The limitations of lithium-ion batteries are prompting a search for longer-duration solutions. Compressed air energy storage (CAES) and other emerging technologies are gaining traction as safer, scalable alternatives to support renewable integration and grid reliability.

The energy storage market is booming internationally. According to Jon Moore, CEO of BloombergNEF, an analyst firm with a focus on low-carbon markets, energy storage investment increased globally by 36% in 2024. Drivers include the price of battery energy storage systems (BESS) dropping by about 20% in one year.

The trajectory of energy storage over the past decade has been nothing short of spectacular. “In 2014, the energy storage market was worth about $0.6 billion worldwide and reached $4.7 billion by 2020, and $53.9 in 2024,” said Moore. “Utility-scale projects in energy storage made up 58% of the market.”

U.S. investment has largely focused on lithium-ion BESS. From 1 GW of BESS in 2020, a steady stream of new projects took the total to about 20 GW at the end of 2024. The U.S. Department of Energy (DOE) has funded dozens more projects around the nation. The vision behind this investment is for excess solar and wind to be stored in batteries for use when the sun doesn’t shine or the wind isn’t blowing. That’s good for the short term—BESS offers up to four hours of storage—but not for longer periods.

BESS exuberance took a hit in January 2025 following a fire at the world’s largest site. The incident at the 500-MW Moss Landing site in California highlighted the dangers of widespread deployment of lithium-ion batteries—the same kind of batteries airlines restrict in checked bags due to the risk of fire.

Longer-Duration Storage to Support Renewables

Between heightened awareness of the fire risk posed by lithium-ion batteries and the demand for storage beyond four hours, long-duration energy storage (LDES) solutions are stealing some of the spotlight from BESS.

Megan Reusser, technology manager at Burns & McDonnell, suggested LDES represents a smart way to compensate for the intermittency of renewables while adding stability and reliability to the grid, and forwarding decarbonization objectives. There can also be financial benefits. “LDES allows you to store energy when costs are low and sell it when costs are high,” Reusser said. “It also reduces the need for grid expansion.”

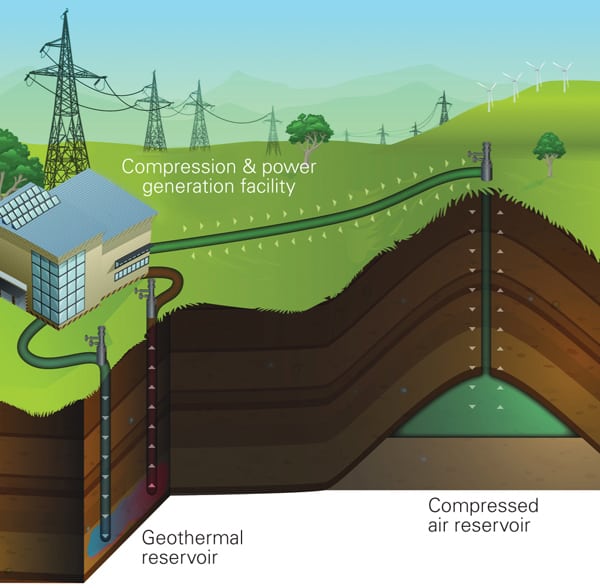

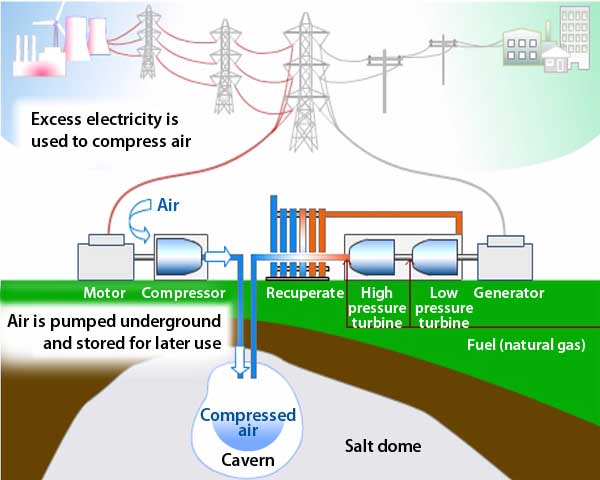

A variety of LDES technologies are available with each serving distinct markets and needs. There is no one-size-fits-all solution. There is interesting research and development work happening related to flow batteries and other types of batteries that have the potential to provide long-term storage at scale. However, mechanical energy storage systems, particularly compressed air energy storage (CAES, Figure 1), is being looked on by many as the most immediate solution to the LDES challenge. Further, it is attracting innovation in the form of variants to the traditional configuration.

