How China Is Improving Coal Technology

In China, though specific achievements are hard to pinpoint owing in part to a dearth of public or internationally available information, coal technology developments appear to be advancing more rapidly than anywhere in the world.

China’s efforts to foster technology advancements are in the country’s national interest, said Mi Shuhua, executive vice president of China Energy Investment Corp.—a company formed in November 2017 with the merger of giant state-owned coal generators China Guodian and Shenua Group. The conglomerate today owns 239 GW of power generating capacity, 179 GW alone that is coal power.

China, which was the world’s biggest coal consumer in 2018, depended on coal for 59% of its total energy consumption last year—which means it is in line to meet targets set by the 13th Five-Year Plan for maximum 58% share of coal by 2020—but it also saw an increase in coal consumption for its growing coal-to-chemical industry. And, according to Mi, coal will continue to dominate China’s energy consumption until 2050, despite challenges the industry faces owing to air and water pollution concerns.

However, the biggest challenge the industry faces going forward is “how it will cope with climate change,” he said, noting that China has signed onto pledges to limit the rise in global temperature to 2 degrees Celsius under the Paris Agreement. Mi, who heads China Energy’s power generation business, procurement management, and research and development efforts, noted China Energy oversees three national laboratories dedicated to improving coal plant efficiency and pollutant control (as well as for wind power), and among its priorities are to wrap up 17 national “innovation” projects by 2030.

Efforts will focus on technologies that will transform coal consumption, move the country toward “green and intelligent coal mining,” and expand carbon capture and utilization, he said. At the same time, China has moved aggressively to shutter older, inefficient coal plants, and to replace them with large-capacity high-efficiency low-emission plants. China Energy today has 30 relatively new gigawatt-level units, and 120 units that are above 600 MW, which make up 42% of total thermal installed capacity. It also has 148 supercritical and ultrasupercritical (USC) units.

Double-Reheat Systems

Notably, the country has been aggressively developing and implementing double-reheat units. Compared to the widely used single-reheat steam cycle—which takes steam exiting from the highest-pressure module in the steam turbine and reheats it in the boiler before releasing it in the second-highest pressure module—double reheat establishes a second reheat loop after the second-highest pressure module before it enters the third-highest pressure module.

According to China Energy’s Zhang Wenjian, who outlined China’s specific measures to ramp up coal plant efficiency on June 4, compared to a 1,000-MW single-reheat system, a 1,000-MW double-reheat unit’s thermal efficiency can jump by two percentage points, and that means coal consumption for power supply can be reduced by more than 7 grams (g)/kWh. The system has been successfully implemented at the Taizhou Power Plant Phase II, a USC plant that has five double-reheat units, achieving a power generation efficiency of 47.95%. Other double-heat USC plants in China include the 660-MW Anyan project and the 1,000-MW Laiwu project.

Double-reheat systems were first introduced in the 1950s, but only 40 coal plants featuring the process have been built globally. One reason has to do with economics. Increased capital expenditures and complexity stemming from the additional boiler, the turbine components, and lengthy piping, are hard to justify, especially with the advent and proliferation of combined cycle gas turbines, as Li Li, deputy general manager at Shanghai Shenergy Power Technology Co., noted.

But China’s emphasis on double reheat for USC units appears to cater to goals to reduce coal consumption. If all the country’s 600-MW units adopted double-reheat technology, it could save 58 million metric tons per year of standard coal, one expert pointed out. That could slash China’s carbon emissions substantially.

