It’s not a secret that the North American power mix is changing. Renewable energy and natural gas are picking up market share while coal-fired generation shrinks and nuclear power remains stagnant at best. Executives from three well-diversified power generators spoke about the future and what their companies are doing to maximize flexibility and minimize costs.

The ELECTRIC POWER Conference and Exhibition was held at the Gaylord Opryland Convention Center in Nashville, Tennessee, March 19–22, 2018. The show floor was filled with a broad range of exhibitors and offered visitors a chance to network with colleagues from around the world. Attendees also had the opportunity to participate in breakout sessions focused on all types of generation—coal, gas, nuclear, and renewables—as well as topics dedicated to operations and maintenance, environmental compliance, workforce development, plant management, combined heat and power, and digital solutions.

Several co-located events were also big draws. The Powder River Basin Coal Users’ Group (PRBCUG) held its annual meeting onsite. The Edison Electric Institute (EEI) Loss Control/Fire Prevention Task Force conducted its spring meeting during the event. The Energy Providers Coalition for Education (EPCE) convened a coalition meeting on the opening day, as did the Plant Management Institute, which is a network of electric power industry leaders dedicated to creating a forum and peer support network for plant managers.

Participating in this year’s executive roundtable discussion were Paul Bowers, president and CEO of Georgia Power; Mike Skaggs, executive vice president of operations with the Tennessee Valley Authority (TVA); and John Hefford, vice president of regional operations for Ontario Power Generation (OPG). POWER Executive Editor Aaron Larson moderated the session, which focused on the evolving power landscape and how the companies were managing their fleets to stay competitive.

The Shift from Coal to Gas

Hefford noted that OPG burned its last coal on April 15, 2014, to comply with government policy (Figure 1). “Obviously, coal is not coming back in Ontario,” he said. But the move has forced the Canadian province to rethink its energy use beyond the short term.

| 1. End of an era. In its heyday, the eight-unit, 4-GW Nanticoke Generating Station was the largest coal-fired plant in North America. On February 28, 2018, the two 198-meter stacks were demolished at the now-shuttered plant in Ontario, Canada. Source: You Tube/CTV News |

“Our challenge with natural gas is that we see it almost as a bit of a transitional fuel, because government policy in Ontario is moving toward decarbonization of industry, not just the electricity industry, but [also] the transportation sector and the home heating sector,” he said. Hefford said about a third of OPG’s generation is nuclear, another third is from hydro, and the remainder comes from natural gas, wind, solar, and biofuels. “Diversification is good for us. We’re not locked into gas,” he noted.

Diversity, too, is important for TVA, said Skaggs. While natural gas’s share of the federal company’s power mix has been growing, other resources are still important. He noted that TVA shapes its future power mix in integrated resource plans—an analysis tool that allows it to assess costs and risks. Coal is still expected to play a key role for TVA, giving the company “an additional level of moderation,” Skaggs said.

Georgia Power, which is a regulated company under power giant Southern Co., also recognizes the importance of diversity. However, Bowers suggested that coal’s role in the resource mix hinges on environmental breakthroughs, like advances in carbon capture technology, but solutions must be economical. “Ultimately, your focus is: What are you delivering to the customer and what is that price?” he said. The generation mix targeted should focus on providing the lowest cost possible, Bowers suggested.

Workforce Woes

Long-term investments in an industry stricken by a spate of coal closures typically focus on how to maximize the value of the closed sites as part of strategic portfolios, the executives noted. But as critical is “looking at the investment in our people over the years,” Hefford said. OPG suffers a scarcity of skilled trades and skilled technical people. “What we’ve learned with our coal closures is that we can take those skills and transition them to other generating technologies and move them around the province. Some who are ex-coal are now working in hydroelectric facilities,” he said.

Hefford, an engineer by training, remarked that compared to technical issues, learning about and resolving the people side of the business is the “tough part.” One thing that could help is “early recognition that the transition is going to happen,” he said. “I think we found for our coal closure experience where we kind of denied it at the front end, saying, ‘it can’t happen, it can’t happen,’ until it happened. We found it was very disruptive to our workforce, and if it’s disruptive to our workforce, it’s disruptive to our business.”

Hefford stressed: “People are emotional creatures.” What’s important during a transition is “being up front with people” and giving them “the best information you’ve got,” he said. “Share early, share often, and engage people in that, and engage them in the solutions.” Bowers agreed, adding it was also important to let employees see the economics behind decisions.

Skaggs suggested paying attention to expanding skill sets through training, helping employees both to learn how to operate older technology and encourage them to be innovative. Leveraging operations data can also be valuable in assessing which issues could benefit from more training, especially when matters concern safety, he noted.

Wind and Solar Are Spilling Water

Asked whether any major investments or upgrades were planned on the hydropower front, Bowers suggested Southern Co. is always looking for ways to squeeze extra megawatts out of its 3,200-MW hydro fleet. Skaggs noted that TVA is working to modernize its hydro fleet, but it is also looking into technologies that maximize fleet stability. While battery storage advancements are notable, the technology hasn’t yet evolved to the scale TVA needs. However, the company’s 1,600-MW pumped storage plant outside Chattanooga continues “to give us a lot of benefits,” Skaggs said.

At OPG, which operates 66 hydroelectric plants—making up 7.4 GW of its total 16.3-GW generating capacity—storage is also becoming an important consideration. Hefford noted that most of the company’s hydro plants are run-of-river. “With the increase in non-dispatchable renewables—wind and solar—and the way demand works in Ontario, we end up at periods of the day with surplus baseload demand, and we’re actually spilling water because wind’s online,” he said. “We’re not taking the energy out of the water that’s going by because it’s being displaced by another resource. So, it makes the business case for adding additional capacity difficult because you’re actually not utilizing all the water you’ve got.”

