With COVID-19 filling the news throughout 2020, it’s very likely you missed some of the most important developments that occurred in the power sector this year. Here’s a look at some of the highlights and big stories covered by the POWER staff this year.

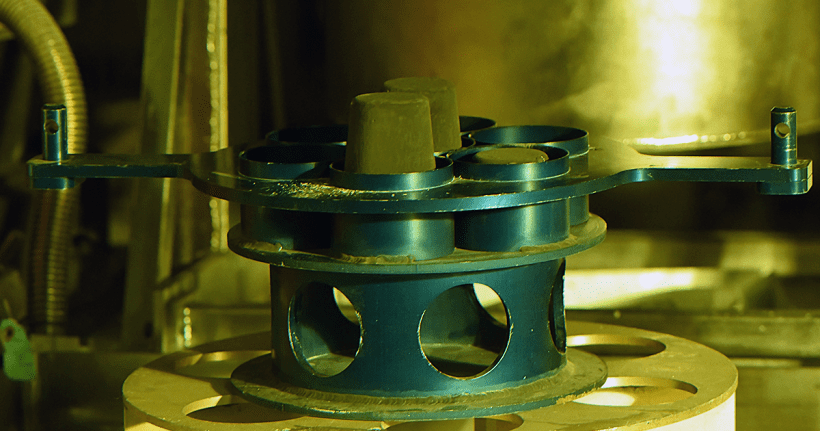

MOX Nuclear Fuel Loaded

In January, Russian engineers announced the loading of 18 mixed-oxide (MOX) fuel assemblies in Unit 4 at the Beloyarsk nuclear power plant in Sverdlovsk Oblast. Distinct from traditional nuclear fuel with enriched uranium, MOX fuel pellets are based on the mix of nuclear fuel cycle derivatives, such as plutonium oxide bred in commercial reactors and uranium oxide derived by defluorination of depleted uranium hexafluoride—the so-called secondary tailings of uranium enrichment facilities.

Rosenergoatom and TVEL (the power generation and nuclear fuel divisions of Rosatom State Corp., respectively) have committed to replacing all remaining uranium-based fuel assemblies in Beloyarsk Unit 4 with MOX fuel by the end of 2021. If completed as planned, it will be the first time a Russian fast neutron reactor operates with a full load of MOX fuel.

To read the entire story, see “MOX Nuclear Fuel Loaded in Russian Reactor, More to Come.”

Priorities Established for Advanced Gas Turbine Technology

Among the findings in a report released by the National Academies of Sciences, Engineering, and Medicine in February was that the U.S. gas turbine industry is set to play a critically important role in power generation, aircraft propulsion, and the oil and gas industry “for decades to come.” However, the researchers said the sector could benefit from prioritized research and development, and technological leadership.

Tasked with identifying improvements that could be achieved by 2030, the 14-member all-engineer committee assessed the current and future gas turbine landscape, scrutinizing global leadership, market trends, and technology developments that could affect gas turbine applications to identify specific research goals. The group also developed a prioritization process as well as high-priority research areas that were the most relevant to achieving these goals.

Improving combined cycle efficiency to 70% and simple cycle efficiency to more than 50% were two of the more impressive goals. Reducing start-up times; slashing CO2 emissions; ramping up fuel flexibility, including in applications using up to 100% hydrogen; and reducing the levelized cost of electricity from power generation gas turbines were other objectives identified.

To learn more about the research, see “Engineering Group: American Gas Turbines Will Remain Relevant But Need Advancement.”

First Battery-Enabled Black-start of GE Gas Turbine

POWER reported in March that General Electric (GE) had for the first time achieved black-start (a process to start up a power plant from a completely de-energized state without needing external power from the grid) of a heavy-duty gas turbine using a battery energy storage system (BESS). The company said the feat was accomplished on a GE 7F.03 gas turbine at a 150-MW simple cycle unit at Entergy Louisiana’s Perryville Power Station, using a 7.4-MW BESS.

Entergy told POWER that construction of the BESS began in July 2019 and was concluded in November that year. The unit was commissioned and charged the following month. The black-start test entailed “using the BESS to successfully start the 150-MW gas turbine two times on the same charge,” the company said.

