Record capacity, record auctions, and record-breaking turbines mark a maturing industry, but U.S. policy reversals and macroeconomic headwinds threaten to slow momentum.

The global offshore wind industry achieved significant milestones in 2024 and early 2025, with installed capacity surpassing 83 GW and a record-breaking 56 GW awarded in competitive auctions worldwide. Yet, this momentum faces significant headwinds, particularly in the U.S., where the Trump administration’s executive actions have halted construction on five major projects representing nearly 5.8 GW of capacity. As turbine technology continues its rapid evolution—with units now reaching 26 MW—and floating wind advances toward commercial scale, the industry finds itself at a critical juncture that will shape its trajectory for years to come.

Asia-Pacific Leads as Europe Rebuilds Momentum

Global offshore wind capacity reached 83 GW by the end of 2024, according to the Global Wind Energy Council’s (GWEC’s) Global Offshore Wind Report 2025. New numbers won’t be released by the GWEC until April, but all signs point to another banner year for the industry in 2025. An additional 48 GW was under construction as of May 2025, positioning the sector for accelerated growth through the decade.

The Asia-Pacific region has emerged as the industry’s center of gravity. China alone accounts for 41.8 GW of installed capacity—roughly half the global total—having added 4 GW in 2024. The Chinese market’s dominance extends beyond deployment. The country’s manufacturers now produce the world’s largest turbines, and its shipyards are building installation vessels for operators worldwide.

Europe, with 36 GW installed, representing 44% of global capacity, added 2.7 GW in 2024. The continent’s mature markets are working to regain momentum following auction failures in 2022–2023 that exposed vulnerabilities in contract structures during a period of high inflation and elevated interest rates. Reforms to contract-for-difference (CfD) mechanisms and improved risk allocation are beginning to restore investor confidence.

The market outlook remains robust despite near-term challenges. Industry forecasts project more than 350 GW of new capacity additions between 2025 and 2034 (Figure 1), bringing total global installations to approximately 441 GW. Annual deployment is expected to exceed 30 GW by 2030 and reach 50 GW by 2033.

Auction activity in 2024 reached unprecedented levels. The 56 GW awarded globally represented a record year, with significant allocations across Europe, Asia-Pacific, and emerging markets. This contracted pipeline provides visibility for the supply chain, though grid connections, permitting delays, and financing challenges in some markets could affect realization timelines.

Policy Reversals Halt Progress in U.S.

The U.S. offshore wind industry faces an existential challenge following a series of executive actions by the Trump administration that have effectively frozen the sector’s development.

On Jan. 20, 2025—his first day back in office—President Trump signed an executive order withdrawing all outer continental shelf areas from new offshore wind leasing, ordering a review of existing leases, and halting new or renewed approvals for wind projects. The order marked a dramatic reversal of the Biden administration’s goal of deploying 30 GW of offshore wind capacity by 2030.

The more consequential blow came on Dec. 22, 2025, when the U.S. Department of the Interior (DOI) announced it was pausing leases for the five large-scale offshore wind projects currently under construction along the East Coast. The affected projects—Vineyard Wind 1, Revolution Wind, Coastal Virginia Offshore Wind Commercial, Sunrise Wind, and Empire Wind 1—have a combined capacity of approximately 5.8 GW and represent billions of dollars in investment.

The DOI cited “national security risks” identified in classified Pentagon reports as justification for the pause. Specifically, the agency pointed to radar interference concerns, noting that the movement of turbine blades combined with reflective towers creates “clutter” that can obscure legitimate moving targets and generate false readings. The DOI stated the pause would allow agencies to assess potential mitigation measures.

Critics, including national security experts, have challenged the rationale. Kirk Lippold, former commander of the USS Cole, told NPR that the projects had undergone years of review by state and federal agencies, including the Coast Guard, Naval Undersea Warfare Center, and Air Force.

“The record of decisions all show that the Department of Defense was consulted at every stage of the permitting process,” Lippold said, arguing that diversifying the country’s energy supply through offshore wind would actually benefit national security.

