Japan’s government this June adopted a new energy white paper that suggests the country must rely on a larger share of nuclear and renewables to slash its carbon emissions and meet its target of a 26% reduction from 2013 levels by 2030.

The annual white paper, which describes trends and the status of key initiatives, said renewables accounted for 16% of Japan’s power supply but nuclear power remained at just 3% in 2017. Natural gas stood at 40%, coal at 33%, and oil at 9%. By 2030, Japan anticipates renewables will grow to 22% to 24%—solar alone could constitute a 7% share, followed by hydropower at 9.2%; the remainder will be biomass at up to 4.6% and wind at 1.7%. Nuclear will make a comeback, taking a 20% to 22% share; and natural gas will fall to 27%, coal to 26%, and oil to 3%, according to government estimates.

However, a companion document the Ministry of Economy, Trade, and Industry (METI) published alongside the white paper to explain Japan’s energy status notes the country has always lacked the resources it uses to produce the bulk of its power. And because all its nuclear plants were shut down in the aftermath of the Fukushima disaster—and few have been reopened—Japan’s reliance on imported fuel has soared, reaching 87.4% in 2017. Today, the country remains highly dependent on Saudi Arabia, the United Arab Emirates, and other Middle Eastern countries for 86% of its crude oil imports; on Australia for 71.5% of its coal imports; and on Australia, Malaysia, and Qatar for 62% of its liquefied natural gas imports.

|

|

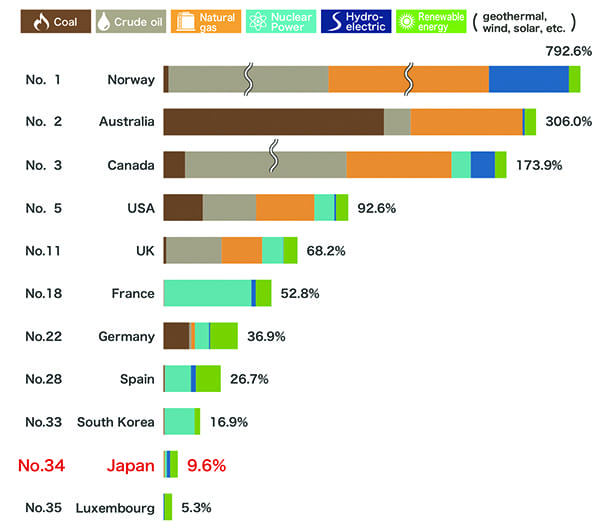

3. This graph, published by Japan’s Ministry of Economy, Trade, and Industry (METI), illustrates how the country compares to others on an “energy self-sufficiency” ratio basis. The ratio considers primary energy required for life and economic activity, and what can be secured domestically. Courtesy: METI |

“The energy self-sufficiency ratio of Japan in 2017 was 9.6% (Figure 3), which is a low level when compared with other OECD [Organisation for Economic Cooperation and Development] countries,” the document says. A low ratio “makes a country susceptible to the effects of international situations, raising concerns over the stability of the energy supply,” it notes.

Among other trends METI notes are that electricity rates, which trended downward since fiscal year (FY) 2014, have begun to rise again, owing to oil prices and a renewable energy surcharge. The feed in tariff (FIT) scheme introduced in 2012 has helped rapidly boost renewable growth, but purchase costs have now reached $33 billion, and the cost of the surcharge based on the standard model has risen to¥767 ($7.08)/month. “To maximize the introduction of renewable energy while also reducing the burden on the people, it will be necessary to expand cost-efficient introduction,” it notes. Plans underway include setting long-term price targets for the FIT system, and establishing a competitive bidding system.

METI acknowledged a total reliance on renewables would be desirable because it would help improve self-sufficiency. But for now, it explained, because renewable power varies depending on the weather or season, “flexible power sources such as thermal power need to be prepared as backup.” The grid—which lacks cross-border interconnections—will also need to be transformed to integrate a large amount of power generated by renewables and energy storage. That’s one reason nuclear will be essential to Japan’s future, it said.

However, as of February 2019, only nine reactors were in operation, six had received regulatory approval to restart, and another 12 were awaiting assessment under new safety rules. The bulk of Japan’s nuclear fleet—33 reactors—had either announced retirement or had not applied for assessment. (For more, see “THE BIG PICTURE: Japan’s Nuclear Comeback,” an infographic in POWER‘s March 2019 issue.)

Hydrogen, produced through power-to-gas technologies, is poised to be Japan’s best future energy bet, METI suggested. “Hydrogen energy is expected to be used for a wide range of purposes and to play a central role of a future source of energy, replacing oil and other energy sources,” it said.

Japan’s investments to demonstrate hydrogen’s potential appear to be paying off. In April 2018, for example, Obayashi Corp. and Kawasaki Heavy Industries, along with Japanese research group New Energy and Industrial Technology Development Organization (NEDO), demonstrated that hydrogen alone could provide heat and power to an urban district. The demonstration used a 1.1-MW hydrogen cogeneration system to fuel a hospital, an exhibition hall, a sewage treatment plant, and a sports center on Port Island, which is an artificial island in Kobe.

In 2020, the country plans to demonstrate an “advanced hydrogen energy chain,” which will entail building a hydrogenation plant in Brunei and a dehydrogenation plant in Kawasaki. Australia will also join the demonstration, producing liquefied hydrogen by gasifying brown coal and shipping it to Japan.

|

|

4. The Fukushima Hydrogen Energy Research Field, which is under construction in Fukushima prefecture, by a consortium comprising New Energy and Industrial Technology Development Organization, Toshiba, Tohuku Electric, and Iwatani Corp. is slated to be completed in July 2020. The facility aims to demonstrate that hydrogen can serve both as a commercial commodity and as an energy source to balance supply and demand on the grid. The project will also demonstrate a new control system that optimizes hydrogen production and supply, using demand forecasting for hydrogen. Courtesy: FH2R |

Finally, and as significantly, Japan plans to demonstrate—in time for the 2020 Olympics in Tokyo—a project for large-scale hydrogen production using renewable energy at Namie Town in Fukushima Prefecture. As part of that project, Toshiba, Tohoku Electric Power Co., and Iwatani Corp. are building the Fukushima Hydrogen Energy Research (FH2R) field, which will house a 10-MW-class hydrogen production facility alongside solar power generation facilities. FH2R (Figure 4), essentially a power-to-gas facility, will produce and store up to 900 tons of hydrogen a year to power fuel cells and support area factory operations.

“It will use a new control system to coordinate overall operation of the hydrogen energy system, the power grid control system, and the hydrogen demand forecast system, so as to optimize hydrogen production, hydrogen electricity generation and hydrogen gas supply,” said Iwatani. Toshiba said power supply to the project using a dedicated power transmission line will begin this August, and commissioning for the overall system could begin in October.

—Sonal Patel is a POWER associate editor.