Finance

-

Commentary

Balancing Essential Utility Infrastructure Investment with Customer Affordability

Electric utilities are entering an era of growing investment opportunities following a decade of low load growth. However, there is increasing evidence that regulators are growing more concerned about the

-

Solar

Community Solar Projects Bring Renewable Energy to the Masses

The National Renewable Energy Laboratory (NREL) explains that community solar, also known as shared solar or solar gardens, is a distributed solar energy deployment model that allows customers to buy or lease part of a larger, off-site shared solar photovoltaic (PV) system. It says community solar arrangements allow customers to enjoy advantages of solar energy […]

-

Commentary

What Does the Nuclear Industry Need to Do to Scale Production Toward Net-Zero Goals?

The United Nations Climate Change Conference (COP28) proved to be a historic moment for nuclear energy, with more than 20 countries including the U.S., France, Japan, and the UK pledging to triple global

-

Commentary

How PG&E Almost Became the Nation’s Largest Cooperative

The history of electric cooperatives is one of individuals striving to improve their local communities. Perhaps the most inspiring electric cooperative formation was initiated by Peggi Timm. Timm, whose accomplishments would fill a library, helped to create one of Oregon’s largest cooperatives, called Oregon Trail Electric Cooperative (OTEC). In 1987, OTEC’s service territory was controlled […]

-

Solar

How Renewable Energy Companies Can Address Increasing Foreign Exchange Challenges

Following a difficult period for the renewable energy industry, firms must begin prioritising foreign exchange (FX) risk management against the rising threat of currency movements. It has been a tough year for the renewable energy industry. The post-COVID inflationary pressures that have gripped the global economy over the last two years are weighing heavily on […]

-

Legal & Regulatory

Three Key Transmission Links Get $1.3B Boost With Federal Capacity Contracts

Three interregional transmission lines connecting six U.S. states will receive the first $1.3 billion tranche of $2.5 billion in federal funding designated under the Transmission Facilitation Program (TFP), a revolving fund enacted by the 2021 Bipartisan Infrastructure Act. The U.S. Department of Energy (DOE) Grid Deployment Office’s (GDO’s) first picks under the TFP, unveiled on […]

-

Press Releases

NuScale Power Comments on Inaccurate Short-Seller Report

PORTLAND, Ore. – NuScale Power Corporation (NuScale or the Company) (NYSE: SMR) today issued the following statement in response to a misleading short-seller report on October 19, 2023 (the Report). The inaccurate and deceptive “research” is riddled with speculative statements with no basis in fact and demonstrates a limited understanding of small modular nuclear reactors […]

-

Hydrogen

U.S. Unveils Seven Regional Hydrogen Hubs, Awards $7B to Kickstart National Hydrogen Network

Seven regional hydrogen hubs spanning Appalachia, California, the Midwest, the Gulf Coast, the American heartland, the Mid-Atlantic, and the Pacific Northwest are poised to receive $7 billion in Infrastructure Investment and Jobs Act (IIJA) funding under the Department of Energy’s (DOE’s) Regional Clean Hydrogen Hubs Program (H2Hubs). The selections, unveiled by the Biden administration on […]

-

Nuclear

Bipartisan Support Makes Backing Nuclear Power an Administration-Proof Investment

Maria Korsnick, president and CEO of the Nuclear Energy Institute (NEI), the policy organization of the nuclear technologies industry, suggested a bipartisan majority in Congress recognizes the importance of nuclear energy and has supported the industry with unprecedented levels of funding. As an example, Korsnick pointed to the Bipartisan Infrastructure Law, which provided a $6 […]

-

Trends

Decommissioning Dilemmas: Navigating the End-of-Life Challenges in Clean Energy Sources

Planning, building, operating, or overhauling power plants has long been an emphasis in the power sector—and an important one, given that the creation of new power capacity plays an outsized role in

-

Trends

Clean Energy Transition Continues Despite Reliability, Supply Chain, and Financial Uncertainty

Although there is a risk of energy shortfalls in parts of the U.S. if extreme summer temperatures materialize, there is no stopping the clean energy transition that is sweeping the nation. Energy storage

-

Research and Development

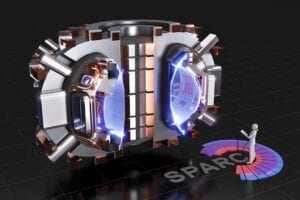

Fusion Energy Projects Get Boost from DOE Funding

The U.S. Department of Energy (DOE) announced the first round of awardees of the Milestone-Based Fusion Development Program. The program is the latest in a series of efforts designed to align public and private sectors toward fusion commercialization. “The Biden administration obviously sees enormous potential in fusion—harnessing the power of the sun and the stars […]

-

Nuclear

Global Commitments Bolster Romanian NuScale Nuclear Project

A project to deploy the first NuScale 462-MWe VOYGR-6 nuclear power plant in Romania by 2029 has garnered a $275 million public-private funding commitment from the U.S., Japan, South Korea, and the United Arab Emirates (UAE) as part of a global infrastructure partnership. The Romanian project may be bolstered by an additional $4 billion outlined […]

-

Nuclear

Emerging Opportunities for Nuclear in the Energy Transition

Nuclear has re-invented itself as a compelling pathway to achieving net-zero. It is said that everything is cyclical—where there are periods of expansions and contractions. Could this be true of nuclear energy? Can the benefits outweigh the fears and flip the switch from decommissioning to accelerated growth? In the late 1960s, federal nuclear energy programs […]

