What’s driving a fundamental shift in engineering, procurement, and construction (EPC) contracting? Equipment lead times. Workforce shortages. Data center timelines. POWER examines how the traditional EPC model—plan, permit, procure, build—has been upended by new market realities.

For decades, engineering, procurement, and construction (EPC) firms have generally entered projects after utilities completed feasibility studies, secured permits, and negotiated power contracts. Typically, equipment procurement has followed design, and construction begins after approvals, in a sequence that has been deliberate, mostly linear, and allowed risk allocation to match project maturity. But, given a number of recent disruptions, that model appears to be on the brink of a fundamental inversion.

The first of three interconnected trends stems from geopolitical tension, which continues to send ripples through global supply chains and challenge project feasibility. According to executives participating in the Energy Projects Conference (EPC) Show 2025, which took place in Houston last June, tariffs and trade realignments have made the cost and availability of key equipment increasingly uncertain, prompting developers and EPCs to reevaluate where and when to invest. A second, more structural tension lies in the industry’s ongoing effort to balance traditional energy infrastructure with energy-transition work. Gas-fired, nuclear, and renewables now compete for limited capital and skilled labor (Figure 1) under volatile policy conditions, they noted. And the third—perhaps the fastest-moving disruption—is the extraordinary surge in electricity demand from artificial intelligence and data center growth, which is reshaping grid and generation planning in real time (see sidebar).

|

|

1. A skilled labor crunch is challenging power project development across nearly every region of the world. Courtesy: Burns & McDonnell |

The Utility Urgency for ProcurementUtility earnings reports released at the end of October 2025 suggest the materialization of demand is occurring at an unprecedented pace, and that rapid scaling has, in turn, prompted a rethinking of project timelines, procurement strategies, and contract structures. At Entergy, data center demand in its Gulf Coast territory has expanded to a 7–12 GW pipeline—up from 5–10 GW just one quarter ago—prompting the company to move aggressively on long-lead equipment and engineering, procurement, and construction (EPC) capacity. The company has secured more than 19 GW of generation components, including 4.5 GW of new power island equipment slated for 2031–2032, and 90% of the materials required for transmission projects through 2030. Executives said projects for customers such as Google and Meta are advancing under cost-protective service agreements, while new laws in Arkansas and Mississippi are expediting approvals for economic-development generation. Chief Financial Officer (CFO) Kimberly Fontan described the current environment as “very strong growth driven by our customer-centric capital plan,” even as CEO Drew Marsh acknowledged tighter craft labor markets and higher EPC costs. American Electric Power (AEP) is also leaning heavily into the infrastructure supercycle as load growth accelerates across its 11-state footprint. The company projects system peak demand will reach 65 GW by 2030, fueled by data centers, reshoring industries, and large industrial projects. About 28 GW of new load—mostly from hyperscalers under take-or-pay contracts—is already committed, prompting AEP to lift its long-term growth outlook and expand its capital plan to $72 billion through 2030. More than two-thirds of that investment targets transmission and generation, supported by 8.7 GW of gas turbine capacity already secured and new high-voltage equipment agreements. CEO Bill Fehrman called this “a transformative moment for our industry,” citing the company’s unmatched 765-kV transmission backbone and legislative wins in Texas, Ohio, and Oklahoma that streamline cost recovery. Dominion Energy, similarly, is tackling one of the largest simultaneous generation and transmission buildouts in its history as load from data centers surges across Virginia and the Carolinas. The company now has roughly 47 GW of data center demand in various contracting stages—up 17% since last year—including 10 GW under executed service agreements. CEO Bob Blue said the growth underscores why Dominion is “developing resources across distribution, transmission, and generation to meet this critical need on a timely basis.” Major projects include the 2.6-GW Coastal Virginia Offshore Wind installation, nearing completion in 2026, and the 1-GW Chesterfield Energy Reliability Center natural gas plant. Dominion has also submitted $2.9 billion in new solar and storage filings, and its largest-ever PJM transmission proposals. NextEra Energy, notably, appears to have more concretely moved beyond traditional EPC sequencing to a vertically integrated, speed-to-market model aimed at serving hyperscale and industrial load growth. The company’s 30-GW renewables and storage backlog now includes 3 GW of quarterly additions, backed by a domestic supply chain that CEO John Ketchum called “a world-class development platform.” Its recent partnership with Google to recommission the 615-MW Duane Arnold nuclear plant in Iowa, for example, illustrates how data center demand is driving bespoke generation agreements that blend nuclear, storage, and gas assets under long-term power purchase agreements. “We are unique in that we combine a national footprint, a strong balance sheet, supply chain capabilities, and experience in building all forms of generation and transmission, together with unmatched customer relationships and an industry-leading team on a development platform second to none,” Ketchum said. Likewise, Southern Co.’s load outlook has accelerated to levels not seen in decades, spurring a decisive shift toward contract-based generation and forward procurement. Executives said the utility has signed four large-load agreements across Georgia and Alabama in recent months totaling more than 2 GW, as part of a 50-GW pipeline of potential incremental demand through the mid-2030s. Georgia Power’s updated forecast supports 10 GW of new capacity requests—including five combined cycle gas units and 11 battery energy storage sites—while Alabama Power is advancing 2.5 GW of new gas and storage builds, and recently acquired the 900-MW Lindsay Hill facility. CFO David Poroch emphasized that new data center contracts include minimum-bill provisions that “cover all of our costs, whether or not the meter spins,” securing cost recovery as load ramps. |

