The Department of Energy’s (DOE’s) first official loan guarantee for a new clean energy technology project since 2014 will go to the Advanced Clean Energy Storage 1 project in Utah—one of the world’s largest renewable hydrogen energy projects.

The DOE on June 8 announced it closed on the $504.4 million loan guarantee for the first phase of the Advanced Clean Energy Storage project. The massive undertaking by ACES Delta, a joint venture comprising Magnum Development, Mitsubishi Power, and Haddington Ventures, seeks to create a new pathway for decarbonization of the Western U.S. grid. The agency offered the project a conditional loan guarantee commitment in April, contingent on several factors, including securing permits and financing for the $1 billion project.

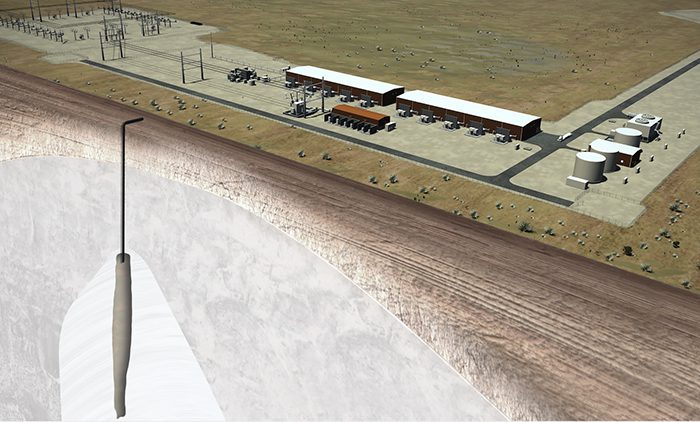

The ACES Delta project envisions producing up to 100 metric tonnes per day of hydrogen from water and renewable energy sources using a 220-MW alkaline electrolyzer bank manufactured by Norwegian firm HydrogenPro—one of the largest deployments of its type to date. ACES Delta will store that hydrogen in two gigantic solution-mined caverns sited in the only salt dome in the Western U.S, each of which can store up to 150 GWh of energy.

“To put that in perspective, we are projecting that there will be about 150 GWh of utility-scale battery storage on the nation’s entire electric grid by 2030,” noted Jigar Shah, director of the DOE’s Loan Programs Office (LPO), during a call with reporters on Wednesday.

The storage facility will provide long-term seasonal energy storage to Intermountain Power Agency’s (IPA’s) Intermountain Power Plant (IPP) near Delta, Utah, a coal-fired plant that is slated to be repowered with two Mitsubishi Power advanced M501JAC power trains as an 840-MW combined cycle power plant by 2025.

| For more about the Advanced Clean Energy Storage I project, read POWER’s in-depth story here: ACES Delta’s Giant Utah Salt Cavern Hydrogen Storage Project Gets $504M Conditional DOE Loan Guarantee |

A Major Boost for Hydrogen Production and Storage

Closing the loan guarantee makes the ACES Delta project the “world’s first and largest integrated clean hydrogen production and storage hub to have reached full financial close,” said Michael Ducker, senior vice president of Hydrogen Infrastructure for Mitsubishi Power Americas and president of Advanced Clean Energy Storage I.

“Just to put three items into perspective on the scale, magnitude, and importance of this project: First, the entire worldwide installed base of electrolyzers at the end of 2020 was 250 MW,” Ducker said. “This project alone will nearly double worldwide capacity, with 220 MW being installed at our site. Second, hydrogen has been stored in salt caverns globally for decades, serving multiple industries, with global volumes of just under 15 million barrels equivalent,” he noted. “This project will have storage volumes of 9 million barrels. That’s a nearly 65% increase in global storage capacity for any type of hydrogen, and it will be the world’s single-largest storage site for hydrogen.”

And third, while renewables penetration in the West is currently only up to 30% of the generation mix, “each one of our caverns at the Advanced Clean Energy Storage hydrogen hub can store 150 GWh of clean, reliable dispatchable energy—effectively capable of storing months worth of renewables overproduction in the Western U.S. and helping to shift this clean energy overproduction into seasons when energy deficits otherwise prevail,” he said. “As we target 100% clean energy, this growing need for seasonal shifting is only going to continue,” he said. “Thus, this project helps solve this exact evolving challenge. It will improve grid resiliency, it will reduce curtailment and grid inefficiencies, and ultimately it will help the region more reliably and cost-effectively achieve its clean energy goals.”

