India has become a global business power even though hundreds of millions of its citizens still live in poverty. To sustain economic growth and lift its people out of poverty, India needs more — and more reliable — power. Details of government plans for achieving those goals demonstrate that pragmatism may be in shorter supply than ambition and political will.

India’s economy has been booming in recent years. Supported by market reforms, huge inflows of foreign direct investment, growing foreign currency reserves, and flourishing sectors such as information technology and real estate, it grew steadily at an average of 7% for a decade. But although progress is evident, the complexities of sustaining such growth are proving challenging. As the country’s Planning Commission says, if the country peopled by 1.1 billion is to eradicate poverty and meet its human development goals, it will need to sustain an 8% to 10% economic growth rate over the next 25 years. And in order to deliver this growth rate, it will need, at the very least, to triple or quadruple its primary energy supplies and increase total electricity generation capacity from 148 GW to nearly 800 GW by 2030.

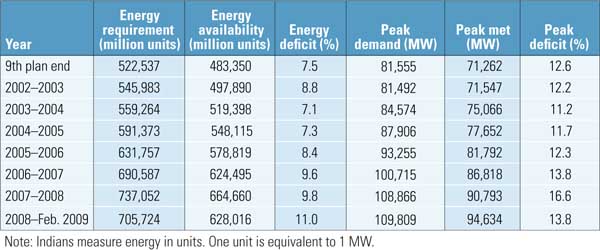

The challenge is formidable. Despite progressive reforms, India’s electricity supply already lags 11% behind demand, and peak shortages surge as high as 17% (Table 1). The quality of the power supply is also very poor, owing to unstable voltages and routine frequency excursions (see sidebar, "A Passage for India’s Power"). More than often, state governments force the industrial sector to bear the brunt of power shortages to meet demand, crippling productivity and hampering economic development. The prevalent outages — which frequently last eight hours at a time — have also been known to cause violent skirmishes in urban areas.

Correction: One unit used to measure energy requirement and availability in Table 1 is equivalent to 1 kWh, not 1 MW as stated in the note.

Table 1. A generation gap. Since 2002, when the government’s 9th plan ended, the gap between energy availability and requirements has widened, and peak demand continues to soar. India will need to add 92,000 MW before 2012 to eliminate these deficits and meet its economic goals. It has only planned to add 78 GW, however, and even this goal is unlikely to be met. Note that peak met and energy availability represent net consumption (including transmission losses). Sources: Economic Survey 2007; Central Electricity Authority

As well as being rapid and reliable, the supply expansion must also be affordable. Pointing to the yawning gap between India’s superpower economic aspirations and realities on the ground is the fact that its energy consumption on a per-capita basis (a factor loosely correlated with gross national product) ranks among the lowest in the world. In terms of electricity use, per capita consumption was only 480 kWh in 2005 — a quarter of China’s and 1/20th that of developed countries.

At the same time, expansion must not come at a steep cost to the environment. The country already emits 4.6% of the world’s greenhouse gases, making it the fourth-largest contributor, after the U.S., China, and Russia. Though it says it is concerned about climate change (see the web supplement "Of Prosperity and Pollution" at www.powermag.com), India has pointed out that, considering it has 17% of the world’s population, those emissions on a per-capita basis are relatively low.

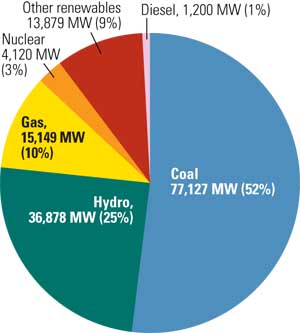

Securing its fuel supplies will be another primary consideration. Today, more than 50% of India’s power is generated with coal, and 10% is natural gas – fired (Figure 1). But, though India has the world’s fourth-largest reserves of coal and has recently made important gas discoveries, the power sector routinely suffers acute shortages of quality coal and gas. Because coal power’s dominance is unlikely to subside, as the Planning Commission recognizes, the country must step up coal production or importation and expand supply of the fuel to more than 2 billion tonnes (2.2 U.S. tons)/year based on the quality of domestic coal.