|

|

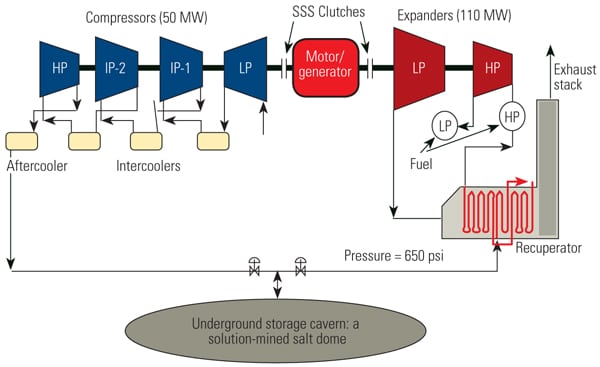

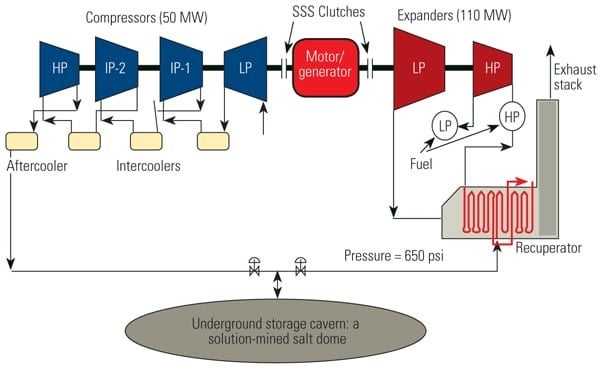

1. The presence of the synchro-self-shifting (SSS) clutch means a compressed air energy storage (CAES) plant can switch between compressing air to be stored underground or releasing that air to generate power. Courtesy: SSS Clutch |

A 320-MW CAES facility has been running efficiently for decades in Huntorf, Germany. It uses off-peak power to run an electric motor-driven compressor to inject air into underground salt caverns. The machinery involved in CAES projects is typically a single powertrain with low-pressure (LP), intermediate-pressure (IP), and high-pressure (HP) compressors, LP and HP turbo-expanders, and synchro-self-shifting (SSS) clutches manufactured by SSS Clutch of New Castle, Delaware. It is the engagement or disengagement of the clutches that controls whether the motor/generator is used to drive the compressor or generate grid power.

During hours of high electric demand, compressed air is withdrawn from the cavern, preheated, and introduced to combustors where natural gas is fired to further heat the air. Hot expanding gases drive expansion turbines that are connected to a generator, which produces electricity for the grid. The fuel rate is considerably better than that of a modern combined cycle power plant. In the case of McIntosh, it takes about 40 hours to compress the chambers. There is enough energy stored to provide power at full capacity for 25 hours.

“The unit performs emergency starts in nine minutes and the plant runs all year round,” said Morgan Hendry, president of SSS Clutch. “It provides peaking power when needed and otherwise helps control the grid in fall and spring or provides backup power based on market conditions. Fuel costs, electricity prices, and grid conditions determine how it operates.”

A study by Global Industry Analysts, “Compressed Air Energy Storage – Global Market Trajectory & Analytics,” predicts that the global CAES market could be worth $10.3 billion by 2026 and might go as high as $19.8 billion by 2030. The U.S. market represents about a third of the worldwide total. The next plant that is likely to be built is the Bethel Energy Center in Anderson County, Texas. It is a fully permitted 324-MW CAES facility that will be able to provide the same volume of fast-start ancillary services as a 2,000-MW combined cycle plant while reducing emissions by about 90%.

China has become a major player in this market. It recently brought a couple of large CAES plants online. Expect many more Chinese facilities over the next few years. Japan, Canada, Australia, Germany, and other parts of Europe have announced projects.

“With many U.S. and European gas turbine plants being transitioned from baseload to peak load, some of these facilities in suitable geologies may be able to add CAES as a way to improve viability,” said Hendry. “They would need to add compressors and SSS clutches to be able to shift from compression mode to power generation mode.”

