Nuclear innovation firm TerraPower has teamed with the Utah Office of Energy Development (OED) and Flagship Companies, a Salt Lake City-based land development firm, to explore siting a Natrium advanced nuclear reactor in Utah. The effort, which could mark the next phase of TerraPower’s expansion beyond its much-watched reactor demonstration project in Wyoming, has the state’s backing under Gov. Spencer Cox’s Operation Gigawatt initiative to double Utah’s power production by 2035 amid a projected surge in electricity demand driven by artificial intelligence.

In an interview with POWER, TerraPower President and CEO Chris Levesque said a memorandum of understanding (MOU) the entities signed on Aug. 25 establishes a non-binding framework to identify and assess candidate sites. Flagship will contribute parcel mapping, ownership records, and topographical data, while OED will coordinate community outreach and regulatory alignment.

TerraPower plans to work to deliver preliminary site recommendations based on community support, Nuclear Regulatory Commission (NRC) licensing feasibility, geotechnical and civil characteristics, transmission access, and water availability by year-end 2025, he said.

“Operation Gigawatt shows leadership,” Levesque said. “We’re looking at sites, considering different off-takers, and because our design is so advanced, we know what we’re looking for.”

TerraPower Weighing Multiple Projects Amid Market Disruption

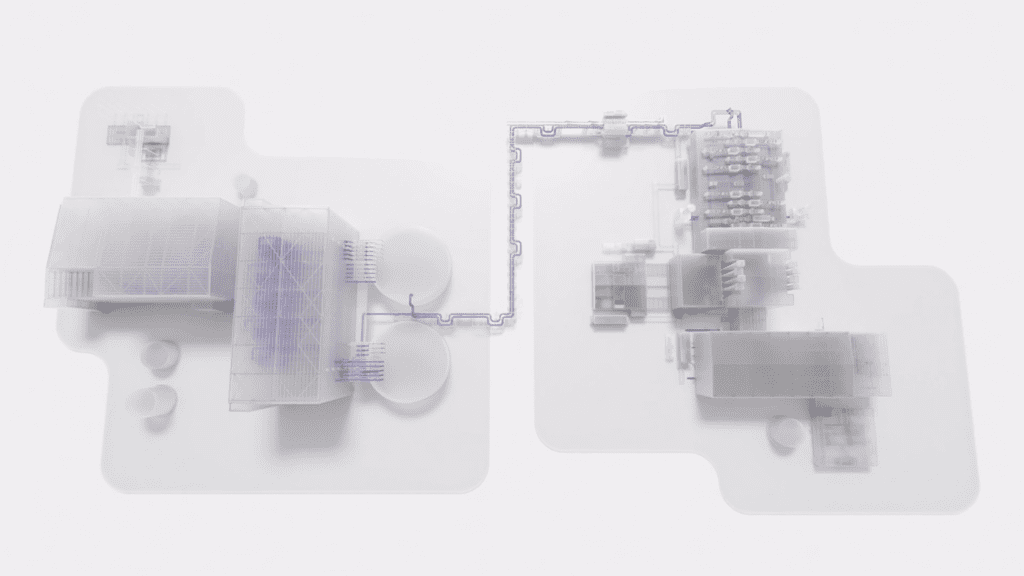

The effort marks another substantial step for TerraPower, a company founded by Bill Gates and a consortium of visionaries in 2006 to advance nuclear innovation. The company unveiled Natrium technology, its flagship 345-MWe/840 MWth sodium fast reactor design paired with a molten salt integrated energy storage system, only five years ago. That same year, the Department of Energy (DOE) launched its Advanced Reactor Demonstration Program (ARDP) and awarded the first $160 million to Natrium and X-energy’s Xe-100 in a decision that set the stage for TerraPower’s $2 billion cost-share award to build Kemmerer 1 in Lincoln County, Wyoming.

Kemmerer 1 is now quickly taking shape about 3 miles from PacifiCorp’s three-unit 604-MW coal and gas-fired Naughton Power Plant. While the demonstration will be a fully functioning commercial power plant, it will showcase a hybrid nuclear facility that will integrate the fourth-generation reactor with a nitrate molten salt-based energy storage system that could boost the system s output to between 100 MWe and 500 MWe of power for more than 5.5 hours when needed, ramping at 10% per minute.

Since groundbreaking for Kemmerer 1 in June 2024, the first-of-its-kind project has rapidly advanced toward operational readiness. Construction activity is intensifying as TerraPower works to meet an accelerated timeline, which envisions a 2030 date for fuel loading and commercial operation starting in 2031. In July 2025, the Nuclear Regulatory Commission (NRC) shortened its review period for the project’s construction permit application from 26 months to 19 months, setting a new target date of Dec. 31, 2025, for the final environmental impact statement and safety evaluation in an acceleration TerraPower called “a testament to the incredible work by our Natrium team and the support for advanced reactors at the federal level.”