Ducker noted ACES Delta had secured all major contracts, including for offtake by IPA, engineering, procurement, and construction (EPC) contractors, as well as major equipment suppliers, and operations and maintenance (O&M) providers. Engineering giant Black & Veatch is slated to provide EPC services, while Mitsubishi Power will provide all hydrogen equipment integration, including the 220 MW of electrolyzers, gas separators, rectifiers, medium-voltage transformers, and the distributed control system. NAES Corp., an O&M service firm, will initially provide the O&M services for the plant and will oversee the current projected team of 20 plant-related personnel. WSP, another engineering giant, will provide EPC management services for the development of the two large salt cavern storage facilities, leveraging decades of experience in its development of more than 200 salt caverns around the world.

Granholm: ‘This Is a Big Deal’

During a call with reporters on Wednesday, Energy Secretary Jennifer Granholm hailed the LPO’s efforts to finalize the loan guarantee. “This is a big deal for the clean hydrogen space,” she noted. “Hydrogen has enormous potential for energy storage, it has enormous potential as a transfer of transportation fuel, as a source of 24/7 clean dispatchable power, and as a means of decarbonizing heavy industry. [The ACES Delta] project is going to help reduce market risk and scale America’s hydrogen economy. It’s a big deal for Utah where the facility is going to be located,” she said.

Granholm’s remarks come just days after the DOE released a Notice of Intent (NOI) to leverage $8 billion in funding from the Infrastructure Investment and Jobs Act (IIJA) to develop regional clean hydrogen hubs (H2Hubs), an initiative that is unrelated to the LPO’s loan guarantee process.

The DOE describes H2Hubs as “a network of clean hydrogen producers, potential clean hydrogen consumers, and connective infrastructure located in close proximity.” The DOE anticipates the H2Hubs will “form the foundation of a national clean hydrogen network that will contribute substantially to decarbonizing multiple sectors of the economy while also enabling regional and community benefits.” It will be a key part of the National Clean Hydrogen Strategy and Roadmap, which is also required under the IIJA.

The DOE’s Office of Clean Energy Demonstrations (OCED) last week said it expects to issue a Phase 1 H2Hubs funding opportunity announcement (FOA) in the September/October 2022 timeframe. “OCED envisions awarding multiple financial assistance awards in the form of cooperative agreements. The estimated period of performance for each Phase 1 award will be approximately 12–18 months, with a total period of performance of 8–12 years for all four phases,” it said.

The DOE, meanwhile, continues to spearhead goals established under its H2@Scale initiative. In 2021 under that measure, the DOE launched the Hydrogen Shot, which entails cutting the cost of clean hydrogen production to “$1 per 1 kilogram of clean hydrogen in one decade.” The IIJA, notably, sets clean hydrogen production cost targets for electrolyzers at less than $2 per kilogram by 2026.

LPO Back in Business

Closing of the loan guarantee is also a “big deal for America because it’s a sign that LPO is finally officially back open for business,” Granholm said.

Activity at LPO has dramatically ramped up over the past 15 months, going from “largely a dormant office to a hub of activity with 77 active applications seeking over $77 billion in loans,” Shah told reporters. “The team has grown from less than 100 people to more than 150 deeply experienced mission-focused professionals.” LPO’s goal has also broadened, he suggested. “The goal of our efforts is not to just produce. The goal of our effort is not to just provide stimulus in the short term, but to create an institution that entrepreneurs and energy leaders can rely upon to help commercialize their technologies and build robust industries right here in the U.S.,” he said.

So far, however, LPO has only made a handful of offers. The ACES Delta project in April became the DOE’s third offered conditional loan guarantee under the Biden administration. LPO in December offered a $1 billion conditional loan guarantee to Monolith, a 2012-established firm that has developed a methane pyrolysis process to convert natural gas into hydrogen and high-purity carbon black using renewable energy. And on April 18, LPO offered to conditionally lend up to $107 million to Syrah Technologies to expand its capacity to produce critical materials for lithium-ion batteries at the Syrah Vidalia Facility in Louisiana.

The DOE’s last set of loan guarantees went to participants in the Vogtle nuclear expansion underway in Georgia. Between 2014 and 2019, the DOE issued up to $12 billion in loan guarantees to Georgia Power Co., Oglethorpe Power Corp., and three subsidiaries of the Municipal Electric Authority of Georgia (MEAG Power) to support the construction of two AP1000 nuclear reactors at Vogtle Units 3 and 4.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).