Utilities and other power generators need to prepare now for increased loads as the electrification of transportation grows. As with any challenge, opportunities exist for those willing to invest in electric vehicle (EV) infrastructure and customer engagement.

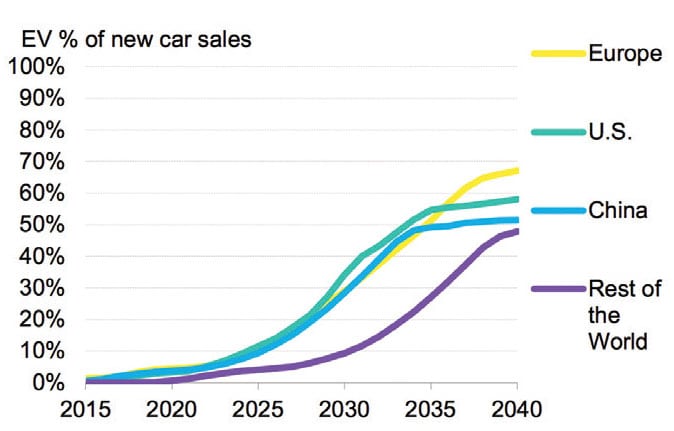

The global market for electric vehicles (EVs) is growing. A McKinsey report from 2019 says worldwide sales of EVs reached 2.1 million in 2018, with a growth rate of about 60% year-over-year. The International Energy Agency (IEA) has said the global EV fleet will reach about 130 million by 2030, a sharp rise from just more than 5.1 million in 2018.

As EV adoption grows, utilities and other power generators are grappling with the issue of determining the power load needed to charge those vehicles, and how to forecast when—and where—that electricity will be needed.

“EV sales continue to increase, but with EV adoption varying by region, the challenges to the power grid remain at the local distribution level,” Harmeet Singh, chief technology officer of Greenlots, a California-based EV charging software and solutions company that is part of Shell Group, told POWER. “The need for grid upgrades will vary by region and depend on the existing grid capacity and utilization rate of EV growth.”

China accounts for just more than half of all EV sales worldwide, with EV sales there at three times the number of both the U.S. and the European Union. The Chinese market is expected to wane—the country this year is reducing subsidies for EVs—but BloombergNEF said sales of pure electric and plug-in hybrid passenger cars in Europe are expected to grow 35% in the first nine months of 2020.

The U.S. market is more difficult to predict, in part due to the continued battle between California, far and away the nation’s leader in EVs on the road, and the Trump administration over that state’s stricter requirements for vehicle emissions and mileage. California also recently revised the income limits for its EV rebate program.

The only certainty about the increased electrification of transportation is that power generators need to be prepared, and grid operators must assess whether their systems are ready.

“At Greenlots, we’re confident that EVs will prove to be a net benefit to the power grid,” said Singh. “Utilities will use EVs to manage demand, integrate renewable energy sources, and maintain the stability of the grid.”

EV adoption also could spur needed infrastructure upgrades. Simon Whitelocke, president of ITC Michigan, an electricity transmission company, told POWER, “There needs to be a new mindset, bold solutions, and even a sense of urgency around creating next-generation transmission infrastructure to keep pace with the growth of EVs and the other emerging demands of society.”

Location, Charging Times Are Key

Analysts have been studying the impact of EV adoption on power grids worldwide, and though there’s disagreement about needed upgrades, there’s a consensus impacts will depend on the region, and the time of day when vehicles are charged (Figure 1).

|

|

1. Utilities and grid operators know that the time of day vehicles are charged is a key part of understanding the increased load from electric vehicles (EVs). Industry experts have said utilities need to be proactive in preparing for the electrification of transportation. Courtesy: Greenlots |

“As I see it, the biggest challenges for the grid with the rise of EVs are around two major things: volume and timing [of charging],” Greg Craig, CEO of Griddy, a wholesale electricity provider in Texas, told POWER. “By volume, I simply mean the overall expectations for adoption of electric vehicles is massive. That amount of new added demand for electricity will by itself become a challenge for grids all around the world, and in particular for grids that are constrained on transmission and distribution infrastructure.”

MORE ON EVs: A Georgia energy regulator says EVs are important for the future of power, and both sides of the aisle should agree on that.

