Corporate Funding for Solar Power Projects Hits 10-Year High

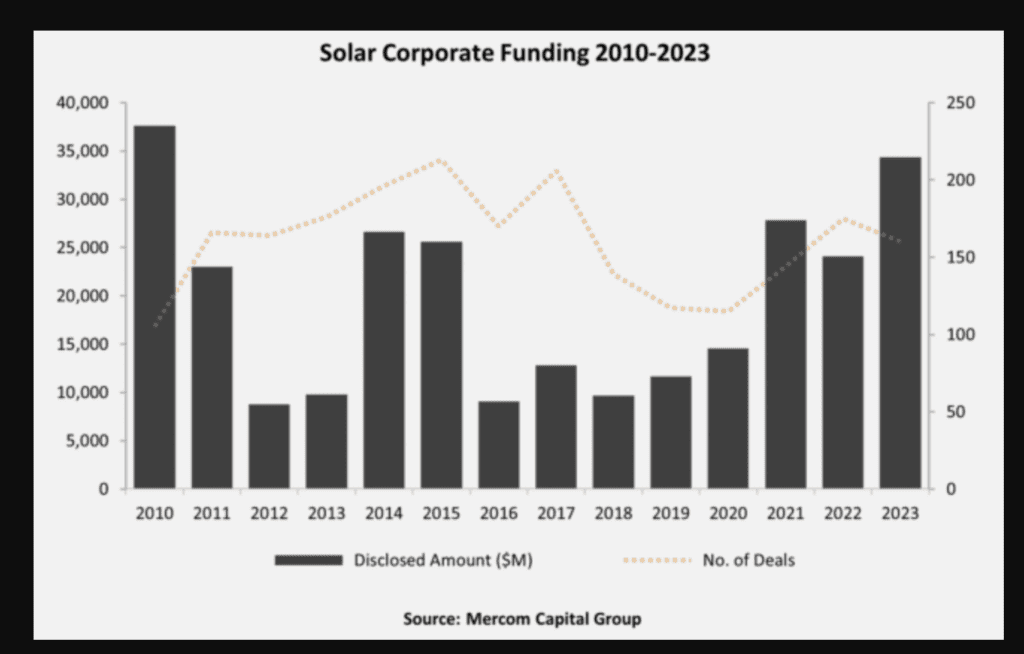

Total corporate funding for solar energy projects hit a 10-year high in 2023, according to Mercom Capital Group’s annual report focused on the solar power sector.

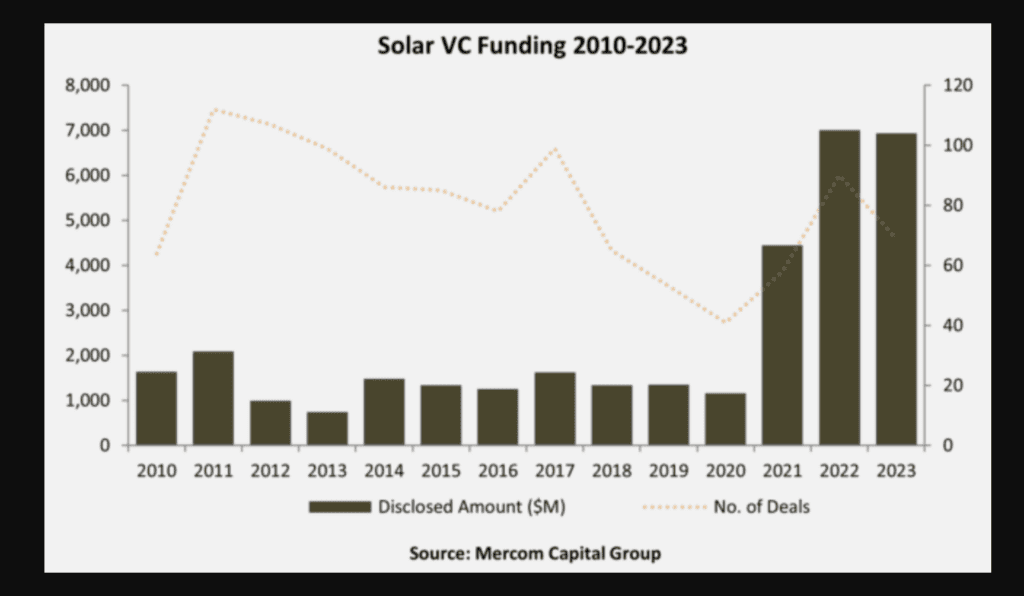

Mercom, an integrated communications, research, and media firm focused on global clean energy markets, said groups raised $34.3 billion to support solar projects last year, including $6.9 billion in venture capital (VC) funding for solar. The VC funding was the second-highest amount invested in solar power in the past decade, trailing only the $7 billion raised in 2022. The group said there were 26 VC funding deals of more than $100 million last year.

The total corporate funding, which includes VC funding, public market, and debt financing in the solar power sector, increased 42% year-over-year from 2022 levels. The $34.3 billion figure was raised in 160 deals, compared to $24.1 billion in 175 deals in 2022.

