In a critical step aimed at bolstering advanced reactor development and their domestic nuclear fuel readiness, the U.S. Department of Energy (DOE) has issued its first round of allocations for high-assay low-enriched uranium (HALEU) under its HALEU Availability Program to five American nuclear developers.

On April 9, the DOE said it made conditional commitments to TRISO-X, TerraPower, Kairos Power, Radiant Industries, and Westinghouse Electric Co. The first-round recipients represent Advanced Reactor Demonstration Program (ARDP) Pathway 1 awardees, companies planning to demonstrate reactors in the DOE’s DOME test bed, and select ARDP risk reduction participants. “DOE received HALEU requests from 15 companies,” the agency noted. “For this first round, DOE identified five of those companies that met prioritization criteria, with three of them requiring fuel delivery in 2025.”

As a next step, the DOE said it will “initiate the contracting process to allocate the material to the five companies, some of which could receive their HALEU as early as this fall.” While the initial distribution marks the program’s launch and sets the stage for broader allocations in the coming months, the agency noted the allocation process “is ongoing, and DOE plans to continue HALEU allocations to additional companies in the future.”

A First Big Step for HALEU Allocations

The HALEU allocations announced on Wednesday were made under the HALEU Availability Program (HAP), established under the Energy Act of 2020 to ensure access to HALEU for civilian research, development, demonstration, and early commercial deployment. While the existing U.S. fleet runs on uranium fuel enriched up to 5% with uranium-235 (U-235), HALEU is a nuclear material enriched between 5% to 20%. The material has several uses in fuel for advanced reactors—such as fast reactors, molten salt reactors, and microreactors— including for tristructural isotropic (TRISO) fuel. HALEU may also be used in operating reactors (enriched between 5% and 10%) to boost their performance.

For now, however, commercial supply of HALEU is only available from Russia’s Rosatom subsidiary TENEX, which has raised national security and energy independence concerns. China also has the infrastructure to produce HALEU at scale, according to the World Nuclear Association.

In total, as outlined by the HALEU Allocation Process finalized in September 2024, the DOE intends to make 21 metric tons of HALEU available by June 30, 2026, to support near-term industry needs. Under the FY 2024 National Defense Authorization Act, Congress directed the DOE to make the 21 metric tons of HALEU available on a set schedule: 3 metric tons by Sept. 30, 2024; 8 metric tons by Dec. 31, 2025; and 10 metric tons by June 30, 2026.

For the allocations announced on Wednesday, the DOE will likely draw HALEU from DOE- and National Nuclear Security Administration (NNSA)-managed surplus stockpiles located at several federal sites, including the Y-12 National Security Complex in Tennessee, the Savannah River Site in South Carolina, and the Idaho National Laboratory.

In parallel, however, the DOE is also supporting limited HALEU production from Centrus Energy’s American Centrifuge Plant cascade in Piketon, Ohio. Centrus in October 2023 kicked off HALEU enrichment operations, delivering its first 20 kilograms (kg) of HALEU in November 2023. Under its contract with the DOE, the facility is slated to produce 900 kg for a full year. The DOE, which owns the HALEU produced from the demonstration cascade, is compensating Centrus on a “cost-plus-incentive-fee” basis, with an expected Phase 2 contract value of approximately $90 million, subject to Congressional appropriations. A contract gives the DOE options to pay for up to nine additional years of production from the cascade beyond the base contract.

As part of the HALEU Availability Program, the DOE is also working to build out a full HALEU supply chain—from from enrichment to deconversion and fabrication. In October 2024, the agency named six companies to provide deconversion services to convert HALEU from uranium hexafluoride (UF₆) into oxide or metal forms suitable for use in advanced reactors. Selected firms include Nuclear Fuel Services (BWXT), American Centrifuge Operating (Centrus Energy), Framatome, GE Vernova, Orano, and Westinghouse. Days later, on Oct. 14, DOE awarded contracts totaling up to $8 million to four nuclear fuel companies—Centrus, URENCO, Orano Federal Services, and General Matter—to strengthen domestic HALEU enrichment capabilities. The contracts will allow these firms to bid on future work to produce and store HALEU in UF₆ form.