In February, the company closed out a critical 18-month procurement period, and has since worked to ramp up its fundraising prowess, recently garnering new participation from investors that include NVIDIA’s venture capital arm NVentures. Simultaneously, the company is expanding its workforce. In August, the company began construction on the 30,000-square-foot Kemmerer Training Center (planned for completion in fall 2026) that will feature a full-scope Natrium simulator, electrical and instrumentation laboratories, classrooms, and an auditorium for future operator training. The company expects approximately 1,600 workers during peak construction, transitioning to 250 permanent operational staff when the plant enters service by 2030.

Levesque said the Utah MOU marks a next important step for TerraPower as it expands its Natrium footprint across the Mountain West, leveraging lessons from Kemmerer 1 to identify suitable new sites.

TerraPower is “pursuing multiple projects right now for what could be reactors two through 10,” he revealed. Kemmerer, which will maintain “first mover status as America’s next reactor,” is “opening up attention for us for literally dozens of opportunities,” he said.

A key driver, he said, has been the disruption created by AI-driven electricity demand and hyperscaler procurement, which has accelerated the move beyond traditional regulated utility tenders toward diverse project structures, including off-grid arrangements and direct power purchase agreements. ““The old-fashioned way you sold the nuclear plant was a regulated utility would do a tender,” Levesque explained. That marked a “slow, moving, expensive process” in which “the utility would pick a winner.” But the data center energy disruption is morphing “traditional relationships between customers and suppliers,” he noted. “It means the projects could be coming at us in many different forms.” These could “still be regulated utility tenders, which we’re participating in.”

Perhaps another, more substantial shift concerns the financial model for new nuclear, which compares to the last wave of new builds in the 1970s and 1980s. “Last time around, the ratepayers paid for everything,” Levesque noted. “This time around, I think there’s a recognition, especially in the U.S., that ratepayers shouldn’t pay for first-of-a-kind costs and all the capex.” The new model leverages hyperscaler power purchase agreements and private investment to cover capital costs, reducing ratepayer exposure while enabling utilities to pursue advanced nuclear projects without burdening residential and commercial customers with construction risks, he said.

The Utah deal is more of a “make-your-own-gravity situation where, you know, a company like ours has a technology. You could have a real estate partner who has land and a potential off-taker, which then creates the opportunity for a new project that could either be off the grid or could eventually involve connection to the grid as well,” he said. “So we were looking at all these mechanisms to launch projects,” Levesque said. “Before the end of the year, we expect to have more news on what the number two—and [three, four, five]—[Natrium] reactors are going to be [built].”

Levesque suggested that future Natrium projects may be greenfield ventures rather than extensions of existing fossil sites, reflecting a shift driven by grid shortages and asset economics. “Over the last three or four years, you’re seeing a trend toward existing assets—even existing fossil assets—being extended because we have a shortage,” he said. “They’ve already been amortized. They can run on the cost of fuel and O&M. So you’re seeing that happen, which means greenfields start to become a bigger focus.”

In practice, he suggested, that approach could rely on partners like Salt Lake City–based Flagship Companies, which will leverage its land development expertise—in assessing parcel mapping, ownership records, and topography across the Mountain West—to identify undeveloped sites adjacent to transmission corridors or emerging load centers such as data campuses, laying the groundwork for purpose-built Natrium reactors and integrated energy storage facilities that can launch off-grid and connect to the grid when ready.

The Mountain West Advantage

The Utah MOU directly supports Governor Spencer Cox’s Operation Gigawatt, an ambitious strategic initiative the state rolled out in October 2024 that seeks to double the state’s power capacity by adding 4 GW of capacity across a diverse portfolio of nuclear, natural gas, geothermal, and renewable sources. According to the Utah OED, the initiative targets four critical areas: increasing transmission capacity to connect more power sources to the grid, expanding existing energy production while developing new sustainable sources, enhancing state policies to enable clean baseload resources like nuclear and geothermal, and investing in Utah innovation aligned with energy policy goals.

So far, under the initiative, the state has implemented substantial policy frameworks to support Operation Gigawatt, including H.B. 249 Nuclear Power Amendments, which creates a nuclear energy consortium and a framework to support project financing and workforce development. A partner bill, S.B. 132 Electric Utility Amendments, is designed to enable large consumers requiring 100+ MW to enter flexible contracts with alternative providers. In April 2025, Utah convened a tri-state energy corridor agreement with Idaho and Wyoming to align energy policies, coordinate infrastructure, and accelerate the deployment of advanced nuclear projects. The agreement established a cooperative “energy corridor” framework centered on shared priorities such as regulatory streamlining, workforce training, grid reliability, and the pursuit of affordable nuclear energy across state lines. Gov. Cox has also notably leveraged a role as Western Governors Association chair to launch the Energy Superabundance initiative. The initiative “will examine challenges and opportunities for expanding production, modernizing transmission, and supporting advanced generation technologies, with the objective to build the backbone of a more reliable, affordable, and secure grid.”

