Affordable electricity prices have become a top priority for consumers, policymakers, voters, and elected officials. Electricity prices for the residential, commercial, industrial, and transportation sectors averaged 6.7% higher in September 2025, compared to the same month one year ago. Residential prices alone increased by more than 7%, making it especially challenging for low- and middle-income families to make ends meet.

COMMENTARY

There are many reasons for these price increases, which include higher demand for electricity caused by data centers and artificial intelligence, expensive grid upgrades, volatile fuel costs, supply chain problems, and flawed electricity market rules. However, one way to avoid making electricity less affordable is to stop retiring coal power plants and replacing them with new renewable energy resources.

Energy Ventures Analysis (EVA) analyzed the annual cost of replacing coal power plants that are scheduled to retire with six renewable sources of electricity: solar only; solar firmed by battery energy storage systems (BESS) or natural gas; wind only; and wind firmed by BESS or natural gas. BESS and natural gas are firming resources that are necessary to ensure power is available when the wind isn’t blowing or the sun isn’t shining. Even though the cost of BESS has been declining, it is still relatively expensive and is able to produce power for only a few hours at a time. Natural gas can be very expensive when prices spike, and it is sometimes in short supply, especially during extreme weather.

Almost 42 GW of coal-fired generation (46 plants with 79 generating units) have retired or announced plans to retire during 2025 through 2028. (Some utilities have been postponing coal retirements because of electricity demand, and this trend is likely to continue.) EVA estimated the annual cost of continuing to operate these coal plants and compared that to the cost of building and operating the six renewable resources. The exhibits below summarize some of the results of the analysis.

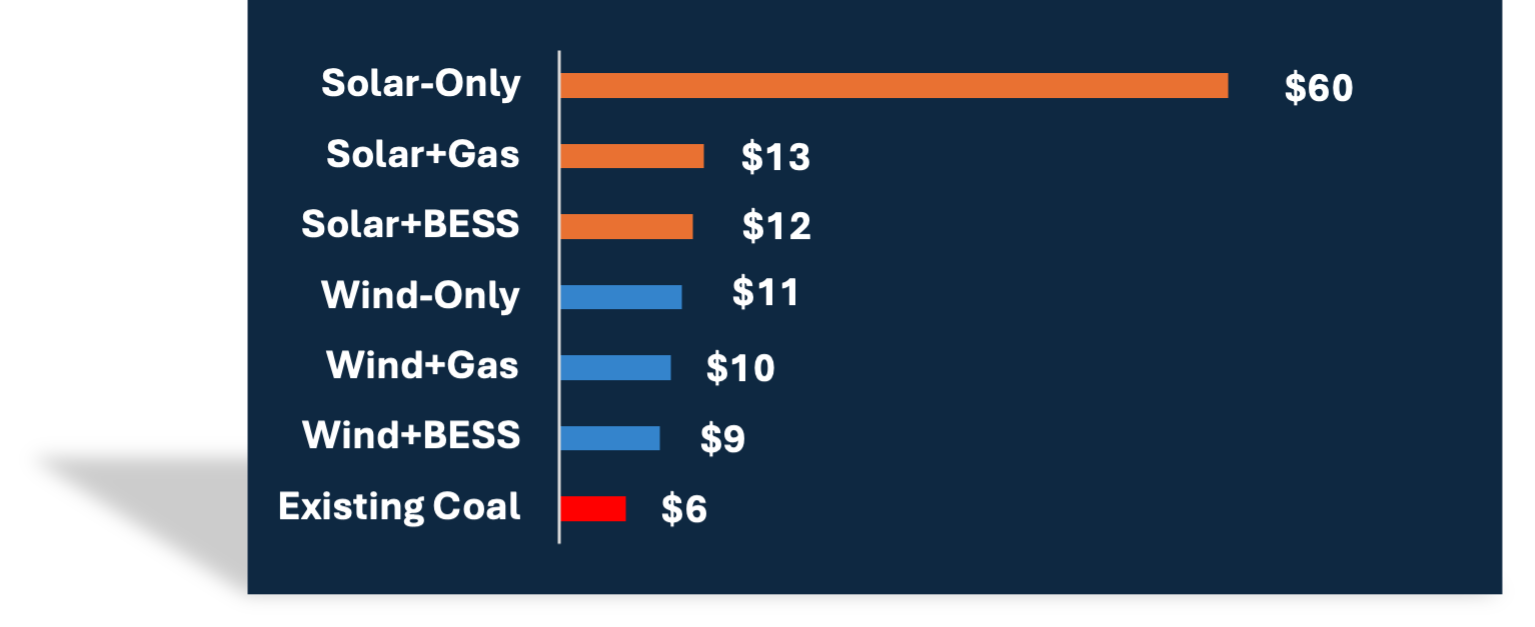

The first chart below shows the annual cost in billions of dollars to continue operating the 79 retiring coal units and the annual cost of building and operating replacement resources. The analysis shows, for example, that replacing retiring coal plants with new solar panels would be 10 times more expensive than continuing to operate the coal plants ($6 billion in annual costs for the coal plants versus $60 billion in annual costs for solar panels to replace the coal plants).