GE said that the milestone project will serve as a “potential model for future projects in GE’s F-class gas turbine fleet,” which comprises about 900 units in 12 countries—a total combined capacity of 150 GW. The development is noteworthy as entities around the world explore new, more-efficient, and less-polluting black-start methods.

To read the full article, see “GE Achieves Battery-Enabled Blackstart of Heavy Duty Gas Turbine.”

World’s First HL-Class Gas Turbine Fired

Siemens Energy completed “first fire”—a term used for the initial time a gas turbine is started—at Duke Energy’s Lincoln Combustion Turbine Station near Denver, North Carolina, in April. The gas turbine was ramped up to a pre-determined test speed and systems were monitored for proper operation. The accomplishment was a major milestone for the world’s first SGT6-9000HL gas turbine, confirming the engine and auxiliary systems, including the gas supply, lube oil system, control system, and startup systems, all worked as designed.

The unit will undergo a four-year testing plan from 2020 to 2024, with technologies to achieve the next level of efficiency gradually introduced, Siemens said. When all testing is completed in 2024, Siemens will turn over the advanced unit to Duke Energy. Duke Energy has said the unit will be the most efficient simple cycle combustion turbine in its fleet.

For more news about the project, see “World’s First HL-Class Gas Turbine Starts Successfully.”

Largest U.S. Solar Project Approved

A Nevada installation that would be the largest solar power project in U.S. history was approved by the U.S. Department of the Interior in May. The estimated $1 billion 690-MW Gemini solar photovoltaic electric generating facility is sited on 7,000 acres about 30 miles northeast of Las Vegas. The project will include four large lithium-ion batteries capable of storing up to 380 MW of solar energy for up to four hours.

The Gemini project marked the third time the Trump administration’s Bureau of Land Management approved a solar power project on federal land. The agency approved an 80-MW project in Wyoming in June 2018, as well as a 550-MW solar farm near Joshua Tree National Park in California in November 2018. The Gemini project’s construction timeline includes two phases. The first phase is expected to begin commercial operation in 2021, with both phases expected to be in operation in 2022.

For more information on the project, see “Feds Approve Largest U.S. Solar Project.”

World’s First Hydrogen Power-to-Power Demonstration Launched

In June, a consortium of European companies, research institutes, and universities launched the world’s first demonstration of a fully integrated power-to-hydrogen-to-power project, at industrial scale and in a real-world power plant application. The four-year project to demonstrate HYFLEXPOWER, which has achieved a technology readiness level of 7, will convert a 12-MWe combined heat and power (CHP) plant at Engie Solutions’ Smurfit Kappa pulp-and-paper industrial site in Saillat-sur-Vienne, France, to demonstrate the entire power-to-hydrogen-to-power cycle.

Engie told POWER the 2007-installed CHP facility currently uses natural gas from the French grid via a Siemens SGT-400 gas turbine and a recovery boiler to produce power, which is sold to French utility EDF under a regulated feed-in-tariff. It also produces steam, which is used by the Smurfit Kappa papermill to dry pulp from recycling of waste paper to make new paper for cardboard.

Siemens will play a crucial role in the project, providing an electrolyzer system to produce hydrogen from surplus renewable power in the region. While part of that hydrogen may be used for storage, Siemens will also upgrade the existing SGT-400 industrial gas turbine at the CHP plant to burn a variety of natural gas and hydrogen mixes for power generation, working to gradually step up hydrogen’s volume of the fuel to at least 80%, and eventually to 100%. Engie, meanwhile, will build the hydrogen production and storage facility, including the natural gas and hydrogen mixing station.

To learn more about the innovative project, see “World’s First Integrated Hydrogen Power-to-Power Demonstration Launched.”

Dispute Broils Over Ethiopian Hydro Project

Ethiopia, Egypt, and Sudan agreed in July to further technical discussions on the filling of the reservoir for the 6.4-GW Grand Ethiopian Renaissance Dam (GERD), paving the way to a “breakthrough agreement” in the contentious dispute that is primarily about use of the River Nile’s waters. The developments were the latest in a long string of diplomatic haranguing about the mammoth $4.6 billion hydropower project.