Whitelocke said the current U.S. power grid needs upgrades to handle the likely added demand from electrification in many areas, including transportation. “Being headquartered in metro Detroit, ITC has a front-row seat to many of the changes occurring in the auto industry, including electrification of vehicles,” he said. “It’s clear that a new era is dawning for how electricity is created, delivered, and consumed in our society. Coupled with the rapid expansion of renewable energy, the deployment of new distribution and storage technologies, and ever-increasing ways Americans are using electricity—including powering the steady growth of EVs—we’re facing a power grid that wasn’t conceived for these uses.”

Griddy’s Craig said power providers and grid operators will need to know when to ramp up for the added electricity demand for charging vehicles. “With timing, the challenge is when do these consumers charge their electric vehicles? In most grids, the peak hours are the ones right when people are arriving home from work, so if consumers are coming home and immediately plugging their EV in to receive a charge, that is going to add a substantial amount of difficulty for the grid operator,” Craig said. “Not only is that overall volume going to be high, but it has the risk of all coming in at the peak. Hypothetically, electric vehicles don’t have to be a challenging aspect of the grid in this way because they certainly can be charged off-peak when generators are producing excess energy. Realistically though, the natural consumer behavior will simply be to charge it as soon as they get home.”

A recent article from The Conversation (a global network of newsrooms), written by researchers at the University of Texas and the National Renewable Energy Laboratory, says, “if virtually all passenger cars in Texas were electrified today, that state would need approximately 110 more terawatt-hours of electricity per year—the average annual electricity consumption of 11 million homes. The added electricity demand would result in a 30 percent increase over current consumption in Texas.” The report went on to note complete electrification of passenger vehicle transportation in California “might require nearly 50 percent more electricity.”

Experts agree the increased demand will stress the grid, particularly in areas with a high concentration of EVs. Greenlots’ Singh said the “nature of these high charging loads is to spike quickly, therefore many local grids must be updated to handle rapid upswings in energy demand. This also affects utility rates around peak demand, which were not designed for such variable loads and therefore can create excessive demand charges for site hosts and charging operators.” He noted that some areas, though, “may have enough capacity to absorb EV charging load growth, [as] power plants deployed to support peak summer load will be idle during other times. This spare capacity can be used to address EV charging during non-peak times.”

Whitelocke said modernizing the grid should be part of the equation. “Most of the transmission grid we have across the country today was built in the 1960s and 70s, meaning that the needs of today, including powering EVs, were not envisioned then,” he said. “A study by WIRES and The Brattle Group indicates the investment in transmission in the U.S. must rise [on average] from $15 billion annually today to as much as $40 billion per year between 2031 and 2050 [high case] to meet this electrification challenge. What we’re also taking away from this study is the need for appropriate transmission planning at the regional planning level—and the time to start planning for future scenarios is now.”

Opportunities for Utilities

The challenges for utilities from growing EV adoption also present opportunities. Harminder Singh, director of Power at GlobalData, a data and analytics company, in a late December 2019 look at trends shaping the energy industry, said, “Governments across the world are setting targets for deployments of EVs and these policy signals are encouraging industry stakeholders to invest across the EV supply chain.” He said that “large power utilities such as EDF, E.ON, and Enel in Europe have been investing in EV charging station infrastructure, [and] increasingly, power utilities are collaborating with EV manufacturers to boost their offerings in areas such as EV charging, vehicle-to-grid (V2G) services, energy storage, and renewable energy sources.”

“Utilities could go down two routes: make expensive and slow-moving infrastructure upgrades, or proactively manage charging behavior,” Aakriti Gupta, product marketing manager for EnergyHub, a company that specializes in advanced asset management strategies, told POWER. “The dynamic nature of the challenges created by EV charging requires a tool that allows a utility to coordinate the charging behavior of an entire EV fleet and orchestrate EV charging in concert with other distributed energy assets. A distributed energy resource management system (DERMS) is the ideal tool to empower utilities to effectively respond to these distribution level challenges.”

Eric Tanenblatt, global chair of Public Policy and Regulation of Dentons, a global law firm that works with several industries, told POWER that government needs to be involved as e-mobility options grow. He said consumers must be confident enough charging stations exist, and noted “private companies won’t invest in infrastructure without enough vehicles in circulation to make their service profitable. As this is a classic market failure, government can and should step in. On the municipal level, cities have been passing ‘EV Ready’ ordinances, which require all new parking facilities to invest in the necessary charging infrastructure to accommodate electric vehicles. Implicit in this policy decision is an understanding that electric vehicles will not thrive unless governments incentivize early adoption and investment.”

