The March 2011 Japanese earthquake and tsunami that destroyed a number of Japanese power plants—most notably, four nuclear units—hit quickly. Almost as speedy were calls to take all other nuclear units out of service for safety reviews. What will take much longer is developing a new, sustainable energy plan to fill the generation gap left by a potential total lack of nuclear power.

The 9.0-magnitude Great Tohoku Earthquake that struck northeastern Japan on March 11, 2011, unleashed a tsunami that killed 20,000 people and triggered a catastrophic nuclear accident at the Fukushima Daiichi plant. These events may have rattled the world’s nuclear sector, but in Japan, they devastated the country’s economy, exposed faults in the resource-poor island’s energy policy, and compromised its energy security.

Geographically isolated Japan has always lacked natural resources, forcing it to rely on imported energy: Compared with the U.S. and China, which produce more than 70% of their energy needs, Japan must import more than 95%. In the past, to counter this reliance on foreign resources, especially since becoming a signatory of the Kyoto Protocol and a vocal global proponent for curbing greenhouse gases, the country had been promoting an energy policy that strives for simultaneous achievement of the three Es: energy security, environment (or climate change mitigation), and economic efficiency (or lowering costs for energy).

“However, this is not at all easy. Promotion of coal is good for energy security and economic efficiency but will conflict with the climate change agenda,” explained Jun Arima, director general for the Japan External Trade Organization (JETRO), in January. “Promotion of renewable energy is good for energy security and climate change mitigation but tends to be more costly. It is for this reason that Japan has been promoting the nuclear option as a key for achieving 3Es.”

Energy economics are exacerbated by other factors. Though the industrialized, free-market nation of 127.5 million people saw average gross domestic product (GDP) growth of 0.52% since 1980, it is a rapidly aging society, and its population is forecast to decline to under 100 million within the next 50 years. Meanwhile, Japan’s strong yen hinders exports, and it has the highest public debt per capita of any major economy. When the earthquake and tsunami hit, they further ravaged the country’s GDP, demolishing many factories and interrupting production lines.

Japan is now bracing for an even bigger impact, stemming from the medium- and long-term consequences of the quake’s effect on the country’s power sector. (See sidebar for an overview of the industry’s structure.) Like its neighbors, China and India, Japan—already the world’s third-largest producer of nuclear power—had sought to expand the nuclear component of its energy mix to reach 41% of total power supply by 2017, and 53% by 2030. Plans were in place to construct nine new reactors by 2020 and another five by 2030. (For an overview of the country’s generating and recycling facilities, see the web supplement associated with this issue titled “Japan’s Nuclear Infrastructure.”)

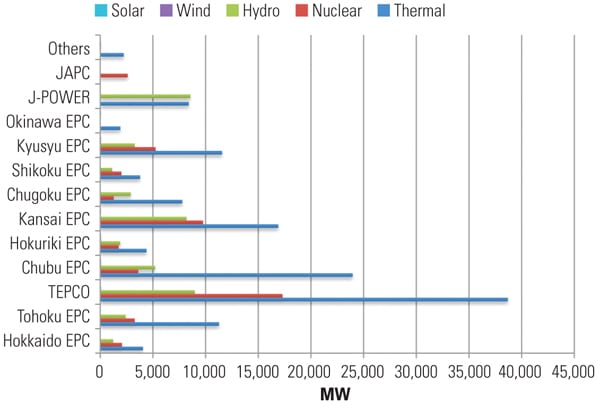

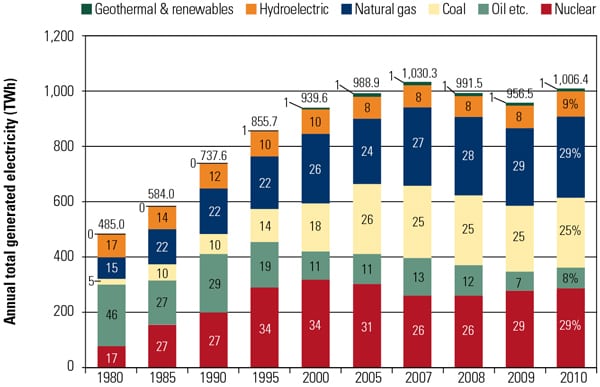

Before the quake struck off the coast of Sendai, about 1,1570 TWh were generated to meet demand. Of power generated by Japan’s 10 biggest utilities (which the Federation of Electric Power Companies [FEPC] of Japan estimates was 1,006.4 TWh), 29% was produced by nuclear power, 9% by hydropower, and 1% by renewables, while 61% was produced from fossil fuels such as coal, oil, and liquefied natural gas (LNG) (Figure 2).

