Three advanced nuclear developers—Radiant, Last Energy, and ARC Clean Technology—announced the closing of major private funding rounds in mid-December 2025, signaling renewed investor momentum behind microreactors and small modular reactors (SMRs) as the companies move from design and licensing into pilot deployment and early commercialization.

The announcements—which span a new $300-million-plus round at Radiant, an oversubscribed $100-million Series C at Last Energy, and a closed Series B at ARC Clean Technology—suggest solid engagement from venture capital and strategic investors in backing factory-built nuclear systems tied to near-term demonstration projects, manufacturing scale-up, and defined regulatory pathways in the U.S., Canada, and the UK.

What “Series” Funding MeansAccording to the venture capital industry’s trade group, the National Venture Capital Association (NVCA), venture capital is purpose-built to finance technologies that fall outside the reach of conventional lending. Venture capital, it says, “turns ideas and basic research into products and services that have transformed the world,” focusing on “building high growth companies from the ground up,” and supporting ideas that “could not be financed with traditional bank financing,” often “require five to eight years (or longer!) to reach maturity,” and may “threaten established products and services in a corporation or industry.” As a result, NVCA notes that venture capital “has the longest asset-holding periods of any investment class and often invests in companies with little to no liquidity,” adding that “the standard VC partnership agreement lasts for ten years with extensions that in practice mean the partnerships generally run even longer.” The funding typically follows a series of rounds—Series A, B, C, and beyond—each which represent different maturity levels. Venture capital (VC) firms typically pool money from multiple investors to fund high-growth companies, and in exchange, VC firms take equity or an ownership stake in the company. “Generally, it takes around 12 to 18 months between the seed and Series A stages, though this can vary,” notes Silicon Valley Bank (SVB), a longtime lender and adviser to technology and energy startups. Each round typically involves issuing new shares at a negotiated valuation to institutional investors. Series A. “Typically is the first round of venture capital financing,” according to Silicon Valley Bank (SVB). At this stage, companies have usually completed their business plans and prepared pitch decks emphasizing product-market fit, are establishing a customer base, and can demonstrate “consistent revenue flow,” SVB says. In a Series A round, companies “need to have a plan that will generate long-term profits,” it adds. Series B. Companies are “now ready to scale,” SVB says, and “this stage of venture capital supports actual product manufacturing, marketing and sales operations.” While Series A investors measure potential, SVB notes that “for Series B, they’ll want to see actual performance and evidence of a commercially viable product or service.” Common Series B investors typically include venture capitalists, corporate venture capital funds, family offices, and late-stage venture capital funds. Series C and Beyond. At the Series C stage, “you’re on a growth path. You’ve achieved success, and incremental funding will help you build new products, reach new markets, and even acquire other startups,” SVB says. SVB adds that it “typically requires two to three years to reach this phase on a quick trajectory,” and that companies at this stage are producing “exponential growth and consistent profitability.” To raise Series C and later rounds, companies need a “stable revenue stream,” a “history of growth,” and a “desire to expand globally,” SVB says. It notes that “investors are eager to participate in Series C and beyond because your proven success means they shoulder less risk.” Investor types include late-stage venture capitalists, private equity firms, hedge funds, banks, corporate VC funds, and family offices. For advanced reactor companies, series funding, notably, suggests a form of technology maturity validation and deployment readiness, with the core benefit of allowing companies to advance capital-intensive commercialization. Companies report using proceeds to accelerate specific milestones, including for licensing, supply chain development, manufacturing, infrastructure, and first-of-a-kind demonstrations. |

Advanced Nuclear Investment Hits Record in 2025

The news arrives as nuclear investment marks a sharp uptick this year. Net Zero Insights, a market intelligence firm that tracks climate and energy investment, reports that by the beginning of the third quarter of 2025, nuclear fission companies had already raised $1.3 billion in equity funding—the sector’s highest annual total on record and accounting for nearly 40% of all nuclear fission equity investment since 2020. Deal activity has also intensified. Net Zero Insights notes 28 equity transactions had been recorded by October 2025, up from an annual average of about 15 in prior years. SMRs and microreactors accounted for roughly 75% of total nuclear fission funding, the firm adds.

