Virtual power plant operator Voltus and energy firm Octopus Energy will partner to aggregate residential flexibility across four major power markets—PJM, Midcontinent Independent System Operator (MISO), New York, and California—to offer Flexibility-as-a-Service (FaaS) and Bring Your Own Capacity (BYOC) solutions. The effort will “help data centers, utilities, and grid operators manage accelerating AI-driven load growth,” the companies said.

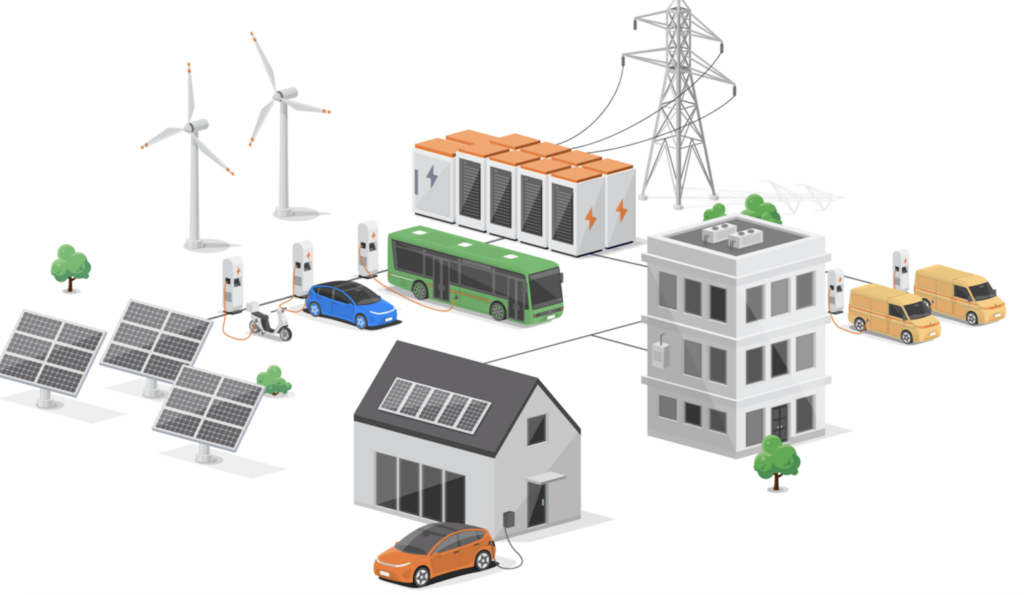

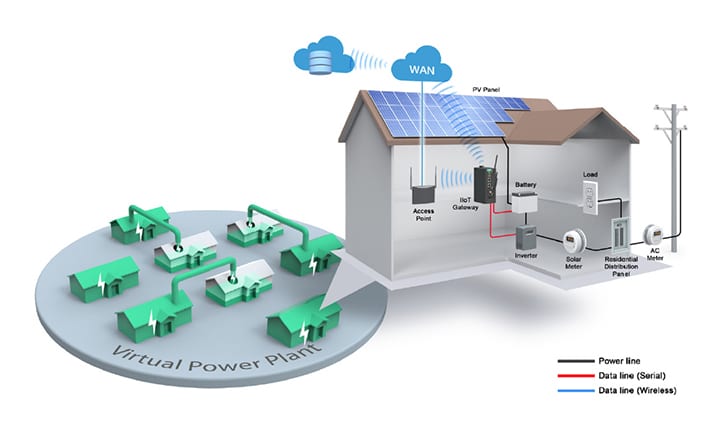

Under the partnership announced on Feb. 3, Octopus will supply Voltus with aggregations of residential consumer devices—smart thermostats, electric vehicles, and home batteries—beginning in 2026. Voltus will integrate that residential capacity into its existing virtual power plant portfolios to expand the scale and diversity of flexible resources available to utilities and wholesale electricity markets. In parallel, Voltus will allow its existing commercial and industrial customers to participate in Octopus’s virtual power plants (VPPs) with utility customers.

“The partnership will leverage Voltus’s load flexibility platform and customer base and Octopus Energy’s consumer engagement and optimization technology to build portfolios of flexible capacity for vertically integrated utilities and in U.S. wholesale electricity markets,” the companies explained.

What Is ‘Flexibility-as-a-Service’—and Is It New?

The term “Flexibility-as-a-Service” as a branded utility procurement model is relatively new, even in European energy markets, where flexibility services have existed for years, particularly in the UK, France, Germany, and the Netherlands. The UK operates the world’s largest local flexibility market, growing from virtually zero in 2019 to 9 GW of contracted flexible capacity in 2025, according to one recent analysis from energy think tank Ember on European demand flexibility scaling. However, European programs typically involve utilities procuring flexibility through market platforms rather than the “design, build, transfer” model that Octopus brands as FaaS.

Octopus Energy introduced FaaS to U.S. utility procurement in July 2025 when it launched a pilot with Southern California Edison (SCE). In that project, Octopus and its partner Kraken engaged SCE residents to demonstrate “a whole home approach” to consumer flexibility, co-optimizing electric vehicles, home batteries, and smart thermostats to address peak demand. The goal was to demonstrate that flexibility could serve as a scalable strategy for utilities to deliver clean, affordable, and reliable power, potentially providing options beyond a traditional, siloed approach in which each device type is managed separately.

The phrase appears deliberately chosen to distinguish this model from both traditional demand response—which utilities have managed in-house for decades—and software-as-a-service (SaaS) platforms that provide monitoring and optimization tools but leave utilities responsible for managing enrollment, customer relationships, and capacity delivery.