Since Ethiopia launched GERD in 2011, the project has garnered significant international scrutiny about its potential political, hydrological, environmental, and economic consequences, especially on Egypt and Sudan. These countries, which lie downstream from the dam’s location on the Blue Nile in the Eastern Nile basin, heavily depend on the river for freshwater supplies.

A key point of contention is that the project will flood 1,700 square kilometers of forest in northwestern Ethiopia, creating a dam reservoir that could become nearly as large as Lake Tana, Ethiopia’s largest lake. Egypt contends that the structure is being built without “sufficient scientific data.”

“If, God forbid, the GERD experiences structural failures or faults, it would place the Sudanese people under unimaginable peril and would expose Egypt to unthinkable hazards,” Egyptian Foreign Minister Sameh Shoukry said during a June 29 UN Security Council meeting to discuss a dispute.

To fully understand the issues involved in the project, see “Egypt Warns Ethiopian Mega-Dam May Provoke Conflict, Crises,” and “Rains Complicate Ethiopian Hydro Dam Dispute.”

World’s Largest Industrial Hydrogen Fuel Cell Power Plant Completed

The largest industrial hydrogen fuel cell power plant in the world and the first to use only hydrogen recycled from petrochemical manufacturing was placed in service in August by Hanwha Energy at its Daesan Industrial Complex in Seosan, South Korea. The innovative 50-MW power plant uses “recycled hydrogen from petrochemical manufacturing” supplied by the Hanwha Total Petrochemical plant located within the same complex.

Hydrogen fuel cells combine hydrogen and oxygen in an electrochemical reaction to generate electricity. The only byproducts from this reaction are heat and water vapor, making hydrogen fuel cells an appealing way to cut carbon emissions. The plant at the Daesan Industrial Complex contains 114 fuel cells. The Hanwha Total Petrochemical plant produces up to three tons of hydrogen per hour. The recycled hydrogen is pumped into the new power plant via underground pipes and fed directly into the fuel cells. Electricity is then generated by the electrochemical reaction.

To learn more about the project, see “Innovative Byproduct-Hydrogen Fuel Cell Power Plant Completed.”

Former SpaceX Engineers Raise Money for Microreactor

A California company announced in September that it was gathering funding for development of a portable nuclear microreactor, designed for use in areas where other forms of power generation are not practical. Radiant, founded by former SpaceX engineers, said it has raised $1.2 million from angel investors as it designs what the company calls a “clean energy alternative to fossil fuels for military and commercial applications.” Radiant executives said the funding is a combination of cash and cost-share commitments to support development of its more than 1-MW microreactor.

Radiant also reported receiving two provisional patents for its advances in portable nuclear reactors. One of the technical upgrades decreases the time and cost for refueling the reactor, while the other enables more-efficient heat transport from the reactor core. Battelle Energy Alliance, the contractor that manages operations at the Idaho National Laboratory, and Radiant have signed a memorandum of understanding seeking collaboration for development and testing of the technology.

To learn more about Radiant and its microreactor design, see “Former SpaceX Engineers Tout New Microreactor.”

Funding for Advanced Reactor Demonstrations Announced

In October, the Department of Energy (DOE) notified Congress that it had chosen recipients for its Advanced Reactor Demonstration Program (ARDP). The ARDP, which the DOE officially launched in May, will help enable DOE and non-federal resources (through cost-shared agreements with industry) to construct advanced nuclear reactors over the near- and mid-term. Under the program, TerraPower and X-energy will each receive $80 million in initial federal funding to build their two distinct advanced nuclear reactors and begin operating them within seven years.

TerraPower will demonstrate the Natrium reactor, a 345-MWe sodium-cooled fast reactor that it unveiled in September as part of a consortium that includes GE Hitachi (GEH) and Bechtel. The consortium says the reactor design blends the “best of” TerraPower’s Traveling Wave Reactor (TWR) and GEH’s PRISM technology, but is also a “cost-competitive” design that uniquely integrates molten salt energy storage. In September, TerraPower also announced it would team with Centrus Energy to establish commercial-scale, domestic production capabilities for high-assay, low-enriched uranium (HALEU).

