Artificial intelligence (AI) is advancing faster than the grid that powers it. As Microsoft’s CEO Satya Nadella recently warned, the real limit on AI isn’t chips … it’s electricity. Power has become AI’s central bottleneck, driving tech giants to create their own and reviving every available energy source. Whoever wins that power advantage will win the AI race.

For the U.S., keeping up with AI’s insatiable appetite is the biggest systemic risk of the next decade. America needs a massive expansion of power plants, transmission lines, and advanced hardware, while using AI itself to drive grid progress and optimize power distribution.

COMMENTARY

In 10 years, utilities, policymakers, and large power users will be judged on a single outcome: whether we closed this supply-demand gap in time. If America loses the global race for AI leadership, it won’t be because our chips or models were inferior, but because we couldn’t get them online. Six AI and grid trends will decide the outcome of this race.

Trend #1: Power is the New AI Bottleneck

In the AI economy, it’s no longer just about compute. Companies need access to reliable, affordable power.

Data centers already consume 3-4% of U.S. electricity, and their slice of the power pie is expected to reach 11-12% by 2030. AI workloads are fundamentally more energy-intensive than the cloud architectures utilities planned for a decade ago, with AI queries requiring more compute (and thus, power) than traditional search.

Utilities face a new reality: integrated resource plans, grid modernization programs, and capital spending will be tested against continuously rising, high‑density AI load. Those that can’t deliver reliable, scalable power will see hyperscaler investment go elsewhere.

Trend #2: Bring Your Own Power

For data center planners, the core question is shifting from “How many racks and servers do we need?” to “How many megawatts, where, and by when?” There is already a structural mismatch between demand and deliverable capacity, with interconnection queues backed up by years.

If hyperscalers can’t connect fast, they’re going to skip the queue, building their own behind‑the‑fence generation. Companies like Meta, Microsoft, and Google are signing long-term fusion, nuclear, and renewable power deals, and many are directly developing or financing generation to secure an edge. AI is now effectively “bring your own power.” For these firms, it’s also “turn that power into profit” by selling surplus electricity back into markets.

Trend #3: Every Electron Wins

The old fight over “good” vs. “bad” electrons—renewables versus fossil, sprinting for net‑zero versus incrementalism—is giving way in real-world energy sourcing decisions. Now, carbon intensity and even cost matter less than the most basic question: “When can I get it?”

As Energy Secretary Chris Wright put it at the January 15 State of the Energy Industry Forum, “We need anything that will productively add to the energy stack, meaning grow our capacity and lower our cost… It doesn’t matter to me the source, but the impact of the source matters to the world.”

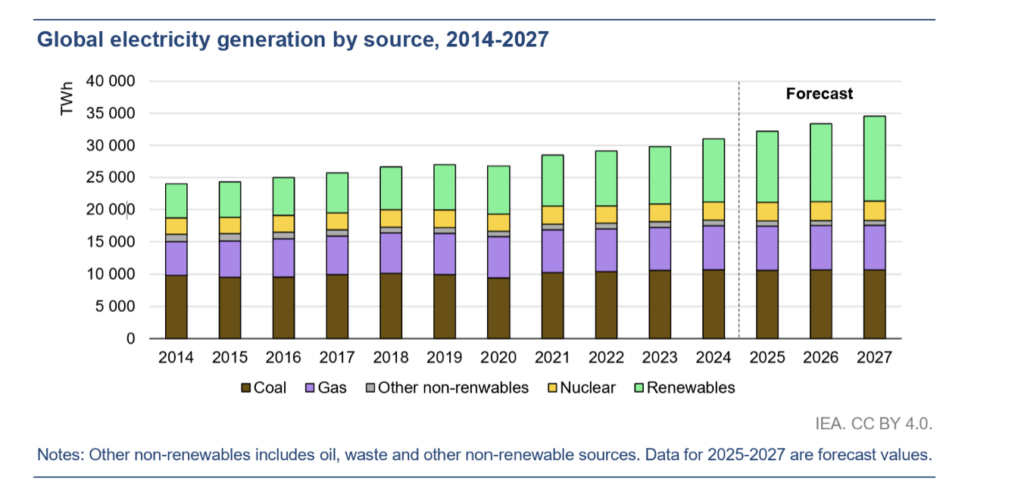

We’re seeing a shift in national policy where every credible energy technology has a seat at the table, and coal isn’t going away. For emerging economies, it remains the fastest lever for industrial growth. Natural gas will continue to grow, perhaps more than forecasts suggest.