So far this year, the largest disclosed private financings in advanced nuclear have come from a small group of developers moving toward first deployments and commercial scale. TerraPower closed a $650 million Series C in June 2025, backed by Bill Gates and NVIDIA’s NVentures, to complete its Natrium sodium-cooled fast reactor project in Wyoming. X-energy completed an upsized $700 million Series C-1 round in February 2025, adding approximately $200 million to an initial $500 million close in October 2024 anchored by Amazon, as the company advances deployment of its Xe-100 high-temperature gas-cooled reactor and associated fuel supply chain.

But fusion has also been a solid contender for private financing. Commonwealth Fusion Systems raised $863 million in Series B2 funding in August 2025 to commercialize its SPARC fusion machine, while Helion Energy secured $425 million in Series F financing in July 2025, led by Sam Altman and SoftBank, pushing its valuation over $5 billion.

Radiant Raises $300M+ Series D to Scale Microreactor Manufacturing and Build Tennessee Factory

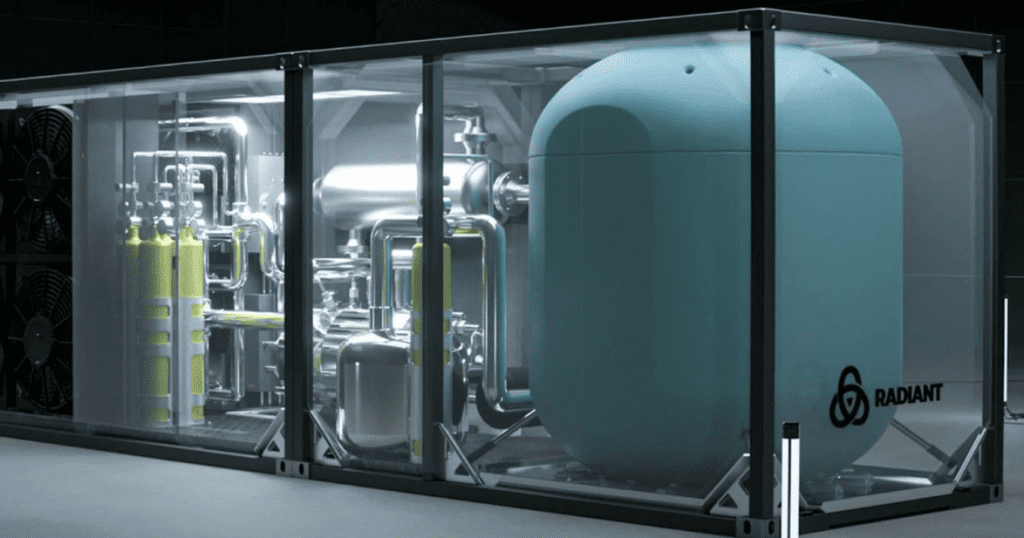

California-based Radiant on Dec. 17, 2025, said that it raised more than $300 million in a new round of funding, capital that the company plans to use to support commercialization scale-up as it prepares to move from demonstration to manufacturing of its portable nuclear microreactors. The latest capital raise is slated to support the scaling of commercialization efforts as Radiant prepares to break ground early next year on its recently announced R-50 factory in Oak Ridge, Tennessee.

Radiant noted the raise came “just six months since closing its Series C” in May 2025, when it secured $165 million and brought its total venture funding to $225 million. The new funding round, led by Draper Associates and Boost VC, included additional commitments from current investors alongside new participants including Founders Fund, ARK Venture Fund, Chevron Technology Ventures, Washington Harbour Partners, Friends & Family Capital, Andreessen Horowitz, DCVC, and Align Ventures. Global law firm Orrick told POWER it is advising Radiant in the new funding round.

