Accident-Tolerant Fuels Could Be a Boon for Nuclear Industry

Following a planned outage, Unit 1 at the Edwin I. Hatch Nuclear Plant near Baxley in southeastern Georgia returned to service in early March outfitted with first-of-their-kind accident tolerant fuel (ATF) test assemblies. The development marks a major milestone for the advanced fuel technology, which, beyond safety benefits, could furnish the world’s light water reactor fleet with much-needed cost efficiencies to help them stay competitive.

For the next 24 months until its next refueling outage, Unit 1, a 1975-built General Electric (GE) boiling water reactor rated at 924 MW, will test iron-chromium-aluminum fuel cladding material known as “IronClad” and coated zirconium fuel cladding known as “ARMOR.” According to Southern Nuclear Operating Co., which operates the two-unit Plant Hatch, the ATF technologies have “industry-changing safety and efficiency advantages” that could make plants safer and result in more operational flexibility. That’s why the installation at Plant Hatch, the first of its kind at a commercial nuclear facility, “is not a small step, but a leap for our industry,” said Southern Nuclear’s Nuclear Fuel Director John Williams.

“An accident-tolerant fuel is an industry term used to describe new technologies that further enhance the safety and performance of nuclear materials. This can be in the form of new cladding and/or fuel pellet designs,” explained Edward McGinnis, principal deputy assistant secretary for the Office of Nuclear Energy at the U.S. Department of Energy (DOE), in February. The concept isn’t new: ATF technologies have been under development since the early 2000s. However, it received a marked boost in the wake of the Fukushima accident in March 2011 as the DOE aggressively implemented plans under its congressionally mandated Enhanced Accident Tolerant Fuel (EATF) program to develop ATFs for existing light water reactors. The program today casts a wide net of collaboration that includes several U.S. utilities, universities, and the Electric Power Research Institute.

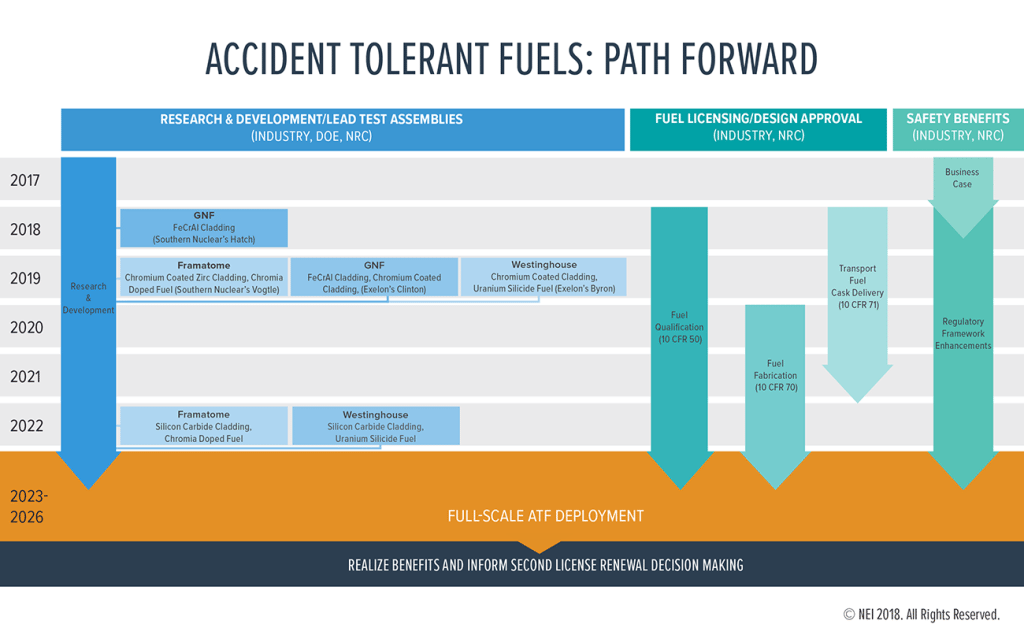

To date, three concepts for advanced ATF fuels—including fuel pellet and cladding materials—are under development and qualification by GE’s Global Nuclear Fuel (GNF), AREVA (which is now Framatome), and Westinghouse, with funding and technical backing from the DOE and its national labs. Reston, Virginia–based Lightbridge is developing its own advanced metallic fuel concept, exploring zirconium-alloy cladding and a metallic uranium alloy, with potential accident tolerant characteristics. The DOE-backed concepts, at least, could come to market within the next 10 years, McGinnis suggested.

Installation of GNF’s IronClad and ARMOR pilot test assemblies at Plant Hatch lead the ATF pack for now, but more developments, as groundbreaking, are on the horizon.