Tanenblatt said private groups are “stepping in to pave the way, no pun intended, for electrification.” He said Electrify America “is investing $500 million in 17 U.S. metro areas to stand up EV infrastructure. Amazingly, the initial investment was only part of the $2 billion Electrify America is prepared to invest. When it comes to infrastructure both governments and private organizations—corporations and non-profits—need to be part of the solution.”

Southern California Edison (SCE) is among the proactive utilities when it comes to incorporating EVs into a business model. Carter Prescott, principal manager of eMobility Operations at SCE, spoke at POWER’s 2019 Distributed Energy Conference and told attendees the utility is fast-tracking electrification in several ways. SCE is earmarking money to deploy charging ports at “3,200 workplaces, apartments, destination centers, and fleets,” and is offering a rebate of “up to $3,500 per port to exceed CalGREEN building code and install a minimum of 16,000 ports at new construction multi-unit dwellings.” The utility also offers “apartment and government customers a turnkey solution,” installing, owning, and maintaining charging ports.

Andrew Dillon of West Monroe Partners, a management and technology consulting firm, told POWER that transportation electrification presents a huge opportunity for power generators. “When you think about the large paradigm shift, it’s roughly $400 billion a year now going to the fossil fuel industry as drivers fill vehicles with gasoline. That’s going to transition into fueling all our vehicles with electricity,” Dillon said. “The second opportunity is to engage customers. We’ve seen that with solar, and the same thing is happening here, for a variety of the EV adoption patterns. It’s very critical for the utility to maintain a proactive relationship with transit agencies, with C&I [commercial and industrial] companies, to make sure power [for charging] is available when it’s needed.”

Grid Upgrades

Tom Baker, managing director and partner with Boston Consulting Group (BCG), told POWER: “We expect that a representative U.S. utility [with two to three million customers and baseline electricity sales of about 40,000 GWh], with 1.1 million EVs in service by 2030 [roughly 15% of all vehicles in such a utility’s service area], would need to invest between $1,700 and $5,800 in grid upgrades per electric vehicle (EV) through 2030. Differences in customer charging patterns, or the degree to which charging happens when and where the grid is constrained, drive the range of grid upgrades needed.

“E-mobility will increase the demand for both energy and grid capacity, but we expect the impact to be larger on grid capacity than on energy,” Baker said. “Assuming 15–20% of all vehicles in a representative utility’s service area are EVs by 2030, and that the utility is somewhat successful at optimizing when and where EVs are charged, we expect a 5–10% increase in energy demand but a 25–33% increase in demand for grid capacity. The actual increases for a specific utility will depend on local EV penetration, the extent to which EV charging happens when or where the grid is already constrained, and the mix of charging infrastructure installed.”

|

|

2. Most industry analysts agree that upgrades are needed to the transmission grid to handle the increased load from EVs. Some, though, say that load could ultimately benefit the grid, making it more efficient. Courtesy: Greenlots |

Baker said utilities “in general” are “not yet” prepared for the loads EVs will bring to the grid (Figure 2). “Many utilities are taking the right first steps of planning for grid expansions and building the capabilities to shift new load to times and places where the grid is best equipped to handle it. Utilities should use their network maps to identify where grid requirements will be needed, create a blueprint for investments, and prepare the regulatory filings needed to recoup their investments.”

Added Dillon: “With EVs, you’ll see a clustering effect. You could effectively double the load of a feeder with EVs, and those feeders weren’t designed for that. Utilities need to stay in close contact with customers, to understand their plans and their thinking.”

Itai Dadon, global head of Smart Cities for Itron, a technology company serving the energy industry, told POWER that utilities “are generally prepared to support the extra load from EVs on the grid. They are proactively taking steps to develop charging infrastructure and are also investing in hardening the grid to support supply and distribution needed. However, the ultimate vision is to incorporate EVs as DERs [distributed energy resources] in a highly dynamic smart grid environment. This will require additional investment in advanced grid orchestration. There is also room for improvement for utilities to improve the customer experience around EV programs. This includes new pricing programs to incentivize customers to charge during times and at specific locations that are ideal for the grid operators.”

Ultimately, increasing EV adoption means power generators must shift gears to adapt to more change in the evolving electricity landscape.

“EVs are a game changer for utilities, but they will need to be active participants in this new market in order to ensure that these systems run efficiently and effectively,” said Dadon. “Utilities will need to partner with a provider that understands how all of these systems can work together and integrate. This goes beyond technical integration. It requires proactive engagement with consumers.” ■

—Darrell Proctor is a POWER associate editor (@DarrellProctor1, @POWERmagazine).