Already planning a major expansion of its renewable capacity, Japan has been forced to redouble its efforts with the loss of its nuclear fleet after the Fukushima Daiichi disaster. Though an array of obstacles stand in its way, the nation hopes to triple its renewable output by 2030.

In 2010, intent on continuing its commitment to energy efficiency and preventing climate change, Japan enacted its second Basic Energy Plan. The new policy document, revising the first, from 2003, called for dramatic increases in both nuclear generation and renewable energy, all with an eye toward reducing the nation’s carbon emissions 25% below 1990 levels by 2020. Renewable generation was to increase from 9% (almost entirely hydroelectric) to 20% by 2030. Non-hydro renewables would be supported by expanding the existing feed-in tariff (FIT) system, established in 2009 to support small-scale solar photovoltaic (PV), to include wind, geothermal, and biomass. An array of other subsidies, credits, and tax exemptions were planned to support the development of new renewable technologies.

Japan has long been one of the leaders in renewable energy, both in innovation and in installed capacity. Its domestic solar PV industry, led by electronics giant Sharp—then the world’s largest manufacturer of solar panels—expected to supply growing demand worldwide for many years.

Much of this changed on March 11, 2011.

Though Japan’s nuclear industry sustained the lion’s share of the upheaval following the Tohoku Earthquake and tsunami, and the subsequent disaster at the Fukushima Daiichi nuclear plant, those changes have also forced Japan to reassess its plans for renewable generation.

Much, however, has not changed. Japan remains a nation with limited resources that must import more than 90% of its energy needs. Its economy, still the third-largest in the world, is stagnant, mired in a two-decade period of flat-to-negative growth in GDP. But its manufacturing sector remains one of the world’s most advanced, and strong government and social support for energy efficiency means the nation’s electricity consumption has been level for the past decade, with total generation for 2012 virtually the same as 2002 levels, according to the Federation of Electric Power Companies, the association of the country’s 10 utilities (though this also reflects the fact that Japan’s entire nuclear fleet remains offline).

Current Policies and Problems

The 2010 Basic Energy Plan, which was scheduled to begin taking effect last year, has undergone repeated revisions. The previous government, led by the Democratic Party of Japan, had planned for a complete phase-out of nuclear by the 2030s combined with an aggressive focus on renewables. The new Liberal Democratic government, led by Prime Minister Shinzo Abe, has backed away from a nuclear retreat, saying in December that nuclear would remain an important part of the nation’s energy mix and that Japan will only seek to reduce dependence on nuclear “as much as possible.”

The most recent draft policy envisions the nation reaching 25% to 35% renewable generation by 2030. The revised FIT system went into effect in 2012 and sets fixed prices that utilities must pay for renewable generation. The initial tariff for solar—¥42/kWh ($0.40/kWh) over a 10-year period for small systems and over 20 years for those larger than 10 kW—was originally about twice that for wind (¥23.10/kWh), though it was reduced in April 2013 (to¥37.8/kWh).

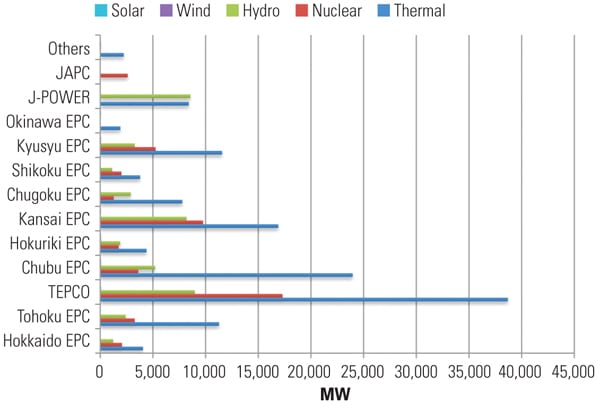

These generous subsidies, which are substantially higher than those offered elsewhere, such as in renewable-friendly Germany and Sweden, have led to a boom in solar construction (Figure 1), resulting in an estimated 5 GW of new capacity added in 2013. As of July, the government had approved 23 GW of new solar projects, nearly all of it since the new FIT came into effect.

|

| 1. Sunny skies. The 10-MW Komekurayama Solar Power Plant in Kofu, built by Tokyo Electric Power Co., came online in 2012. Courtesy: Sakaori |

Still, there are substantial barriers in the way of reaching the ambitious 2030 targets.

Perhaps the biggest challenge is where to site all this space-intensive generation in a mountainous country that is one of the most densely populated industrialized nations in the world. The lack of space elsewhere has meant many new large projects are being sited in the less-populated north, particularly on the island of Hokkaido. The recent crush of applications for power sales—amounting to 25% of all projects approved nationwide—has overwhelmed Hokkaido Electric Power Co. (HEPCO), leading to delays in processing.