The December pause came just two weeks after a federal court dealt the administration a legal setback. On Dec. 8, Judge Patti Saris of the U.S. District Court for the District of Massachusetts vacated Trump’s Jan. 20, 2025, executive order, ruling that the blanket halt on wind energy approvals was “arbitrary and capricious” and violated the Administrative Procedure Act. The ruling came in response to a lawsuit filed by a coalition of 17 state attorneys general and Washington, D.C., led by New York Attorney General Letitia James.

Legal challenges to the December lease pause mounted quickly. On Dec. 23, Dominion Energy filed suit in the U.S. District Court for the Eastern District of Virginia, arguing that the U.S. Bureau of Ocean Energy Management’s (BOEM’s) stop-work order for its 2.6 GW Coastal Virginia Offshore Wind (CVOW, Figure 2) project “sets forth no rational basis, cannot be reconciled with BOEM’s own regulations and prior issued lease terms and approvals, is arbitrary and capricious, is procedurally deficient, violates the Outer Continental Shelf Lands Act, and infringes upon constitutional principles that limit actions by the Executive Branch.”

In a statement, Dominion warned: “Stopping CVOW for any length of time will threaten grid reliability for some of the nation’s most important war fighting, AI [artificial intelligence], and civilian assets. It will also lead to energy inflation and threaten thousands of jobs.”

The market impact has been severe. The International Energy Agency (IEA) revised its U.S. renewable capacity forecast down approximately 50% for the 2025–2030 period following the administration’s actions. Wind energy, specifically, saw a 60% downward revision, representing 57 GW of capacity—both onshore and offshore—that is now unlikely to be built during the forecast period. Ørsted, the Danish developer with significant U.S. exposure including the Revolution Wind project, saw its share price drop 12% on Dec. 22, the day of the pause announcement, although the price returned to its previous level within two weeks.

The Conservation Law Foundation, a Boston, Massachusetts–based group, characterized the administration’s approach as a “desperate rerun” of failed attempts to kill offshore wind. Other environmental groups also objected. “For nearly a year, the Trump administration has recklessly obstructed the build-out of clean, affordable power for millions of Americans, just as the country’s need for electricity is surging,” said Ted Kelly, director and lead counsel, U.S. Clean Energy, with the Environmental Defense Fund. “Wind—when allowed to move forward—offers some of the most affordable, reliable power,” he claimed.

The Race to Scale Continues

Offshore wind technology continues its relentless march toward larger, more powerful machines. The average capacity of turbines installed offshore in 2024 reached 10 MW, according to GWEC, a figure that would have seemed implausible a decade ago. Yet, the frontier has already moved well beyond that threshold.

Chinese manufacturer Dongfang Electric Corp. commissioned the world’s largest operational wind turbine in late 2025: a 26-MW behemoth (Figure 3) featuring 150-meter (m, 492-ft) blades and a rotor diameter of 310 m (1,017 ft). Goldwind launched its 22-MW platform in December 2024, while most other major Chinese original equipment manufacturers now offer turbines rated at 16 MW or greater, GWEC reported.

This rapid scaling reflects intense competition among Chinese manufacturers, supported by massive domestic testing infrastructure. GWEC said new facilities include offshore test sites in Guangdong and Fujian provinces, a 40-MW test bench operated by Shanghai Electric Wind Power Group in Yancheng, and a 35-MW six-degrees-of-freedom drivetrain test bench from SANY in Beijing. Blade testing capabilities have expanded with new sites in Jiangsu province’s Dafeng district and Lianyungang.

Western manufacturers are responding. Siemens Gamesa’s 14-MW platform is being deployed across major European and Asian projects, while Vestas and other suppliers advance their own large-turbine programs. However, the scale of Chinese investment in manufacturing capacity and testing infrastructure has opened a significant lead in turbine ratings.

Meanwhile, GE Vernova is supplying wind turbines for what developers claim “will become the world’s largest offshore wind farm when fully operational.” The project, Dogger Bank, is a joint venture partnership between SSE Renewables (40%), Equinor (40%), and Vårgrønn (20%). SSE Renewables is leading on the development and construction of the wind farm, while Equinor will operate it over its expected 35-year lifespan.

