U.S. power plant operators continue to change procedures at their facilities, including pushing back scheduled maintenance, due to lockdowns and quarantines associated with the coronavirus pandemic. The changes are impacting companies such as General Electric (GE) and Siemens, which are major service providers to power plants, at a time when these global companies already are taking a revenue hit due to COVID-19.

Maintenance of power plant generation equipment is a major revenue source for Siemens, GE, and other equipment manufacturers. GE’s aviation unit earlier this month announced it would furlough half of the division’s engine manufacturing workers, idling thousands of staff for as much as four weeks. That announcement came a few weeks after the company said it would cut 10% of the workers in that unit, or about 2,600 jobs. The company’s aviation business is struggling as airlines worldwide reduce orders, with many airlines simply parking planes due to the global collapse in air travel.

The impact to GE’s power business could be made clearer Wednesday when the company announces its first-quarter operating results. GE’s stock has fallen 53% from its mid-February 2020 peak of $13.26, closing at just $6.26 on April 26. The company declined to comment Monday on the virus’ impact on its power unit, citing a quiet period.

GE reported $3.6 billion in revenue from its power unit in the previous quarter. GE in March cut its profit forecast and said its outflow of cash could reach $2 billion in the first quarter.

Several utilities have cited COVID-19 as a risk factor to their earnings in recent filings with the U.S. Securities and Exchange Commission (SEC), including Xcel Energy, CMS Energy Corp., and American Electric Power (AEP). “This is a rapidly evolving situation that could lead to extended disruption of economic activity in our markets,” AEP said in its filing. “We have instituted measures to ensure our supply chain remains open to us; however, there could be global shortages that will impact our maintenance and capital programs that we currently cannot anticipate.”

Deferred Maintenance

Power plant operators have said the reduction in demand for electricity caused by the COVID-19 outbreak is enabling them to halt or defer maintenance that otherwise would be prioritized. Power demand in New York City has fallen by more than 20% on average over the past two months, according to the New York Independent System Operator, which manages New York’s grid.

The Edison Electric Institute, an association that represents all U.S. investor-owned electric companies, last week said U.S. electricity demand was at its lowest point since May 2003.

Utilities have told POWER that some work can be postponed without an impact on the power grid as power loads have fallen. Critical work is still being performed—several nuclear power plants are still performing scheduled refueling outages—though utilities for the most part have only essential personnel on-site.

The Nuclear Regulatory Commission has so far granted individually requested exemptions from work-hour controls to seven U.S. nuclear power plants.

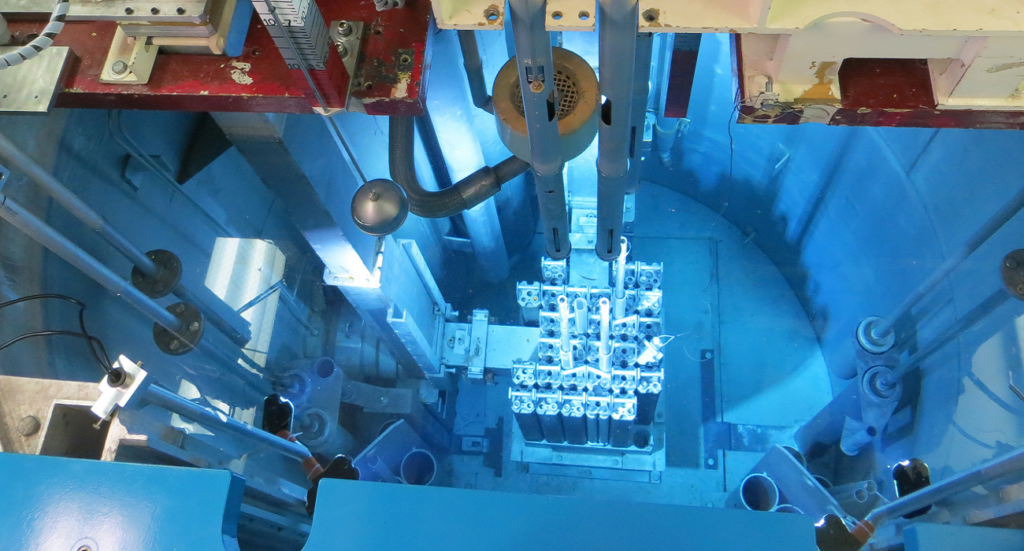

The Palo Verde Generating Station in Arizona, the nation’s largest power plant of any kind, discussed its refueling outage (Figure 1) with POWER earlier this month, with spokespeople saying the plant has “narrowed the outage scope in order to have the least amount of people and for the least amount of time while still safely and reliably completing essential outage work.”

A spokesman for the Tennessee Valley Authority (TVA) told Reuters that the utility is deferring routine maintenance at some facilities, though “still performing the work needed to maintain reliability.” TVA’s power generation fleet includes several units with GE-manufactured natural gas turbines. Reuters reported it interviewed five large U.S. utilities, companies using a total of more than 130 GE turbines. The news service said each utility is “putting off some maintenance work while performing critical jobs necessary for operation, compliance and safety.”