-

Distributed Power

DOE Offers $3B Conditional Loan Guarantee to Virtual Power Plant Initiative

Sunnova Energy Corp., an energy-as-a-service (EaaS) provider, has snagged a first-of-its-kind conditional federal loan guarantee commitment of up to $3 billion for a project that could further future virtual power plant (VPP) deployment. The Department of Energy (DOE) Loan Programs Office (LPO) on April 20 said it would provide a partial loan guarantee for up […]

-

Offshore Wind

Entergy, RWE Partner to Assess Offshore Wind Prospects in Gulf of Mexico

U.S. utility Entergy and global power giant RWE are partnering to jointly assess the best means to develop an offshore wind market in the Gulf of Mexico. The two companies on March 30 unveiled a memorandum of understanding (MoU) under which they will analyze the Gulf of Mexico offshore wind market and define an optimal […]

-

Nuclear

Last Energy Secures PPAs for 34 SMR Nuclear Power Plants in Poland and the UK

Last Energy, a U.S.-based micro modular nuclear technology firm and project developer, has secured power purchase agreements (PPAs) for 34 PWR-20 small modular reactor (SMR) units with four industrial partners in the UK and Poland. The deals, which represent a combined $18.9 in power sales, mark “the largest pipeline of new nuclear power plants under […]

-

News

Understanding How Securitization Can Help with Power Plant Retirements

Power companies across the nation are being pressured to retire fossil-fueled power plants and transition to cleaner energy resources. But many existing fossil plants have not been completely paid off or

-

Wind

Siemens Gamesa Posts Nearly $1 Billion Quarterly Loss

Siemens Gamesa chief executive Jochen Eickholt acknowledged equipment failures in both the company’s onshore and offshore wind turbines, leading to higher warranty provisions, contributed to a nearly $1 billion net loss for the company in the last three months of 2022. Eickholt on Feb. 2 said the company’s October to December—the group’s fiscal first quarter—loss […]

-

Trends

10 Near-Term Global Power Sector Trends

While 2021 provided its own share of extraordinary energy debacles, Russia’s invasion of Ukraine in early 2022 cascaded into full-blown energy turmoil. This year will begin with the world “in the midst of

-

Renewables

Risk Mitigation: An Essential Prerequisite for Inflation Reduction Act Funding

The groundbreaking Inflation Reduction Act (IRA) will put hundreds of billions of dollars toward renewables. As the most comprehensive energy policy in recent years, the IRA is already having a profound impact

-

Nuclear

GE Hitachi Formally Enters BWRX-300 SMR in UK Race for New Nuclear

GE Hitachi Nuclear Energy (GEH) has submitted a Generic Design Assessment (GDA) entry application for its BWRX-300 small modular reactor (SMR) to UK authorities, kicking off a key regulatory process that could give the advanced nuclear technology a competitive edge as the country races to potentially triple its nuclear capacity to up to 24 GW by […]

-

Renewables

Investment Bank ‘Mobilizing’ up to $115 Billion for Renewables, Energy Storage and More in EU

The European Investment Bank Group (EIB Group) said it will support an initial investment of €30 billion ($30.2 billion) in loans and equity financing to move the European Union (EU) away from fossil fuels and toward cleaner forms of energy over the next five years. The EIB board of directors on Oct. 26 said a […]

-

News

Risks and Opportunities: It’s an Interesting Time to Be in the Power Industry

War rages in Europe. Natural gas prices are through the roof. Drought threatens hydro production. Weather extremes are becoming commonplace. Supply chains are strained. Demand for electricity is headed

-

T&D

DOE Launches $2.5B Fund to Upgrade and Build New Transmission Lines

The Biden administration has launched efforts to shape the $2.5 billion Transmission Facilitation Program (TFP), a key Infrastructure Investment and Jobs Act (IIJA) initiative dedicated to building out critical new transmission lines and related facilities across the country. The Department of Energy’s Grid Deployment Office on May 10 issued a joint notice of information (NOI) […]

-

Cybersecurity

Goldman Sachs Stake in Fortress Underscores Supply Chain Cybersecurity Priority

A Goldman Sachs private equity business is taking a stake in critical industry cybersecurity firm Fortress Information Security. The $125 million investment underscores a heightened awareness of supply chain vulnerabilities within the investor community. Fortress, which announced the investment from Goldman Sachs Asset Management Private Equity on April 19, said it also highlights a wider […]

-

Legal & Regulatory

SEC’s Landmark Climate Disclosure Rule Weighing on Power Sector

Investor-owned electric companies are thoroughly reviewing the Securities and Exchange Commission’s (SEC’s) broad new proposed rule that requires registrants to disclose climate-related risks and governance, and plan to remain engaged with the regulatory agency as the rulemaking continues. The proposed rule, which the SEC approved 3–1 on March 21, has drawn intense interest from the […]

-

Nuclear

Natural Gas and Nuclear Power Are Not ‘Green’ Investments

It is not an over-reaction to state that we are in the midst of a planetary emergency. We face the combined threats of climate, nature loss, and human health pandemics. Of the nine planetary boundaries that

-

Gas

GE Grasping for Growth as It Prepares for Integrated Energy Spinoff

GE’s first earnings release after the American conglomerate last November announced it would combine and spin-off its Renewable Energy, Power, and Digital business suggests flagging orders for onshore and offshore wind equipment and gas turbines amid a business environment wrought with uncertainty. GE on Jan. 25 reported revenues of $15.7 billion for its Renewable Energy business, […]

-

News

ESG Aspects Loom Large in Power and Utilities M&A Activity

Environmental, social, and governance (ESG) efforts are factoring into merger and acquisition (M&A) deal activity within the power and utilities sector across North America, according to a report issued by PwC, a professional services firm serving the “Trust Solutions and Consulting Solutions” segments. “As policies are clarified and ESG strategies are strengthened, broad investor interest […]