|

| 2. Generation leveling off. This chart shows generation by Japan’s 10 largest electric companies, and power purchased, over the past three decades. After increasing from 1980 to 2000, the amount of nuclear power flattened. Note that figures may not add up to totals due to rounding. Oil includes crude oil, heavy oil, naphtha, and LNG. Source: FEPC |

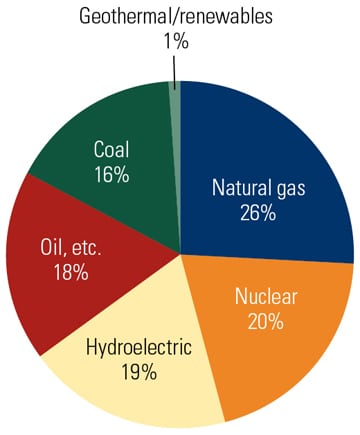

The bulk of Japan’s power capacity produced by nation’s 10 largest utilities, totaling 243.87 GW, was natural gas–fired (26%), though nuclear capacity followed closely at 20%. Hydropower made up 19%; coal, 16%; and plants combusting crude and heavy oil, naphtha, and LNG made up 18% of the country’s total capacity (Figure 3).

|

| 3. Generation capacity by source. The nonprofit Japan Electric Power Information Center, established to sustain an exchange of information between the country’s power companies, says Japan’s total capacity in 2010 was 282.3 GW: 228.5 GW owned by electric utilities and 53.8 GW owned by industry. This chart shows shares of power capacity by source owned by the Federation of Electric Power Companies’ 10 members, who are also the nation’s largest electric producers. In 2010, these companies together owned 243.87 GW of capacity. Source: FEPC |

Sudden Supply Loss

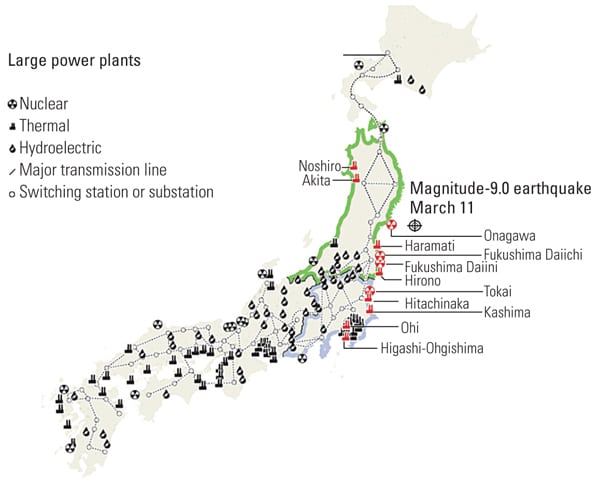

In the immediate aftermath of the earthquake and tsunami—as the four Fukushima Daiichi units experienced subsequent explosions and core meltdown—about 33 GW of power capacity from various sources (roughly 12% of Japan’s total capacity) in northeastern Japan’s was recovering from calamity. Estimates, which vary, say 9.7 GW of nuclear power capacity went offline and 12 GW to 14.3 GW of conventional capacity were seriously damaged. Five coal thermal power stations with a capacity of 7.05 GW were rendered inoperable (Figure 4). Former Prime Minister Naoto Kan also reluctantly called on some reactors around the country to shut down, prompting rolling blackouts that affected several prefectures.

|

| 4. The temblor’s effect. After the 9.0-magnitude earthquake hit northeastern Japan on March 11, 2011, an estimated 33 GW of nuclear and thermal power plants were affected (large plant closures shown in red), including TEPCO’s Fukushima Daiichi plant. At least four substations were reported down. Most areas around the plants (within the green boundary)—with the exception of central Tokyo—experienced rolling blackouts. Source: FEPC |

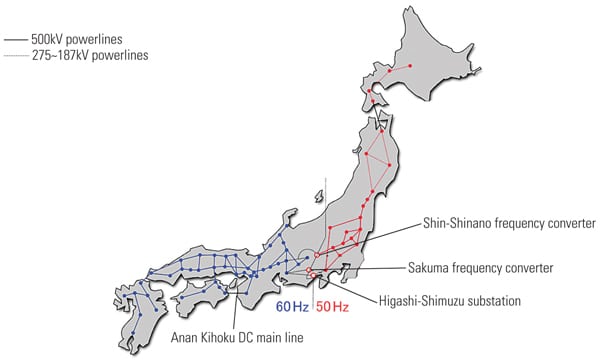

Tokyo Electric Power Co. (TEPCO), owner of the beleaguered Fukushima Daiichi and nearby Daiini plants, said it could only provide 30 GW of its 40 GW capacity because 40% of the electricity used in the greater Tokyo area was supplied by reactors in the Niigata and Fukushima Prefectures. Utilities including Kansai EPC said they could not share power because their system operates at 60 Hz, whereas TEPCO and Tohoku Electric Power Co., which lost several plants in the quake, operate at 50 Hz.