Separately, the DOE in December 2024 selected six companies to compete for up to $2.7 billion in contracts to supply low-enriched uranium (LEU) and bolster the domestic fuel supply chain. These include: American Centrifuge Operating, General Matter, Global Laser Enrichment, Louisiana Energy Services, Laser Isotope Separation Technologies, and Orano Federal Services.

Who’s Getting the HALEU—and Why

While the DOE did not publicly disclose the specific quantities of HALEU allocated to each of the five companies that garnered conditional commitments on Wednesday, the HALEU Allocation Process outlines criteria designed to ensure that material is distributed based on project readiness, alignment with DOE missions, and near-term fuel needs. The evaluation process is meant to consider factors such as licensing status, fuel fabrication capability, technical maturity, and whether the requested HALEU form and amount are available within DOE’s inventory—ensuring priority is given to developers positioned to use the fuel on an accelerated timeline.

The five companies selected for conditional HALEU commitments reflect a diverse cross-section of reactor types, project timelines, and end-use cases.

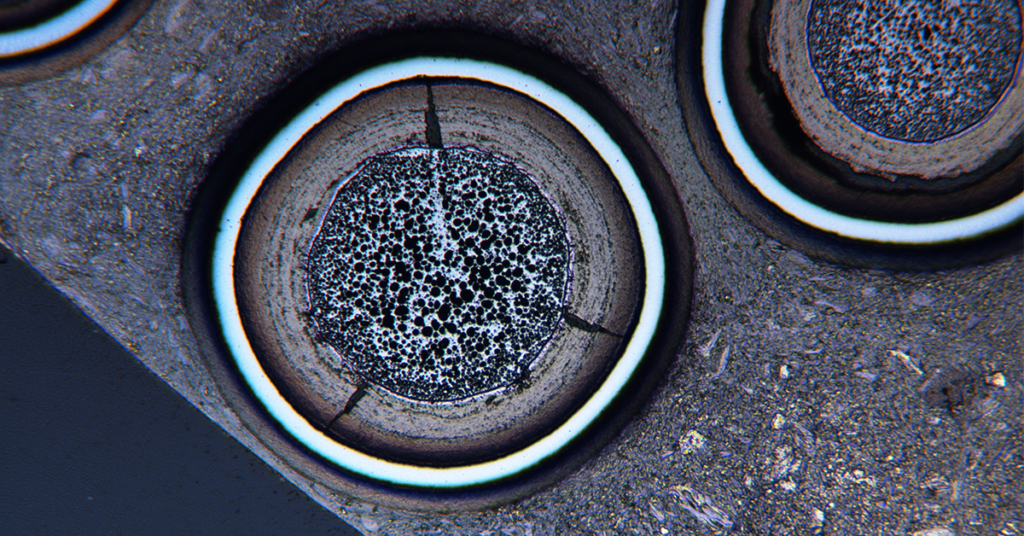

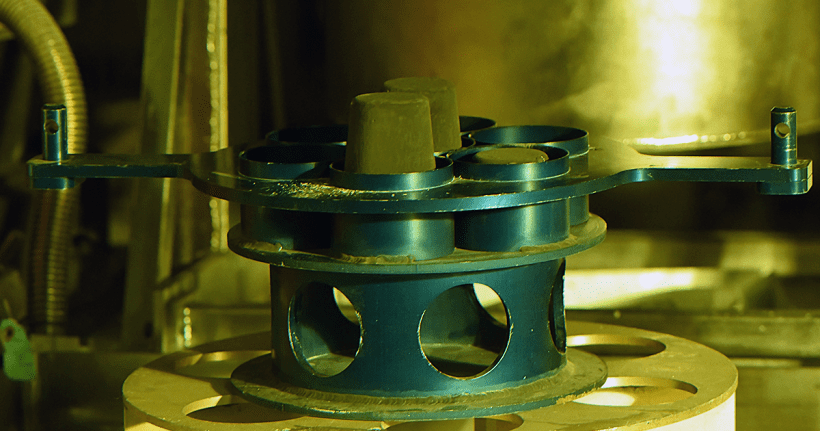

TRISO-X (X-energy). A subsidiary of X-energy, TRISO-X is advancing the nation’s first commercial-scale HALEU fuel fabrication facility in Oak Ridge, Tennessee. The TRISO-X Fuel Fabrication Facility (TF3) will produce TRISO (tri-structural isotropic) fuel—uranium kernels encased in multiple protective layers capable of withstanding extremely high temperatures—designed for use in high-performance advanced reactors. X-energy broke ground on the TRISO-X facility—formally named TX-1—in October 2022, and in December 2024, it awarded a $40.8 million contract to Geiger Brothers for the site development phase, which is expected to be completed by July 2025.

The $300 million facility is backed by an $80 million ARDP Pathway 1 award from 2020 and a $148.5 million tax credit under the Inflation Reduction Act, awarded in 2024. Once operational, TF3 is expected to produce up to 8 metric tons of fuel annually by 2027. As of 2024, its 40-year NRC license application was reported to be 45% complete.

TRISO-X’s fuel is intended for advanced reactors, including X-energy’s Xe-100 high-temperature gas-cooled reactor, the first of which submitted a combined license application (COLA) to the Nuclear Regulatory Commission (NRC) on March 31 for deployment at Dow’s Seadrift manufacturing site in Texas.

