Propelled in part by the White House Nuclear Fuel Working Group’s (NFWG’s) recent roadmap to strengthen the U.S. nuclear fuel cycle, the nation’s nuclear industry this week blazed ahead on efforts to energize a U.S. commercial fuel supply that it says will be crucial for the widespread development and deployment of advanced nuclear reactors.

At least three significant industry-led developments, and a possible new advanced nuclear demonstration were announced this week, ahead of a high-profile two-day public-private workshop that began April 28 to explore the status and challenges associated with high assay, low-enriched uranium (HALEU) fuel for fabrication and reactor development.

Centrus Energy on Tuesday signed a letter of intent with Advanced Reactor Concepts (ARC), developer of a 100-MWe sodium-cooled fast reactor design, that potentially secures the nuclear fuel supplier a first commercial customer for HALEU fuel supply. Holtec International, meanwhile, sealed a deal to adapt its SMR-160 design to Framatome GAIA assemblies. These announcements come on the heels of a pivotal research and development agreement that will allow Lightbridge Corp.—a much-watched developer of an innovative metallic fuel technology—to design an experiment for irradiation of Lightbridge metallic fuel material samples at Idaho National Laboratory’s (INL’s) Advanced Test Reactor (ATR). And last week, BWX Technologies (BWXT) announced that its TRISO nuclear fuel manufacturing restart activities are continuing to progress ahead of schedule.

Separately on Tuesday, the Department of Energy (DOE) announced $5.4 million in funding awards to accelerate advanced nuclear technology development, including to support site preparation for a future advanced reactor demonstration in Portsmouth, Ohio.

Burst of Activity for Advanced Nuclear Fuel

More industry-led developments related to advanced nuclear technology may emerge if the April 28–29 workshop hosted by DOE’s Gateway for Accelerated Innovation in Nuclear (GAIN) initiative, the Electric Power Research Institute (EPRI), and industry trade group Nuclear Energy Institute (NEI), provides more clarity to industry about crucial gaps and challenges they face.

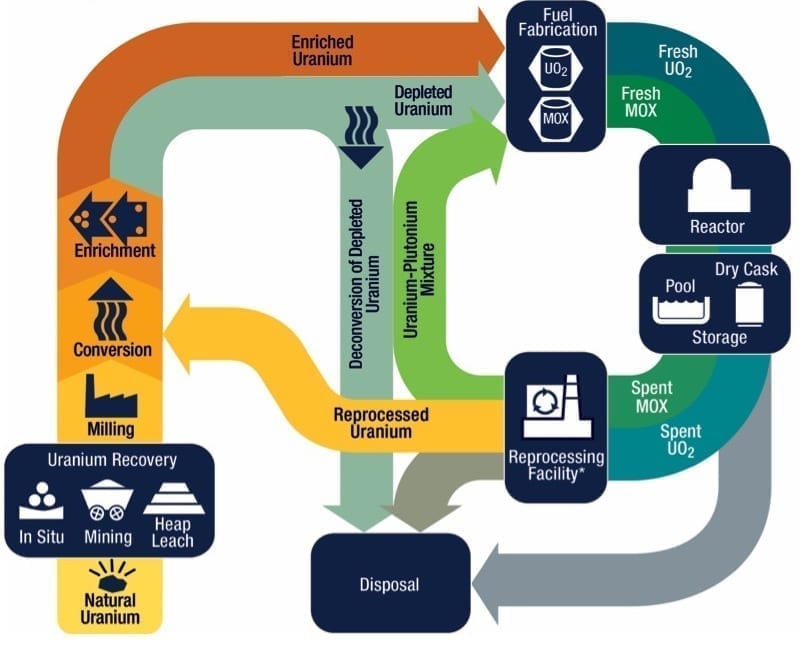

Though not open to the press—and it is unclear whether discussions will be made public—the virtual event promised to shed light on key issues, such as how much demand industry is projecting for HALEU, and how soon that demand could be met. The workshop also was supposed to look at associated enrichment, conversion, and deconversion considerations; transportation issues; and central legislative and regulatory issues.