1. Fueling growth. Coal dominates India’s 148.4-GW power generation portfolio. According to Planning Commission scenarios, by 2030, coal-fired capacity will likely be in the range of 200 GW to 400 GW, up from the 77 GW today. Source: Central Electricity Authority, “Power at a Glance”; Ministry of New and Renewable Energy

The country will also have to secure uranium resources — of which it has meager reserves — to support its planned nuclear renaissance. Exploitation of its large hydropower potential, on the other hand, will involve displacing people and submerging land — not to mention potential environmental consequences. Renewable energy sources, therefore, are especially attractive. Although efforts have long been under way to promote them, renewables such as wind, solar, and biogas make up only 9% of the country’s generation portfolio.

Overarching all these challenges is a rickety institutional framework. A host of energy policies were adopted after independence to serve the socioeconomic priority of development, but these have instead "encouraged and sustained many inefficiencies in the use and production of energy," as the Planning Commission acknowledges.

Under India’s constitution, electricity is a "concurrent" subject, which places it under the control of both central and state governments. After independence in 1947, the electricity sector was organized around public State Electricity Boards (SEBs); these operated as extensions of state energy ministries — but as commercial entities that could develop policy. Driven by populist politics, they pushed for cheap electricity for agriculture in the late 1970s to stimulate India’s Green Revolution. In the 1980s, by raising tariffs on industrial consumers, farmers in several states began receiving power for free or at flat rates.

Gradually, while pushing the industrial sector to build captive power plants (that is, facilities commissioned by a group of users for self-consumption of the electricity provided), this approach led to a rampant lack of accountability that finally caused an average fiscal deficit of more than 20% in the states’ budgets. As the gap between demand and supply widened, the government was forced to rethink its policies. Finally, to deal with the macroeconomic financial crisis in 1991, it opened the door for domestic and foreign independent power producers.

Nevertheless, despite lucrative incentives, twice as much capacity was added in the public sector as in the private sector during the second half of the 1990s. Reform to the sector came only after the World Bank pushed the government to view power as a commodity, pointing out that the sector’s problems were a result of a conflict of interest "between government’s role as owner and its role as operator of utilities." The eastern state of Orissa was the first to adopt the recommended — albeit controversial — legislative and institutional changes. First it set up an independent regulatory commission to promote accountability and further encourage private sector investment. Then it split its SEB into two generation companies and a grid management company. The central government consolidated these reforms through the Electricity Regulatory Commission Act in 1998 and the Electricity Act in 2003.

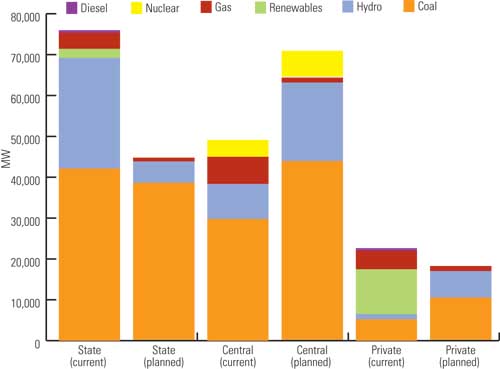

Despite these changes, however, the public sector continues to play a dominant role in determining India’s power generation and supply (Figure 4). Through the Ministry of Power, the central government sets overall power policy, while state governments focus on power plants and regional transmission and distribution networks located within their boundaries.

4. Sharing power. Though it was liberalized almost 20 years ago, India’s power sector continues to be dominated by the government. Today, state governments produce 52% of the nation’s power, followed by the central government (34%) and the private sector (15%). Source: Central Electricity Authority

State governments produce 52% of the nation’s power, followed by the central government (34%) and the private sector (15%). The industry’s other major players are also central government – owned: The National Thermal Power Corp. (NTPC), for example, accounts for 28% of the country’s capacity, while the Nuclear Power Corp. of India (NPCIL) owns all 17 existing nuclear power plants. The Ministry of Power also oversees key organizations like the national grid operator, Power Grid Corp., and the Central Electricity Authority (CEA), which conducts techno-economic assessments. The coal sector is also dominated by public sector institutions — as is the electric power technology manufacturing sector. Bharat Heavy Electrical Ltd. (BHEL), a holding company overseen by the Ministry of Heavy Industry, manufactured more than 60% of the generation units installed in the 1970s, and it will build many of the power plants planned in the coming decades.