X-energy also has a high-profile partnership with hyperscaler Amazon, which in October 2024 invested in the company to explore advanced nuclear as a long-term clean energy source for its data centers. The collaboration aims to deploy 5 GW of new nuclear capacity by 2039, beginning with a four-unit, 320-MW Xe-100 project with Energy Northwest in central Washington, with an option to expand to 12 units totaling 960 MW. Amazon’s investment will also support the completion of the Xe-100 reactor design, licensing milestones, and initial phases of the TRISO-X fuel facility.

TerraPower. Backed by an $80 million ARDP Pathway 1 award from 2020 and more than $750 million in private funding, TerraPower is developing its first Natrium power plant—comprising a 345-MWe sodium-cooled fast reactor coupled with molten salt-based energy storage—at a site near PacifiCorp’s retiring coal plant in Kemmerer, Wyoming. The pioneering project, which began non-nuclear construction in June 2024, is supported by up to $2 billion in DOE cost-share funds and is aiming to begin fuel loading by 2030, with commercial operation potentially in 2031.

The Natrium demonstration will be the first-of-a-kind deployment of TerraPower’s 840-MWth pool-type fast reactor, integrated with an energy storage system that can flex output between 100 MWe and 500 MWe for over 5.5 hours. TerraPower submitted its NRC construction permit application (CPA) in March 2024 and anticipates approval in late 2026. It has secured long-lead nuclear components and is now focused on standing up a full supply chain for both nuclear and thermal systems.

The Natrium project, however, has been hindered by a lack of HALEU availability. TerraPower’s HALEU supply strategy includes agreements with Centrus Energy, Framatome, and ASP Isotopes, which plans to establish enrichment capabilities in South Africa. In parallel, TerraPower and Framatome are developing a pilot line for high-assay low-enriched uranium (HALEU) metallization, a crucial deconversion process at Framatome’s nuclear fuel manufacturing facility in Richland, Washington. In October 2022, TerraPower and GE Hitachi Nuclear Energy (GEH) announced they would build a fuel fabrication facility at GNF’s Wilmington facility to create reliable fuel for the Wyoming demonstration and future Natrium plants.

