The rapid adoption of electric vehicles (EVs)—both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs)—is expected to transform global electricity consumption through 2040, three separate reports released in July and August suggest.

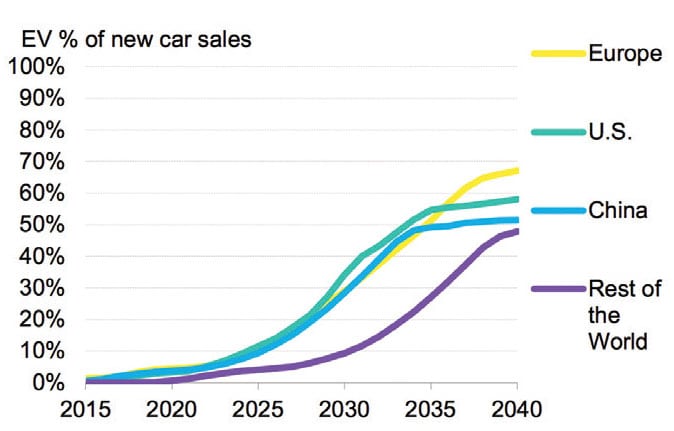

Bloomberg New Energy Finance’s (BNEF’s) Electric Vehicle Outlook 2017 forecasts that by 2040, 54% of new car sales and 33% of the global car fleet will be electric. Adoption of EVs will be tempered until 2025, though the long-term annual forecast expects EVs to become economical—reaching parity with comparable internal combustion engine vehicles (Figure 2)—on an unsubsidized total-cost-of-ownership basis across mass-market vehicle classes by 2030.

BEVs, in particular, will account for the vast majority of EV sales, it says, owing to the “engineering complexity of PHEV vehicle platforms, their cost and dual powertrains.”

In another report released this August, Future of renewables: a radical disruption,Wood Mackenzie and GTM Research posit that by 2035, 21% of all cars on the road will be EVs. The International Energy Agency (IEA) meanwhile said in its Global EV Outlook 2017 report that the global EV stock surpassed 2 million vehicles in 2016 after crossing the 1 million-vehicle threshold in 2015. This represented a general slowdown in EV sales growth compared to previous years, but the agency remained optimistic, pointing to newly announced research, policy, and financial support by several countries worldwide.

The reports separately cite a number of reasons for their high growth forecasts for EV adoption. Chief among them is that prices for batteries—the key components of EVs—are expected to plunge. Lithium-ion battery prices have fallen 73% per kWh—allowing grid-scale battery energy storage to thrive (see “Battery Storage Goes Mainstream,” in POWER’s May 2017 issue)—and improvements to manufacturing and battery density are projected to prompt a further decrease of more than 70% by 2030, BNEF noted. The reports also point to a recent uptick of EV commitments by automakers (such as from Tesla, Volkswagen, and Volvo), growing consumer acceptance, and the growing role of car sharing, ride hailing, and autonomous driving as reasons for their rapid EV adoption projections.

Paul McConnell, research director of global trends for Wood Mackenzie, noted that the falling cost of EVs and their batteries will put EV purchase prices on par with internal combustion engine cars, and that this will ramp up consumer demand. “This is going to force automakers to develop even better EVs or far more efficient internal combustion engines, as per-mile running costs become a key differentiator between the new technology and legacy engine types,” he told POWER. “Additionally, under this scenario, we foresee EVs potentially displacing about 6.5 million barrels of oil demand, offsetting growth from other sectors such as petrochemicals.”

The IEA also specifically noted that a growing number of governments have set national EV deployment targets as part of carbon commitments and mobility ambitions. Targets set through 2016 by Austria, China, France, Germany, India, Ireland, Japan, the Netherlands, Portugal, South Korea, Spain, the UK, and at least eight states in the U.S. suggest that 13 million EVs may be deployed within these countries alone by 2020. In 2017, EV policy took a more pronounced leap in these countries:

India. New Delhi earlier this year outlined ambitions to ensure most, if not all, vehicles sold in the country would be powered by electricity by 2030. The country’s charging infrastructure is woefully lacking, but the government is reportedly formulating incentives to encourage EV purchases.

Norway. A transportation plan requires all passenger cars and vans sold in 2025 to be zero-emission vehicles. In June, owing to hefty tax exemptions, 42% of vehicles registered in the country were EVs.

France. One day after Swedish carmaker Volvo announced it would only make fully electric or hybrid cars from 2019, the French government in July announced it would end sales of gas and diesel-powered vehicles by 2040.

UK. Sales of new gas and diesel cars will also be banned in 2040, and by 2050, all cars on the road will need to have zero emissions, the UK government announced on July 26. But according to its grid operator National Grid, the UK—which has moved to phase out coal power and is struggling to add new nuclear capacity—would experience a surge of between 3.5 GW and 8 GW in peak demand by 2030, if there were to be such dramatic growth of EVs on British roads.

Globally, meanwhile, the impact of this significant EV adoption could mean electricity consumption from EVs will rise to 1,800 TWh by 2040, a stunning increase when compared to the 6 TWh EVs consumed in 2016, BNEF said. “While this represents just 5% of our projected global power consumption in 2040, the ‘peakiness’ of fast-charging load profiles will need to be managed by utilities and regulators through the introduction of time-of-use rates to encourage off-peak charging, as well as storage solutions at the operator site which can mitigate high power demand from the grid.”

According to the IEA, the extent to which higher shares of EVs and their demand for charging will impact power networks will “depend highly on the technologies and charging modes used.” Because the bulk of EV charging is expected to occur at homes, at businesses, or in public charging facilities, rising EV penetration is likely to have an impact on low-voltage distribution girds in residential or commercial areas first, it suggested. “IEA analysis shows the additional energy demand from EV loads is sizeable but largely manageable,” the report notes.

Even so, one way countries can mitigate EV impacts on generation markets, the grid, and at the distribution level is to deploy charging infrastructure with foresight on usage patterns. This will also require common standards and interoperable solutions among charging stations, distribution networks, and EVs themselves. Another option is to incentivize end users to maximize self-consumption through solar systems and storage. The IEA report says: “As utilities transition to distributed energy, such business models could be deployed as an integrated service combining energy efficiency, distributed energy resources and the minimisation of EV charging costs—and, on the utility side, provide system benefits by reducing the impact of the charging profiles seen by the grid.”

BNEF noted that even by 2040, however, the world might still grapple with a dearth of charging infrastructure. A lack of home charging will be a “significant barrier to adoption and will restrict EV sales from reaching 100%,” it said.

—Sonal Patel is a POWER associate editor.