The project is located in the Dogger Bank Offshore Development Zone, which is between 125 kilometers (km, 78 miles) and 290 km (180 miles) off the east coast of Yorkshire, England, and extends over approximately 8,660 km2 (2,140,000 acres) with water depths ranging from 18 m to 63 m (59 ft to 207 ft). The current project (Figure 4) is being constructed in three phases—A, B, and C—and will consume only a portion of the development zone (less than 20%). When fully completed, Phases A and B will each have 95 GE Vernova Haliade-X wind turbines rated at 13 MW each, and Phase C will have 87 Haliade-X turbines with an upgraded 14-MW rating.

Floating Wind Approaches Commercial Scale

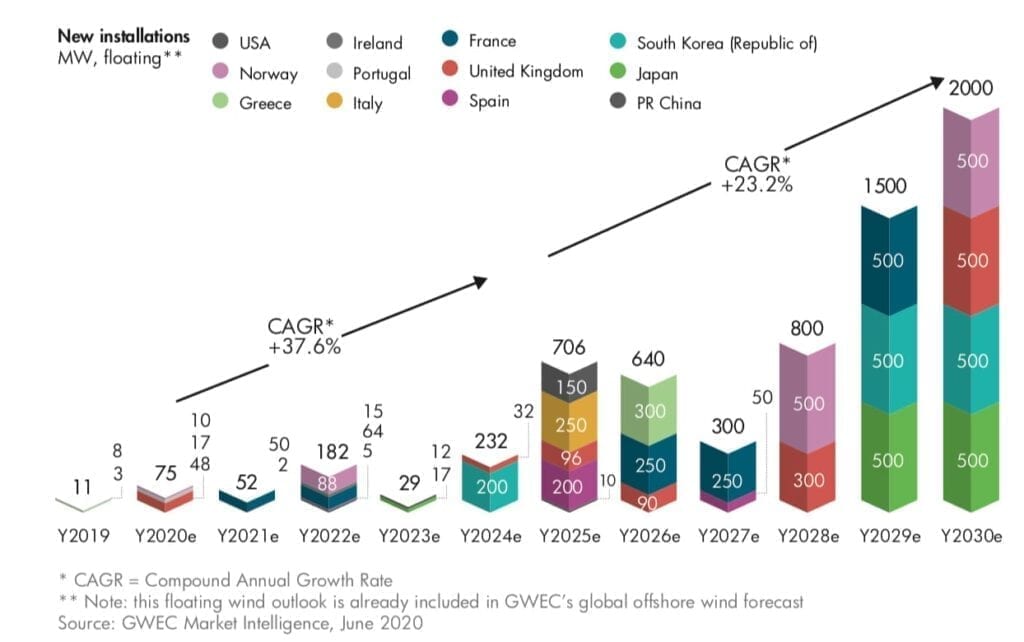

Floating offshore wind technology—which enables deployment in deeper waters unsuitable for fixed foundations—is transitioning from demonstration projects toward commercial scale. GWEC reported global installed floating capacity reached 278 MW by the end of 2024, distributed across Norway (101 MW), the UK (78 MW), China (40 MW), France (27 MW), Portugal (25 MW), and others.

More significantly, 2.4 GW of floating wind capacity has now secured routes to market through competitive auctions or contracts. GWEC said France awarded 750 MW across its AO5 and AO6 tenders at strike prices of €85.5/MWh to €92.7/MWh ($98.40/MWh to $106.6/MWh). South Korea awarded the 750-MW Bandibuli floating project, while the UK’s CfD Allocation Round 6 included the 400-MW Green Volt floating project.

China is pursuing floating wind at scale with its 1-GW Wanning project in Hainan province. A 100-MW prototype phase, featuring turbines of 16 MW to 18 MW from Shanghai Electric, Dongfang, CRRC, and Windey, was scheduled to complete by the end of 2025, the GWEC report says.

Japan’s offshore wind ambitions received a significant boost in June 2025 when the Diet (the country’s bicameral national legislature) passed the Exclusive Economic Zone Bill, enabling floating wind development in waters beyond Japan’s territorial sea. This legislation opens vast new areas for potential development in a nation with limited shallow-water continental shelf.