At the Experience POWER conference in Denver on Oct. 29, Michael Caravaggio, EPRI’s vice president of fleet reliability, noted that these pressures come amid an already strained operational profile. “Six of the top 10 days for electricity use occurred this year,” he said. “For essentially my entire career, the peak energy use has always been in the summer, but two of the highest peak days that occurred in 2025 were winter days.” He added, “We actually have 20 GW less of coal and gas capacity today than we did about five years ago, but we had many more days this year where we needed more than 9 TWh from that energy. That’s a big concern, especially if we’re going into a period of growth, especially if we can’t build fast enough to bridge that gap.” Caravaggio suggested that load growth, once measured in decades, is now arriving in quarters, driven by data center demand as utilities sign multi-gigawatt service agreements to support hyperscale projects. If flexible capacity isn’t built adequately or fast enough, “it’s a lot of load that makes the system get closer and closer to being put on the edge,” he warned.

A Key Constraint: Infrastructure Timelines and Equipment Bottlenecks

As some experts told POWER, urgency—not necessarily cost—has now become the defining force reshaping EPC contracting. In its November 2025–released 2025 Electric Report, Black and Veatch found data centers in 18 months from final investment decision to operation, while the grid and power infrastructure required to serve them can take three to six years. “The mismatch is straining utilities as they try to deliver city-scale power on exponentially squeezed timelines,” the report notes.

“The urgency is real,” the report says. “Data center developers need firm answers—how much dispatchable power is available, where and when. Utilities are working to meet that demand, even as they navigate complex permitting, aging infrastructure, uncertainty in planning and forecasting, material lead times, and workforce limitations. While there’s not a one-size-fits-all answer to this challenge, there is real opportunity and progress when utilities and data center developers bridge the gap and work closely together and with their local Authorities Having Jurisdiction (AHJs).” However, “This isn’t just about megawatts. It’s also about speed, uncertainty about demand and funding, and the moving goalpost that requires business strategy updates on a continuous basis, not single projects that demand gigawatts,” it adds.