The discrepancy stems from the Meiji Era, in the late 19th century, when Eastern Japan (currently served by TEPCO) built its electricity grid based on a German system operating on 50-Hz cycles, whereas Western Japan (served by Chubu, Kansai, and Hokuriku) opted to go with generators from U.S. company General Electric Co., which used a 60-Hz standard (Figure 5).

|

| 5. Incompatible grids. After the quake and tsunami forced several large power plants offline in March 2011, plants in southwestern Japan, which were largely unscathed, could not alleviate power shortages in the northeast, even though they had surplus capacity. The country’s grid not only is isolated from other Asian countries, but also, the western grid operates at 60 Hz, whereas the eastern grid operates at 50 Hz. Chubu EPC plans to increase the capacity of the Higashi-Shizmu substation from 135 MW to 300 MW by late 2014 to reinforce the east-west connection. Courtesy: Tosaka |

Three substations in Shizuoka Prefecture and one in Nagano Prefecture could convert the cycles and transfer electricity from the west to the east—but their capacity was limited to 1.13 GW a day.

The chaos was mitigated only by compulsory power cuts and energy-saving measures, mainly in the Kanto region. Later, as power demand climbed in the summer of 2011, stringent energy conservation measures helped lead to a 12% reduction in power consumption (relative to 2010) in August, and more significantly, a reduction in peak demand reaching 18%, exceeding the government target of 15%, experts said. This was only achieved because energy efficiency, called setsuden, was already a growing movement in Japan, thanks to a campaign spearheaded by the media and embraced by companies and households. In the days following the quake, setsuden assumed the garb of national unity, comparable to early post–World War II efforts by the Japanese to rebuild their country.

Rapid Industry Changes

Setsuden has had far-reaching implications for power-thirsty northeastern Japan. In an April 16 bulletin, the FEPC said total power generated by its members declined by 5.1% in fiscal year 2011 (which begins and ends in March), due in large part to efficiency measures nationwide.

The closure of several nuclear plants also created marked changes in the country’s generation profile, foremost among them a year-to-year 25.8% increase in thermal power generation to 610.69 billion kWh. This means Japan’s coal-, gas-, and oil-powered plants generated more than 65% of the country’s power. Nuclear power generation dropped 62.9% compared with 2010, accounting for just 100.7 billion kWh. Nuclear capacity factors in 2011 were 24.7% compared with 67% in 2010.

Not surprisingly, new nuclear safety measures have been implemented. As well as completely halting construction of new nuclear reactors, new rules require that all reactors undergo two-phase stress tests. The tests (to determine whether the plants can withstand large earthquakes and tsunamis) are carried out while reactors are offline for periodic inspections; plants that have entered scheduled maintenance outages since the accident cannot resume operations until they get government approval.

Among major reforms to nuclear sector oversight is the creation of a new independent nuclear regulation agency under the Environmental Ministry that will combine the role of the Nuclear and Industrial Safety Agency (NISA) and Nuclear Safety Commission (NSC)—regulatory bodies that came under stiff criticism for their handling of the Fukushima crisis last year. This reorganization seeks to create an entity responsible for regulating nuclear power generation that is separate from the entity promoting it. FEPC is expected to establish an independent organization to study nuclear safety measures.

A Lingering Shadow on the Electricity Sector

“Looking back, the past year has been marked by a series of emergencies, which the electric power utilities have never experienced before,” Makoto Yagi, FEPC chair said in March.

Japan’s power companies now face the difficult task of restoring public trust in the electricity industry and nuclear power. FEPC’s primary goal in short term is to “secure the necessary supply capacity while keeping demand under control” and ensuring nuclear safety,” Yagi said, noting that various discussions were ongoing concerning the electric power sector, energy policy, nuclear policy, and reforms of the electric power system. “Further delays in restarting these plants could cause power shortages that significantly affect people’s daily lives, and the economy and industry of Japan.”