The Plan to Power the People

With all the aforementioned challenges in mind, the Planning Commission — the nodal agency that integrates the developmental priorities of different ministries with the sole aim of raising the standard of living — has established long- and short-term plans for a massive capacity expansion that will meet its foremost aspiration: to provide power to all its people. The plan rests on the assumption that India’s gross domestic product (GDP) will grow between 8% and 9% per year. As of March 2009, even as the International Monetary Fund forecast that growth would slump to 6.5% this year (India claims it has dropped to 7.1%), this projection has not changed. In a 2006 integrated report, the commission determined that the country should have between 778 GW and 960 GW of installed capacity by 2030. To achieve this goal will require 9.5% annual growth in the power sector.

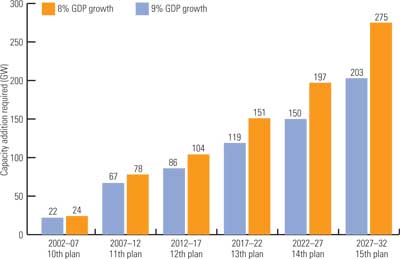

But India is already far behind quotas established by the plan; at the end of the 10th five-year plan (2002 – 2007), though it added 21.2 GW — falling just short of its 22-GW target for 8% GDP growth (Figure 5) — the country’s total installed capacity stood at 132 GW, not 153 GW, as anticipated. Still, the CEA projects that if 78.7 GW — as based on actual orders — are added during the 11th plan (2007 – 2012), India would be able to drastically reduce its peak demand deficit to 0.2% while increasing its energy surplus by 5%.

5. The plot thickens. India’s Planning Commission has determined that to sustain national gross domestic product (GDP) growth at 8% to 9%, between 778 GW and 960 GW will be needed by 2030. This will require capacity additions in allotted increments every five years. But the country is already off target: At the end of the 11th plan, it should have added between 220 GW and 233 GW of new capacity, and although new projects worth 78 GW are in the offing, they will only raise installed capacity to 210 GW. Nevertheless, federal bodies predict that this will drastically reduce peak deficits and create an energy surplus. Source: Planning Commission

As expected, the commission’s plan is imperfect. Data from the CEA show that the Indian electric power sector has been able to achieve only about 50% of its target in previous five-year plans. Many groups attest that this is because of closed planning by the government, which results in overestimation or underestimation of the nation’s needs. By the end of the 12th plan (2012 – 2017), for example, the government predicts that installed capacity of between 306 GW and 337 GW will be adequate. But, as a study by consulting firm McKinsey & Co. notes, after adjusting for plant availability and 5% spinning reserve, fulfillment of this requirement will warrant tripling generation capacity from current levels to 415 GW to 440 GW — roughly 100 GW more than the government expects.

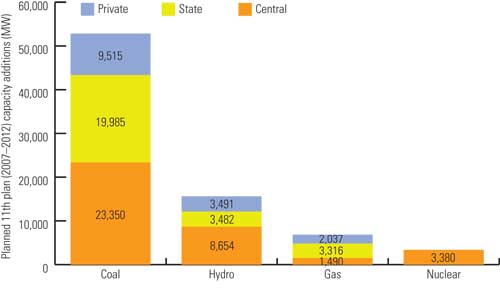

So how will India power its growth? Considering the challenges at hand, and to alleviate demand and supply issues in the short term, the Planning Commission’s 11th plan relies on the massive expansion of coal, gas, nuclear, and hydropower capacity, with most of it being built by the central government (Figure 6).

6. Putting the heat on thermal. The 11th plan calls for the massive expansion of coal, gas, nuclear, and hydropower capacity by 2012. The central government will build more than 45% of new capacity. Source: CEA

Counting on Coal

Because of its abundant reserves, India has always relied on coal for much of its power needs — and that isn’t about to change soon. Currently, 77 GW (52%) of India’s capacity is coal-fired, generated by subcritical pulverized coal combustion power plants manufactured by BHEL and based on technologies licensed from various international manufacturers (Figure 7). These consume about 78% of India’s domestic coal supply, which is a high-ash coal with a low calorific value of around 3,500 kcal/kg. Though about 9.6 GW of new coal-fired capacity was installed during the 10th plan, the 11th plan calls for adding a stunning 52 GW. About 6 GW were already in place as of March 2009.