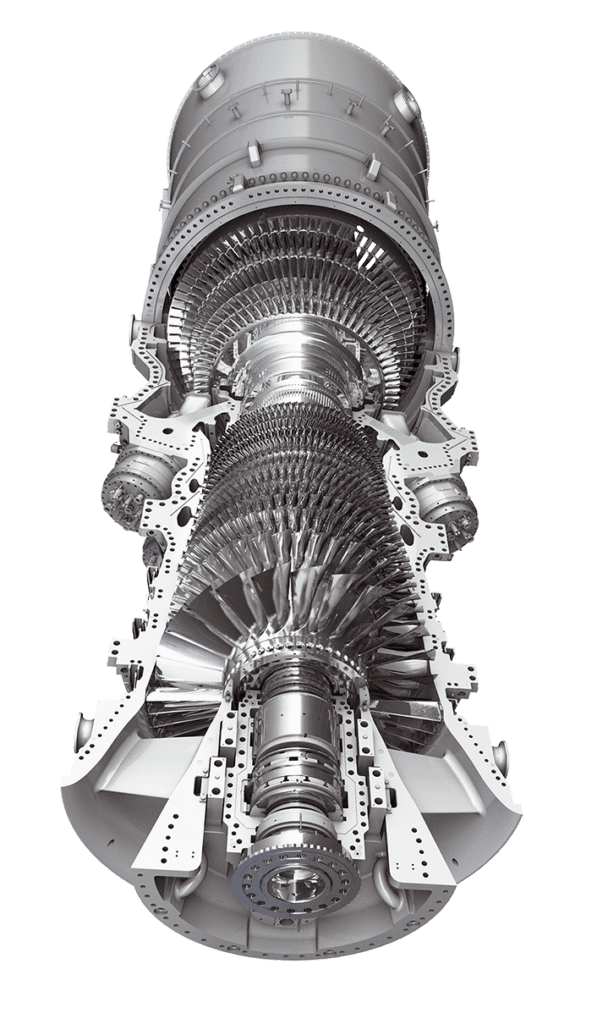

Still, the biggest pinch point compounding project timelines remains equipment procurement, experts told POWER. One reason is that procurement is no longer a utility-EPC supply chain concern—it has become a multi-industry competition for constrained manufacturing capacity. Data centers, renewable developers, manufacturing facilities seeking electrification, and grid modernization programs are all competing for the same transformers, gas turbines, and grid equipment simultaneously. Gas turbine and transformer manufacturers—once comfortably sequenced downstream of project approvals—are now first in line for capital commitments, given lead times of five years or more. In its third quarter (Q3) earnings call on Oct. 22, GE Vernova reported 12 GW of new gas turbine orders in Q3 2025, following 9 GW in Q2, pushing its total gas power backlog—including slot reservation agreements—to 62 GW.

GE Vernova CEO Scott Strazik said the company now begins “the funnel with slot-reservation agreements” because customers want to secure long-lead equipment early. While GE Vernova classifies these separately from orders, “in many cases, [customers are] providing us enough financial capital on day one that one could argue we could be booking these things as orders,” he explained. Those deposits guarantee that “they’ve got the equipment while, in parallel, they work those other solutions,” he added. GE Vernova’s Electrification business backlog echoes the crunch: Orders “more than doubled year-over-year” to $26 billion, including $400 million in hyperscaler orders in Q3 alone. Prolec GE, a joint venture originally established between Xignux and General Electric in 1995—whose full acquisition GE Vernova announced on Oct. 21—reported that transformer sales to data centers have risen from 10% of total business in 2024 to 20% in 2025.

And while transformer shortages are cited as a particular crisis, an October 2025 analysis conducted with American Clean Power by Wood Mackenzie reported that demand for transmission and distribution (T&D) equipment has surged by 35% to 274% since 2019, driven by data center expansion, manufacturing investment, grid modernization needs, and extreme-weather resilience efforts. Power transformer lead times averaged 128 weeks—nearly two and a half years—down from a peak of 138 weeks but still twice pre-2022 levels, while switchgear averaged 44 weeks. The firm noted that tariffs, volatile electrical steel and copper prices, and ongoing order backlogs continue to strain domestic production capacity. Circuit breakers—another critical category of T&D infrastructure—are also emerging as component bottlenecks. At the October 2025 Experience POWER conference, industry panelists highlighted supply constraints for medium-voltage breakers as utilities race to build and upgrade substations to accommodate data center loads.

‘Ready, Go, Set’ as Industry Standard

EPC firms told POWER they are responding to the myriad shifts in the broader energy industry with their own evolution. At Burns & McDonnell, a legacy design-build firm founded in 1898, that evolution has meant collapsing the traditional boundary between strategic planning and project execution. “The complexity of the energy transition requires smarter, more strategic planning from the start,” Scott Strawn, senior vice president and general manager of the Power Group at Burns & McDonnell, told POWER. “The integration of 1898 & Co., our consulting arm, has been pivotal, combining their upfront business and utility consulting experience with our traditional engineering, procurement, and construction services. This allows us to partner with clients at the earliest stages, helping them navigate everything from decarbonization strategies to grid modernization before a single shovel hits the ground.”