According to the Institute of Energy Economics Japan (IEEJ), despite the “gloomy shadow” cast on Japan’s electric sector, most energy supplies have been restored. All damaged thermal plants are back online—with the exception of Tohoku’s 2,000-MW Haramachi coal-thermal station, which will restart in the summer of 2013.

But the task of reconstruction continues to be overwhelming, the Tokyo-based think tank said in a mid-March update. While only 6% of debris and rubble—amounting to some 22 million tons—have been cleared in the quake-stricken prefecture, and many evacuees have yet to return to their homes, summer is looming, it warns, and the country is facing closure of every last one of its 50 operational reactors (not counting the four destroyed Daiichi units).

As this article was going to press, only Hokkaido EPC’s Tomari Unit 3 remained online, but it was scheduled to be shut down for routine inspections in early May. The remaining 49 were shut for periodic inspections, unplanned inspection, or even anticipated decommissioning. NISA, which is overseen by the Ministry of Economy, Trade, and Industry (METI), has so far appraised and rated “appropriate” the primary test reports of Kansai EPC’s Oh-i Unit 3 and 4, and Shikoku EPC’s Ikata Unit 3.

Even so, “we cannot be optimistic on the outcome,” Junichi Ogasawara, IEEJ’s group leader of its electric power group, cautioned. For one, plant restarts will depend on new safety standards based on lessons learned from Fukushima, which means none will be operational until the full investigation into the Fukushima crisis is concluded. And, “It is still uncertain if local governments and societies would accept restart of nuclear power plants even if the [Yoshihiko] Noda administration came to such a political judgment,” he said.

In the short term, it is almost certain that utilities that have relied heavily on nuclear power, like Kansai EPC and Tokyo EPC, will strain to meet normal year demand peaks, especially if, as in 2010, Japan has a hot summer and cold winter (Figure 6). As it did in the summer of 2011, following the quake, the government may be compelled to force power savings, invoking the Electricity Business Act, Ogasawara said. And this would result, as it did last summer, in some “prohibitively costly and inefficient” measures.

|

| 6. Desperate remedies. To meet summer demand without nuclear reactors, TEPCO has embarked upon urgent installation of three new 334-MW gas turbines at its liquefied natural gas–fired Chiba plant (shown here) and three new 268-MW gas turbines at its oil-fired Kashima plant by July 2012. The turbines will be converted to combined cycle operation by July 2014. Courtesy: TEPCO |

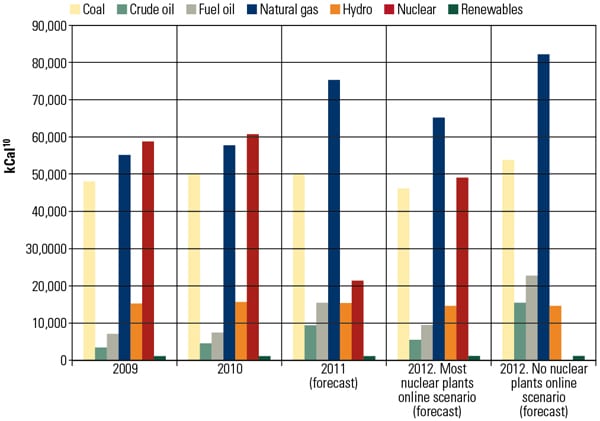

If no nuclear plants are restarted this summer, supply is expected to be 5.4% short of demand on a kilowatt-hour basis, even with energy-saving measures, IEEJ says in a short-term outlook. Under this scenario, coal use for power generation would pick up 16.2% compared with 2011, oil use by 8.3%, and natural gas use by 9.7% (Figure 7).

|

| 7. Short-term generation mix. Japan is facing the prospect of having no nuclear plants online this summer. This graph shows the possible generation mix utilities may resort to in scenarios that assume either most of the country’s 50 reactors are back online or none are online. Note that 1 kCal10 = 11.6 GWh. Source: IEEJ |

Though thermal plants will likely fill the nuclear gap, their prolonged and continuous operation could mean increasing risks of failure, while reactivated older thermal plants will be unable to produce their full nameplate output.

Then there is the issue of water, Ogasawara said, the availability of which will have a substantial impact on maximum supply capacity.

At least for this summer, METI is discussing alternative measures, such as allowing flexible operation of regional interconnections, reviewing methods of estimating peak supply capacity of pumped hydropower and solar photovoltaic (PV), applying tariffs differentiated for day and night, or by time zone, and promoting power saving through negative tariffs for peak usage curtailment. Even then, none of these efforts “is decisively effective,” he added.