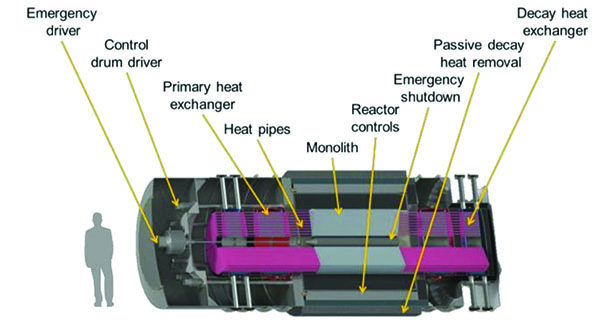

Founded in 2020, Radiant is developing Kaleidos, a 1-MWe/1.9 MWth helium-cooled microreactor with Tri-structural ISOtropic (TRISO) fuel and passive air-jacket natural-convection cooling. The reactor, designed for factory assembly and rapid field deployment, is engineered for “always-on power for defense, disaster response, remote industry, and critical infrastructure applications where traditional energy systems fall short,” according to the company. Radiant’s core competitive advantage centers on factory-built, transportable designs that enable rapid deployment at scale.

Radiant plans to test its first reactor in 2026 at the Idaho National Laboratory’s DOME facility, following its selection by the U.S. Department of Energy (DOE) to receive high-assay low-enriched (HALEU) fuel for the demonstration, eyeing initial customer deployments beginning in 2028, the company said. To support that model, the company announced in October it will build its first manufacturing facility on a former Manhattan Project site in Oak Ridge, Tennessee. Facility construction is slated to begin in early 2026, and production is expected to scale. “By 2028, we’ll be rolling out the first factory-built nuclear generator, and within a few years we’ll be producing over a dozen per year,” said Doug Bernauer, CEO and Founder of Radiant.

Customer commitments have emerged as critical validation of Radiant’s commercialization timeline. The company signed a deal (with deposits) with data center firm Equinix to purchase 20 Kaleidos microreactors for data center applications. It has also secured what it describes as the “first-ever deal for mass-manufactured nuclear microreactors on a U.S. military base” through agreements with the Defense Innovation Unit and the Department of the Air Force. On the fuel supply front, Radiant became the first reactor company to sign a contract with the U.S. DOE for HALEU fuel for its 2026 INL test, and subsequently signed “the first binding commercial contract by a U.S. advanced reactor developer for Western commercial HALEU enrichment services” with Urenco at a ceremony at the U.S. embassy in London.

Radiant has strengthened its operational and technical leadership during 2025, bringing on board Dr. Rita Baranwal, the former Assistant Secretary for Nuclear Energy, as Chief Nuclear Officer; Dr. Mike Starrett, as Chief Revenue Officer; and nearly a dozen additional VP and Director-level hires across engineering, manufacturing, and supply chain organizations. On the regulatory front, Radiant has secured approval of its Nuclear Safety Design Agreement (NSDA) and acceptance for review of its DOE Authorization Request for Kaleidos (DARK), positioning it for summer 2026 testing at INL.

Last Energy Secures $100M+ Series C to Fund Texas A&M Pilot Reactor and UK Regulatory Pathway

Austin-based Last Energy on Dec. 16, 2025, announced it closed an oversubscribed Series C of more than $100 million led by the Astera Institute, with participation from JAM Fund, Gigafund, The Haskell Company, AE Ventures, Ultranative, Galaxy Interactive, and Woori Technology Co., Ltd., among others.

The company will deploy proceeds to complete its PWR-5 pilot reactor at the Texas A&M–RELLIS Campus under the DOE’s Reactor Pilot Program, a streamlined regulatory pathway that authorizes advanced reactor demonstrations outside the traditional Nuclear Regulatory Commission licensing framework, with a target of achieving criticality in 2026.

The PWR-5 pilot is a scaled-down derivative of Last Energy’s PWR-20, a 20-MWe pressurized water reactor (PWR) designed around full modularization and factory fabrication. The commercial PWR-20 uses standard full-length PWR fuel (<4.95% enriched, 17×17 assemblies) and a four-loop pressurized-water design, drawing on operating experience from more than 300 PWRs in service worldwide. Last Energy’s approach centers on off-the-shelf nuclear and thermal power components sourced through an established global supply chain, with all major systems factory-built, tested, and integrated into standardized modules prior to delivery. The design employs a subterranean nuclear island, air-cooled tertiary loop, and a compact footprint—about 0.3 acres—intended to enable siting flexibility and reduce construction scope, with target delivery timelines of less than 24 months, the company says.