Kairos Power. Kairos Power, a privately held engineering and nuclear technology company, is advancing its fluoride salt–cooled, high-temperature reactor (KP-FHR) through a phased, iterative development strategy. Its Hermes 1 test reactor, under construction at the East Tennessee Technology Park in Oak Ridge, Tennessee, is the first non-light water reactor permitted for construction in the U.S. in over 50 years. Funded partly by a $629 million ARDP risk reduction award (with a $303 million DOE share), the pebble-bed molten salt demonstration reactor will validate systems and de-risk licensing for future commercial units.

In December 2023, the NRC approved the construction of Hermes 1. Less than a year later, in November 2024, the agency authorized Hermes 2, a 70-MWth two-unit facility that will produce up to 20 MWe, marking it as the first electricity-generating Gen IV reactor approved for construction in the U.S. Kairos aims to begin operations by December 2027. Both Hermes units will use TRISO fuel sourced from a partnership with Los Alamos National Laboratory.

Kairos’s KP-FHR technology will scale to commercial units, including a 50-MWe KP-X demo and a dual-unit 150-MWe KP-FHR plant. In October 2024, Kairos signed a master development agreement with Google to deploy 500 MW of advanced nuclear capacity by 2035 to power data centers. The first unit is expected online by 2030, part of Google’s effort to meet 24/7 carbon-free energy goals.

Radiant Industries. Based in El Segundo, California, Radiant is developing the Kaleidos microreactor, a 1.2-MWe portable, helium-cooled, high-temperature gas-cooled reactor (HTGR) designed to replace diesel generators in remote and off-grid locations. The compact design, which uses TRISO fuel and a graphite moderator, is engineered for five years of continuous operation without refueling and is being advanced under the ARDP risk reduction program. Founded in 2019 by former SpaceX engineers, Radiant’s goal is to deliver zero-emissions, factory-built energy systems for military and commercial applications.

To support deployment, Radiant partnered with Centrus Energy in 2023 to secure HALEU for up to 20 Kaleidos units. In November 2024, the DOE awarded the company and Westinghouse $5 million to participate in the Demonstration of Microreactor Experiments (DOME) test bed at INL. The award supports Radiant’s progression into the Detailed Engineering and Experiment Planning (DEEP) phase, a key step toward final reactor testing.

Radiant plans to demonstrate a full-scale 3.5-MWth Kaleidos reactor at DOME by 2026, pending completion of its Preliminary Documented Safety Analysis (PDSA). If successful, the fueled test—anticipated to run for 150 continuous hours—would provide critical data to support licensing and commercial scaling of the company’s high-efficiency, transportable microreactor platform.

Westinghouse Electric Co. Westinghouse’s eVinci microreactor is a 5-MWe/13-MWth “nuclear battery” designed for off-grid, remote, and mission-critical applications, offering up to eight years of continuous operation without refueling. The heat pipe–cooled microreactor, which uses HALEU-based TRISO fuel in a solid-state monolith core, is engineered for factory fabrication and containerized delivery. The design features no moving parts and supports combined heat and power generation at temperatures up to 600C, making it ideal for applications in mining, military, hydrogen production, and remote industrial facilities.

In 2024, Westinghouse was part of the $5 million DOE award to advance eVinci’s testing through the DOME test bed at INL with a demonstration targeted for as early as 2026. The company has signed a long-term HALEU supply agreement with Urenco, targeting fuel deliveries in the early 2030s, and is progressing toward licensing under NRC’s 10 CFR Part 52 pathway.

Westinghouse also made headlines in November 2023, when Canada’s Saskatchewan Research Council (SRC) became the first confirmed customer for eVinci, aiming to deploy a unit by 2029 backed by CA$80 million in provincial funding. That project will support licensing under the Canadian Nuclear Safety Commission (CNSC) and could become Saskatchewan’s first advanced nuclear reactor, demonstrating eVinci’s commercial viability and laying the groundwork for wider deployment in both U.S. and international markets.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).