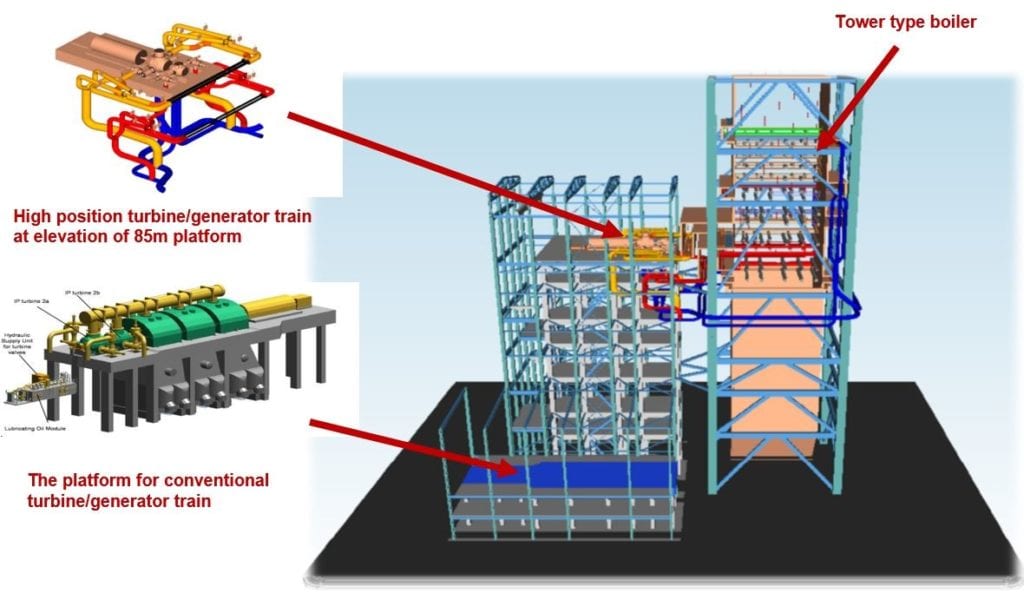

Among notable projects under construction is the massive single-unit 1,350-MW Pingshan Phase 2, a USC unit that, when online at the end of 2020, will have an efficiency of 49.6%. “It will be the most-efficient A-USC unit in the world,” said Li. Especially notable about that project is that it uses an elevated layout with the turbines split into two trains. One train, which houses the high-pressure turbine, is mounted 80 meters above ground level, raising it to the level of the boiler steam header. The other, with two low-pressure turbines, is in a conventional layout. But Shenergy Power has begun improving on that plant, too. “1,350-MW is somehow too large for a single unit, also making it difficult to promote more projects,” he said.

Another issue that the company faces is the pressure and heat loss associated with the second hot-reheat piping, which can be “very expensive for the 700C project,” Li said. Shenergy and China Resources Power are attempting to resolve these issues at a second plant under development in Fuyang. The 660-MW double-reheat USC unit “will very likely” have a lower power consumption and a higher efficiency than Pingshan’s, he said.

CFB and Pollution Controls Advancements

As Zhang noted, China has also made substantial gains in developing circulating fluidized bed (CFB) as well as integrated gasification combined cycle technologies. CFB is attractive because it can use “low-calorific value fuels, such as slime and gangue, to achieve low-cost pollution control and utilization of waste resource,” he said. The shining example among China Energy’s 47 CFB units is the 2013-commissioned 600-MW Baima CFB unit in Sichuan. The supercritical plant’s boiler efficiency is 91.64% and overall unit thermal efficiency is 43.22%, he said.

Also under construction is a 660-MW USC CFB unit that will be air-cooled—the first of its kind in the world, Zhang noted—at Binchang. China is also actively tackling water consumption concerns at USC projects. When commissioned in 2013, China Energy’s Bulian power plant became the world’s first 660-MW USC air-cooled power plant. Today, it features a water consumption of 0.31 kilograms/kWh, said Zhang.

Pollution controls developments have also yielded results. China Energy’s Zhoushan 4 emits 2.46 milligrams/cubic meter (mg/m3) of particulates, 2.76 mg/m3 of SO2, and 19.8 mg/m3of NOx, substantially lower than the strict “ultra-low emission targets” that China set in August 2018, and ordered 49 GW of coal capacity to meet or shut down.

China Energy is now pushing harder toward zero-emissions. In 2018, for example, it carried out a “near-zero emission retrofit” at Hainan Ledong 1, a project that targets particulates, SO2, and NOx emissions of lower than 1 mg/m3, 10 mg/m3, and 10 mg/m3 respectively, Zhang said.

An interesting technology avenue that Zhang described involves the company’s proprietary plasma oil-free ignition system, which involves a plasma generator and a burner in an oxygen-enriched environment. So far, the technology has been applied to 826 units around the world, helping to conserve 150,000 tons of oil.

Another one involves a series of low-nitrogen combustion technologies, which were developed “to reduce NOx emissions at the furnace outlet by 40% to 60% to reach 100 mg/m3at minimum, and thus achieve emission reduction from the source,” Zhang said. The technologies have been applied at 600 boilers.

Meanwhile, China has retrofitted 17 units with high-back pressure heating technology. “Pure condensing units or units with insufficient heating capacity are retrofitted with high back pressure heating technology, increasing the steam pressure and temperature by reducing the vacuum degree of the condenser,” Zhang explained. The effort can help increase the heating capacity of the unit by 25% to 40%. “The overall energy utilization efficiency can be increased by more than 20%, and the coal consumption of power supply during heating period can be reduced by 60 to 90 g/kWh,” he said.

China is also closely scrutinizing ways to integrate coal power into peak load regulation. Flexibility is being explored at 22 demonstration projects, using a variety of solutions, including heat accumulators, system retrofitting, boiler and deNOx solutions, and heat storage.

Other efforts at China Energy, according to Zhang, include digitalization of control systems; seawater desalination; and coal yard management, which has so far yielded 50 fully enclosed coal yards.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)