Under the TerraPower–OED–Flagship collaboration, the parties will begin a structured siting process modeled on TerraPower’s Wyoming experience. Levesque described the framework as “a multi-attribute process” requiring detailed geotechnical studies, soil borings, and transportation analyses to ensure the efficient movement of large reactor components to the site. The evaluation will also incorporate socioeconomic factors and tribal considerations, alongside NRC licensing feasibility, weather conditions, and civil characteristics—elements that collectively influence site viability. “All these things would come into play,” he said.

Levesque also underscored that the multi-faceted evaluation process will assess current grid conditions, required transmission upgrades, and connection feasibility, factors that could shape Utah’s site recommendations as much as local community support. “All across the country, we’re seeing interconnect as being a really crucial thing,” he said. “For some sites, the interconnect project ends up being more complicated and more lengthy than the advanced nuclear project.” Interconnection, he cautioned, could be a “bigger limiter than having available technologies or available supply chain.”

Utah operates within a sophisticated energy ecosystem dominated by Rocky Mountain Power (PacifiCorp), which owns and operates 17,500 miles of transmission lines across the West. The state’s 2024 electricity mix indicates a rapid transition: coal provided 45% of total net generation (down from 75% in 2015), natural gas supplied 32% (up from 20% in 2015), and renewables—primarily solar—contributed about 22% of generation. Solar energy alone powered 94% of Utah’s new electric generating capacity added since 2015.

Utah, historically a net energy exporter, has notably recently begun using a larger share of its generation in-state. Critical transmission nodes include the Mona substation in central Utah and the Mercer substation in Eagle Mountain, which serves major industrial loads, including Meta’s Eagle Mountain data center. PacifiCorp is advancing the 45-mile Spanish Fork to Mercer 345 kV transmission project, scheduled for in-service March 2028, to accommodate projected load growth and enable 2,950 MW of additional renewable energy connections.

Levesque sees the Mountain West as uniquely positioned for nuclear expansion. “These are energy-producing communities,” he explained. “Wyoming and Utah have been powering the rich West Coast for a long time. There’s lots of electrons in California today that are produced in Wyoming and Utah, but with fossil and renewables resources.”

The region also fosters a pragmatic energy culture, he noted. “People in these states understand energy. They’re very pragmatic about regulation. They’re very supportive of nuclear energy—they’re not afraid of it.” In addition, the Mountain West offers uranium resources in both Wyoming and Utah that create multi-level stakeholder interest in nuclear projects. “We’ve just found the Mountain West to be a very constructive place to work,” Levesque said. TerraPower plans to “keep tremendous focus there” while exploring other Wyoming sites alongside the Utah initiative,” he said.

While TerraPower isn’t fully ready to announce the specific sites yet, the MOU kicks off a crucial exploratory process that takes into account the region’s growing flexibility needs, which he noted Natrium, with its built-in energy storage, satisfies. The Natrium design also uses significantly less water than traditional light water reactors and small modular reactor designs, he noted.

“The Mountain West “isn’t like your typical area for nuclear energy,” he noted. “Nuclear energy was kind of born, and they really grew in the East. And following our work in Wyoming, you know, we really learned a lot about the region and what, you know, what a great environment it is for nuclear, great political support,” he said.

Fuel Supply Chain Development

For now, however, TerraPower’s Utah expansion may depend on securing adequate high-assay low-enriched uranium (HALEU), a specialized fuel required for advanced reactors. While the DOE announced conditional commitments in April 2025 to provide HALEU for TerraPower’s near-term demonstration needs, commercial deployment requires establishing robust private supply chains. “To support loading fuel in Kemmerer in 2030, we had to take matters into our own hands, because the U.S.-based projects weren’t moving fast enough,” Levesque explained in the interview. “So that’s why we made a deal last November with ASP Isotopes.”

The partnership represents a pragmatic approach to fuel security constraints. ASP Isotopes is “a NASDAQ-listed American company, but their facility where they’re going to enrich our HALEU is actually in South Africa,” Levesque said. TerraPower announced the strategic agreement in October 2024 to commercialize laser-based uranium enrichment technology, with definitive agreements finalized in May 2025 providing conditional commitments for up to 150 metric tons of HALEU over a 10-year period beginning in 2028. The South African facility at Pelindaba is expected to begin HALEU production in 2027 with annual output around 15 metric tons.

However, Levesque emphasized the importance of domestic capacity for broader nuclear expansion. “The whole industry needs that if we’re going to triple nuclear—light water reactors and advanced reactors, both need more fuel, or we won’t be able to expand nuclear capacity,” he said. “We need diversity. We need U.S. capacity. So that’s why it’s going to be very important for DOE to deploy that $3 billion in funding,” referencing Congress’s HALEU Availability Program, which has awarded contracts to Centrus Energy, General Matter, Orano Federal Services, and Urenco USA to establish domestic enrichment capabilities.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).