The higher cost for renewables would ultimately result in higher electricity bills. However, the magnitude of the increases would vary by state and region.

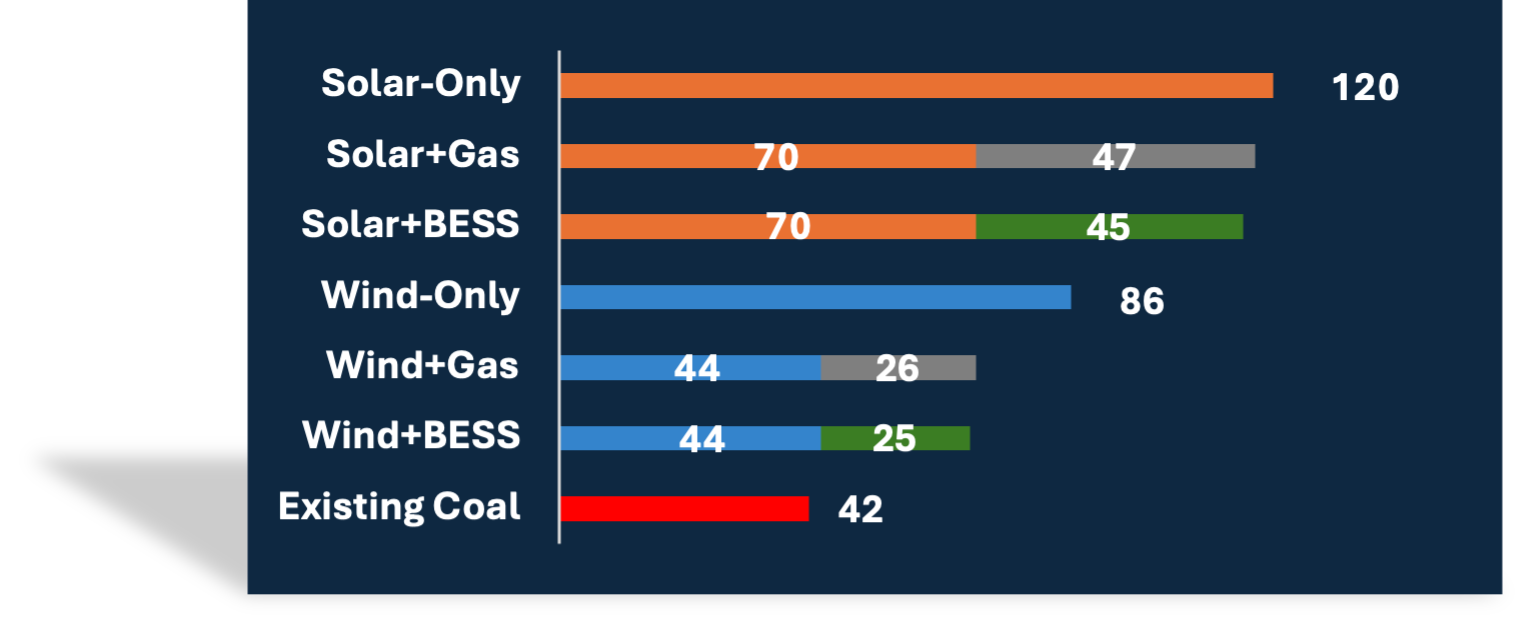

The second chart below shows the amount of generating capacity in GW that is required to replace 42 GW of retiring coal capacity. Solar+gas and solar+BESS show the capacity of replacement solar (orange) plus the firming capacity (grey for natural gas and green for BESS). For example, solar+gas means 70 GW of solar plus 47 GW of natural gas firming capacity. Similarly, wind+gas and wind+BESS show the amount of replacement wind capacity (blue) plus firming capacity (grey for natural gas and green for BESS).

These results show the amounts of total replacement capacity, but the amounts alone do not take into account the loss of certain reliability attributes that coal provides and renewables do not.

We support an all-the-above strategy, and this analysis shows one of the reasons why coal has to be an essential part of this strategy. The EVA analysis is not intended to discredit renewables, but rather to show that adding more renewables to the grid is not always the best way to maintain affordable electricity prices.

—Michelle Bloodworth is president and CEO of America’s Power.