The need to site so much generation so far from population centers in the south has also led to concerns about transmission capacity. HEPCO complained last April that it had received applications for four times as much new capacity as its grid is capable of handling. The problem is so acute that the country’s Ministry of Economy, Trade and Industry (METI) has allocated nearly $300 million to build what will be the world’s largest storage battery for HEPCO. The 60-MW battery, due to come into service in 2015, will boost HEPCO’s ability to accommodate independent generation by an additional 10%.

Elsewhere, many applicants are being denied access to local grids because of similar overcapacity. A survey conducted by the Japan Renewable Energy Foundation found that 20% of the respondents were denied access and 37% were approved, but with limited output.

While this is an issue with renewable generation nearly everywhere, it is a special concern in Japan, which operates two separate national grids—one at 60 Hz in the west and the other at 50 Hz in the east—with only limited ability to move power between them. Worse, the 10 regional utilities typically operate as separate systems, only rarely sharing power.

In hopes of addressing these issues, the government passed legislation in December that would establish a single national grid company by 2015. The aim is to better align standards and practices across the regional utilities and two grids. METI is also advising developers to seek solar sites outside of Hokkaido.

Cost is another issue. One reason for the high FIT is that prices for installed solar PV in Japan are around twice those in Germany. Land is more expensive, labor costs are high, and limited space for installation often means more sophisticated technology is necessary.

This is a problem despite the fall in solar panel prices, which has wreaked havoc in the nation’s renewables manufacturing sector. Once supplying nearly 90% of Japan’s solar PV demand, domestic manufacturers saw imports—mostly from China—claim a 56% market share last year. The competition has forced Sharp to close three of its four solar PV factories, while Panasonic recently cancelled plans for a new domestic plant, deciding instead to site it in Malaysia.

Wind generation has its own set of issues. Though the nation has many areas of good wind potential, bureaucratic hurdles have slowed development, and the nation currently has only 2.3 GW of installed capacity. New wind projects are required to complete lengthy and complex environmental assessments, which have stalled several large projects, including a 120-MW facility in Tokyo. Turbines over 100 feet tall are required to incorporate expensive seismic safeguards (though this is the reason most of its existing turbines survived the earthquake unscathed). Even so, the government is hoping that at least 10 GW of wind generation can be added by 2030.

Another problem has been the lack of a consistent energy policy. The national government has seen six different prime ministers since 2008, and the frequent shifts in direction, especially since 2011, have created uncertainty about future support for renewables. Industry officials and policy analysts have stressed the need for consistent, long-term policy goals if further progress is to be made. Streamlining approval processes and reducing bureaucratic impediments will also be important.

Current Projects

Japan’s renewable output is dominated by hydropower, but most of the current development is focused on solar, with wind running a distant second—though the latter has the most interesting potential.

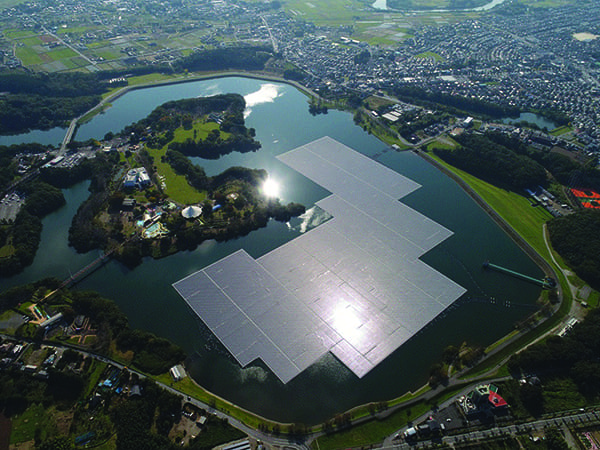

Solar. More than 90% of Japan’s installed capacity of non-hydro renewables is solar. In 2013, Japan became the fifth country with at least 10 GW of solar capacity. In November, electronics company Kyocera inaugurated what is so far the nation’s largest solar PV plant, the 70-MW Kagoshima Nanatsujima Mega Solar Power Plant in Kagoshima City, at the southern tip of the country (Figure 2). The $275.5 million project, which comprises 290,000 solar panels manufactured by Kyocera, is a joint venture between Kyocera and six other companies. The consortium was formed in July 2012, shortly after the FIT program took effect, and construction was completed in a little over a year.

|

| 2. Biggest for now. The 70-MW Kagoshima Nanatsujima Mega Solar Power Plant is currently the largest solar plant in Japan. Courtesy: Kyocera |

Larger projects are in the works. Telecommunications and internet company Softbank, which already operates seven solar energy facilities across the country (though most are fairly small), had plans for three large solar plants in Hokkaido totaling 180 MW. The uncertain situation on Hokkaido forced Softbank to scale back the project to 110 MW. Construction was due to start in October, with completion scheduled for 2015.

