Xcel Energy has moved to lock in supply and development capacity for what could become 6 GW of data center load through separate strategic agreements with GE Vernova and NextEra Energy, announced this week, that reserve five F-class gas turbines, multiple gigawatts of wind capacity, and joint development resources to support generation buildout into the 2030s.

The Minneapolis-headquartered electric and natural gas utility serving eight states on Feb. 3 announced a strategic alliance with GE Vernova covering gas turbines, wind equipment, and grid technologies. On Feb. 4, it unveiled a memorandum of understanding with NextEra Energy focused on co-developing generation, storage, and interconnections to serve data center projects across Xcel Energy’s service territories.

Discussing the NextEra agreement on Xcel Energy’s Feb. 5 earnings call, Xcel chairman, president, and CEO Bob Frenzel said the collaboration is designed to deliver “increased clock speed” by combining the companies’ development, analytical, and commercial capabilities. “By engaging early with leading developers like NextEra, we can better anticipate system needs for new data centers, streamline development timelines, advance innovative grid technologies, and continue to provide the network benefits that data centers bring to all of our customers,” he said.

The parallel agreement with GE Vernova is designed to secure long-lead equipment and execution capacity as load growth extends into the next decade. “As a first step, Xcel Energy is purchasing five additional natural gas turbines from GE Vernova, bringing our total to 24 gas [combustion turbines] on order across our vendors,” Frenzel said during the call. The company is also “bidding several gigawatts of wind projects with GEV turbines in our pending and upcoming [request for proposals (RFPs),” he added.

GE Vernova Alliance Secures Gas and Wind Supply for Long-Term Buildout

Xcel Energy and GE Vernova signed a “landmark” strategic alliance agreement (SAA) designed to support Xcel Energy’s generation and grid projects into the 2030s, according to the Feb. 3 announcement. The agreement includes a reservation agreement for five F-class gas turbines and a capacity reservation agreement to utilize multiple gigawatts of GE Vernova wind turbines in future projects, the companies said. The gas and wind turbines are manufactured at GE Vernova facilities in the U.S., according to the announcement.

The companies will also collaborate on grid equipment opportunities, building on a 2025 order for grid systems, including synchronous condenser technology, Xcel Energy said.

“As we work to meet our sustainability and grid modernization goals and seize this once-in-a-generation opportunity to power our communities’ growing demands for energy, Xcel Energy is committed to collaborating with organizations who bring the best skills, innovation and expertise to our projects,” Frenzel said. During the earnings call on Thursday, Frenzel noted that the collaboration would support Xcel’s growth into the 2030s. “This partnership will focus on delivering key benefits to Xcel Energy’s customers and stakeholders through enhanced certainty of supply, operational flexibility and cost affordability. Key to the partnership is a mutual commitment to innovation and strategic collaboration,” he said.

Scott Strazik, CEO of GE Vernova, also suggested the agreement would allow deeper strategic coordination between the companies. “This agreement allows us to collaborate more strategically, aligning our technology roadmaps and unique service capabilities with Xcel Energy’s vision. Together, we are better positioned to innovate and execute on projects that will provide reliable power for generations to come,” he said.

The five F-class gas turbines covered by the Xcel strategic alliance are incremental to GE Vernova’s existing backlog and were not included in the 83 GW of contracted gas turbines and slot reservations the equipment supplier reported during its Jan. 28 quarterly earnings call, according to Xcel.

Beyond gas turbines, the alliance also covers wind equipment supply, with Xcel planning to bid “several gigawatts of wind projects with GEV turbines in our pending and upcoming RFPs,” Frenzel said.

