In Part 1 of this series, published in the March 2020 issue, POWER explored how existing reactors may leverage advances in nuclear fuel to boost power generation safety and economics. This installment surveys nuclear fuel developments that may support the emerging fleet of advanced nuclear reactors, including small modular reactors and microreactors.

The brightest prospects in the vast realm of possibilities that relate to the future of nuclear power are advanced reactor technologies. The reason is, experts will tell you, because many are inherently safer. But because they can also be relatively small and flexible, they could fit the bill for less-developed grids, complement renewables, and even pry open new non-electric applications. Boosted by public and private efforts, a wide range of innovative designs are under development, from large plants—of up to a gigawatt—to tiny ones, including about 50 small modular reactor (SMR) designs, hovering between 60 MW and 300 MW, and microreactors, which are generally 10 MW or less.

Industry interest—for near-term deployment, at least—appears focused on SMRs. Their biggest draw for the nuclear sector, which has of late struggled to attract private capital for behemoth projects, is that they can be modular and shipped to site, potentially slashing both construction time and costs. Yet, despite more than a decade of development, only a handful of non-military SMRs are operational today (in Pakistan, India, and Russia), and most are based on previously existing designs, with the exception of Rosatom’s RITM-200, an advanced pressurized-water reactor, which derives from Russia’s ship reactors.

According to the World Nuclear Association, at least three other SMRs are under construction (in Argentina and China), and the development of a dozen others are “well advanced.” While some industry think-tanks suggest the first of these designs could be commercially operational within the next decade, experts also caution that many uncertainties about their widespread deployment remain.

The most prominent among them: licensing and fuel supply. A key reason: “A number of combinations of fuel materials, types, forms, clad, fuel geometry, and reactor coolant are available for application in an SMR,” as experts from the U.S. Department of Energy’s (DOE’s) Idaho National Laboratory (INL), Oak Ridge National Laboratory (ORNL), and Argonne National Laboratory explained in a February 2020 report.

Addressing a Key Technology Gap

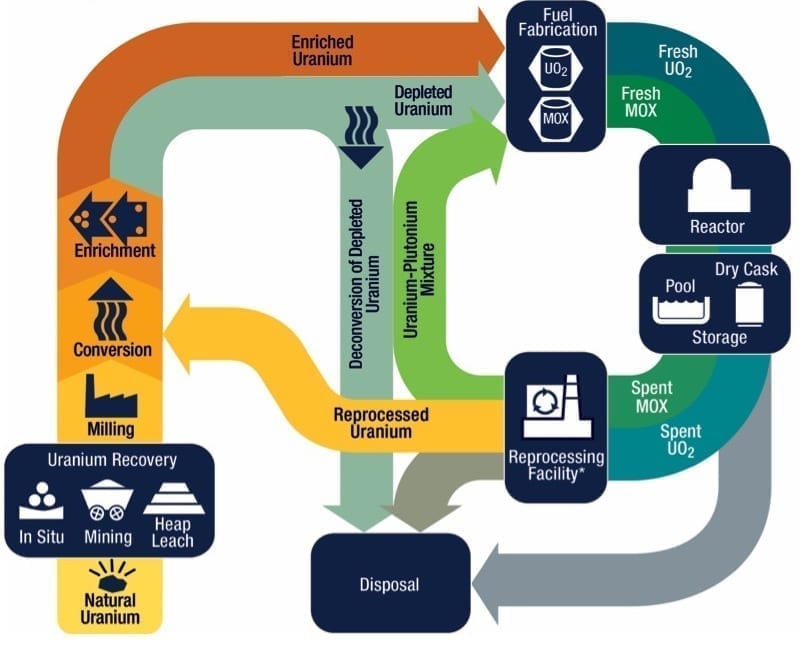

The report was the first key step of a project recently begun by the U.S. National Nuclear Security Administration (NNSA) Office of Defense Nuclear Nonproliferation to address a “technology gap” that exists for low-enriched uranium (LEU) fuel systems, materials, and fabrication technologies for compact, power-producing, and high burnup applications, such as would work for (presumably military) off-grid power sources and transportable systems to fixed locations. These applications appear to distinguish NNSA’s quest for “advanced LEU” (or aLEU) from “high-assay, low-enriched uranium” (HALEU), which the DOE is separately developing to establish a commercial fuel supply chain for advanced nuclear reactors.

