Transmission congestion currently affects approximately 70% of the U.S. grid. Bottlenecks delay the interconnection of cost-effective clean energy sources, limit the transfer of electricity between regions, and raise operational and consumer costs.

Dynamic line rating (DLR) technology mitigates these challenges with valuable newfound transmission capacity. DLR allows operators to utilize the maximum capacity of existing infrastructure by dynamically adjusting transmission limits based on real-time environmental conditions such as wind speed and temperature. DLR helps utilities delay costly infrastructure upgrades while maximizing the flow of electricity during peak times, minimizes capacity-related service interruptions, and frees capacity for interconnection of clean energy resources.

Dynamic line ratings bring business benefits to utilities in three areas. DLR technology maximizes the utility of existing transmission lines, allowing for delayed or re-prioritized infrastructure investments. It dramatically reduces ratepayer costs through improved reliability, efficiency, and power cost savings. Finally, it simplifes compliance with regulations that call for delivery of safer, cleaner, more affordable energy.

Saving Capital Costs by Maximizing the Life of Existing Lines

Utilities often consider adding new lines or reconductoring to address transmission constraint issues. Both are expensive and time-consuming. The average cost to build new transmission lines varies based on factors such as voltage capacity, terrain, and regulatory requirements. Costs generally range from $1.5 million to $2.5 million per mile of 355-kV lines, while the costs for 765-kV lines can reach $3 million to $5 million per mile. Expenses include location siting, right-of-way acquisition, materials, labor, and construction, not to mention constraints around sensitive or urban areas.

According to research, reconductoring using advanced, higher-capacity conductors is generally more cost-effective than building new lines—about 50% to 75% cheaper—though the materials may be two to three times more expensive than conventional conductors. Utilities often face costs between $300,000 and $1 million per mile, depending on the project’s complexity. While these improvements are necessary in the long run, utilities must optimize their infrastructure in the interim. This is where DLR comes in.

DLR technology can be relatively affordable, especially compared to traditional grid upgrades. DLR systems are simpler to acquire and install, and cost just a small fraction of rebuilding or reconductoring lines. Deploying DLR technology can cost $50,000 per mile for short lines, with significant price decreases as line length increases. DLR allows utilities to utilize all transmission line capacity and minimizes costly downtime caused by congestion. Deploying DLR on existing transmission lines will enable utilities to buy time, delay capital investments in new transmission lines and/or reconductoring, and immediately ease capacity constraints on existing lines.

Ratepayer Savings: An Undeniable Benefit of DLR

To quantify DLR savings, utilities must evaluate and measure their current (often hidden) congestion costs. Increased costs occur when transmission lines cannot meet the demand for electricity flow, leading to higher electricity prices and re-dispatching costs. For example, in the U.S., costs include locational marginal prices (LMPs), redispatch costs, curtailment, and sometimes congestion fees charged by independent system operators.

LMP Costs. When a transmission line becomes congested, the LMP in areas receiving limited power rises. The difference between LMPs at the point of generation and the point of consumption indicates the congestion cost. For example, if the LMP at the generation node is $30/MWh and at the load node it rises to $50/MWh due to congestion, the congestion charge is $20/MWh.

Redispatch Costs. The cost of altering the planned dispatch to avoid overloaded lines can be calculated as the difference between the original (cheaper) and alternative (more expensive) generation costs. For example, if cheaper generation was available at $20/MWh, but redispatch to a local plant costs $60/MWh and the utility must generate 100 MWh, the redispatch cost is: (60 – 20) × 100 = $4,000.

Curtailment. This refers to situations where grid operators reduce the output of energy generation sources to avoid overloading transmission lines. It can be measured in lost revenue and reduced operational efficiency, calculated by the amount of curtailed energy multiplied by the market value of that energy. For example, if 500 MWh of wind energy is curtailed and the market price is $40/MWh, the cost is 500 × 40 = $20,000.

By leveraging real-time LMP in the U.S. (or zonal data in the European Union [EU]), redispatch costs, and curtailment logs, utilities and market operators can accurately estimate congestion costs. Case studies from Ampacimon customers PPL in the U.S., Elia in Belgium, and TenneT in the Netherlands have shown that dynamic line rating reduces congestion costs by finding and utilizing transmission line capacity.

Reducing Congestion Costs Saves Ratepayers Millions

Many forward-looking utilities are already seeing the benefits of DLR and reducing congestion costs by $150,000 to $250,000 per day by unlocking additional capacity without new lines. Ampacimon customers Elia in Belgium and PPL in the U.S. found that DLR increased operational efficiency, provided better grid reliability, and integrated renewable energy sources more effectively. These projects highlight how DLR can mitigate transmission constraints and defer capital investments, yielding rapid payback periods.

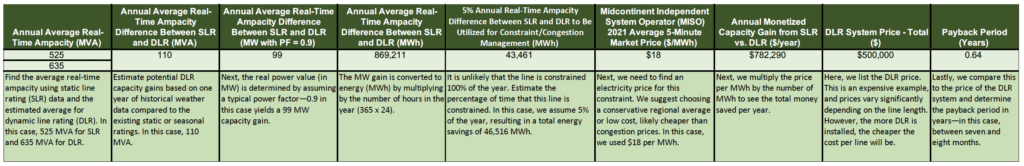

Ampacimon customers PPL and Elia noted that the return on investment (ROI) can be realized within a few months. DLR implementations around the globe increase capacity by 20% to 40% on average, helping utilities handle increasing demand without infrastructure upgrades. For example, PPL found an average 30% increase in line capacity, yielding savings of $64 million on one line within the first year. Elia and RTE in France also achieved an average 30% gain in the first year. This shows how investing in DLR technology can significantly improve performance while ensuring better grid stability and customer service reliability. Table 1 shows an example ROI calculation.

While the example above is just an estimate, it is clear that using conservative numbers, the output will be conservative, and the actual return will likely be greater. We’ve found that congestion costs are so significant that even using conservative numbers in estimated ROI shows a payback period of months. The payback period seldom exceeds a year in areas with more than 5% congestion.

Getting a Jump on Regulatory Requirements

The generation and distribution of energy is a key priority for governments worldwide. The Federal Energy Regulatory Commission (FERC) in the U.S. and the Agency for the Cooperation of Energy Regulators (ACER) in the EU are two examples. Through these agencies, utilities are obliged to follow regulations that ensure equitable energy distribution and safety. Many of these organizations also focus on decarbonization and environmental regulations that affect energy production and distribution.

In the U.S., California is one of the few places requiring utilities to incorporate grid-enhancing technologies (GETs) to increase transmission capacity, reduce congestion, and improve grid reliability and flexibility. Several other states and FERC require utilities to adopt GETs through regulatory mandates, integrating them into grid planning and utility rate cases. Both regulations and incentives are being developed and implemented across the U.S. and other global energy markets.

Utilities that deploy DLR technology not only reap the benefits of capital savings as they defer transmission system improvements and ratepayer savings, but they’re also ahead of pending regulatory requirements. Finally, by maximizing the capacity of existing infrastructure, utilities can reduce congestion bottlenecks that prevent the interconnection of new, inexpensive, clean energy sources.

Dynamic line rating makes business sense for utilities and ratepayers. It facilitates more accessible, cost-effective regulatory compliance while progressively embracing tomorrow’s energy reality.

—Brian Berry is chief product officer with Ampacimon.