New Wave of CAES Innovation

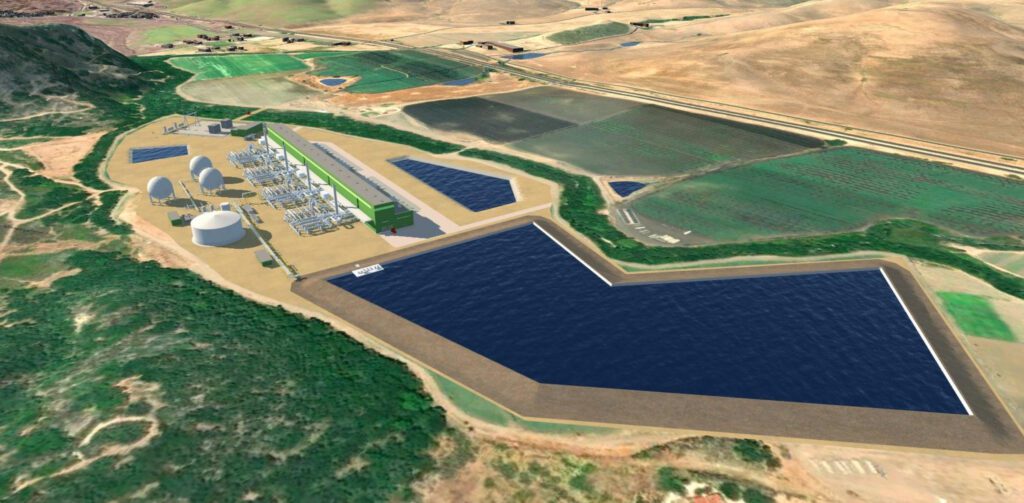

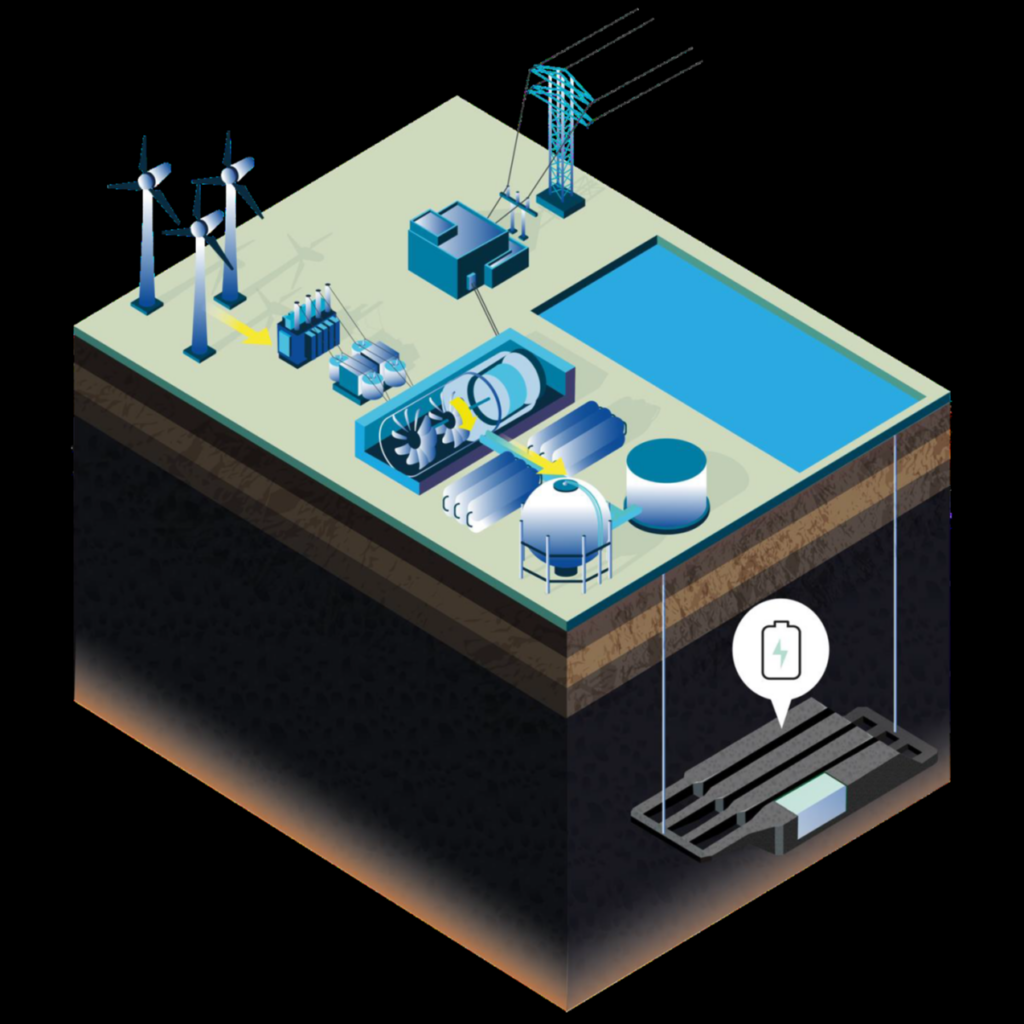

The basic concept behind CAES is proven in large, real-world applications (Figure 2). It is inspiring a wave of innovation that presents the market with several variants to standard CAES systems.

|

|

2. Hydrostor’s Advanced-CAES approach uses pressurized air and water storage to eliminate the need for a gas turbine to generate power. Courtesy: Hydrostor |

“Traditional CAES is scalable but produces carbon emissions as it uses natural gas combustion to generate power from compressed air,” said Reusser. “Advanced CAES systems can provide efficiency rates as high as 80% in some of the latest applications.” CAES variants include the following:

- Canadian company Hydrostor is well-advanced along the approval/permitting pipeline to build what it calls an Advanced-CAES facility (Figure 2) in Rosamond, California. Known as the Willow Rock Energy Storage Center, it will provide 500 MW of power using many of the traditional elements of CAES, but it stores compressed air in a cavern up to 2,000-feet below ground surface. That air is used to displace water from the underground cavern, forcing the water up to a spill pond on the surface. To generate power, air is released from the cavern, heated in hot water tanks, and is used to power turbines.

- Liquid air energy storage (LAES) is another variation of CAES using liquid rather than compressed air. Highview Power, for example, is developing up to 2 GWh of long-duration LAES in Spain. Up to seven of Highview’s “CRYO Batteries” use liquid air as the storage medium. LAES liquefies air to –250F and is said to be 50% to 70% efficient, scalable, and has no significant geological constraints. Off-peak power is harnessed to produce liquid air. Two small-scale versions are already operating in the UK.

- Just-In-Time Energy has devised an “Optimized LAES” process that provides power from hot air expansion and improves project economics. The company is also developing a combined gas and electric storage system that replaces liquid air with liquefied natural gas (LNG). The LNG is produced at off-peak times using excess renewable power. Then, power is returned to the grid and the gas to the pipeline system at peak times with gas flowrate three to four times more than the withdraw rate to make the LNG, thus providing a high deliverability source of stored gas and peak load power.