The group said public market financing in 2023 was $7.4 billion, also the second-highest amount since 2013.

Investments ‘Defy Expectations’

“Investments into solar continue to defy expectations. Despite high-interest rates and challenging market conditions, corporate funding in the sector was the highest in a decade,” said Raj Prabhu, CEO of Mercom Capital Group. “Debt financing also hit a decade high, and venture capital investments and public market financing recorded the second-highest amounts since 2010. Driven by the Inflation Reduction Act, the global focus on energy security, and favorable policies worldwide, solar continues to attract significant investments.”

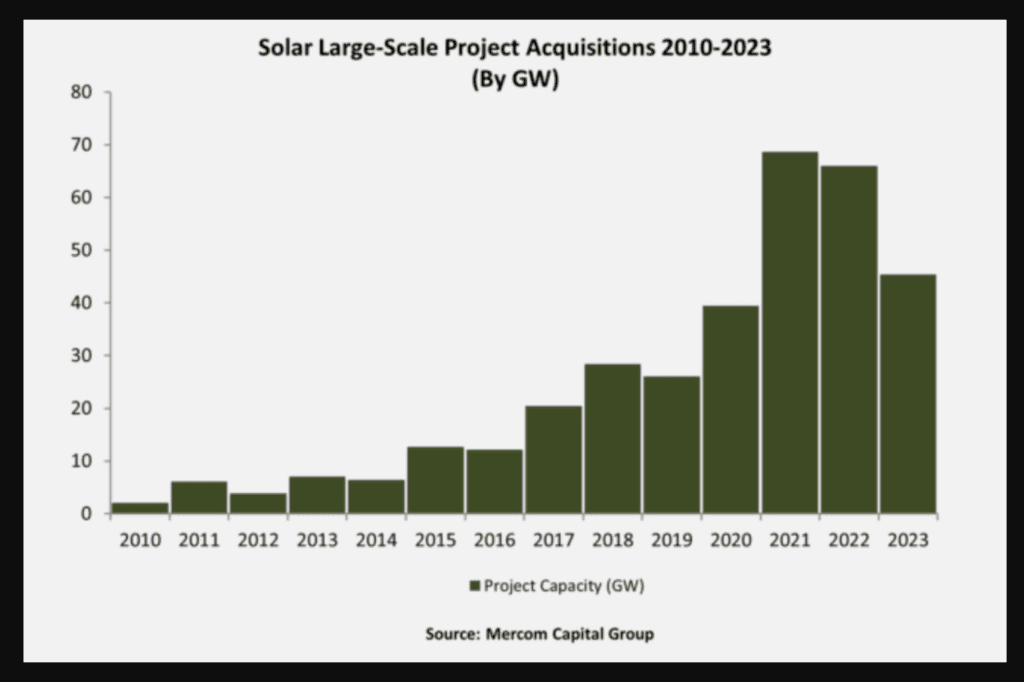

Mercom’s Annual and Q4 2023 Solar Funding and M&A Report, released Jan. 17, reported 231 large-scale solar power project acquisitions in 2023, representing generation capacity of almost 45.4 GW.

That figure represents a 31% drop from 2022, though, when 66 GW of generation capacity was acquired.

That figure represents a 31% drop from 2022, though, when 66 GW of generation capacity was acquired.

Mercom said solar companies raised about $20 billion in debt financing, also the highest amount in a decade.

The report said that of the $6.9 billion in VC funding raised in 69 deals in 2023, $4.7 billion (68%) went to 42 solar downstream companies. Solar photovoltaic (PV) companies raised $1.9 billion; balance of system (BOS) companies raised $311 million; and service providers raised $32 million. Mercom said the top VC-funded companies in 2023 were 1KOMMA5° ($471 million), Enfinity Global ($428 million), Silicon Ranch ($375 million), CleanMax Solar ($360 million) and Juniper Green Energy ($350 million).

Public market financing last year totaled $7.4 billion, 45% higher than the $5.1 billion in 2022. Announced debt financing in 2023 came to $20 billion, 67% higher than the $12 billion in 2022, and the highest amount raised since 2010. Securitization activity was a key contributor, with $3.4 billion in 11 deals, according to the report.

M&A Activity Falls

Merger and acquisition (M&A) activity fell 25% year-over-year, with 96 corporate M&A transactions in 2023 compared to 128 in 2022. The largest transaction was by Brookfield Renewable Partners, which agreed to acquire Duke Energy’s unregulated utility-scale commercial renewables business in the U.S. for about $2.8 billion.

“While funding activity has been strong, macroeconomic and geopolitical uncertainties, recession worries, and elevated interest rates have significantly slowed down both corporate and project M&A activity in 2023,” said Prabhu. “Higher borrowing costs have put a damper on M&A transactions, with cautious investors biding their time for more favorable valuations. Solar projects continue to attract interest, but high valuations and a lower risk appetite, compounded by unpredictable project completion timelines due to interconnection delays, labor shortages, and scarcity of components, have all contributed to a drop-off in project M&A activity.”

The report covers activity from 250 companies and investors.

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).