The IronClad assemblies (Figure 2) are based on a technology developed by GNF in cooperation with Oak Ridge National Laboratory, which essentially uses a combination of iron, chromium, and aluminum for its fuel cladding to improve the fuel’s behavior under severe accident scenarios. “The steel material has a much lower oxidation rate when exposed to high temperature steam,” said McGinnis. “This improves the safety margins at higher temperatures over traditional zirconium cladding used today.”

GNF, which shipped the test assemblies to Plant Hatch in early 2018, said the IronClad assemblies include two variations of the iron-chromium-aluminum material. “One material will be in fuel rod form but will not be fueled, while the other material is in the form of a solid bar segment,” it said. The ARMOR lead test assemblies, which the company developed outside the DOE’s program, contains standard zirconium fuel rods coated with ARMOR coating to provide debris resistance and more oxidation resistance than standard zirconium cladding.

GNF CEO Amir Vexler in a February statement said that the ferritic steel and coated zirconium cladding are just some of many technologies GNF is exploring as part of its advanced fuel portfolio, but they are best poised to be brought into the market in the near term to provide myriad benefits. Beyond Plant Hatch, GNF also plans to test IronClad and ARMOR cladding material at Exelon Generation’s Clinton Power Station in 2019.

Meanwhile, Framatome is working on two ATF concepts—chromium-coated cladding and chromia-doped fuel pellets. The chromia-doped pellets have a higher density and help reduce fission gas release in the event that the reactor loses cooling. Adding a chromium coating to existing zirconium-alloy cladding offers a number of advantages, including improved high-temperature oxidation resistance, dramatic reduction of hydrogen generation, coolable geometry, and mechanical properties preserved for higher coping time, and additional resistance to debris-fretting, among others, the company said. The French company reported major developments last year as it began producing chromia-doped fuel pellets at a facility in Richland, Washington, and tested them at the Idaho National Lab. In spring 2019, the company plans to install four lead test assemblies with both chromia-doped pellets and a chromium coating to the fuel rod cladding at Southern Co.’s Vogtle Unit 2. Around 2022, Framatome could also develop silicon carbide cladding containing chromia-doped fuel.

Westinghouse, which is emerging from bankruptcy buoyed by the prospect of an acquisition by Brookfield Asset Management, is exploring two cladding concepts: chromium coatings on current Zircaloy claddings for accident mitigation, and silicon carbide composite cladding—which it is developing with General Atomics—to increase corrosion resistance and ramp up maximum tolerable cladding temperatures to 2000C, more than twice what can be sustained by metal cladding used in current reactor cores. It is also developing uranium silicide fuel pellets featuring both high uranium density and high thermal conductivity. The company’s initial ATF fuel solution comprising chromium-coated cladding containing uranium silicide pellets—which the company has branded as “EnCore Fuel”—will be tested at Exelon’s Byron Unit 2 in the spring of 2019. Westinghouse’s silicon carbide cladding containing uranium silicide fuel could also see more attention beyond 2022.

All three fuel makers tout ATF’s ability to improve nuclear plant safety and reliability as well as their fuel cycle cost benefits. According to GNF’s Vexler, for example, ATF offers “superior safety margin to address a beyond-design-basis event and the potential for more cost-effective operation of the existing boiling water reactor fleet,” he said.

The Nuclear Energy Institute (NEI), too, recognizes ATF’s potential to pare down operations and maintenance costs, giving the industry a much-needed advantage to compete more robustly in power markets increasingly saturated by cheap natural gas. The trade group has been pushing industry to work toward a goal of phased deployment of ATF in a commercial reactor by the early- to mid-2020s, a schedule it deems should be significant in the decisions its members will need to make when evaluating the ATF safety benefits against the costs of adopting the technology.

The U.S. Nuclear Regulatory Commission (NRC), meanwhile, is contemplating how to best review, license, and regulate ATF designs, publishing a draft plan in December that received nearly 80 comments from a variety of stakeholders, including NEI, the DOE, and the Pressurized Water Reactor Owners Group. During a February 27 public meeting to discuss the draft project plan, the NRC said it plans to incorporate concerns in a final plan, due this summer, about regulatory clarity, communication, coordination, and licensing time lags.

Meanwhile, the NEI also urged Congress to allot more funding to the DOE’s EATF program to enable the agency to increase cost-sharing for ATF technologies and to facilitate more national lab testing, as well as for NRC licensing efforts.

—Sonal Patel is a POWER associate editor.

Editor’s note: Corrected on April 2, 2018, to reflect that Lightbridge is headquartered in Reston, Virginia. Updated on April 3 to reflect AREVA is now Framatome.