI) describes as a technology that “performs a task or part of a task that was previously carried out manually.” Automation, EPRI notes, promises to streamline nuclear operations by reducing labor hours, minimizing safety risks, enabling continuous online monitoring, improving data quality, reducing human error, and enhancing scheduling flexibility for personnel.

While nuclear “is rarely the first adopter of contemporary technologies,” most “have taken at least initial steps to implement digital online monitoring,” the research organization says. Plants are using advanced sensors, including ultrasonic and vibration sensors, to support continuous online monitoring of critical components like pumps, turbines, and condensers. “Data generated by online monitoring is processed in recently established monitoring and diagnostic (M&D) centers, where [nuclear plants] have also been able to start automating real-time data analysis,” it says.

These and other tools are also poised to revolutionize non-destructive evaluation (NDE), a set of techniques used to inspect and assess the condition of materials and components without damaging them. NDE is advancing from basic radiography and manual ultrasonic testing to leverage techniques such as phased array ultrasonic testing (PAUT) and automated data analysis. For example, recent trials by EPRI have demonstrated how artificial intelligence tools can drastically reduce inspection time by quickly flagging areas of concern, cutting analysis time from days to hours, while drones and permanent sensors provide continuous, real-time monitoring in high-risk areas.

The use of robotic tools for inspections, particularly in hazardous areas to limit personnel exposure, also appears to be gaining prominence. The Krsko Nuclear Power Plant in Slovenia offers one example of camera-based monitoring to conduct visual inspections and as a predictive diagnostic method. But several other plants are using robotic platforms, such as single-purpose robots, to navigate and inspect various components. These include static or semi-fixed arms, diggers and rollers, submersibles, and light detection and ranging (LIDAR)-equipped drones.

|

|

3. Talen Energy has tested “Spot” in high-radiation areas at the Susquehanna nuclear power plant. Spot can conduct visual and thermal inspections safely and effectively, without the need for costly derates or shut downs. Courtesy: Boston Dynamics |

Robots like Boston Dynamics’ “Spot” are actively enhancing operations at facilities such as Talen Energy’s Susquehanna plant in Pennsylvania (Figure 3), Duke Energy’s Oconee Nuclear Station in South Carolina, and Ontario Power Generation’s Pickering Nuclear Generating Station in Canada. At Oconee, Spot assists in inspecting hard-to-reach areas, including underground piping and containment buildings. According to EPRI, future advancements in AI could allow robots to perform more autonomous tasks, such as identifying issues in real time and possibly even executing corrective actions, which could more substantially reduce manual intervention.

As an especially bright spot for nuclear O&M, over recent years, digital instrumentation and controls (I&C) upgrades have also proven transformative, including to enhance precision, enable further automation, and improve safety. Although costly and complex to install, digital systems promise lasting benefits, including, for example, rapid, precise adjustments to reactor or steam generator water levels—crucial attributes that could help plants respond swiftly to both routine and unexpected conditions.

As just one example, Ukraine’s Rivne Nuclear Power Plant has adopted the RadICS digital I&C platform, which provides near-complete diagnostic coverage, channel redundancy, and compliance with nuclear regulatory standards. The flexible, modular system has streamlined Rivne’s operations, allowing them to reduce equipment footprint and improve monitoring capabilities, says Curtiss-Wright (which partnered with RadICS in 2019 to bring the RadICS digital I&C platform to the U.S. nuclear fleet).

Finally, as in other power sectors, nuclear plants have homed in on digital twin technologies, and AI and machine learning (ML), to enhance predictive maintenance (see sidebar “What’s AI’s Value for Nuclear O&M?”). Digital twins (DTs), virtual models that replicate nuclear systems throughout their lifecycle, are using real-time data to enhance design, licensing, construction, and O&M processes. By leveraging decades of operational knowledge, DTs also improve plant availability, reduce operational risks and costs, and support the feasibility of operating advanced reactor designs, including SMRs.