Meanwhile, last January industrial giant Mitsubishi announced plans to partner with another firm to build an 80-MW solar plant in Tahara City, in Aichi Prefecture southeast of Nagoya. The $221 million project will be built by Toshiba and is scheduled for operation in early 2015.

Wind. Japan’s wind industry has lagged well behind solar. The largest currently operating wind farm in the country is the 148-MW Mutsu facility near Kyoto, but only a handful of other projects larger than 50 MW exist. Nevertheless, ambitions are large.

In 2012, Fukushima Forward, a project backed by METI and a coalition of private companies led by Marubeni Corp., began what may one day become a 1-GW floating wind farm off the coast of Fukushima Prefecture. The first phase of the project comprised a 2-MW Hitachi turbine mounted on a spar buoy, which began supplying power in November (Figure 3). A floating 66-kV substation, the first of its kind in the world, has also been constructed. The next phase of the project, slated for March, will comprise two 7-MW Mitsubishi Heavy Industry turbines. METI has committed $220 million for the five-year project. If all goes well, the project may ultimately be expanded to 143 floating turbines with a total capacity of 1 GW by 2020.

|

| 3. Setting sail. This 2-MW wind turbine off the coast of Fukushima may be the first element of a planned 1-GW floating wind farm. Courtesy: Marubeni Corp. |

Despite the technological challenges, experts think floating wind power may have substantial potential for Japan. Though it has many areas of prime offshore wind resources, the continental shelf around Japan is too deep to construct the sort of fixed offshore wind farms common in Europe—more than 80% of its wind potential is in deep water. The seas at the Fukushima Forward site, for example, are around 100 meters deep. METI’s long-term plan is to make Japan a world leader in floating offshore wind power.

Another floating test project has been underway off Nagasaki since May 2012. After launching a 100-kW test bed, the project was upgraded with a 2-MW turbine this past fall.

Geothermal. Japan has been producing geothermal energy since 1966 and currently has 17 geothermal plants in operation with a total capacity of 535 MW. Most of them, however, were constructed before 1974, when the national government banned further development out of environmental concerns. Though Japan, with numerous active volcanoes, is thought to have enormous geothermal potential—as much as 20 GW, according to government research—most of it is found in areas that have been set aside as national parkland. Japan’s long cultural affinity for enjoying its natural hot springs has made geothermal development highly sensitive.

Even so, pressure from the nuclear shutdown has caused some rethinking. Last March, the government lifted the ban to allow five new projects to proceed, though oversight is strict.

The FIT for geothermal is currently¥27.3/kWh for projects over 15 kW. Around 20 other projects are under consideration, though some are quite small.

Hydropower. Hydro has traditionally supplied the bulk of Japan’s renewable output, around 70% in 2011. With an installed capacity of 27 GW and 82.5 TWh of total generation in 2011, Japan ranked eighth in the world for hydroelectric production. Almost no new capacity has been added in decades, however, and nearly all of the nation’s major hydroelectric potential has already been harnessed. Small-scale projects continue to be developed, but these are not expected to make a meaningful impact on the generation mix.

The future is likely to be in pumped storage. Japan has a number of large dams with pumped storage capacity, and three major pumped storage projects are due to come into service in the next decade. The Kannagawa Hydropower Plant in Nagano is currently about one-third of the way through construction of its six-unit generating plant that will ultimately reach 2,820 MW capacity, with final completion expected in 2020. The 600-MW Kyogoku Pumped Hydro Power Station in Hokkaido is expected to be completed in 2022, and the Kazunogawa Dam in Yamanashi is adding 800 MW to its pumped storage capacity, also by 2022.

Outlook

As this article went to press, METI was still revising the latest Basic Energy Plan, and was expected to present a new draft to a government panel in late December. Much of the current debate centers on the role of nuclear, but further efforts to open up the 10 regional power companies to more competition are also under discussion. Meanwhile, the nation burned record amounts of imported coal and liquefied natural gas in November, a situation all parties agree is unsustainable. Whatever direction Japan ultimately takes, a greatly expanded role for renewables seems certain.■

— Thomas W. Overton, JD (@thomas_overton) is POWER’s gas technology editor.