Despite this progress, floating wind faces significant headwinds. The technology remains more expensive than fixed-bottom installations, and the specialized vessels, mooring systems, and dynamic cables required add complexity to project execution. More broadly, the IEA revised its global offshore wind forecast downward in its most recent forecast by 27% from the previous year, citing U.S. policy changes, macroeconomic pressures, and supply chain challenges that have undermined project bankability in several markets.

Foundation and Installation Innovations

As turbines grow larger, so too must the foundations that support them—and the equipment that handles these massive components. Monopile foundations, the industry’s workhorse for bottom-fixed installations, now regularly exceed 2,000 tonnes and 80 m (262 ft) in length.

A notable innovation in monopile logistics debuted at the Windanker project in Germany during 2024–2025. Dutch heavy-lift specialist Mammoet deployed its XXL monopile transport system at the port of Rønne in Denmark to marshal foundations for the 315 MW project. The system employs MTC1600 terminal cranes (Figure 5) with a combined lifting capacity of 3,200 tonnes, capable of handling monopiles up to 2,150 tonnes and 87 meters in length.

The significance lies in operational efficiency. Conventional monopile handling requires extensive port reinforcement, Ro-Ro (roll-on/roll-off) operations, and sequential vessel loading. Mammoet’s approach eliminates ground reinforcement requirements and enables continuous feeding of installation vessels—a critical capability as project scales increase and weather windows constrain offshore operations.

Manufacturing processes are also evolving. Lincoln Electric reported its Long Stick-Out (LSO) welding technology has been deployed worldwide for fixed foundation fabrication, achieving deposition rates of more than 37 kilograms/hour (kg/hr) with tandem configurations and more than 40 kg/hr with triple-arc setups. These rates represent 30% to 100% improvements over conventional submerged arc welding, which typically achieves less than 27 kg/hr. Faster welding translates directly to higher factory throughput and shorter lead times for foundation delivery.

The installation vessel fleet is expanding to address a longstanding bottleneck. China now operates 65 jack-up vessels and barges plus 47 heavy-lift vessels dedicated to offshore wind construction, according to GWEC. Chinese shipyards have become suppliers to European installation contractors, building wind turbine installation vessels to specifications capable of handling the latest turbine generations. Orders placed in 2021–2022 are now delivering, gradually easing vessel availability constraints.

Projects in Progress: A Global Portfolio

Offshore wind construction activity spans at least four continents, with major projects advancing across varying stages of development and completion. The following are a sampling of notable projects well-underway or recently finished.

Europe. Construction continues on the previously mentioned Dogger Bank offshore wind farm in the North Sea. Phases A, B, and C are all underway, with Phase A in commissioning and generating first power. Developer SSE and partner Equinor have finalized the lease for Phase D (1.5 GW), with terms agreed in August 2025. The full project is expected to contribute £6.1 billion ($8.3 billion) to UK gross domestic product (GDP) and support 3,600 full-time equivalent jobs during its peak construction year.

Van Oord’s Svanen heavy-lift vessel has installed 21 monopiles for the 315-MW German Windanker project in the Baltic Sea. As mentioned previously, the foundations were marshalled through Rønne port in Denmark, using Mammoet’s specialized handling equipment.

In Poland, Baltica 2, a 1.5-GW PGE and Ørsted joint venture, achieved a significant milestone in December 2025 with the delivery of four 450-MVA transformers to the onshore substation at Osieki Lęborskie. The facility will convert power from 275 kV to 400 kV for transmission to the national grid. Commercial operation is targeted for 2027, when the project will supply renewable electricity to approximately 2.5 million Polish households.

Dieppe-Le Tréport in France is a 496-MW project (Figure 6). Ocean Winds’ consortium installed the project’s first jacket foundation in September 2025. The 62-turbine array, located 17 km offshore, secured €2.4 billion ($2.8 billion) in financing in April 2023, with Sumitomo Mitsui taking a 29.5% stake. Commercial operation is expected in 2026.