“We believe this financing will fully capitalize us through our DOE pilot project and position us to transition into commercialization of our production power plants,” said Bret Kugelmass, Founder and CEO of Last Energy. “A new nuclear era is underway, and we intend to showcase how factory fabrication will unlock the scalability that the energy market demands.”

Beyond the Texas A&M pilot, the Series C financing also supports parallel regulatory and commercial positioning in the UK. The company is advancing plans to build four 20-MW PWR-20 reactors at the former Llynfi Coal Power Station site in South Wales, potentially becoming the first new commercial nuclear site to enter UK licensing since Torness in 1978. In June, regulators completed a preliminary design review, and the company is targeting a site-licensing decision by December 2027.

In the U.S., the company has secured a lease at the Texas A&M–RELLIS Campus, executed an Other Transaction Agreement (OTA) between the DOE and a reactor developer, and leveraged a previously procured full core load of fuel to support its planned 2026 criticality demonstration. As POWER has reported, the company has also secured a Texas site to build 30 microreactors.

ARC Clean Technology Closes Series B to Advance ARC-100 Commercial Deployment

ARC Clean Technology on Dec. 16, 2025, announced it had closed a Series B financing round to support the commercialization of its ARC-100 advanced small modular reactor, as the company advances regulatory, project development, and partner-driven deployment activities in North America and abroad. The round drew participation from Xplor Ventures, Hennessy Capital Group, Cleantech Ventures, Core Synergy, and Banpu Ventures, alongside strategic investors, corporate venture capital, and family offices. ARC said proceeds will be used to advance commercialization programs for the 100-MWe ARC-100, expand work under U.S. DOE programs, support collaboration with Korea Hydro & Nuclear Power (KHNP), and continue Canadian project development with engineering partner Hatch.

“This investment reflects strong confidence in ARC’s progress and the capability of the ARC-100 to deliver reliable, clean heat and power for energy-intensive industries and next-generation data centers,” said James Wolf, who was freshly appointed CEO as the company enters its next commercialization phase.

ARC’s flagship technology is the ARC-100, a 100-MWe/286-MWth Generation IV sodium-cooled fast reactor derived from the Experimental Breeder Reactor-II (EBR-II), which operated for 30 years at Idaho National Laboratory. The ARC-100 uses liquid sodium coolant, a fast neutron spectrum, and metallic uranium-zirconium fuel, enabling low-pressure operation, high thermal efficiency, and inherent safety characteristics. The design targets a 20-year core life without refueling and a 60-year plant operating life, according to the company’s technical documentation.

In Canada, the financing will build on ARC’s recent regulatory milestones. In July 2025, the company completed Phase 2 of the Canadian Nuclear Safety Commission’s Vendor Design Review for the ARC-100 and is supporting New Brunswick Power’s License to Prepare Site application for a proposed demonstration at the Point Lepreau site. Completion of Phase 2 provides an external regulatory assessment that no fundamental barriers to licensing have been identified.

“It validates the licensability of the technology,” Senior Vice President and Chief Operating Officer Bob Braun told POWER in a July 2025 interview. “Ultimately, what this milestone does is significantly de-risk the project. It’s a clear signal to the market and to potential launch customers that this is a viable, licensable technology.”

Braun said the next major step is preparation of a preliminary safety analysis report to support a License to Construct application, which New Brunswick Power is targeting for submission in late 2027 in support of an early-2030s demonstration timeline. Fuel availability remains a pacing factor, he acknowledged at the time, but said ARC and New Brunswick Power had active engagement across the uranium supply chain.

In parallel, ARC is participating in the U.S. DOE’s Advanced Reactor Demonstration Program (ARDP), where it is completing preliminary design activities for a U.S.-sited ARC-100 model. Braun said the DOE work has enabled early engagement with the Nuclear Regulatory Commission (NRC).

Internationally, ARC is advancing its collaboration with KHNP as a potential construction and fleet-deployment partner and in September 2025 formed NuARC, a joint development entity with Calgary-based Nucleon Energy, to pursue ARC-100 deployments beginning in Alberta. The company has identified grid power, industrial heat, hydrogen production, and data-center applications as primary early markets for the technology.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).