But as the Nuclear Energy Institute (NEI) explains, both efforts fulfill a significant hurdle that has stymied the development of new nuclear designs. While the world’s existing fleet of light water reactors (LWRs) typically uses fuel enriched to less than 5% uranium-235 (U-235), many advanced reactor concepts may require HALEU, which is enriched to a higher degree—between 5% and 20%.

As experts note, HALEU promises to provide more power per unit volume than conventional reactors, and its efficiency allows for smaller plant sizes. It also promises longer core life and a higher burn-up rate of nuclear waste. But, though annual commercial requirements for HALEU could soar to a cumulative 185.5 metric tons annually, there is no current supply of HALEU, NEI notes, which is why it has urged the DOE for years to tap into its access of high-enriched uranium and down-blend it in the interim to supply HALEU for demonstration purposes. Heeding those calls over the last year, the DOE jumped into action to establish HALEU fuel production capability, noting that in the near future, it will be critical to U.S. leadership, as global competition—specifically from China and Russia—heats up to design and build SMRs as well as larger non-LWRs.

Last November, for example, the DOE formally signed a three-year contract with Centrus Energy at the agency’s American Centrifuge Plant, a uranium enrichment facility in Piketon, Ohio, to deploy a cascade of centrifuges to demonstrate the advanced nuclear fuel. Under the contract, Centrus will license, build, assemble, and operate AC100M centrifuge machines and related infrastructure in a cascade formation to produce HALEU.

In February, meanwhile, INL announced it would give Silicon Valley–based Oklo access to recycled HALEU recovered from the now-decommissioned Experimental Breeder Reactor-II (EBR-II) to demonstrate its 1.5-MW Aurora design, a fast reactor that derives from the EBR-II. INL told POWER that the recovery and recycling process, which will involve electrometallurgical treatment, would produce up to 10 metric tons of HALEU—and Oklo would only need a “fraction” to power its demonstration for 20 years without needed a refuel. The remaining fuel may be used for entities developing other advanced nuclear reactors backed by the lab’s newly established National Reactor Innovation Center—a hub for testing, demonstration, and performance assessment, whose main aim is to accelerate deployment of advanced nuclear technology concepts, INL said.

Still, not all reactor designs are immediately well-suited to advanced LEU enriched to 19.75% uranium—while achieving other crucial goals of load-following, high burn-up, and a long single core life—and some fuel types may not be suited to certain applications, as the research team concluded in their initial NNSA study. The team chose three designs on which to focus their further analysis and experimental studies: pressurized water reactors (PWRs), which they added, are “well-known”; sodium-cooled fast reactors; and lead-cooled fast reactors (LFRs). The latter two “provide a technological advance with a substantial experience base,” the researchers wrote.

As the team explained, to generate power, a fuel must transfer heat to the working fluid, but fuel geometry—such as from plates and rods—and coolant dictate the heat transfer parameters. That’s why, “Limitations on core size and thermal mass make gas-cooled systems more challenging than liquid cooled,” the report says. Other designs, like molten salt systems, would require “extensive development and demonstration of corrosion control,” it says. “The linkage of coolant and reactor types affects not only performance metrics but also drive numerous requirements of the fuel-cladding system. Neutron moderation, its presence or absence, is another significant consideration,” the report says.

Custom-Made Fuel

However, public research limitations such as these don’t seem to have deterred serious private technology developers. And, because fuel availability has grown into such an important aspect of new nuclear, some developers have even designed reactors that can efficiently use novel fuel designs. A notable example is Ultra Safe Nuclear Corp. (USNC), a Seattle-based firm founded in 2011, which has vertically integrated “all stages of the fourth-generation nuclear power production,” as USNC President Mark Mitchell told POWER.