Other companies reporting maintenance deferrals include Pinnacle West Capital Corp., the owner of Arizona Public Service, which said recently some nonessential planned work was being moved to later this year. Detroit-based DTE Energy last month in a statement said it was “safely winding down and voluntarily suspending for the time being all non-critical infrastructure and maintenance work.” The utility said construction of the Blue Water Energy Center, a planned 1,146-MW gas-fired and waste heat power plant, had been stopped, though it said the project remains on track to open next year.

Dominion Energy and Entergy Corp., both companies whose power plants use GE turbines, were among companies telling Reuters they are deferring non-critical work.

Impact to Siemens’ Renewable Group

Siemens CEO Joe Kaeser earlier this month said the company would not cut jobs due to the pandemic, but the company is experiencing negative impacts from the coronavirus. Siemens Gamesa Renewable Energy (SGRE) last week said it would withdraw its financial guidance for this year. SGRE in a statement April 21 said the “uncertainty associated with COVID-19” was “compounding challenges in India and Northern Europe.”

SGRE said “COVID-19 disruptions” in its supply chain, manufacturing operations, project execution, and commercial activity had “primarily affected and adversely impacted the situation” in its onshore wind power business. The company said offshore and service operations also could experience disruptions in the next several months.

Siemens Gamesa earlier this month confirmed it is furloughing workers at two manufacturing plants in Iowa “for three to four weeks” due to supply chain issues caused by the coronavirus.

The company’s Siemens Healthineers unit, meanwhile, is set to launch an antibody test to identify past coronavirus infections. The division in a statement April 23 said the blood test, which requires the company’s processing equipment, would be available to large labs by late May. The unit said more than 25 million tests could be supplied per month beginning in June after the company upgrades a manufacturing site in Walpole, Massachusetts.

Vestas Cuts 400 Jobs

Danish wind turbine manufacturer Vestas on April 20 said it would lay off about 400 workers, and also suspend its financial guidance for 2020, due to disruptions from the pandemic, including installations, manufacturing, and supply chain issues. Vestas, the world’s largest wind turbine manufacturer, said jobs related to “technology projects” would be impacted as the company instead focuses on delivering wind turbines through the rest of this year.

“Simultaneously, and due to the extraordinary situation from the pandemic, additional measures are needed to ensure the organization executes as strongly as possible on our order backlog and customer commitments in 2020. To this end, Vestas intends to reduce its workforce across functions in Denmark that do not directly support 2020 deliveries,” Vestas said.

Vestas said most of the layoffs would be at the company’s locations in Lem and Aarhus, Denmark. Vestas employs about 25,000 workers worldwide, with about 4,000 in Denmark.

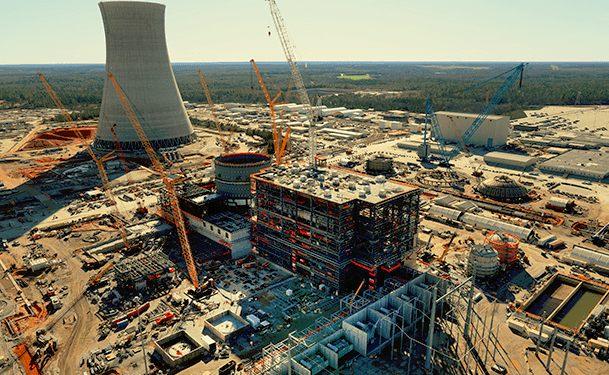

Workforce Reduction at Vogtle Nuclear Project

The coronavirus outbreak also has disrupted construction of Plant Vogtle Units 3 and 4 near Waynesboro, Georgia. Southern Co. in a recent filing with the SEC, said it had reduced the workforce at the site by 20% after several workers tested positive for the coronavirus. Georgia Power, the Southern Co. subsidiary in charge of the project, said the reduction should not delay the scheduled timeline to bring the units online, with Unit 3 scheduled to be operational next year, with Unit 4 starting up in 2022.

Southern Co. in the SEC filing said, “This reduction in workforce is a mitigating action that is intended to address the impact of the novel coronavirus (‘COVID-19’) on the Plant Vogtle Units 3 and 4 workforce and construction site, including ongoing challenges with labor productivity that have been exacerbated by the impact of COVID-19. It is expected to provide operational efficiencies by increasing productivity of the remaining workforce and reducing workforce fatigue and absenteeism.”

The renewable energy sector is experiencing widespread impacts from the pandemic. Research and consultancy firm Wood Mackenzie last week said as much as 150 GW of wind and solar power projects in the Asia-Pacific region could be canceled or delayed between now and 2024 if the “coronavirus-led recession” continued past this year.

“The extent of the coronavirus impact on Asia Pacific markets is key to the future growth of the renewables sector,” Alex Whitworth, a research director at Wood Mackenzie, said in an April 22 statement. “Over the last five years (2015–2019), the Asia Pacific region accounted for over three-quarters of global power demand growth, while leading the world in wind and solar capacity installations. The coming months will be crucial to determine if the region is moving towards a rapid recovery or extended recession future.”

—Darrell Proctor is associate editor for POWER (@DarrellProctor1, @POWERmagazine).