GE Vernova Gearing Up for a 100-GW Gas Turbine Backlog

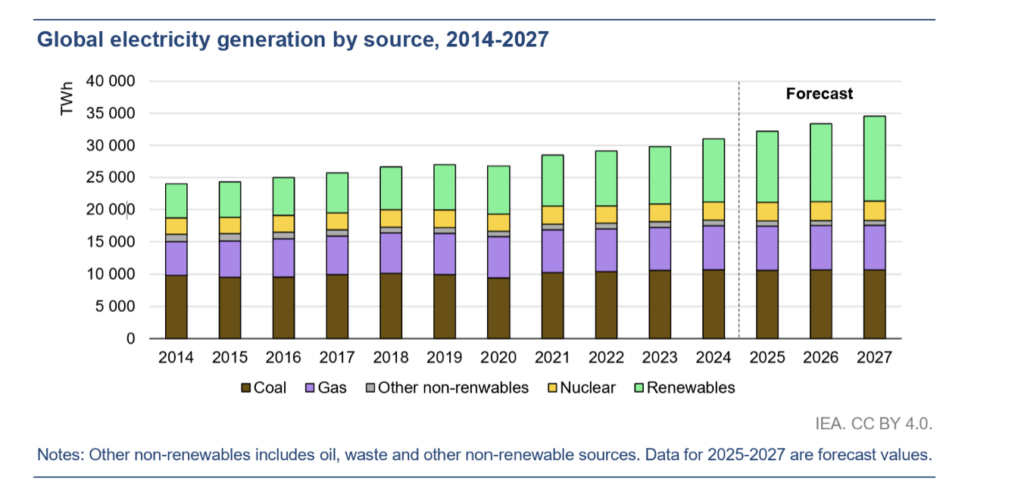

Last week, during its own fourth-quarter earnings call, GE Vernova said its gas power equipment backlog and slot reservations surged from 62 GW to 83 GW in the fourth quarter of 2025, “primarily due to strong U.S. demand,” though the company also secured agreements in the Middle East, Vietnam, and Taiwan. Of the total, 40 GW represent firm equipment orders, while 43 GW are slot reservation agreements (SRAs).

The company said it expects to reach approximately 100 GW under contract by 2026, assuming shipments in the “high teens” of gigawatts this year and new contract signings span “north of 30 GW.”

Strazik told analysts that pricing on current slot reservation agreements is running “10 to 20 points higher” than existing backlog, which suggests intensifying competition for scarce gas turbine manufacturing capacity. “When we look at where we’re trending with our slot reservation agreements today versus our existing backlog, there’s another 10 to 20 points of pricing strength in the SRAs today,” Strazik said.

He added that GE Vernova expects the current 40-GW order/43-GW reservation split to shift toward a roughly 60-40 mix by year-end 2026, as a greater share of reservations converts into firm equipment orders. However, Strazik cautioned that the company’s 100-GW outlook does not yet assume the closure of additional framework agreements for delivery slots from 2031 to 2035, even as those discussions remain active.

During the quarter, GE Vernova booked 41 heavy-duty gas turbines, its largest orders quarter of 2025 and an increase of more than 70% year-over-year, including 15 HA-class units. The company also secured orders for 18 aeroderivative turbines, up from 10 in the prior-year quarter. For the full year, GE Vernova booked approximately 63 aeroderivative units.

Strazik said that by the time the company reaches 100 GW under contract, “both ’29 and ’30 will be largely sold out,” though he noted that slots for 2029 deliveries remained available as of late January.

Addressing emerging competition from smaller turbine providers and jet-engine conversions, Strazik said those technologies are helping developers access earlier power but do not threaten GE Vernova’s long-term position in baseload generation. “When you’re underwriting 20-year business cases, efficiency matters a lot when you’re running these units at baseload,” he said. “We don’t really view those smaller units to be competition, but that doesn’t mean that’s not a good business in the near term.”

To meet rising demand, GE Vernova is vastly expanding its manufacturing capacity. The company installed more than 200 new machines in its factories and added nearly 1,000 production workers in 2025, and plans to add an additional 200 machines and more than 500 workers in 2026. GE Vernova expects a “substantial step-up” in gas turbine output beginning in the third quarter of 2026, when annual production capacity will reach approximately 20 GW.

NextEra MOU Targets Co-Development for Data Center Projects

Xcel Energy on Feb. 4 signed an MOU with a subsidiary of NextEra Energy to accelerate the delivery of generation resources to serve large load customers, including data centers, the companies said. The MOU represents an expansion of a long-standing commercial relationship between Xcel Energy and NextEra Energy, the companies said. Xcel Energy has been a 20-year partner with NextEra Energy, signing its first power purchase agreement with the company in 2006 and its first project sale agreement for a development transfer a decade ago, Frenzel noted.