- Development of the Columbia Energy Storage Project is led by Alliant Energy in partnership with Wisconsin Public Service Corp., a subsidiary of WEC Energy Group, Madison Gas and Electric, and the Electric Power Research Institute. This 20-MW/200-MWh site in Wisconsin will use energy from the grid and store it by compressing CO2 gas into a liquid. When energy is needed, the system converts the liquid CO2 back to a gas, which powers a turbine to create electricity.

- Corre Energy and Contour Energy are combining hydrogen and CAES technologies at facilities built in large underground salt caverns in west Texas. This 280-MW project awaits final investment decision (FID).

Part of the reason for the renewed interest in traditional and hybrid CAES is better funding potential. The IRA provides a tax credit of up to 30% that broadly applies to energy storage technologies. Coupled with the cost of energy (COE) of CAES, funding possibilities have grown in recent times. According to financial advisory firm Lazard, CAES has a COE in the range of $116/kWh to $140/kWh. Pumped hydro storage is next at about $150/kWh to $200/kWh. Utility-scale lithium-ion BESS of at least 100 MW costs $170/kWh to $296/kWh for four hours of storage. Other forms of battery technologies typically come in at $300/kWh or more.

“CAES components are well-known in terms of their performance, represent a low technology risk, and have a very low levelized cost of storage, if underground storage is available,” said Jeremy Shook, principal consultant, Strategic Advisory, with Black & Veatch. “However, roundtrip efficiency is relatively low and A-CAES is looking to improve this.”

The CAES market, then, is more vibrant than it has been for decades. But it remains to be seen whether the power industry will indeed see a CAES or hybrid CAES renaissance in the coming years.

—Drew Robb (drewrobb@sbcglobal.net) has been a full-time freelance writer for more than 25 years specializing in engineering and technology.