7. The Maharaja. India’s current 77 GW of coal-fired capacity are produced by subcritical pulverized coal combustion giants like the Singrauli Thermal Power Plant, at Shaktinagar, Uttar Pradesh—the largest in the 15-plant fleet operated by state-run National Thermal Power Corp. (NTPC). Commissioned in 1982, this 2,000-MW facility comprises five 200-MW units and two 500-MW units. The Singrauli area also has four other superthermal power plants, which together supply 10% of India’s power. But though the area is thought of as “India’s power capital,” it has also been widely maligned as one of the worst polluted regions in the country. The 11th plan calls for an additional 52 GW of coal-fired capacity. Courtesy: NTPC

The plan seeks to replace a large number of coal plants that are nearing the end of their lives. It also focuses on higher efficiency. One reason for efficiency improvement is the limited fuel supply: Though it says that 45% of the nation’s coal reserves has yet to be exploited, the Planning Commission has acknowledged that if production continues to grow at 5% per year, its extractable coal reserves could run out in about 45 years. Therefore, it has recommended that, capacity additions aside, power generation companies should improve existing plant performance — in particular, the average gross efficiency of generation, which stands at 30.5%. Despite being constrained by inefficient and low-quality fuel linkages, overhaul practices, and maintenance, the sector has made great strides in improving plant load factors from an average of 70% in 2001 to 78.6% in 2007.

Meanwhile, about 30% of planned capacity will be based on supercritical technologies. Only two projects — comprising six units rated at 660 MW — are under construction by state-run NTPC at Sipat, Chhattisgarh and Barh, Bihar. According to the NTPC, these are at an advanced stage of construction, with the first unit slated to be commissioned in October this year.

As part of the 11th plan, the Indian government has also made available for award on the basis of competitive tariff bidding the development of nine coal-based Ultra Mega Power Projects (UMPPs) — supercritical facilities generating 4,000 MW or more. Four UMPPs — each estimated to cost $3 billion — have so far been awarded: Reliance Power has snapped up the Krishnapatnam UMPP in Andhra Pradesh, the Sasan in Madhya Pradesh, and the Tilaiya in Tamil Nadu, while Tata Power will build the Mundra in Gujarat.

Reliance has projected that the Sasan project could start up in December 2011, though it has not yet obtained construction financing for its plant — as Tata has. Industry experts are also skeptical of whether Reliance’s assertion that power from the three UMPPs will cost between 4 and 5 cents per kWh is realistic, questioning what would happen if the utility finds it difficult to supply those rates.

In the meantime, the central government is preparing to award three more UMPPs: two at pithead (mine-mouth) sites at Bedabahal in Orissa and at Akaltara in Chhattisgarh, and one at a coastal site at Cheyyur, Tamil Nadu. The request for qualification (equivalent to a request for proposals) for these projects is expected to be issued in one-month intervals, starting in June.

Gas’s Mercurial History

Although India’s priority continues to be accelerating installed capacity increases, the growing debate about climate change (see the web supplement, "Of Prosperity and Pollution" at powermag.com) has prompted deployment of the nation’s first 125-MW integrated gasification combined-cycle plant (IGCC) at Vijayawada, in Andhra Pradesh. Joint owners BHEL and Andhra Pradesh Power Generation Corp. plan to complete the $188 million plant by 2011. According to a Ministry of Power official, another IGCC plant — a 200-MW plant jointly built by NTPC and BHEL — is in the offing at Auria, in Uttar Pradesh.

Climate change concerns could also fuel a resurgence in India’s gas-fired generation. Out of the total installed capacity today, about 10.3% is fueled by natural gas or liquefied natural gas (LNG). Most was built in the 1990s when, following two decades of several important gas reserve discoveries, gas-fired capacity increased fourfold (Figure 8). But because existing power plants are experiencing low load factors resulting from inadequate supply (India imports its LNG), the 11th plan only calls for about 9% (about 6.8 GW) of gas capacity additions — mostly to increase generation in the short-to-medium term.

8. Gaslights. Plants like NTPC’s Jhanor-Gandhar, a 648-MW combined-cycle power plant in Gujarat, were built during the 1990s, when India saw a fourfold increase in installed gas-fired capacity. That growth rate has slowed, largely due to cost uncertainties and long-term fuel supply concerns. The discovery of new gas reserves, paired with climate change concerns, will likely lead to new gas-fired capacity. Courtesy: NTPC

Given Reliance’s discovery of new reserves in the Krishna-Godavari basin in 2001, coupled with the recent large discovery of natural gas claimed by Gujarat State Petroleum Corp., cautious development could soon end, however. Compared to coal, gas is favored in India for its shorter plant project development period, fewer environmental impacts, and higher thermal efficiency.

