As energy demand intensifies across data centers, industrial clusters, and electrification efforts, small modular reactors offer a scalable path forward. Yet, their success depends on preparing the ground—literally and figuratively—for rapid deployment.

The conversation around small modular reactors (SMRs) has evolved. “Do they work?” has become “How do we scale deployment?”

The answer lies less in the reactors themselves and more in the systems that surround them. Modular reactors need modular ecosystems and scaling them requires that the supporting infrastructure—civil works, environmental and regulatory permitting, water access, balance of plant and utility electric grid integration, and investor and funding frameworks—become standardized and replicable too.

|

|

1. Concept of a small modular reactor (SMR) power plant. Courtesy: Jacobs from Getty Images audioundwerbung |

Governments across Europe and North America are committing billions to standardization, delivery models, and enabling infrastructure. With 127 SMR designs in development (Figure 1), innovation isn’t an issue. The global pipeline for SMR projects now exceeds 22 GW, with an estimated $176 billion in planned investment. This wave of activity includes both first-of-a-kind deployments and program-scale planning, as the market shifts from purely technology validation toward commercial readiness.

Meeting Demand

Energy users are now becoming infrastructure drivers. Be it with hyperscale data centers, hydrogen hubs, clean industrial clusters, or desalination plants, demand is concentrating fast, and with it, pressure on legacy grid infrastructure. Facilities now plan in gigawatts, not megawatts. Some estimates place future site loads at 2.5 GW or more—greater than the draw of many cities.

Take data centers for example. Artificial intelligence (AI) workloads, cloud expansion, and colocation services are all fueling demand for them and the energy they require to operate is huge. Today, most large users rely on grid-delivered renewables to meet decarbonization goals, but for operations requiring 24/7 power, that model is under strain because of limitations to the transmission and distribution systems, as well as the need for non-intermittent generation. The alternative option is onsite generation, but finding a carbon-free supply that is highly reliable, cost-predictable, and insulated from grid volatility is the challenge.

SMRs are emerging as the viable solution here. By having them located on the same site or closely coupled with data centers or other large end-users, they can offer a highly reliable load supply, thermal integration, and in some instances, the opportunity to support the local grid with the surplus energy produced. These types of “behind-the-meter” setups can help improve overall energy resilience and increase efficiency with the elimination of transmission losses.

Getting Off the Ground

The case for SMRs is now well-understood. But real progress will depend on how quickly and reliably projects move from approvals to poured concrete. There are currently seven SMR designs in construction or operation globally, with more than 51 in an active pre-licensing or licensing process.

Selecting sites that enable deployment of modular plant foundations and balance-of-plant equipment will be critical to bringing this generation of reactors to market quickly enough to meet the forecasted AI-driven demand growth. Establishing repeatable permitting pathways and integrated site planning that anticipates cooling, security, transport, and local impacts are equally essential. This also means treating civil works as a strategic function, and not merely a support service, as was the case for the previous generation of reactors.

For SMR deployment to be fast, the ground beneath them and the surrounding supporting infrastructure must be ready so that when the construction permit is issued, work can commence. Even for these smaller units, civil work remains substantial. Foundations must be seismically qualified. Flood defenses must withstand 1-in-10,000-year events, with design parameters shaped by site topography, climate forecasts, and operational life. Transport logistics are also equally critical. Modules weighing 200 to 300 tons require strengthened access roads, new bypass routes, or rail extensions.

When it comes to site selection, this often starts with a desktop review of geotechnical and environmental conditions, followed by in situ investigations. Brownfield sites may offer more in the way of existing infrastructure that can be adapted, but they’re not always cheaper. Land remediation, legacy licensing, or constrained layouts can also negate those advantages. The decision often comes down to certainty and speed.

To support rollout, developers are rethinking civil sequencing. Repeatable, modular approaches can reduce interdependency delays and streamline design approvals.

Permitting remains one of the most significant influences on program pace. In the UK, the dual pathway of the Development Consent Order (DCO) and nuclear site license introduces complexity, often with interconnected but separate requirements. In the U.S., licensing offers a similarly heavy lift.

But there are signs of acceleration. The UK’s 2050 Civil Nuclear Roadmap now recognizes SMRs as part of a critical national priority for low-carbon energy infrastructure. That designation may help reduce overall approval timelines. It also broadens eligible sites beyond coastal locations, making inland siting possible where grid and water connections exist.

At the same time, expectations have sharpened. The draft National Policy Statement for Nuclear Energy Generation (EN-7), a newly proposed framework by the UK government to guide the planning and development of nuclear infrastructure beyond 2025, no longer balances discretionary and exclusionary siting criteria—all must be met. This raises the bar for developers, but also reduces ambiguity. The policy message is clear: nuclear power will be supported, but it must be ready.

Planning reform is underway too. In the UK, proposed updates to infrastructure legislation could reduce legal risk such as over-consultation, repetitious documentation, or delays caused by minor modifications.