Renewables, too, are playing a larger role for both TVA and Georgia Power. In Georgia, which relies on voluntary clean energy programs rather than a mandate, solar specifically is growing driven by economics, which is an important consideration, noted Bowers. In the Tennessee Valley, the surge in renewables has meanwhile been driven by customer preference, Skaggs said. “We entertain that discussion. We allow that to happen. We work with them,” he said.

Nuclear: Bankable Baseload?

Beyond renewables and grid-scale storage, a number of disrupters are emerging that all three company executives mentioned, including electric vehicles and distributed energy resources. For now, however, all three touched on efforts their companies are making to keep their baseload fleet efficient and economic.

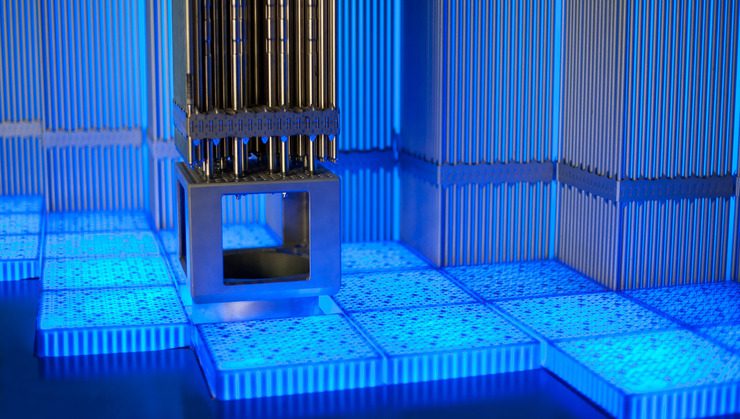

OPG, for example, is focusing on refurbishing its four-unit, 3.5-GW Darlington nuclear power plant (Figure 2) and extending its life another 40 to 50 years. The Darlington Unit 2 refurbishment project (the first of the four undertakings) is “about halfway right now, tracking on-time and on-budget for a nuclear project, which we think is something to be quite proud of,” Hefford said. Though Darlington and OPG’s other nuclear facility, the 3.1-GW Pickering plant, together provide 50% of Ontario’s power, the company will likely shutter Pickering’s six operating CANDU reactors by 2024, when it reaches the end of its lifetime, considering there’s an “excess capacity situation in the province,” he said.

However, closure of Pickering, too, poses workforce issues, Hefford pointed out. “One of our biggest challenges is: How do you run a plant, which requires skilled operators, out to 2024, maintain those skills, and keep those people, and hire new people—as our demographics are such that a lot of people are retiring—when there’s a cliff at 2024?” That challenge has required “creative labor agreements to allow for the use of term employees,” he said.

For TVA, which put online the 1.1-GW Watts Bar Unit 2 in October 2016, following a long and convoluted path since ground was broken in 1973, the investment has paid off, said Skaggs. “You had to make sure that goal was always in front of you—that you had the staff and the technical capability to build a solid schedule—and a roadmap, which served as a basis to finish it. It also helped to set expectations for safety, quality, and costs.” TVA, which produces about 40% of its power from three nuclear plants—Browns Ferry, Sequoyah, and Watts Bar—is also upgrading its Browns Ferry plant, anticipating that nuclear will play a strong role in future reliability, Skaggs said. However, that focus will be limited to its existing facilities for now.

While the company has been considering small modular reactors (SMRs), submitting an early site permit to the Nuclear Regulatory Commission in January 2017 for the potential construction and operation of multiple SMRs at the Clinch River site in Oak Ridge, Tennessee, they likely won’t be realized within a 10-year timeframe, Skaggs said. “We are participating in the discussions and working with teams on design perspectives. But stand back and look at where we are. Demand continues to decline for us… we don’t think that’s going to change.” TVA is committed to producing low-cost power, Skaggs stressed. “Right now, there’s not a need for [an SMR]. Right now, the completion of one is moderately viable, in our opinion. So, we’ll continue to be part of the discussion … but right now, it’s not part of our plan.”

Glimmer of Hope at Vogtle

For Georgia Power, a similar impetus for economical and reliable power is driving construction of two Westinghouse AP1000 reactors with partners at its Vogtle nuclear plant in Waynesboro, Georgia. Though it has suffered costly delays owing to a series of regulatory and management changes—and appeared imperiled after Westinghouse’s bankruptcy in March 2017—the project is pressing forward with engineering management company Bechtel leading current construction under the direction of Southern Co.’s nuclear arm Southern Nuclear.

The project has the strong backing of state regulators and the benefit of multiple partners, Bowers noted. Even before Westinghouse’s financial debacle, Georgia regulators recognized that the company’s share of the originally estimated capital construction costs of $4.4 billion weren’t enough as a result of shifting requirements. The contractor changes required “transitions” that were “not for the faint of heart,” but “it is part of the process,” he said. However, Bowers noted, productivity has ramped up dramatically at the project site after Southern Nuclear assumed project management.

“The rest of the story is that we’re going to get this plant done,” he said. When complete, the project will prove a good economic bet, Bowers suggested, because a nuclear plant in Georgia dispatches at 1¢/kWh. “That in itself [makes it] purely the best economic option. When you compare it to $2.50 or $3 gas, or a $4 price range, it’s going to save customers between $1.5 to $2.5 billion on just fuel costs for the life of the plant.” ■

—Sonal Patel is a POWER associate editor and Aaron Larson is POWER’s executive editor.