A Planned Nuclear Renaissance

India has long recognized the major role that nuclear power could play in its future energy supplies. Despite decades as a nuclear pariah — it was excluded from the Nuclear Non-Proliferation Treaty and was subject to a subsequent 1974 trade embargo for acquiring nuclear weapons capability — it has cultivated a robust, largely indigenous nuclear power program. Today, the country’s 17 reactors produce about 4 GW, only about 2.8% of its total generating capacity.

With the exception of two boiling water reactors, all are mid-size or small pressurized heavy water reactors (PHWRs), and most were domestically built based on a Canadian design. As part of the 11th plan, six new nuclear reactors are under construction, including the country’s first large nuclear power plant at Kudankulam, in Tamil Nadu. That plant will comprise two VVER-1000, each rated at 1,000 MW (Figure 9). Built by the state-run Nuclear Power Corp. under a $3 billion Russian-financed contract, the reactor is expected to come online later this year. Russia, which, like several European countries and the U.S., scrambled to secure bilateral nuclear power trade agreements with India earlier this year, will also supply the plant’s fuel pellets and has agreed to build up to four additional reactors at this site. In total, the six reactors are expected to add about 3 GW of capacity by 2011.

9. Crowning dome. India’s first large nuclear power plant, at Kudankulam in Tamil Nadu state, will comprise two AtomStroyExport-designed VVER-1000 reactors. Courtesy: AtomStroyExport

Until recently, the most critical setback India faced was its meager uranium reserves. The country’s known supplies total only 61,000 tonnes — and most of that lies in low-grade ores (from 0.7% to as low as 0.1%). Despite this challenge, India pressed on during its long isolation, establishing a unique long-term program that pushes for research and development of reactors using all three main fissionable materials: uranium-235, plutonium, and uranium-233. The three-pronged program also factors in India’s abundant reserves of thorium (see sidebar, "Switching from Uranium to Thorium").

But now the country has both an improved fuel supply and willing international cooperation on nuclear technology. On Sept. 6, 2008 — after three days of intense deliberation — the 45-nation Nuclear Suppliers Group awarded India a clean waiver to the embargo. And on Feb. 2 this year, the country signed an agreement with the International Atomic Energy Agency (IAEA) allowing United Nations oversight of 14 of 22 civilian reactors by 2014.

The end of the 34-year "nuclear apartheid," as All India Radio called it, set off a chain reaction: Soon thereafter, the country inked a bilateral nuclear cooperation accord with France, followed by the historic Indo-U.S. 123 Agreement and a nuclear pact with Russia. With experts projecting that India will need to inject $100 billion into its nuclear program to attain its goals, the deals are only expected to accelerate.

So far, India has established supply arrangements with some of the world’s most prolific uranium suppliers, including Kazakhstan, Canada, Russia, and South Africa. Several trade delegations — including those from the UK, Canada, and the U.S. — have also visited India to seal a wide range of deals for everything from raw materials to equipment and fabrication skills. A company once solely reliant on the government research and development of nuclear technologies, NPCIL is now in talks to assess "techno-commercial aspects" with Westinghouse Electric for its AP1000 reactors, Russia’s Atomstroyexport for VVER-1000 reactors, and France’s AREVA for its EPR. AREVA has already sealed a $12.3 billion deal to provide India with two to six EPRs for NPCIL’s Jaitapur site in Maharashtra plus 300 tonnes of uranium to fuel those reactors.

Meanwhile, GE-Hitachi said in March 2009 that it is working with NPCIL and BHEL to set up an advanced boiling water reactor (ABWR) facility. According to Timothy Richards, managing director of energy policy for GE in Washington, D.C., because the Indian government allows for up to 10,000 MW to be built at a specific nuclear site, the potential station could house as many as six or seven reactors.

However, he told POWER that before a definitive agreement could be reached for the facility, India and the U.S. would need to iron out some elementary issues. "India has stated it recognizes the importance of establishing an adequate nuclear liability regime and that it intends to comply with the multilateral convention on Supplementary Compensation for Nuclear Damage (CSC)," he said. The countries will also need to determine which nuclear technologies require government-to-government nonproliferation assurances, while India will need to finalize the listing of facilities to be inspected by the IAEA. Once this is achieved, he said, "U.S. companies will need to obtain specific authorizations from the Department of Energy (10 CFR Part 810) to allow transfer of nuclear technology to Indian entities."