The parties expect to support existing and new large load opportunities across Xcel Energy’s service territories through improved collaboration on generation, storage, and associated transmission investments, Xcel Energy said. Xcel executives added that much of this growth is expected to move through new large‑load tariff structures, and they suggested that future data center energy services agreements will likely be paired with dedicated generation and transmission portfolios that demonstrate net benefits for existing customers and enable faster development timelines.

“Working with the right partners is critical to deliver on this once-in-a-lifetime opportunity to meet increased energy demand in our communities. This collaboration will align two of the best development teams in the industry to deliver reliable and affordable power for all Xcel Energy customers,” Frenzel said.

“Across the country, energy demand from data centers, advanced manufacturing, and other large load customers is accelerating rapidly,” said John Ketchum, chairman and CEO of NextEra Energy, in a statement.”This MOU reflects our shared commitment to proactively plan for that growth, using NextEra Energy’s leading digital tools to explore scalable, cost-effective and quick to deploy energy solutions that will also help ensure customers have access to cost-effective energy today and in the future.”

During NextEra Energy’s fourth-quarter earnings call on Jan. 27, Ketchum described data centers as a central driver of the company’s long-term infrastructure strategy and said hyperscalers are increasingly expected to carry the cost of the generation required to serve their load.

“We really see this heading more towards ‘bring your own generation.’ And I think that’s how we’ve set up our entire pipeline and our development effort. And we are one of the very few companies that are out there building,” Ketchum said. “I think that’s where Washington is heading. I think that’s where the various ISOs are heading because it’s going to be really important that the hyperscaler shoulder the cost associated with the incremental generation that has to be built to power the data center.”

Ketchum also noted that NextEra Energy Resources, the company’s contracted generation arm, is advancing discussions around data center “hub” developments that combine multiple technologies and allow capacity to expand over time. “These data center hub opportunities, as we call them, represent a powerful channel to originate large generation projects with expansion opportunities where we can grow alongside our hyperscaler partner rather than building on a project-by-project basis,” he said.

NextEra currently has 20 potential data center hubs under discussion and expects that number to increase, Ketchum said. “We expect that number to rise to 40 by year-end,” Ketchum said. “While we won’t convert every single hub, I’ll be disappointed if we don’t double our goal and deliver at least 30 GW through this channel by 2035.”

Ketchum said early project phases are often anchored by faster-to-deploy resources, before adding firm capacity later. “Think of it as a hook, so to speak, that’s important for two reasons. First, it means a hyperscaler doesn’t have to wait. Second, it allows us to then grow with our data center customers over time by providing additional capacity through other power generation solutions like new gas-fired generation or [small modular reactors],” he said.

As part of its strategy, like Xcel and other utilities, NextEra has already secured forward access to gas turbine supply. “We also continue to advance our potential gas-fired generation build with a pipeline that’s now topped 20 GW. To get us started, we’ve secured gas turbine slots with GE Vernova to support 4 GW of gas-fired generation projects,” Ketchum said.

Addressing concerns about availability, he added: “I don’t worry too much about it in terms of gas turbine availability though. I mean, given the relationship, the partnership that we have with GE Vernova, getting our hands on gas turbines at an economic and competitive price is not the top of my list of things to be concerned about.”

The MOU between NextEra and Xcel Energy is non-exclusive and not limited to any specific fuel type, Frenzel noted on Thursday. Key commercial terms have been agreed to, and the companies expect to execute a formal joint development agreement in the coming months, subject to definitive agreements and regulatory approvals.