What’s AI’s Value for Nuclear O&M?Like other power sectors, the nuclear industry has begun to embrace artificial intelligence’s (AI’s) potential to enhance efficiency, automation, safety, predictive maintenance, and process optimization. So far, machine learning (ML), a subset of AI, is already being used extensively for monitoring and predictive maintenance across the world, enhancing precision, reducing costs, and allowing operators to focus on high-value tasks. A recent report authored by several U.S. national labs highlights several more potential use cases, including for AI-driven digital twins for real-time monitoring, automated anomaly detection, and remote operations and maintenance (O&M) management to support workforce challenges. The report also explores the potential of large language models (LLMs) as “virtual subject matter experts” that could help with complex regulatory reviews, compliance documentation, and risk assessment, providing critical support for both nuclear plant operators and regulators. However, the report stresses that extensive validation will be essential to ensure reliability to meet nuclear regulators’ stringent safety standards, especially as AI evolves toward more autonomous functions. Regulators in the U.S., UK, and Canada have begun assessing how AI applications can be safely integrated into nuclear operations. Several regulatory bodies have convened workshops in recent months to explore frameworks to address the unique risks AI poses, including those that anticipate future, more advanced uses, particularly around cybersecurity, data integrity, and transparency in AI decision-making processes.

In one particularly illustrative triumph for an AI use case, Indiana-based BlueWave AI Labs recently deployed ML tools at Constellation’s Peach Bottom and Limerick boiling water reactor (BWR) plants. Backed with a U.S. Department of Energy $6 million grant, the three-year initiative tested its advanced ML tools at the plants starting in 2022 leveraging vast amounts of historical plant data to analyze and improve sensor measurements within the reactor core. In 2023, BlueWave’s system identified out-of-calibration sensors at Limerick 2, which allowed operators to recalibrate without power output—an intervention that preserved operational efficiency and avoided costly downtime (Figure 4). BlueWave estimates that its AI tools can be deployed across all 32 of the nation’s BWRs within three years, potentially saving the industry up to $80 million by optimizing sensor accuracy, improving fuel management, and reducing manual inspection time. It is also working to adapt the AI algorithms to pressurized water reactors, which make up most of the American nuclear fleet. “Constellation’s collaboration with Blue Wave AI Labs has allowed us to use powerful machine learning tools to complement traditional engineering practices when designing innovative nuclear fuel products for our operating fleet,” said Jason Murphy, vice president for nuclear fuels at Constellation. “Widespread adoption of these new tools will benefit nuclear reliability and cost-effectiveness.” |

Despite these benefits, the nuclear industry faces several formidable challenges and risks when integrating digital solutions into aging nuclear infrastructure, as EPRI notes. Initially designed with analog systems, modernization requires diligent assessment to consider technical and logistical hurdles.

Cybersecurity is another critical consideration, especially given that civil nuclear infrastructure is a high-value target. Technical, personnel, and sector-wide vulnerabilities in nuclear cybersecurity include reliance on outdated, unsupported software; “security by obscurity” assumptions in rare control systems; insufficient cybersecurity personnel; and cultural overconfidence, according to a recent Chatham House report. Digital O&M technologies also introduce new dependencies for both highly skilled labor and resilient supply chains, which could affect maintenance costs and operational efficiency.

New Considerations for the Coming Wave of SMRs

The next evolution of the nuclear sector is, meanwhile, poised to introduce a new wave of SMRs and advanced reactors. According to EPRI, which is spearheading a dedicated Advanced Nuclear Technology (ANT) program, SMRs are designed for modularity, which simplifies scalability and reduces construction costs but could require specialized O&M strategies tailored to their potential remote (Figure 5) or off-grid applications. Advanced reactors, including Gen IV technologies—spanning fast reactors to molten salt reactors and high-temperature gas-cooled reactor (HTGR) designs—typically incorporate passive safety features and alternative coolants. While these designs reduce reliance on active safety systems, they will require tailored maintenance protocols and distinct O&M practices.

|

|

5. Akademik Lomonosov, the world’s first floating nuclear power plant, underwent its first full refueling operation in Pevek, Chukotka, in 2023. The comprehensive procedure involved replacing the entire reactor core for each of its KLT-40S reactors to ensure uninterrupted power. Managed by Rosatom’s specialized teams, the procedure was the most extensive maintenance campaign since the novel plant’s commissioning in 2019. Courtesy: Rosatom |

Advanced reactors, notably, will also bolster new applications beyond power generation, including heat production, desalination, and hydrogen production. These applications introduce new operational demands, but also present opportunities, for example, to integrate automated chemistry control systems that could reduce corrosion and extend the lifespan of components.