The list of industry participants attending the invitation-only workshop is also especially notable. From the conversion and enrichment side, they included ConverDyn, Urenco, BWXT, Centrus, TVEL, and Global Laser Enrichment. Daher Nuclear Technologies appears to be the sole vendor from the transportation side. Among the long list of participating advanced reactor developers are companies that are making headway on the regulatory front, or whose technologies have won federal funding for demonstration : X-energy; Oklo; TerraPower; Kairos; Lightbridge; and Ultrasafe Nuclear.

Of specific interest to the larger nuclear industry is how developers are handling licensing challenges. So far, the Nuclear Regulatory Commission (NRC) has received formal notice of intent to begin regulatory interactions from six non-LWR developers, which are in different stages of design development. In March, Oklo, developer of the 1.5-MW Aurora micro-reactor, submitted the first-ever combined license application (COLA) for an advanced non-light water reactor (LWR) to the federal regulatory body, formalizing the start of a new era for nuclear regulation in the U.S. The NRC made Oklo’s application available for public review on March 27. The Silicon Valley company last year notably also received a first-of-its-kind site use permit to build its Aurora plant, at an INL site, and this February it also became the first modern advanced reactor design firm to secure access to fuel recycled to HALEU from INL for demonstration purposes.

Along with Oklo, which initiated discussions in November 2016 for its micro fast-reactor design, the NRC said it is interacting with X-energy for its pebble bed high-temperature gas-cooled reactor (HTGR); and Kairos Power for its pebble-fueled, molten-salt-cooled reactor. The NRC is also in discussions with X-energy on a pre-application interaction for a fuel fabrication facility to produce tristructural isotropic (TRISO) fuel.

Much-Needed Clarity on HALEU

The HALEU-focused public private workshop is perhaps especially notable because it comes just days after the White House’s NFWG outlined steps the nation could take to prop up the front-end of its nuclear fuel cycle—mainly to boost its competitiveness with Russia and China. As POWER noted, however, the roadmap was vague in its objectives to ensure the long-term competitiveness of the domestic civil nuclear industry, including how or how long it will take the nation to leap ahead of international contenders in the race to establish a commercial supply of commercial supply of more efficient next-generation fuel.