Pre-Disaster Energy Policy

Japan had established several laws, regulations, and programs governing its energy sector in response to the oil shocks of the 1970s, but it wasn’t until 2002 that the Japanese Diet—its bicameral legislature composed of the popularly elected lower House of Representatives and upper House of Councilors—adopted the Basic Act on Energy Policy. Though it set no specifics, the act required government to formulate a basic plan to promote energy supply and demand, and it established three general goals for Japan’s energy policy—the three Es previously mentioned: energy security, environmental sustainability, and economic efficiency.

The first Basic Energy Plan developed in October 2003 promoted nuclear power generation to enhance efforts to secure a stable oil supply and lead the formulation of an effective international framework for enhancing energy conservation and coping with climate change. The commitment to climate change was renewed in September 2009, when a new government led by the Democratic Party of Japan (DPJ) announced goals to reduce greenhouse gas emissions by 25% below the 1990 level by 2020 and submitted to the Diet a detailed plan to achieve that goal.

As a result, the most recent Basic Energy Plan, approved in 2010, foresaw a substantial change to Japan’s energy mix, calling for shares of renewables and nuclear power to more than double by 2030. Generation from renewables was to increase from 9% in 2007 to 20%, while nuclear power generation would increase from 26% in 2007 to about 53%—meaning Japan would need to build nine more nuclear plants by 2020 and more than 14 by 2030.

Japan had also planned to increase the overall capacity factor of its nuclear sector, from a low of 60% in 2007 to about 85% by 2020 and about 90% by 2030. To promote nuclear generation, it planned to extend the time between routine power plant inspections and shorten shutdown times during inspections. It also aimed to establish a complete nuclear fuel cycle, including development of “pluthermal” light-water reactors, which can use plutonium fuel, and fast breeder reactors.

To increase its use of renewables, the government had expected to expand a newly introduced feed-in tariff system, which applies to small-scale PV generation, to include wind, geothermal, biomass, and small- to medium-scale renewable technologies through subsidies, tax reductions, and support for research and development (R&D). Plans were also in place to deregulate the domestic energy market and prepare the power grid for intermittent sources of supply.

Then the Fukushima disaster happened.

Back to the Drawing Board

The Basic Energy Plan, originally scheduled for revision in 2013, is now to be completely revamped, under former Prime Minister Naoto Kan’s orders, and released this summer.

In June 2011, Japan’s government set up the Energy and Environment Council and put the Minister of State for National Policy at its head to carve out and abide by several fundamental concepts for the revision. The body will seek to draw up a scenario of reduced dependence on nuclear energy while avoiding energy shortfalls and conducting a review of existing nuclear policies.

Meanwhile, rigorous discussions are under way to determine a future energy mix. Almost weekly, the 25-member Fundamental Issues Subcommittee of the Advisory Committee for Natural Resources and Energy, freshly created as an advisory panel to METI, meets to discuss the country’s crucial future steps.

At a mid-March meeting, Masakazu Toyoda, chair and CEO of the Institute of Energy Economics of Japan, for example, proposed a generation mix for 2030 that would entail 25% nuclear, 25% renewables, 35% thermal (with an accelerated shift to LNG), and 15% energy efficiency and cogeneration.

Another member of the advisory committee, Jitsuro Terashima, president of the Japan Research Institute, proposed a different mix: 20% nuclear, 30% renewables, 40% fossil fuels, and 10% energy efficiency and cogeneration. “While the ratio of supply by fossil fuels will have to be increased temporarily, we should attend to the trend towards natural gases; shale gas, for instance, is entering a new era,” he said in an Economist Intelligence Unit report released this April. “We can also expect a significant role to be played by non-conventional energy sources, including domestically produced methane hydrate.”

One consideration that should be underlined in the debate about phasing out nuclear power is that, unlike Germany, which was able to decisively break away from nuclear energy because it can procure energy from France through shared power-distribution lines, “Japan has not collaborated with its neighboring countries, such as Korea, China and Russia, to secure such a system,” Terashima said. “At least for the moment, Japan will have to pursue a self-contained energy strategy. Coming up with a pan-Asian energy distribution network will take at least 10 years.”

The IEEJ told POWER that, so far, member energy mix proposals have been consolidated based on similarities. Most are “very similar,” as they concern energy efficiency and cogeneration, but they seem to diverge on how Japan should handle its future nuclear power and renewables.

