Bipartisan Support Makes Backing Nuclear Power an Administration-Proof Investment

Maria Korsnick, president and CEO of the Nuclear Energy Institute (NEI), the policy organization of the nuclear technologies industry, suggested a bipartisan majority in Congress recognizes the importance of nuclear energy and has supported the industry with unprecedented levels of funding.

As an example, Korsnick pointed to the Bipartisan Infrastructure Law, which provided a $6 billion investment in the Civil Nuclear Credit (CNC) program and also directed $2.5 billion toward advanced reactor demonstrations. She also noted that Congress added enormous new incentives for nuclear energy last year, making nuclear projects eligible for clean energy production tax credits and clean electricity investment credits for zero-emission facilities.

“This type of support is really unprecedented in a hyper-partisan political climate that we live in today. It’s really a rare area of agreement,” Korsnick said while speaking during a NuScale Power Analyst Day presentation (Figure 1). “Nuclear energy had support under the Biden administration, and it also had support under the Trump administration. So, it really should leave no question about the government’s view—nuclear is vital to a clean-energy grid and to our economic future. And that commitment and that perspective is why you can expect support for nuclear to last, Congress to Congress and administration to administration.”

States Seek to Capitalize on Nuclear Power

Support is not only being found at the federal level, but also within state legislatures. “State governments are realizing that advanced nuclear can absolutely satisfy their energy needs and help invigorate their economies,” said Korsnick. “And they’re not just reconsidering nuclear, they’re really looking at what incentives they can offer, and how can they attract nuclear to their state.”

More than 200 nuclear-related bills have been authored in states across the country in 2023, according to Korsnick. That’s a marked increase compared to years past, when she said it was hard to find even a dozen nuclear-related bills being considered.

Among the states specifically mentioned by Korsnick were North and South Dakota, which are studying options for small modular reactors (SMRs). Wyoming was said to be evaluating how nuclear could transform its energy economy. West Virginia reportedly lifted a moratorium that prevented the building of new nuclear plants. And lawmakers in California, acting against the wishes of a number of anti-nuclear organizations, took advantage of the CNC program to keep the Diablo Canyon units online.

Interest from Industries Beyond Power Generation

Opportunities for nuclear plant suppliers are coming from outside of the electric power generation sector too. Nucor Corp., the nation’s oldest and largest steelmaker, is investing millions in SMR technology to potentially power its steel production. Powering data centers is another potential growth area for SMRs. In fact, Standard Power and NuScale announced a deal on Oct. 6 for two new SMR power plants to be sited in Ohio and Pennsylvania. X-energy and Dow are planning to site a four-unit 320-MWe Xe-100 advanced nuclear reactor facility at Union Carbide Corp. Seadrift Operations, a sprawling Dow chemical materials manufacturing site in Seadrift, Calhoun County, Texas. Beyond those deals, SMRs are also being talked about for district heating, desalination, commercial-scale hydrogen production, and other process heat applications.

“We’re really talking about demand, not for one or two reactors—this pie is really big—so it’s hundreds, I’ll be honest, if not thousands of reactors,” Korsnick said.

Many Countries Consider New Nuclear Power Options

And the excitement for nuclear power is growing outside of the U.S. too. Ghana, Indonesia, Kenya, Poland, Romania, and Ukraine were all mentioned as actively pursuing new nuclear power units. “But global demand isn’t only about new markets, we’re witnessing really a sea change in opinion in countries where nuclear capacity had previously stalled,” said Korsnick. Some of the places where nuclear power is gaining fresh momentum include Canada, Finland, France, India, Japan, South Korea, Sweden, and the UK.

“There’s no question that the global demand is going to last. We’re seeing it firsthand at NEI,” Korsnick said. “We’ve had 18 different countries come through our offices just in the last six months alone. And in comparison, I would say, last year and in years past, we might have had three or four international visits and trade missions.”

The Financial Pie Is Vast, but China and Russia Are Formidable Competitors

According to Korsnick, U.S. companies stand to benefit greatly, if they can cash in on these global opportunities to export technology abroad. “According to one estimate, revenues for U.S. companies alone could be $1.9 trillion over the next 30 years,” she said.

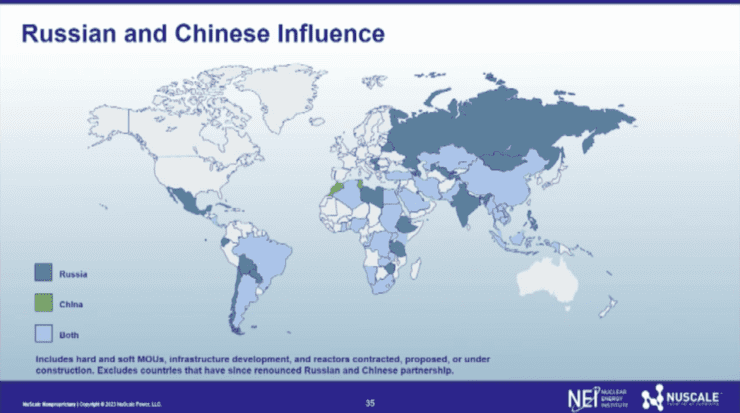

However, the competition from Russia and China cannot be overlooked. “Ceding leadership and nuclear exports to Russia and China would be a strategic disaster for the United States from a safety and security perspective,” Korsnick said. “There is a deep bipartisan commitment to preventing that outcome.”

U.S. companies are starting with a handicap, however; Russia and China are already in the process of signing agreements and starting builds around the world (Figure 2). Korsnick noted that 22 exported Russian reactors are currently under construction including in Egypt, Hungary, Iran, and Turkey.

Appealing for private investment dollars, Korsnick said, “It’s quite clear that the world is better off when U.S. companies are the go-to partner for nuclear development, and private investment in American nuclear technology is a huge part of the solution. So, by investing now and establishing our U.S. companies as suppliers in these key markets, you can really open the door to exponentially greater opportunity down the road, and you can be confident that those investments will be aligning with the priorities of the U.S. government.”

—Aaron Larson is POWER’s executive editor (@POWERmagazine).