Rockville, Maryland–based X-energy, meanwhile, will use the funding to deliver a commercial four-unit power plant based on its Xe-100 reactor design, an 80-MWe/200-MWth pebble-bed high-temperature gas reactor (HTGR), which can be scaled as a four-pack to 320 MWe. X-energy, notably, will also leverage the award to deliver a commercial-scale fuel fabrication facility for its proprietary TRISO-X TRi-structural ISOtropic particle fuel, technology it developed under the 2015 DOE Advanced Gas Reactor Fuel Qualification Program.

To learn more about ARDP and the reactor designs that were selected, see “DOE Has Chosen Advanced Nuclear Reactor Demonstration Winners,” and “Natrium, Xe-100 Are DOE’s Picks for Advanced Nuclear Reactor Demonstrations.”

What a Biden Presidency Means for the Power Industry

The U.S. election took center stage in November with voting taking place on Tuesday, Nov. 3. Energy, and its implications on the environment, figured prominently as key points of contention between the two presidential candidates. After much hand-wringing and ballot recounts in several states, Joe Biden was declared the winner of the 2020 presidential election by many major media outlets on Saturday, Nov. 7.

The Biden campaign outlined a bold plan it calls the “Clean Energy Revolution” that leans on the Green New Deal as a framework. The Green New Deal is a term that has been used interchangeably by several entities, from the United Nations to the Obama administration, to describe a set of policies that aim to make systemic change. While Biden denied embracing the Green New Deal outright during the presidential debates, his Clean Energy Revolution echoes the measure, though his plan provides a less ambitious timeframe and lower costs.

The following actions are among the Clean Energy Revolution’s major tenets:

- Re-entering the Paris Agreement.

- A 100% clean-energy economy that reaches net-zero emissions no later than 2050.

- Bolstering state and city goals.

- A focus on innovation, including grid-scale storage, going big on nuclear and advanced nuclear, carbon capture use and storage (CCUS), decarbonized gas—hydrogen, and buildings and industry.

- Electric vehicles.

- An infrastructure overhaul.

- Action against fossil fuel companies.

- Turning climate change from threat to opportunity.

- Protections for coal power plant workers.

- Paying for it through a rollback in tax incentives.

To dive deeper into all of these measures and understand where industry trade groups stand on the proposed changes, see “How Biden’s Presidency Could (Further) Transform the Power Sector.”

Major Companies Exit Coal Power Sector

Several coal-related business announcements were made by companies near the end of the year. GE in December took a position in the global fight against climate change, advocating for immediate and effective power sector decarbonization through the replacement of coal-fired power generation with a combination of renewables and natural gas-fired power. The company laid out its position on Dec. 15 in a wide-ranging white paper that explores multiple technical pathways through which the power sector could achieve a lower-carbon generating footprint.

Earlier in the year, GE said it would exit the new-build coal power market, subject to applicable consultation requirements. “GE’s Steam Power business will work with customers on existing obligations as it pursues this exit, which may include divestitures, site closings, job impacts and appropriate considerations for publicly held subsidiaries,” the company said in a Sept. 21 announcement. It will also continue to deliver turbine islands for the nuclear market, and service existing nuclear and coal power plants.

Among other companies exiting the coal power sector were Black & Veatch, Siemens, and Toshiba. Black & Veatch on Oct. 29 said it was ending the company’s participation in coal-based power market design and construction, saying the move would allow the company to focus on clean energy technologies. Siemens on Nov. 10 said it would stop selling turbines for new coal-fired facilities. Toshiba on Nov. 11 announced it would stop taking new construction orders for coal-fired power plants.

To more fully understand where these companies are positioning their businesses for the long term, see “GE Throws in the Towel on Coal-Fired Power,” “Black & Veatch: No More Coal Construction,” “Siemens, Toshiba Pulling Out of Coal-Fired Generation,” and “GE All-in to Fight Climate Change, Urges Accelerated Replacement of Coal Power.”

Prepare for 2021

News breaks daily in the power industry. If you don’t want to miss the most important developments as they occur throughout the year, subscribe to POWER. In addition to its monthly magazine, POWER offers e-newsletters, a podcast, video insights, webinars, in-person events, and much more. Visit powermag.com/membership/ to sign up.

—Aaron Larson is POWER’s executive editor, Sonal Patel is POWER’s senior associate editor, and Darrell Proctor is POWER’s associate editor.