Participants have reportedly so far also agreed to prepare three options for quantitative and qualitative analysis for nuclear power shares of 0%, 20% to 25%, and 35%, but all with the same 10% ratio of energy conservation, and in-house power generation and cogeneration of 15%. These proposals were to be submitted and vetted more by the Energy and Environment Council at the beginning of May.

Balancing Cost and Capacity Options

The task at hand will be challenging, as JETRO’s Arima noted. Consider that gas-fired power plants could be constructed relatively quickly—but government estimates suggest that replacing all nuclear power with thermal power will incur an additional $38 billion per year for fuel imports. “This will raise monthly electricity bills for households and industry by 18% and 36% respectively,” he said. “Such a price hike could result in industry hollowing and significantly damage the Japanese economy.”

Arima’s claims were echoed in a recent IEEJ report, which found that if most of the country’s nuclear plants were shut down this summer, the country’s GDP would grow just 0.1% in 2012, and Japan could find itself struggling with electricity shortages. If Japan began switching its nuclear reactors back on this summer, the economy would grow 1.9% this year—largely because lower electricity prices would allow factories to ramp up production. The report also suggests that by curtailing fossil fuel imports, Japan could run a trade surplus this year—instead of a projected $57 billion trade deficit.

Power prices will certainly surge if no nuclear plants are online this summer, IEEJ also forewarns. In April, for example, TEPCO, which has a near-monopoly on power sales in Tokyo, sought an average 17% rate increase for large users in contracts, saying raising prices was crucial to covering an estimated ¥685.5 billion ($8.3 billion) increase in generating costs this year. Other utilities could soon follow TEPCO’s charge, prompting speculation that more Japanese manufacturers could relocate production facilities abroad.

TEPCO, which just weeks earlier had asked for a ¥1 trillion ($12.5 billion) capital injection from the government, said it had to buy more natural gas and other fossil fuels to compensate for the loss of its 17 nuclear reactors—including the four destroyed at Fukushima Daiichi—which provided 40% of its power. (TEPCO lost four-fifths of its value because of the March 2011 disaster and reported a ¥1.2 trillion loss in May 2011.) The pricing stand-off has been intensified by public anger over the Daiichi disaster, and only one in five customers has so far agreed to the increase. The Financial Times in April quoted Hiroshi Ito, secretary-general of the Kawaguchi Chamber of Commerce, as saying the increase is “abuse of TEPCO’s dominant power.”

But replacing nuclear with renewables will be challenging, especially given Japan’s weak policy on renewables, Makoto Iida, a professor at Tokyo University, noted this March. Currently, the country operates on a 2003-passed renewable portfolio standard mandating that 1.3% of Japan’s electricity must come from renewable sources. But “The objective is so small that the power companies have already achieved it and have no further incentive to purchase more,” he said.

This could change in the near future, other analysts note. Japan’s legislators are debating a feed-in tariff bill, based on German policy, that could be enacted as soon as this year. “While the purchase price is fixed for a certain period of time, the government will reduce it according to the adoption of new projects; eventually, it is hoped, to a point where no burden will be shouldered by consumers if they choose renewable sources of electricity,” said Institute for Sustainable Energy Policies Executive Director Tetsunari Iida in April.

Massive additions of renewable energy are possible through feed-in tariffs plus R&D efforts, and this will “certainly” reduce renewables’ generation costs over time, Arima suggests—even though generation costs for PV, geothermal, and wind power are currently in the range of 61 cents/kWh, 10 to 28 cents/kWh, and 12 to 17 cents/kWh respectively. He pointed out, however, that replacing all of Japan’s nuclear capacity with PV has been estimated to require 200 GW of PV farms—at a cost of $1 trillion and 5,260 square kilometers of space. If wind power were to fill the nuclear gap, Japan would need 152 GW of wind turbines, requiring $375 billion in capital investment and 5,000 square kilometers of land. Neither estimate includes back-up power or battery facilities to manage intermittency.

“Of course, the current cost comparison should not be taken for granted,” Arima cautioned. “Nuclear could become more expensive taking into account more stringent safety measures and payments to local communities where nuclear plants are sited.” The IEEJ has already raised the cost of nuclear generation to ¥8.5 ($0.11)/kWh, taking into account compensation of up to ¥10 trillion ($130 billion) for loss or damage from a nuclear accident. A draft report submitted to the Energy and Environment Council further increased that cost estimate to ¥8.9/kWh, covering capital costs (¥2.5), operation and maintenance costs (¥3.1), and fuel cycle costs (¥1.4). But it also includes ¥0.2 for additional post-Fukushima safety measures, ¥1.1 in policy expenses, and ¥0.5—at minimum—for dealing with future nuclear risks. Costs would increase by ¥0.1 for each additional ¥1 trillion ($12.5 billion) of damage, the council estimates.