In practice, FaaS is structured so that a third party assumes responsibility for customer enrollment, technology integration, and capacity delivery. Rather than a utility building a customer engagement platform and managing aggregations internally, the model is designed to allow utilities to contract for delivered megawatts of flexibility, in a manner intended to resemble capacity procurement from other resources. Under the approach, the service provider bears the risk associated with enrollment and performance, while the utility receives contracted flexibility subject to program and market rules.

According to recent industry interviews, Octopus’s model follows a “design, build, transfer” framework: the company designs flexibility portfolios using its consumer engagement and grid optimization software, builds consumer enrollment and incentive programs, then transfers operations to the utility once the platform is mature and scalable.

However, the partnership announced on Tuesday combines products that Voltus, which has developed a commercial and industrial virtual power plant platform, has positioned as solutions to data center capacity constraints. In September 2025, Voltus launched its “Bring Your Own Capacity” (BYOC) product to allow data center developers and hyperscalers to bring their own capacity stack to utilities.

“Voltus’s BYOC product harnesses its VPP platform—aggregating distributed energy resources—to deliver market-accredited capacity,” Voltus says. “Developers and hyperscalers can deploy these flexible capacity solutions in parallel with their own projects, reducing time-to-power.” The company notably joined forces with emerging data center infrastructure enabler Cloverleaf Infrastructure, which has lauded the solution as a “direct way for data centers to bring economic benefits to the community.” By funding VPPs, data center developers can provide local businesses and residents with an opportunity to earn income through participation, Cloverleaf said in September.

“As a first step, in 2026 Octopus will supply Voltus with aggregations of residential consumer devices—including smart thermostats, EVs, and home batteries, in PJM, MISO, New York, and California. Voltus will add this residential capacity to its existing VPP portfolios, expanding the scale and diversity of flexible resources available to these markets. In parallel, Voltus will provide its customers with the opportunity to participate in Octopus’s VPPs with its utility customers,” the companies said on Tuesday.

Voltus CEO Dana Guernsey framed the partnership around speed to deployment: “Load flexibility is the fastest to deploy form of capacity. By combining our platforms and customer relationships, we can deploy VPPs at the accelerated scale and speed that is needed to meet today’s load growth needs.”

For Octopus, the payoff will likely emerge from market opportunity and consumer benefit. “The clean energy transition is creating an urgent, multi-billion dollar opportunity for demand side flexibility that Octopus Energy and Voltus can address with Flexibility-as-a-Service,” said Octopus Energy US CEO Nick Chaset. “By combining our unique, complementary strengths, we can move faster to deliver flexibility at the scale the grid needs, while putting money back in consumers’ pockets.”

Flexibility Is Becoming an Imperative

The Voltus-Octopus announcement arrives as the U.S. power sector grapples with a structural mismatch to provide adequacy, given that data center demand is accelerating faster than generation can be built or interconnected.

PJM, the nation’s largest grid operator, expects its summer peak could grow 3.6% annually over the next 10 years, reaching approximately 222 GW by 2036—a 10-year increase of nearly 66 GW, according to the grid operator’s January 2026 long-term load forecast. In preliminary analysis released in November, the grid operator projected data center growth of up to 30 GW between 2025 and 2030, noting that PJM serves approximately 40% of U.S. data centers as of 2025.

The path to new generation, however, remains congested. Grid planners are processing more than 233 GW of large-load interconnection requests, with over 70% of them attributed to data centers. In New York, the number of large load projects in the interconnection queue has surged from six projects totaling 1,045 MW in 2022 to 29 projects representing nearly 6,055 MW as of July 2025, according to NYISO’s large load analysis. California ISO projects data center load could increase by 1.8 GW by 2030 and 4.9 GW by 2040, according to the grid operator’s January 2026 large load considerations issue paper.

Demand flexibility is increasingly being explored as a potential tool to moderate the system impacts of large-load growth, particularly by reducing short-duration peak demands that drive expensive infrastructure buildouts. Policymakers, grid operators, and utilities are testing a range of mechanisms—spanning incentive-based curtailment programs, revised interconnection and tariff structures, and pilot market constructs—to assess whether large loads can reliably reduce consumption during periods of system stress. Early efforts suggest that some forms of rapid load response may be technically feasible, especially for certain computational and industrial facilities, but questions remain about performance consistency, real-time observability, and economic viability at scale.

Still, the growing concentration of large loads is raising questions about whether flexibility programs can meaningfully offset infrastructure constraints. In its July 2025 Large Loads Task Force white paper, the North American Electric Reliability Corporation (NERC) explains that many emerging large loads “can cycle their consumption on and off in less than a minute and can ramp from zero to hundreds of MW of power demand over very short time frames,” creating operational challenges while also opening the door to rapid demand response. However, NERC draws a clear distinction between flexible and non-flexible large loads. While cryptocurrency mining and certain AI training facilities can curtail quickly, traditional data centers supporting cloud computing typically “have high load factors and non-conforming behavior, so their consumption is relatively static,” limiting their flexibility value.

Critically, NERC stresses that most emerging large loads are seeking firm transmission service during interconnection, which obligates utilities to “provide the transmission infrastructure capable of serving the load’s peak demand request at all times,” even when customers voluntarily participate in curtailment programs. Utility controllability of load “is usually not accounted for at the transmission planning stage,” which limits planners’ ability to assume sustained load reduction when sizing infrastructure, it says. The report also warns that AI training facilities can change load “35–70 MW or more within a minute,” and that these rapid swings—especially when aggregated across multiple facilities—can degrade balancing authority performance if not visible or predictable to system operators.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).