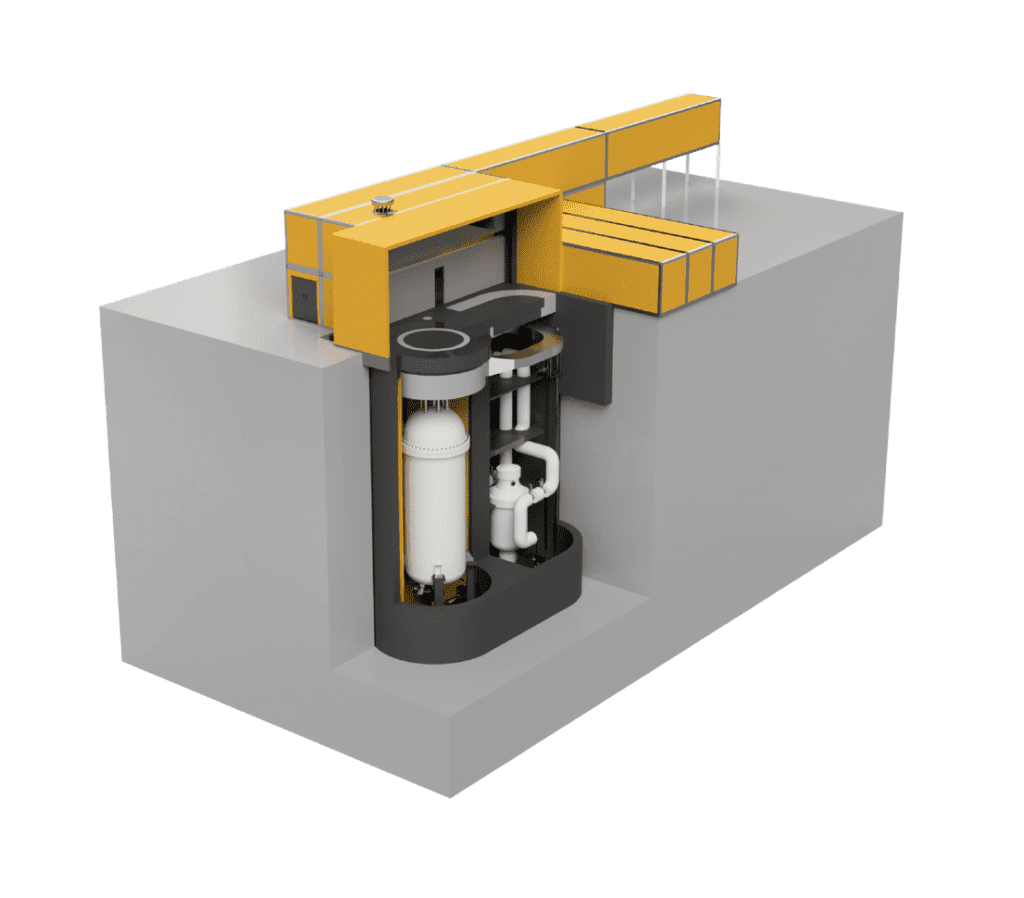

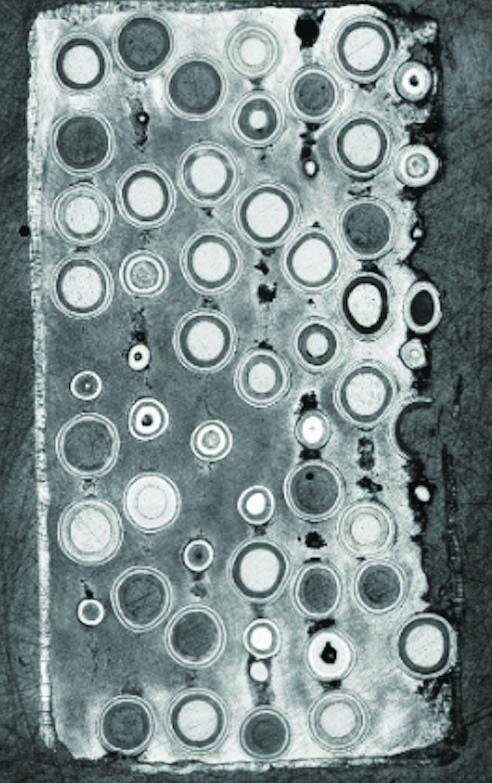

The company’s 5-MWe (15-MWth) MMR microreactor—a high-temperature gas-cooled reactor (HTGR)—is based on USNC’s proprietary Fully Ceramic Micro-encapsulated (FCM) fuel technology (Figure 1), Mitchell explained. The tristructural-isotropic (TRISO) fuel is a “new approach to inherent reactor safety by providing an ultimately safe fuel,” he said. Essentially, “industry standard TRISO fuel, which contains the radioactive byproducts of fission within layered ceramic coatings, are encased within a fully dense silicon carbide matrix. This combination provides an extremely rugged and stable fuel with extraordinary high temperature stability,” he said.