Standardization as Strategy

SMRs promise repeatability, but only if civil, regulatory, and supply systems also standardize. The U.S. is seeking to accelerate reactor development, reform permitting, and expand domestic capacity. Underground nuclear islands are being explored to reduce the need for above-ground security structures. These designs offer a smaller visual footprint and limit vulnerability to surface-level threats—even though most of the new designs already carry a significantly reduced inherent safety risk, some due to their shift to a TRISO (TRi-structural ISOtropic) fuel, which is an advanced nuclear fuel designed for high-temperature reactors, particularly gas-cooled reactors and microreactors. From a planning perspective, this approach may ease local concerns and simplify perimeter layouts.

Early-stage seismic and flood assessments are also being carried out on brownfield industrial sites that may not have hosted nuclear before but could be repurposed. The key is clarity on what can be reused, what needs upgrading, and how that integrates into a broader rollout model.

The need for coordination goes beyond the site. With more than 70 active SMR vendors globally, the risk of fragmentation is real. Without alignment on key interface requirements, from enclosure sizes to utility connections, many of the theoretical benefits of modularization will be lost.

Some in the industry are already considering platform models, where a neutral delivery partner prepares standardized civil infrastructure that can accommodate multiple reactor designs. That kind of flexibility, backed by a rigorous baseline, could become a key factor to unlock rapid deployment.

Predictability Over Novelty

Next generation nuclear power is gaining ground with policymakers, but investor confidence will determine the pace and scale of deployment. In the U.S., most projects will rely on private capital and rate-based recovery models are no longer typical. Venture capital, infrastructure funds, and corporate procurement all expect delivery certainty and a return timeline that aligns with business cycles.

The UK continues to support SMRs through policy frameworks like EN-7. But long-term fleet buildout will require private-sector momentum. As with the U.S., investors will be looking for replicable delivery and not first-of-a-kind complexity.

Partnerships like the UK-Czech agreement, targeting six units capable of powering three million homes, show what’s possible when policy, industry, and finance align. But they also highlight the dependencies: siting certainty, streamlined approvals, vendor readiness, and integrated civil delivery.

This is where program governance becomes critical. Investors are backing a product, but they’re also backing a system. From civil readiness to permitting, to original equipment manufacturer coordination, every interface must reduce the risk for them.

|

|

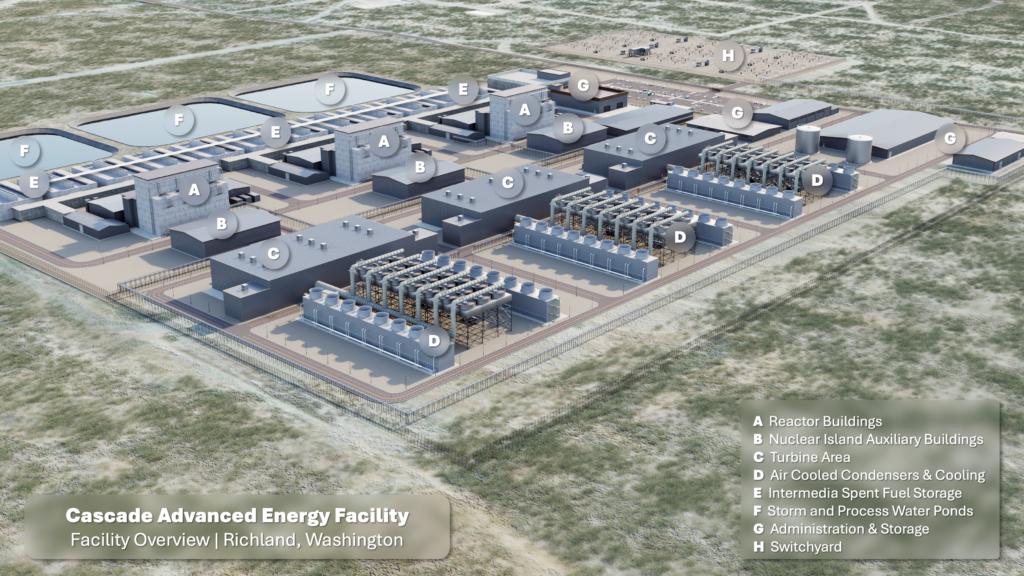

2. Concept of a SMR nuclear power plant. Courtesy: Jacobs from Getty Images audioundwerbung |

SMRs are no longer just proposed solutions (Figure 2) for the nuclear market resurgence. They now present a commercial and infrastructure challenge that the market has spent decades preparing for—it will succeed if we continue to focus on the need to standardize delivery, align permitting, and prepare the ground before the first module even arrives.

For governments, operators, and investors alike, success will depend on coordination. That begins with strategic site selection informed by civil engineering, and environmental and power infrastructure requirements. By aligning these critical elements early, we set the stage for efficient delivery, minimized risk, and the confidence needed to achieve program success.

—Rebecca Reynolds is Capability Director at Jacobs.