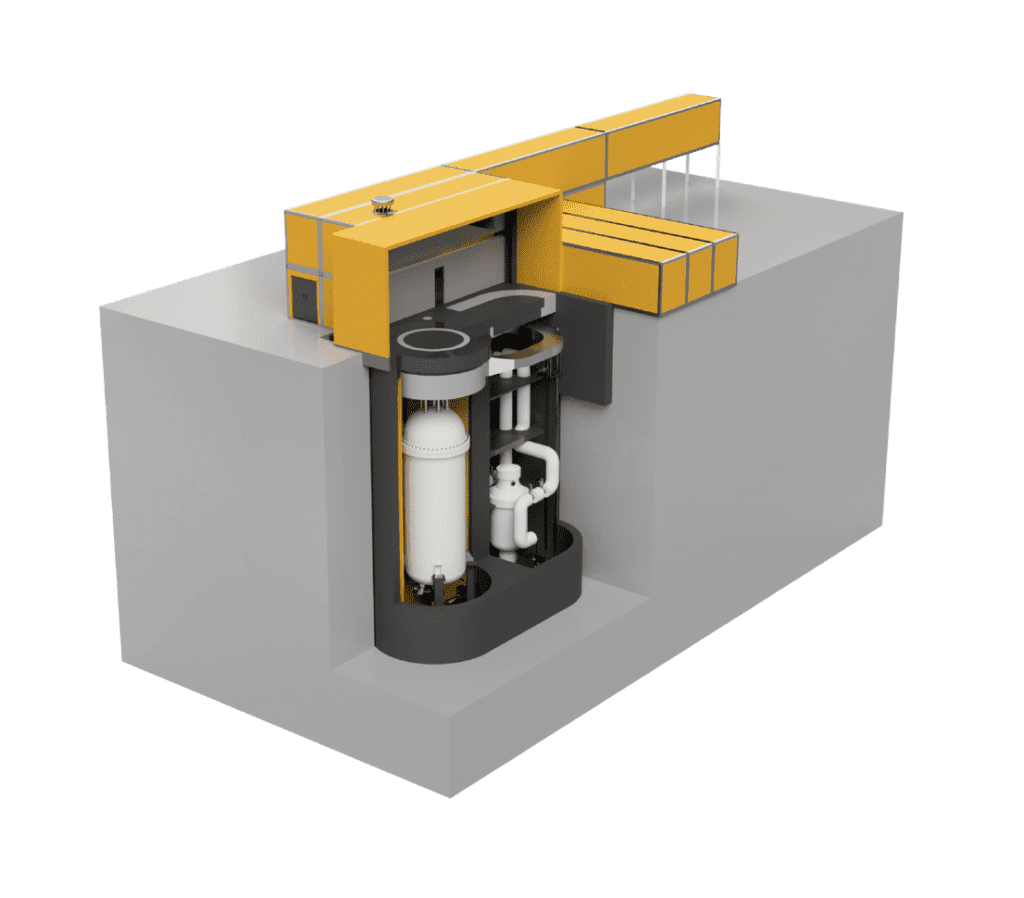

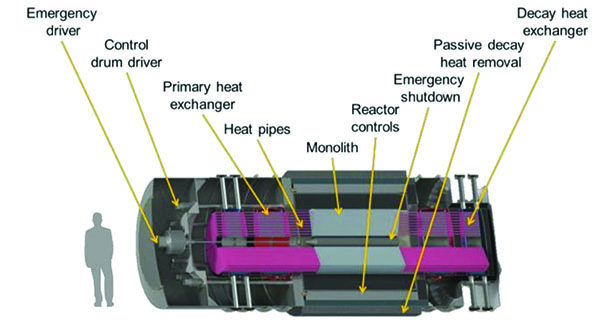

Compared to fuel used in most light water reactors (LWRs), which is fuel enriched to less than 5% U-235, HALEU—fuel comprising U-235 enriched to a higher degree (of between 5% and 20%)—promises to provide more power per volume than conventional reactors, and its efficiency allows for smaller plant sizes. It also promises longer core life and a higher burn-up rate of nuclear waste. According to the NEI, many advanced reactor concepts—including small modular reactors and micro-reactors (many smaller than 10 MW), high-temperature gas reactors in the 100-MW to 200-MW range, and salt reactors—may require this type of fuel. HALEU could also be used in existing light water reactors.

Despite its many advantages as a nuclear fuel, HALEU is not commercially available today, nor are any HALEU-fueled reactors in commercial operation. “The lack of available HALEU constrains the deployment of advanced reactors and advanced fuels, and vice-versa,” Centrus Energy explained Tuesday. “This is the ‘chicken and egg’ dilemma that must be resolved for the U.S. to establish itself as the global leader in building and fueling the next generation of reactors around the world, which is critical to U.S. influence on nonproliferation.”

While the NFWG’s report recognizes this as a significant hurdle, it suggests that a national nuclear strategy—one which aggressive in research and demonstration funding and support demonstration—will be an important aspect to counter surging competition abroad, especially from countries like Russia and China, where nuclear innovation is entirely achieved by state-owned enterprises. The working group, for example, urges the U.S. government to continue funding of advanced nuclear reactor research and development, and enabling the demonstration of advanced nuclear reactors in partnership with the private sector.

In addition, it urges the federal government to use its purchasing power to spur demand for SMRs and micro-reactors. It recommends, for example, that the White House issue an executive order that would push the Department of Defense (DOD) to demonstrate “SMRs’ potential to enhance energy flexibility and energy security at domestic military bases in remote locations.” The DOD is already exploring that possibility: On March 9, a year after it issued a request for information to industry, it selected three micro-reactor developers—BWXT, Westinghouse, and X-energy—to begin design work on a mobile nuclear reactor prototype under a strategic capabilities initiative it has dubbed “Project Pele.”