Data Center Pipeline and Capital Plan

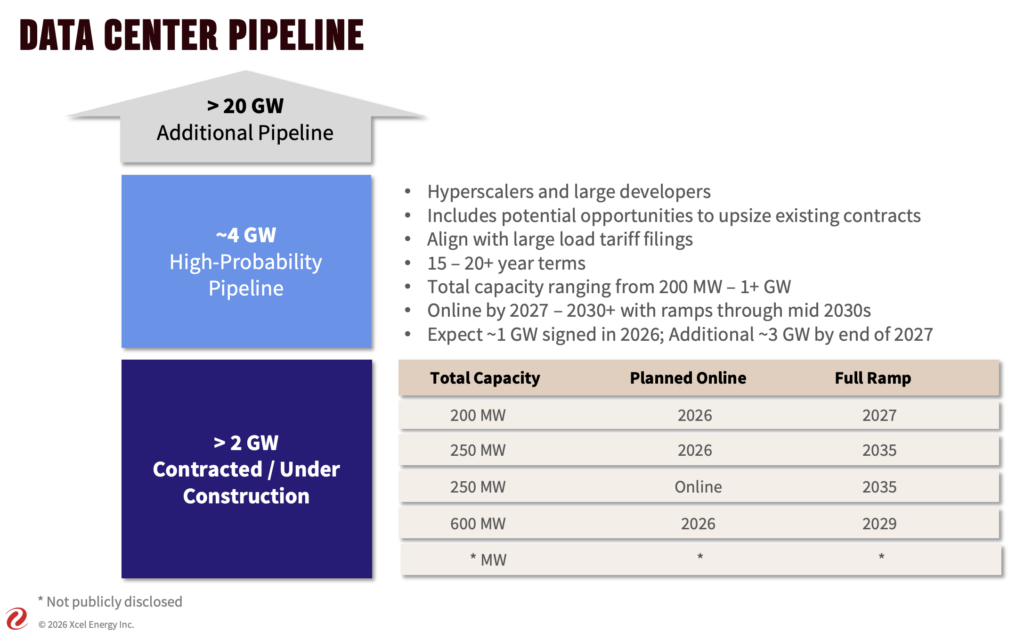

Xcel Energy announced during the Feb. 5 earnings call that it has signed energy services agreements (ESAs) for more than 2 GW of data center capacity, including a recently signed ESA with a large data center in the Upper Midwest. The company’s goal for 2026 is an additional 1 GW, bringing total contracted data center service to 3 GW by the end of 2026 and 6 GW by the end of 2027.

“We doubled our data center expected contracted capacity from 3 GW to 6 GW. That 6 GW is contemplated across our system right now. You saw the one we just signed is focused on Upper Midwest,” said Brian Van Abel, executive vice president and CFO of Xcel Energy, during the call.

Xcel Energy has one data center already energized and three additional data centers scheduled to energize in 2026, Van Abel noted. In addition, the company is pursuing large load tariff filings in Colorado, Texas, and New Mexico to establish regulatory frameworks for data center contracting. Colorado’s large load tariff filing is expected in early second quarter 2026, he said. Van Abel said that data center sales are expected to ramp in the 2029 to 2030 timeframe and into the 2030s, with generation investment ramping in the later part of this decade.

Xcel Energy released an updated 2026 to 2030 capital plan in 2025 that includes an initial 7,000 MW of company-owned renewables, natural gas generation, and storage across its states to transition its fleet and build for growth, Frenzel said during the call. Over the next five years, Xcel Energy expects to invest more than $60 billion to modernize and expand the grid, adding advanced transmission and distribution infrastructure, new natural gas and renewable generation, and smart, weather-hardened infrastructure, he said.

The company has strategic agreements with multiple Tier 1 engineering, procurement, and construction (EPC) firms across its portfolio of renewable natural gas generation projects, as well as transmission, distribution, and natural gas systems, Frenzel said. The company has safe-harbored equipment for approximately 20 GW of renewable generation and storage, and it will preserve a significant volume of production and investment tax credits for the benefit of customers, he said.

During the call, Van Abel said that the company has a $10-plus billion pipeline of additional investment opportunities, including 10 to 12-plus GW of additional generation RFPs and transmission opportunities in the Southwest Power Pool (SPP) and Midcontinent Independent System Operator (MISO). In SPP, Xcel Energy was awarded another 765-kV transmission line, which provides line of sight to $1.5 billion of additional investment over the base five-year plan, Van Abel noted.

—Sonal C. Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Editor’s Note: This story has been updated to include additional context on GE Vernova’s gas turbine backlog, manufacturing capacity expansion, and pricing trends, as well as NextEra Energy’s broader data center development strategy and gas turbine supply agreements, based on the companies’ fourth-quarter 2025 earnings calls on Jan. 27 and Jan. 28, 2026.