The approach seeks to address a fundamental mismatch. While utilities face 18-month data center interconnection timelines, they lack the internal capacity to complete feasibility studies, equipment selection, and procurement strategy simultaneously. “By pairing deep consulting knowledge with execution strength, we deliver holistic, end-to-end solutions that help clients manage existing assets and plan for a sustainable, reliable, and resilient energy future,” Strawn said.

The consulting-plus-execution model addresses a fundamental sequencing problem that now qualifies project viability. “In today’s gas market, the traditional ‘Ready, Set, Go’ development cycle has been flipped to ‘Ready, Go, Set,’ ” Brendan O’Brien, senior business development manager in the Power Group at Burns & McDonnell, told POWER. “Owners are now required to make major capital commitments, such as placing deposits on long-lead equipment, at the earliest stages of a project, often before permits are secured, or the project is even fully defined.”

All of the Above Is Now the Norm

Another notable shift is a push for technology flexibility, given, as Black & Veatch’s 2025 Electric Report notes, load growth is now edging out emissions reduction as utilities’ top priority, driven by data centers, industrial electrification, and manufacturing reshoring. Only two-thirds of surveyed utilities now report active clean-energy goals—down from 80% in 2024—while near-term investment plans for solar, wind, and electric vehicle fleet electrification have declined. In their place, utilities are pursuing more diversified “all-of-the-above” portfolios that balance renewables with natural gas, nuclear, and battery storage to maintain reliability and energy security. The firm calls it “a transition within the transition,” where success may depend less on any single technology and more on optionality, pivotally, to support the ability to flex across fuels, policies, and timelines as load growth accelerates faster than infrastructure can catch up.

Bechtel, for example, simultaneously manages a $21 billion liquefied natural gas (LNG) portfolio (Rio Grande LNG Phase 1, Rio Grande Trains 4 & 5, Port Arthur LNG, and Corpus Christi expansion), as it is building advanced reactors (the Natrium Demonstration Project in Kemmerer, Wyoming, targeting 2029 operation). But, on the heels of success at Vogtle 3 and 4 in Georgia, it is also developing next-generation large reactors internationally (Poland’s AP1000 facility, targeting 2033), while working on utility-scale solar (Mammoth Solar in Indiana, 1.3 GW across three phases by 2027), and providing front-end engineering and design (FEED) services for gas-fired generation.

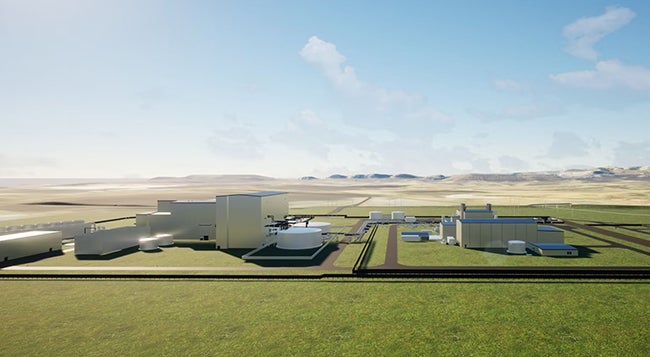

The Natrium project (Figure 2), which broke ground in June 2024, is notable in that the first-of-its-kind facility exemplifies the expanding role EPCs are playing in advanced nuclear technology projects. Bechtel notes its “Digital Delivery” approach integrates building information modeling (BIM)—a comprehensive 3D virtual representation of the entire facility—with a central data environment to streamline design-to-construction workflows, enabling real-time coordination across design, procurement, and construction teams.

|

|

2. TerraPower’s Natrium Demonstration Project in Kemmerer, Wyoming—developed with Bechtel as its engineering, procurement, and construction (EPC) partner—features a 345-MWe sodium-cooled fast reactor coupled with molten salt energy storage to enable output to boost to 500 MW when needed. Courtesy: Bechtel |

Likewise, Kiewit, through a joint venture with Black & Veatch and Aecon called Cascade Nuclear Partners, secured the progressive design-build contract for Energy Northwest’s Cascade Advanced Energy Facility—four X-energy Xe-100 small modular reactors totaling 320 MW—while simultaneously partnering with NRG and GE Vernova on 5,000 MW of conventional gas generation across the Texas and PJM markets. The firm is also delivering Oklo’s Aurora fast reactor at Idaho National Laboratory for operations later this decade.