Responses to Nuclear Fuel Working Group Report

Reactions to the NFWG report sent to POWER over the past week by an assortment of participants who represent various parts of the nuclear fuel cycle suggest the strategy could be positive for the future of nuclear power.

Maria Korsnick, CEO and president of the NEI, a trade group that develops policy on key legislative and regulatory issues affecting the industry, said the report showed strong support for maintaining domestic fuel cycle capabilities. Industry also appreciates the group’s support for the development of next-generation technologies and advanced fuels. But that while it appreciates “continued attention to the economic challenges facing the existing nuclear fleet,” more actions “should be taken to preserve the plants operating today, and we will continue to work with Congress to ensure the industry is included in legislative proposals for tax credits and other incentives to the energy sector.”

Seth Grae, president and CEO of Lightbridge Corp., a company which has invented, patented, and validated an innovative metallic nuclear fuel that could be deployed in large existing reactors and future SMRs, called the report a “breakthrough moment for the nuclear industry.” Grae, who noted he was one of 10 industry leaders who met with President Trump last year and participated in discussions that helped to form the NFWG, said the original goal of the NFWG was to develop recommendations for reviving and expanding domestic nuclear fuel production, and the recommendations in the report “are more far-reaching.”

Uranium mining companies, predictably, lauded the report. According to the Energy Information Administration (EIA), in 2019, the nation produced 173,875 pounds of domestic uranium concentrate (U3O8)—the lowest annual production amount since before 1949. At the end of 2019, meanwhile, only three domestic in-situ recovery (ISR) plants were operating (all in Wyoming) and three domestic conventional uranium mills were on standby.

Uranium Energy Corp., a company that has operations in South Texas and Wyoming, as well as a pipeline of projects in Arizona, New Mexico, and Paraguay, said the multi-year strategy represented a “clear and unambiguous commitment by the U.S. government to establish the development of domestic uranium mining capabilities at the forefront of America’s national security” would “put people back to work.”

The nation, meanwhile, has only one domestic uranium conversion facility—Honeywell International’s uranium conversion plant in Metropolis, Illinois. The plant received the NRC’s approval to run 40 more years on March 26, but it has been on standby since 2017, owing to poor market conditions. In March, the company told POWER that to operate sustainably, it needs to ensure it has “ongoing robust demand, firm commitments from customers and sustainable prices before we restart.” It added that since its shutdown, it has seen “positive trends in the market and feedback from utilities that they will need our capacity.” Responding recently to POWER’s question about its prospect for restart if the Trump administration established a domestic fuel capability, it said: “As the only U.S. convertor, we are positioned to ramp up to full operations and help maintain a U.S. nuclear fuel supply chain that is critical for commercial utilities and for our national security.”

Centrus, an enriched uranium supplier, and developer of an advanced gas centrifuge enrichment technology, meanwhile noted that the last domestic uranium enrichment plant that could meet U.S. national security requirements was built in the 1950s and shut down in 2013.

“The problem goes beyond uranium enrichment. U.S. uranium mining has fallen by 93% since 1980, and the sole U.S. uranium conversion plant has not operated since 2017. The [DOE] identifies State-owned enterprises and competitor nations as a threat to the U.S. fuel cycle,” it added. The report’s support for Centrus’s ongoing work to deploy centrifuges that will demonstrate production of HALEU is especially pivotal, it said.

“Establishing an assured U.S.-based source of this new fuel is essential so that America’s innovative advanced reactor designers can compete in the global market against foreign companies that are backed by large, state-owned enrichment enterprises,” Centrus said. “Securing a strong U.S. role in the global market for advanced reactors and fuel is essential to our ability to set and enforce the highest nonproliferation standards around the world.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).