There is no silver bullet, Arima concluded. “In the long-term horizon, more penetration of renewable energy will raise energy self-sufficiency and save the cost of imported fossil fuel,” he said. “However, in the short- to mid-term perspective, the Japanese economy will have to bear considerably higher electricity price.”

Restructuring for More Competition

Japan’s electricity supply market currently imposes rate restrictions on “general electricity utilities” and obligates them to supply power, but it allows them to be monopoly businesses within their respective regions. After a revision of the Electric Utilities Industry Law went into effect in 1995 (and two later revisions), the scope of liberalization was expanded by allowing newly participating power producers and suppliers to meet demand alongside general electricity utilities and to use those utilities’ powerlines.

The effect of the law is much debated: Some say it has led to efficiency improvements through competition while ensuring reliability, but others point out that because regional monopolies remain, competition is insufficient.

Among the first things that became apparent after the quake (besides the country’s dual frequencies) were the risks of concentrating large-scale power sources in distant regions of the country and relying on a system designed to supply electricity corresponding to demand while knowing little about consumption. In Japan, as METI explains, major electricity consumers have supply contracts that allow them to use unrestricted electricity based on a predetermined rate table—which means that electricity rates are unchanged even when the supply-demand balance is tight.

To address these challenges, METI has told the Task Force on the Reform of Electric Power Systems that the nation must develop “an electricity system that has the ability restrict the peak demand, by utilizing consumer behavior patterns, and [that allows] fair and transparent entry into the electricity business.” This should include reform of the electricity business system and address current and future possibilities that include smart grid development.

One option under discussion hinges on deregulation. It establishes price mechanisms to help reduce demand and increase supply, where dominant companies do not hold monopoly power, and in which customers can make “free choices” about providers.

Separation of the country’s power generation and transmission sectors is also under consideration to “secure fairness of competitive conditions,” but this move has been opposed by FEPC, the 10-utility coalition.

Competing for Natural Resources

Japan’s reluctance to rely on thermal sources for the bulk of its power stems not only from a commitment to reduce greenhouse gases but also from the fact that several Asian countries—China and India in particular—are stiffly competing for global oil, coal, and natural gas imports. (See “THE BIG PICTURE: Coal Demand Surges” in the May 2012 issue or in the archives at https://www.powermag.com.)

In 2011, the country’s crude oil imports fell 2.4% to 209.85 million kiloliters, owing mostly to heightened prices: The cost of oil purchases increased 22% to ¥11.9 trillion.

Japan, already the world’s biggest LNG importer, increased imports of the fuel to a record 83.18 million metric tons last fiscal year, up 18% from pre-quake levels, and the highest level since the government started collecting data in 1980. The cost of fuel imports also climbed to a record ¥5.4 trillion ($66 billion), compared with ¥3.5 trillion in fiscal year 2010.

LNG is certain to play a major role in future energy policy. Analysts say natural gas will likely fill most of the gap left by nuclear generation, making up 30% to 35% of the country’s generation by 2030. They anticipate the building of new gas-fired generation facilities and the conversion of older capacity to more efficient technologies.

Here, too, serious hurdles will have be overcome. One is that Japan’s existing infrastructure limits the amount of natural gas it can import. In Tokyo Bay, for example, only 24 million tons per year can be imported by TEPCO. And then there are permitting delays: In Japan, building a new gas-fired plant takes from seven to 10 years, owing to a five-year-long environmental assessment. Only TEPCO and Tohoku Electric Power Co., whose gas plants were demolished by the earthquake and tsunami, have so far been exempted from environmental assessment requirements.

To bypass increasing competition in the Asia-Pacific LNG market—as well as energy security risks posed by imports from the Middle East and Russia—Japan’s future energy policy could also push less-expensive LNG with flexible volumes from the U.S. If that occurs, Japanese utilities will have to devise technical solutions to combust lean gas (as opposed to rich gas, which is 90% of the gas imported today).

Japan was the world’s biggest coal importer from 1975 and 2010, but this January, it lost that title to China. As China’s coal demand soared to 182.4 million metric tons to fuel its booming economy, Japanese customs-cleared imports fell 5.1% to 175.2 million metric tons in 2011, as demand for coking coal slackened as steelmakers curbed production. Imports of thermal coal also fell about 0.4%, to 101.2 million metric tons, in 2011, because the quake damaged several coal-fired power plants along the northeast coast. However, if nuclear reactors do not resume operations, thermal coal demand could jump by 8.3% over the next year, IEEJ said.

