Europe’s ambitious push toward carbon neutrality is rapidly replacing fossil fuel–fired power generation with variable renewable resources (VRE), but this shift is exposing the region to a growing risk of grid instability, power deficits, and supply shortages. The Energy and Turbomachinery Network (ETN Global), an international non-profit association focused on advancing gas turbine technology, has warned that Europe’s decarbonization agenda could falter without immediate and substantial investment in dispatchable power generation, energy storage, and grid modernization.

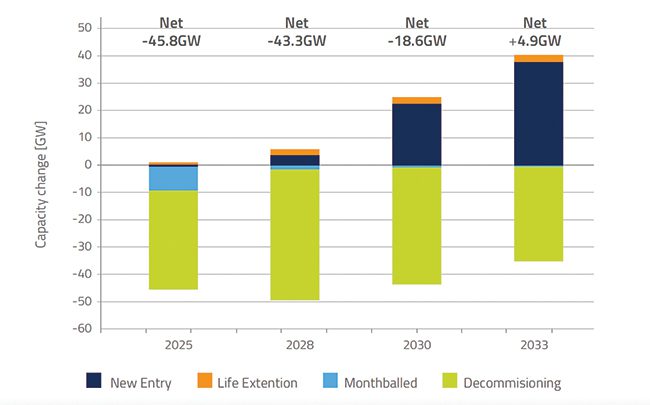

In a recent white paper, the trade group suggests the region’s flexibility needs will double by 2030 as the region grapples with a surge in demand stemming from increased electrification in households, industry, and mobility. “The daily flexibility need alone is expected to grow by 209 Terawatt-hour (TWh) from 2021—equivalent to adding the yearly electricity consumption of a small European country,” it said. “Looking to 2050, the total requirement for flexibility (daily+weekly+monthly) will have a dramatic fivefold increase,” it predicted. “According to the European Network of Transmission System Operators for Gas (ENTSO-G), the flexibility in energy to support the aforementioned changes is projected to increase by 40%–65% by 2050,” it said. ENTSO-Electricity, notably, forecasts a net decrease of 107 GW in flexible generation capacity, primarily from dispatchable thermal turbines, by 2030 (Figure 1).

|

|

1. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), Europe’s existing flexible generation capacity is currently dominated by dispatchable thermal turbines. Thermal turbine capacity, however, is slated to decrease starting this year, mainly owing to economic reasons. Courtesy: ETN |

ETN said the region’s core dilemma stems from a “mismatch between instantaneous demand and supply.” To meet flexibility requirements, Europe will need a “portfolio of sustainable dispatchable solutions that can provide reliable flexibility services, including load following, peaking, backup capacity (spinning reserve), grid services (rotating inertia, frequency control), and medium-to-long-term storage solutions as well as black start capabilities.”

Batteries are effective at storing and quickly providing electricity for a short term. While pumped hydropower can provide longer-term storage, it is limited by geographical constraints, the group said. Compressed air storage is limited by available reservoir volume, and while Carnot batteries promise energy storage at a utility scale without geographical constraints, “they are still at a low Technology Readiness Level.” Large-scale underground storage in salt caverns or depleted gas fields could provide more flexible opportunities, and for now, “power-to-hydrogen-to-power remains the only viable option for seasonal energy storage at large scale with the current state of technology,” ETN Global concludes.

The trade group has urged European policymakers to enact urgent reforms to expand flexible generation through incentives, emphasizing dispatchable thermal turbines, particularly those capable of burning hydrogen and synthetic fuels. “Dispatchable thermal turbine-based power generation is well suited to fill this gap with its adaptability to use carbon-neutral fuel,” it said.

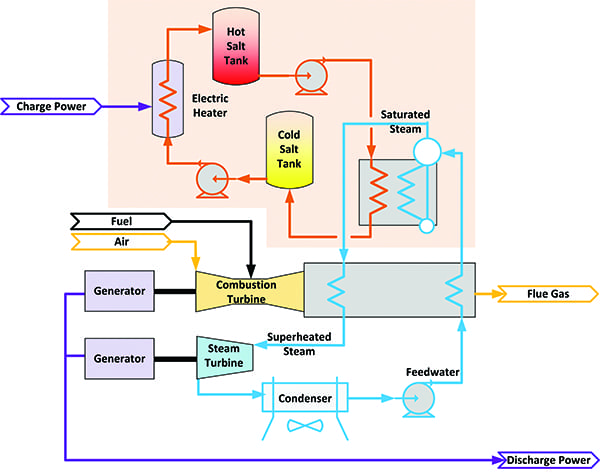

“Thermal turbines are a scalable enabling technology that can provide clean and flexible generation, and cover electricity grid requirements from frequency control reserve (FCR) to seasonal flexibility. From modular and flexible open cycle turbines to high efficiency combined cycle turbines, thermal turbines can operate as clean generation options either by using clean fuels—such as sustainable hydrogen or e-fuels—or with the use of post-combustion carbon capture utilization and storage (CCUS),” it said. “Such fuels can be stored for long periods of time before reconversion to power and heat through dispatchable thermal turbines.” In addition, thermal turbines can complement ultra-fast-response systems like batteries and flywheels, which help smooth intraday fluctuations, it said.

Interest in hydrogen and synthetic fuels have ramped up in Europe, though availability and cost remain major obstacles. The ETN Global report notes that while full-scale 100%-hydrogen turbine tests are underway, widespread adoption is being stalled by supply chain gaps, inadequate production capacity, and high costs. “To build confidence in these solutions and attract future investments, it is essential to conduct large-scale operational testing. Achieving this will require a sufficient and reliable supply of hydrogen to be available in the coming years,” it said. “These two challenges create uncertainties that delay final decisions in the power sector and broader industry regarding investments in low-carbon or carbon-neutral fuels, dispatchable thermal turbine technologies, and CO 2 capture technology options.”

Infrastructure remains the biggest bottleneck. The European Union’s (EU’s) hydrogen strategy calls for 40 GW of electrolyzer capacity by 2030, yet current hydrogen availability is far below demand projections. Hydrogen production has re-emerged as a key priority in the wake of geopolitical instability, fossil fuel dependency, and the growing penetration of renewables. The 2022 energy crisis, driven by supply shocks following Russia’s invasion of Ukraine, exposed the region’s overreliance on imported fossil fuels and generally forced policymakers to accelerate the transition to homegrown electrification.

According to a flagship study on energy security released in March by Europe’s power trade group Eurelectric, repercussions have been a wake-up call. While Europe was able to maintain generation adequacy, affordability collapsed, and system vulnerabilities—including supply chain risks, cyber threats, and raw material dependencies—have become glaringly evident. These challenges have underscored the need for a “Security of Supply 2.0” approach, which entails integrating energy resilience across the electricity value chain, Eurelectric suggests.

The study notes Europe has made significant progress in decarbonization—74% of Europe’s electricity is now carbon-free. However, it suggests the shift toward an electrified economy presents new security risks. By 2050, electricity demand will rise by nearly 50%, with peak loads increasing by 26% as transport, industry, and heating sectors electrify, it says. For now, the power system remains ill-prepared for extreme weather events, cyberattacks, and geopolitical supply disruptions, which threaten the reliability of an increasingly decentralized grid. The European Commission has estimated that more than €580 billion in grid investments are required by 2030 to avoid supply bottlenecks, while power market reforms must ensure flexible assets—such as dispatchable thermal turbines and energy storage—are adequately incentivized, the study notes.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).