For now, research and development efforts are notably focused heavily on how advanced reactors can minimize O&M costs. Several notable projects are underway under the U.S. Department of Energy’s (DOE’s) Generating Electricity Managed by Intelligent Nuclear Assets (GEMINA) program. Argonne National Laboratory is spearheading the Maintenance of Advanced Reactor Sensors and Components (MARS) project, which is looking to slash O&M costs from $23/MWh—the minimum considered for nuclear energy cost competitiveness—to $2/MWh.

The project, focused on Kairos Power’s molten salt HTGR, is working to enhance sensor diversity and functionality, and enable simultaneous measurement of multiple variables while using ML for automated fault detection and diagnostics. GEMINA is also fostering Framatome’s digital twin diagnostics for HTGR cooling systems, GE’s AI-powered predictive maintenance for advanced reactors, high-fidelity digital twins for BWRX-300 systems, and irradiation data for molten salt reactors. Moltex Energy is exploring fully automated and digitized stable salt reactor (SSR) plants, while the University of Michigan is developing its SAFARI project for secure automation for advanced reactors. X-energy is also exploring digital twin-enhanced O&M techniques in the Xe-100 to lower fixed costs.

Some approaches propose a “fresh think” strategy, deviating from traditional O&M (see sidebar “On the Prospect of Load Following”). EPRI recently wrapped up a project that sought to rethink O&M for advanced reactors through a “Build-to-Replace” model. The approach proposed shorter, planned lifespans for structures, systems, and components (SSCs), and critical reactor components, shifting from the traditional “monitor and repair” strategy to a “replace and refurbish” model. The project assumed that by designing components with predictable lifetimes—similar to practices in the airline industry—the model could potentially lower O&M costs to below $5/MWh for advanced reactors.

On the Prospect of Load FollowingWhile existing nuclear plants and new designs are technically capable of performing frequency control and load-following operations, most nuclear generators worldwide prioritize operating at full capacity for as long as maintenance and refueling schedules permit, mainly for economic and regulatory reasons. But as power intelligence firm Kpler Power posits in a recent paper, new power paradigms that support the heavy integration of renewables are driving nuclear “modulation”—whereby generation follows not just residual demand (purely, “load following”) but is also influenced by “market price signals, which act as proxies for residual demand and cross-border flows.” When residual demand and price decouple amid low prices, nuclear generation is more responsive to price movements, it contends. Nuclear power plants modulate their output for different reasons: fuel savings, efficient resource allocation, and cooling constraints,” it notes. The increasing trend is driven by increased renewable energy installed capacity and market price volatility. The 56-reactor French fleet is a prime example, the firm says. “Today, the fleet continuously shows its ability to ramp down to 12 GW in under a day, a 20% flexible output of its total operational capacity. A single reactor is able to reduce output by as much as 1 GW, as seen in the case of Cattenom 2 and 3. Moreover, the age at which nuclear plants modulate does not look like an issue: the Tricastin nuclear site example shows that plants built as far back as the 1970s can still adapt to modern modulation practices.” Kpler’s data suggests a generally positive correlation between cumulative ramp-down intensity and capture rates—the ratio between a generator’s average revenue from electricity produced and the average spot price. “This suggests that as reactors become more flexible and modulate their output to adapt to grid demands, they can take advantage of market grid volatility, which often rewards flexibility, particularly during periods of peak pricing.” Still, this type of flexible operation can pose new operation and maintenance (O&M) challenges, Kpler acknowledges. Thermal cycling can lead to significant wear on reactor components, and temperature fluctuations could affect materials like steel and zirconium alloys used in the reactor pressure vessel, fuel cladding, steam generators, and piping. It also causes steam turbine erosion due to condensation, and it demands intricate control of reactor kinetics, particularly in adjusting neutron flux and reaction rates, with degradation impacts to control rods. It may even affect the uniformity of fuel burnup, leading to “suboptimal fuel use.” The emerging fleet of small modular reactors (SMRs), which are being marketed with load-following capabilities, may face a different set of challenges, as two experts from the University of Western Ontario suggest in a paper recently published in the journal Progress in Nuclear Energy. “Since an SMR can be considered as a combination of the reactor and the balance-of-the-plant, its power output can be regulated at the reactor power output or from the balance-of-the-plant,” experts explain. Load-following can generally be implemented through direct techniques (involving reactivity control and turbine control) or indirectly, leveraging energy storage systems (as Kemmerer 1, the first Natrium plant, will demonstrate). The experts, however, highlight several issues that aren’t usually encountered during existing baseload nuclear operations. These include the risk of uneven core power distribution leading to localized overheating, flow-induced vibrations that stress components, excessive production during peak demand, heightened risk of fission product leaks due to fuel cladding strain, and flow-accelerated corrosion in piping, which can compromise structural integrity over time. The experts recommend further investigation into optimal component sizing, combining direct and indirect load-following methods, assessing long-term wear effects, and refining operational strategies to manage dynamic changes and avoid adverse conditions unique to load-following in SMRs. |