Nuclear fission is on track to expand, doubling or even tripling worldwide by 2050 and becoming a sovereign fund business for the U.S. government. Fusion has been elevated by the U.S. Department of Energy (DOE) as a strategic commercialization priority, backed by new science, technology, and supply‑chain initiatives.

Solar and batteries will continue to dominate new builds, supported by vast suitable land and rapidly deployable, affordable, modular technology.

The regulatory playbook is shifting to compress timelines and reduce delays, with federal permitting reforms and new legislation advancing manufacturing and grid component upgrades. These changes will be contested and litigated, but over time, projects that can be built and integrated quickly will prevail.

Trend #4: Component Supply Chains Are the Real Cap Limiters

Even where policy, economics, and community sentiment align, the ugly truth is that we’re short on specialized grid hardware. Turbines, power transformers, switchgear, and capacitor banks now have multi-year lead times, and major OEMs are effectively sold out through the end of the decade. Threatening supply further, China controls manufacturing and critical material processing for many of these components.

Capacitors are a telling example. They sit quietly inside almost every power asset: substations, power‑electronics converters, HVDC links, SMR and fusion systems, EV chargers, and more. In the U.S., capacitor film has historically been fully imported, and many system designs rely on legacy films that struggle under the high temperatures and fast switching typical of data centers, fusion, and 800‑volt EV architectures.

Components like capacitor films need to be improved. Companies are bringing newer designs to market, like Peak Nano, which has engineered a capacitor film that runs hotter, cycles faster, and stores more energy in a smaller footprint, while being engineered and sourced domestically and through allied supply chains.

Capacitor films are just one of many components whose performance and availability will determine how fast the U.S. economy can grow. Policy is beginning to favor upgraded equipment and reshoring. Over the next decade, we will likely see more incentives for allied manufacturing, targeted procurement, and critical‑materials designations for grid-enhancing components.

Trend #5: AI is Integral to Grid Demand and Fusion

AI will help wring far more efficiency out of our grid. It can forecast demand, optimize dispatch, reduce losses, and better manage distributed energy resources. But AI systems will consume nearly all of the added capacity those efficiencies create.

AI will also accelerate fusion and other advanced energy technologies, from materials discovery to machine design and operations. This creates an interesting feedback loop. We must power AI so that AI can help modernize the grid and speed commercial fusion… which, in turn, is what will ultimately sustain AI’s own electricity use.

The implication? Funding and planning for AI’s power needs is not optional. AI is central to solving the very consumption problem it amplifies.

Trend #6: The Grid Becomes a Strategic Weapon

In the new global energy system, the grid itself is an instrument of geopolitical power. Those who produce, move, and export firm, affordable electricity will set worldwide energy standards, shape supply chains, and gain strategic leverage.

The U.S. is increasingly treating nuclear, fusion, and grid-enhancing technologies as strategic assets, beginning to back them with sovereign‑wealth‑style structures. China has long pursued a parallel path, pairing aggressive domestic deployment with exporting the equipment and financing other countries need to build their power systems.

As this dynamic intensifies in the U.S., support for major grid projects will increasingly be tied to domestic and allied sourcing, and export‑oriented utilities will face pressure to adopt interoperable standards that align with those supply chains.

Looking Ahead: Anticipating Next Steps from the U.S. Government

The next decade of energy leadership won’t be defined by ambition or capital, but by solutions to hard constraints. Where power can be sited. What equipment can be built. And how fast aging infrastructure can be adapted to unprecedented load growth.

In that reality, power becomes strategy. Access to reliable, scalable electricity will determine not only business outcomes but also national economic growth, energy security, and AI leadership. To respond, we anticipate U.S. policy will focus on a clear set of priorities:

- Incentivize modernization: Prioritize dispatchable, flexible capacity and digital grid upgrades—not just megawatts added.

- Orchestrate demand: Treat data centers as grid participants, rewarding load shifting and curtailment during system stress.

- Secure the supply chain: Onshore and friend-shore critical components like transformers, switchgear, and power electronics.

- Plan for AI load growth: Make rising AI and data-center demand a core assumption in national energy planning.

- Make permitting a competitive advantage: Fast-track transmission, generation, and grid upgrades tied to reliability, AI, and critical infrastructure.

For Secretary Wright and the DOE, the governing equation for AI is simple: no power, no progress. The electricity economy of 2026–2036 will not demand perfection, but it will reward preparedness. The countries that act quickly and decisively on this new reality will determine their nations’ competitiveness in AI and the future energy economy.

—Shaun Walsh is CMO for Peak Nano.