Yeu-Noirmoutier, also in France, is a 500-MW wind farm. Construction began in April 2023 for this Ocean Winds consortium project. The first Siemens Gamesa–supplied 8.2-MW turbines began generating power in June 2025. The project is reportedly on track to reach full operational capacity during the first quarter (Q1) of 2026.

Asia-Pacific. Hai Long (Taiwan, 1,044 MW) is a three-phase project being developed by Northland Power and Yushan Energy. It reached a major milestone in December 2025 when all 21 turbines at the Hai Long 2A phase achieved mechanical completion. Commissioning is underway for the Siemens Gamesa SG 14-222 DD turbines, with the full 73-turbine array progressing toward commercial operation.

In Japan, the 112-MW Ishikari Bay project achieved commercial operation in early 2024, adding to Japan’s nascent but growing offshore wind portfolio. Meanwhile, the Jeju Hallim project was the largest commercial offshore wind farm in South Korea, featuring 18 Doosan 5.56-MW turbines. It also achieved full commissioning in 2024, as did the nearby Jeonnam 1 project (96 MW), GWEC reported.

Still, China is currently leading the way in offshore wind worldwide. Among its projects is Fujian Zhangpu Liu’ao Phase II. This project achieved full grid connection in July 2024, and was notable for deploying the first commercial 16-MW turbines. The array comprises 7 Goldwind GWH252-16MW units alongside 13 GWH252-14.3MW machines. Yangjiang Qingzhou Phase VI is another Chinese project featuring Goldwind turbines. It has 74 GWH252-13.6MW units. This substantial project is expected to reach full commercial operation this year.

Wanning Floating Offshore Wind is perhaps the most notable project in Hainan province. It’s being watched by the international energy community for two main reasons: scale and typhoon resistance. Wanning is 10 times larger than most previous floating offshore wind projects, aiming to solve the cost-per-kilowatt problem through sheer volume. Additionally, the Wanning area is prone to intense tropical cyclones. The project serves as a live test for active ballast systems and mooring technology designed to keep 17-MW turbines stable during intense storms.

Market Challenges and Industry Response

The offshore wind sector faces a complex set of challenges that vary significantly by region but share common themes.

Macroeconomic headwinds—including inflation, increased capital costs, and supply chain constraints—have squeezed project economics across markets, according to GWEC. Supply chain bottlenecks persist for critical components such as transformers, submarine cables, offshore substations, and installation vessels. Grid connection delays have emerged as a binding constraint in several European markets, with Germany, Belgium, and the Netherlands experiencing transmission infrastructure backlogs, GWEC said.

Permitting remains a persistent friction point. Many markets contend with slow approval processes, fragmented regulatory systems, and under-resourced permitting agencies. Auction design has proven problematic in some jurisdictions. For example, tenders in the UK and Denmark failed to attract bids due to what GWEC described as “poor commercial viability” and strike prices that failed to reflect rising costs from inflation and higher interest rates.

Policy instability represents perhaps the most significant risk, as events in the U.S. demonstrate. The IEA noted that “regulatory and political risks remain high” globally, with the sharp downward revision in U.S. forecasts reflecting not technical limitations but policy choices.

Industry associations and market participants have advocated for reforms including two-sided CfDs that provide floor prices alongside caps, better risk allocation between developers and offtakers, predictable project pipelines, and indexed power purchase agreements that adjust for inflation. Permitting recommendations focus on centralized review processes, designating renewable energy development as an “overriding public interest” for environmental assessments, and deploying digital tools to accelerate reviews.

Grid planning has emerged as a critical area for coordination. Industry groups are calling for anticipatory transmission investment—building infrastructure ahead of confirmed generation capacity—and clearer delineation of responsibilities for offshore and onshore connection works.

Despite these headwinds, the global pipeline remains substantial. With 48 GW under construction, 56 GW awarded in recent auctions, and multiple gigawatt-scale projects progressing through development, offshore wind appears positioned to deliver continued growth—though the pace and geographic distribution of that growth will depend heavily on how policymakers in key markets address the structural challenges confronting the sector.

—Aaron Larson is POWER’s executive editor.