Fluor, a long-time investor in NuScale, has moved to monetize its equity stake in NuScale Power following an agreement announced in November 2025, marking what CEO James Breuer described as a strategic pivot “away from a strategic investor to a market-focused solution,” driven by shareholder demand for value clarity. While full monetization expected by mid-2026, Fluor expects to continue Phase 2 FEED work on Romania’s six-reactor NuScale plant, leveraging what Breuer called its position as “the only EPC contractor that has real project experience on NuScale.” Zachry Group spans the spectrum from conventional gas (Duke Energy’s 1,360-MW Person County combined cycle facility, targeting 2028) to “clean combustion” technology, including for NET Power’s first utility-scale near-zero-emissions gas plant in Texas, now expected online between 2029-2030 (with gas turbines potentially delivering power to the grid starting in 2028). It also has a joint venture with Quanta Services to deliver NiSource’s combined cycle generation project in Indiana, featuring two 1,300-MW units (2,600 MW total) by 2032.

However, not all EPCs are responding to equipment scarcity and timeline compression by taking on construction risk. KBR formally exited the lump-sum EPC market in 2022, following a decision first announced during the COVID-19 period. The company cited volatility in labor, materials, and logistics costs as incompatible with fixed-price contracting, where the EPC firm assumes full responsibility for delivering a project at a single agreed-upon cost. And, despite its deep nuclear and infrastructure history, AECOM recently deliberately shifted toward professional services models that emphasize advisory, program management, and owner’s representation rather than lump-sum EPC delivery. In its August 2025 Q3 earnings call, AECOM CEO Troy Rudd emphasized the firm’s advisory business grew at double-digit rates with plans to double the platform to $400 million in net service revenue within three years.

Likewise, at the May 2025 Bernstein Strategic Decisions Conference, Jacobs CEO Bob Pragada reportedly told investors that about 70% of the firm’s work is now cost-reimbursable rather than fixed-price. He said Jacobs is increasingly focused on advisory and conceptual design engagements “because there is no scope” defined yet—allowing the company to shape projects at the decision-making stage before construction risk materializes. WSP’s $1.78 billion acquisition of POWER Engineers in 2024 reflects a similar pivot. Both firms describe themselves as “consulting” organizations providing “program and construction management” and “high-level advisory” services rather than at-risk construction delivery, according to WSP’s acquisition announcement and program management materials.

“We’ve seen across the industry companies pull back from lump sum,” Andy Hemingway, Worley’s executive group director of growth, reportedly said at the EPC Show in Houston this June, according to materials published by conference organizers. “I think there are a few reasons for that. One is that the premiums right now are high—people will take the risk, but they will charge for it. And the second one is probably each of us on this panel has had some painful experiences around lump-sum contracting due to misalignment on successful outcomes, so we’re looking at more collaborative models.”

Michael McKelvy, CEO of McDermott International, appeared more direct about the financial reality: “I think that we’re all undergoing a transition where we cannot—for a variety of reasons—afford to bid EPC projects lump sum now. That is the reason so many companies have failed—they bit off more than they could chew, they took on risk that they couldn’t mitigate.” If contractors cannot bear the risk, it falls to customers and project owners. “We’re all taking less risk,” he said. “The financing side wants to see a little bit more cost certainty. The clients certainly didn’t factor in the ultimate, realistic cost of the projects into their performance.” McKelvy also suggested that strong customer relationships and early EPC integration could help avoid cost surprises for project owners.

Bechtel, which is still willing to accept fixed-price work, attributes success to early engagement with supply chains and equipment selection during pre-FEED and FEED stages. “You can’t blur the lines of accountability. I think that’s really, really critical,” Paul Marsden, president of Bechtel’s Energy global business unit, reportedly said at the EPC Show panel. “But there’s so much you can actually do with a very modest level of investment to get in help and work to make each other successful.”

Workforce: Potentially the Most Critical Constraint

Still, for now, while equipment shortages and capital availability dominate headlines, workforce limitations are rapidly ascending as the most immediate and pressing bottleneck on project execution in 2025. At Experience POWER, panelists repeatedly called attention to the convergence of surging demand by multiple industries (including data centers), which is potentially creating more competition for a shrinking skilled trades pool.