For now, nuclear service firms are readying for new demands from advanced nuclear. Trillium told POWER it is “engaging in structured and in-depth discussions with current and potential customers in the SMR space, encompassing both Gen III and Gen IV types, with a central function to manage trends and inform the innovation activities.” The company said: “It’s important to note that while SMRs share similarities with existing GW-scale water-cooled nuclear programs, there are also significant differences that define SMRs as a distinct market sector with unique requirements, which the industry needs to tune in to. Next-generation nuclear technology challenges conventional thinking, and Trillium encourages its employees to embrace this mindset.”

The Workforce Question

Among the industry’s most prominent challenges as it grapples with emerging O&M demands is retaining its specialized skillset and talent. During France’s 2022 nuclear outage crisis—prompted by a series of overlapping issues that dropped its operational capacity to about 40% at its lowest point—workforce shortages featured prominently as a debilitating factor. While routine inspections revealed corrosion-related cracks in critical reactor piping, requiring time-consuming repairs, the thin labor force left EDF struggling to keep pace with maintenance needs. EDF and French labor unions pointed to the declining nuclear workforce as a critical factor, emphasizing that “wavering government support and lack of policy clarity” had discouraged young engineers and skilled trades personnel from pursuing careers in nuclear.

Given prospects for tripling nuclear capacity globally, Europe’s nuclear trade group Euronuclear suggests the industry is bound to face skills shortages in certain disciplines, technical areas, or locations. “There are some skills like [instrumentation and control], licensing, or major project management that are difficult to find, either because the skills are rare or because competition with other sectors is strong,” said Callum Thomas, CEO of Thomas Thor. “The problem that nuclear industry has, certainly in Western Europe and North America, is that it did not hire from the late 1980s until the early 2000s. During these 15 years, we saw a significant immobilism, and a lack of investment, which has led to a generation-sized gap in experienced staff and leaders. On the one hand, we have a vibrant, nuclear young generation, while on the other hand, we have a very talented older generation, which often decides to postpone retirement. This kind of postponement of retirement is among the factors that saved the nuclear industry facing severe skill shortages in the Western world.”

In the U.S., the DOE “predicts that by 2035, we will need hundreds of thousands of additional workers in the workforce,” noted Erin Hultman, NEI’s vice president of Human Resources & Finance, and Chief Financial Officer. “A typical nuclear energy plant employs 500 to 800 individuals. So, that’s a lot of different types of skills that we need. The skilled trades are of critical importance. We need mechanics, electricians, carpenters, welders. We need IT [information technology] and cybersecurity professionals. And just like any business, we need accountants, human resource professionals, and administrative support. There’s room for everyone.”

To address growing workforce needs, the nuclear industry is placing a strong focus on knowledge transfer and training. Programs that promote mentorship are helping bridge the skills gap by ensuring experienced workers can pass down essential expertise. EPRI also emphasizes the role of digital tools in capturing critical procedural knowledge, including through AI, which supports real-time decision-making and smooth transitions for new staff. Additionally, automation is poised to streamline routine tasks.

The commercial industry is already playing its part. “In some cases, when operators have a shortage of trained staff in certain areas, Trillium has stepped in and become embedded within customer organizations,” the company noted. “We then redeploy when those roles are filled, supporting the upskilling efforts in some cases. Additionally, in the UK, for instance, Trillium is actively developing a concept for country-wide training academies and has a regular annual intake of apprentices and school leavers.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).