|

|

1. A cross-sectional view of an Ultra Safe Nuclear Corp. (USNC) FCM (Fully Ceramic Microencapsulated) fuel pellet. The fuel uniquely encapsulates tristructural-isotropic (TRISO) particles within a dense ceramic matrix, which provides an extremely strong structural support and protects them during power production, postulated accidents, and into long-term storage. Courtesy: USNC |

Owing to its size and comprehensive package, the MMR-FCM pairing in July became the first SMR for which the Canadian government began an environmental assessment. In February, USNC entered into a collaboration agreement with USNC-Power, a USNC subsidiary, to pursue research related to the manufacturing of USNC’s FCM fuel, designing an irradiation program for USNC’s graphite core, and the establishment of a functional laboratory for fuel analysis at Canadian Nuclear Laboratories’ (CNL’s) Chalk River campus. If preliminary activities prove it is feasible to site an FCM manufacturing facility at Chalk River, the agreement will allow the CNL and USNC to develop a “multi-year testing program” to support the validation of USNC’s fuel and core as it progresses through the Canadian Nuclear Safety Commission’s Vendor Design Review process, where it has already been invited to participate in the third stage. That will be crucial to commercialization of the unique process to manufacture the fuel. As the company told POWER in February, creating the ceramic matrix is challenging because the melting temperature of ceramic material is greater than damage thresholds for TRISO particles. USNC resolved the issue by developing and patenting a technique of ceramic microencapsulation of TRISO particles through processing and additive manufacturing, it said.

TRISO Gaining Ground

While it still has no commercial power-producing users, TRISO—a type of HALEU fuel—is also seeing a resurgence of interest in the U.S., where it was first developed in the 1960s for gas-cooled reactors. Leading the charge is BWX Technologies (BWXT), a company that worked with the DOE for more than 15 years to develop and manufacture TRISO-coated kernels at the nation’s only TRISO-licensed facility in Lynchburg, Virginia, under the DOE’s Advanced Gas Reactor Fuel Development Program.

Last October, BWXT began preparing to restart production of its TRISO fuel, which has already undergone safety testing at up to 1,800C, which is “much higher than the standard operating temperature of reactors.” Because it retained the processing equipment, production capability, and talent, it is already positioned to meet emerging demand from Department of Defense (DOD) microreactors; NASA, for nuclear thermal propulsion requirements; and civil advanced reactors, it told POWER. BWXT also currently has the only private Nuclear Regulatory Commission Category 1 licenses in the U.S., and they can also be used to produce Category 2 material, which HALEU requires but which “can take several years and substantial investment to obtain.” The company noted that distinction cannot be underscored enough. Though it is not a traditional commercial nuclear fuel supplier for existing power plants, it said it is “aware that the infrastructure and licensing requirements to support higher enrichments is not trivial.”

In parallel, the DOE is also hosting a 5,000-square-foot TRISO-X pilot fuel facility at ORNL under two active cooperative agreements with X-energy that allow the 2009-established Rockville, Maryland–based firm to manufacture TRISO particles. X-energy, which recently won a $3.5 million award from the DOE to further its 75-MWe Xe-100 pebble-bed helium-cooled HTGR design, now wants to move toward commercializing the technology and build a larger TRISO-X Fuel Fabrication Facility. In November, it partnered with Global Nuclear Fuel to help offset costs required for Category 1 licensing. In March, meanwhile, BWXT and X-energy’s fuel capabilities garnered both companies (as well as Westinghouse) contracts to separately develop mobile nuclear reactor prototypes under the DOD’s “Project Pele.” ■

—Sonal Patel is a POWER senior associate editor.