“As much as all of us are probably pretty happy we’re in this industry, I’m not sure if all our kids are thinking about being in this industry,” said Carvaggio during the show’s keynote speech. The workforce burden extends across operations and construction, he said. “You need an enormous amount of people to build these assets, and you need a dedicated, skilled workforce to run these assets,” he said. “We’re competing against the data center for labor. We’re competing against the LNG terminals for labor. It’s a huge challenge, and it’s going to get worse.”

While a definitive figure is difficult to pinpoint, estimated numbers are staggering. A Kearney study released in August 2025 in collaboration with the IEEE Power and Energy Society found that the global power engineering workforce must grow 100% to 200% by 2030—from roughly 450,000 to as many as 1.5 million engineers—to design, implement, and operate new power infrastructure. Today, “Up to 40% of global power executives find that an insufficiently skilled workforce and competition for talent are the two biggest challenges in filling engineering roles,” Kearney noted. The scale of the challenge could grow even more acute at the regional level. At the June 2025 EPC Show panel in Houston, Bechtel’s Marsden projected a shortfall of 45,000 to 50,000 craft workers across the U.S. Gulf Coast alone—a region hosting roughly 1,200 miles of active construction sites for LNG facilities, refinery expansions, and power generation projects.

Proactive EPCs are responding with transformational workforce development initiatives. Burns & McDonnell, for example, launched a 14,000-square-foot Construction Academy in Pearland, Texas, earlier this year, designed as both a recruitment hub and skills development center. The firm is also deploying mobile training units that bring in-the-field knowledge assessments directly to project sites, reducing onboarding time and ensuring a supply of skilled artisans ready to work. Addressing the labor shortage requires new, scalable approaches, said Jeff Rashall, vice president of Burns & McDonnell’s Construction Group. The company’s initiatives aim to create a self-sustaining pipeline of talent, emphasizing safety, productivity, and rapid upskilling, he said (Figure 3).

|

|

3. Burns & McDonnell opened a 14,000-square-foot Construction Academy in Pearland, Texas, in 2025, offering knowledge assessments and hands-on training. A permanent skills facility simulating job site conditions will open in 2026. The academy qualifies craft workers through online knowledge assessment followed by hands-on evaluation—part of Burns & McDonnell’s effort to address labor constraints and develop next-generation talent at scale. Courtesy: Burns & McDonnell |

Bechtel is pursuing complementary workforce strategies that combine global skills development with local training partnerships. Internationally, the company has launched initiatives such as its 2025 nuclear energy skills collaboration with the Gdansk University of Technology in Poland to help train the next generation of nuclear engineers. Domestically, Bechtel continues to work with high schools, colleges, unions, and veteran programs in Texas Gulf Coast communities—including Sabine Pass and Port Arthur—where large-scale LNG and pipeline projects are underway.“ Our industry’s future depends on rebuilding America’s construction workforce,” Craig Albert, Bechtel’s president and COO, recently wrote. “Without enough tradespeople, mission-critical projects could face lengthy delays or fail to get off the ground at all. Rebuilding America’s construction workforce is no longer optional—it’s a national imperative.”

Kiewit is also investing heavily in workforce training through its Accelerated Journeyman Development Program and a growing network of mobile training facilities to build structured career paths for emerging craft professionals. A key facet entails bringing instruction directly to job sites nationwide. “Companies will need to start hiring people who don’t necessarily have experience,” noted Andrew Pate, who manages Kiewit’s Training Center in Colorado. “That’s why training is going to become even more important, especially over the next five years.”

Still, amid these challenges, firms see opportunity in reinvention. At Burns & McDonnell, leaders say the same ingenuity driving modularization, automation, and digital delivery must now be applied to developing the labor force itself. “We’ve strengthened and expanded our construction capabilities to drive deeper integration across every phase of project delivery,” said Strawn. “That integration, paired with technology and training, gives our teams greater certainty and consistency in outcomes.” Across the industry, a new generation of builders, technicians, and engineers is beginning to emerge—supported by data, digital tools, and deliberate investment in skill.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).