To secure future coal supplies, Japan must strengthen relationships with major coal suppliers such as Australia and Indonesia, and build relationships with new ones such as Mongolia and Mozambique, Hisayoshi Ando, director general of METI’s Natural Resources and Fuel Department Agency, told attendees at a coal conference in September. As China and India are already doing, Japan must also support development of new coal mines and transportation infrastructure in emerging supply countries, Sumitomo Corp. executive Toru Furihata said. The country’s future energy policy should also promote clean coal technologies.

The bottom line is that Japan’s revised energy policy will have a tremendous impact on world energy policy, Nobua Tanaka, former executive director of the International Energy Agency and now a IEEJ global associate, told newspapers in March. “Competition over energy will be inevitably aggravated in the future, even though nonconventional oil and natural gas are now being actively developed,” he said. “Japan has to formulate its energy policy based not solely on domestic context, but on energy security for the whole of Asia.” Tanaka says that, considering this, and ensuring that lessons learned from Fukushima are capitalized upon, “we should keep a certain amount of nuclear generation capacity.”

Upheaval in Japanese Politics

Politics will play another important role in determining the country’s future energy mix. As some academics note, Japan’s administrative bureaucracy determines government policy in most fields—the result of single-party dominance by the Liberal Democratic Party (LDP) that lasted nearly 40 years, beginning in 1955. The Democrat Party of Japan’s taking of majority seats in the House of Representatives and House of Councilors in 2009 loosened the country’s political standpoint, but the “ancient regime” remains, and resists change, with many LDP members of parliament representing the vested interests of particular industrial sectors.

This is not to say that DPJ members haven’t pushed their own agendas. From his election as prime minister in June 2010 until his resignation in August 2011, long-time alternative energy backer Naoto Kan pushed for renewables to become a main pillar of Japan’s energy policy. The move was fiercely criticized: Even before the quake, the DPJ was facing serious problems relating to the country’s economy. Japan has a rapidly aging society, an export-hindering strong yen, and the highest public debt per capita of any major economy. Post-quake, the embattled party is tasked with expensive cleanup and reconstruction efforts. In his inauguration speech last September, Kan’s successor, Prime Minister Yoshihiko Noda, who is also a DPJ member, called for a gradual, long-term phase-out of nuclear energy.

“It is easy to argue for a move away from nuclear power,” Tadashi Maeda, an executive for the Japan Bank of International Cooperation and special adviser to the Cabinet on energy matters, told the Asahi Shimbun newspaper in April. Maeda has been cited as a likely key figure in the shaping of Japan’s future nuclear energy policy—but it is clear that his stance may not mesh with that of other DPJ members. “However, even if all 54 nuclear reactors in Japan stopped operations, nuclear fuel rods would still be in place and spent nuclear fuel will also remain. How will those be removed safely and where would the fuel be stored temporarily before final processing?” he asked rhetorically.

Maeda also pointed out that Japan could see a brain drain to nations such as China and India that are forging ahead with ambitious plans to expand nuclear capacity. Maeda, and Harufumi Mochizuki, another Cabinet adviser and former vice minister of economy, trade, and industry, have been pushing the government to support nuclear infrastructure exports. The “growing move abroad to construct nuclear plants” will not peter out, Maeda noted. Even though Japan may decrease its own reliance on nuclear power, if an accident were to occur in neighboring nations, Japan wouldn’t be safe. “For that reason, there is nothing strange about having foreign nations employ the technology of Japan that has experienced the accident and strengthened safety measures,” he said.

Some things are certain to change. Prior to March 11, 2011, the Japanese government and electric utilities dealt with local skepticism about nuclear plants by granting subsidies to host communities, for example. Such actions would be hotly contested today.

Ultimately, the interplay of politics and economics could decide the fate of nuclear power in Japan. “Regulatory uncertainty is pervasive. Financial markets are uneasy. And energy development remains subdued as investors await a clear political decision. If the next 12 months unleash economic havoc by forcing businesses to curtail operations or face the spillover effects, it may be that public opinion will favor the reopening of closed nuclear facilities,” Robert Dujarric, director of the Institute of Contemporary Asian Studies, Temple University Japan, said in a recent commentary in the Asahi Shimbun. Dujarric pointed out, however, that it was possible that public stance could harden “if it turns out that the country can somehow ‘muddle through’ without them.”

— Sonal Patel is POWER’s senior writer.