Harnessing Hydropower

India, a peninsula crowned by the 1,500-mile Himalayan mountain range, is traversed by several surging rivers. The Himalayan rivers, such as those in the Indus and the Ganga-Brahmaputra-Meghna system, are perennially snow-fed, while the Deccan rivers in the south depend on the monsoons for their torrent. According to the Ministry of Power, if all economically exploitable and viable hydro potential were harnessed at a load factor of 60%, it could produce 84 GW.

For that reason, in the 11th plan the government has called for 15.6 GW of new hydropower capacity — almost half the current installed capacity of 37 GW. The CEA reports that 11.9 GW is already under construction. About 57% of this total will be run-of-the-river projects, 32% will be storage projects, and about 11% will be pumped storage. The plan includes projects like the 2,000-MW Subansiri Lower Plant near North Lakhimpur on the border of Assam and Aruncachal Pradesh. It will join a list of several spectacular hydro projects the government has already built, including the Tehri Power Station in Uttarakhand (Figure 11).

11. Gating a goddess. After 35 years and an investment of nearly $1 billion, the 2,400-MW Tehri Hydroelectric Power Station in Uttarakhand, northern India, started operations in 2006. This hydropower project is one of India’s largest and most controversial. Located on the Bhagirathi River, a principal tributary of the grand Ganges River, it draws frequent protest from Hindus who resent the reduced flow of the sacred river as a result of the 855-foot dam (the fifth tallest in the world). Courtesy: Ministry of Power

By 2025, the government hopes to have added 500 GW of new hydropower capacity, more than half in Arunachal Pradesh state. The accelerated plan must regard established environmental standards, the Planning Commission has said. To help reduce the number of Indians displaced as a result of mega hydropower projects (nonprofit group Rivers International puts that total at 20 million to 50 million people), the government has planned to build more run-of-river projects rather than large storage dams. This decision is despite its finding that "the available energy [of run-of-river projects] varies from month to month and peaking capacity is minimal."

Running Renewables

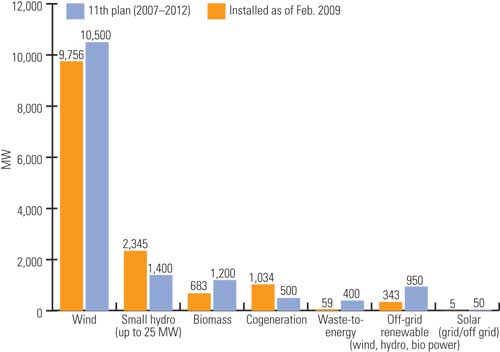

India’s Ministry of New and Renewable Energy — perhaps the world’s only ministry dedicated solely to the development of renewable energy — evolved from a government agency created in 1982 to steer the nation away from its reliance on oil, following two oil shocks in the 1970s. The ministry pursues a similar mission today, pushing renewables to supplement the country’s coal-heavy portfolio. And it has been largely successful. In 2006 — before the ministry had been formally named — nonconventional sources of energy like small hydro, wind, solar, and biogas constituted less than 1% of the country’s portfolio. Today, 9% (14,224 MW) of India’s power is produced by these sources, and the 11th plan projects that this capacity will more than double (Figure 12).

12. Doubling clean capacity. India currently has 13,880 MW of grid-connected wind, small hydro, biomass, cogeneration, waste-to-energy, and solar power plus 350 MW of off-grid power, including captive power plants. The 11th plan seeks to add 15,000 MW of new renewable power, including 10.5 GW from wind. Source: Ministry of New and Renewable Power

Wind power, particularly, has seen stellar growth. During the 10th plan, India saw the installation of 5.4 GW, against a target of 2 GW. With 9.8 GW, India now has the fifth-highest level of installed wind capacity, trailing the U.S., Germany, Spain, and China. Tamil Nadu boasts the most wind power (about 4 GW), followed by Maharashtra, Karnataka (Figure 13), Rajasthan, and Gujarat. But though these states are also expected to receive most of the 10.5 GW of new capacity called for by the 11th plan, experts say that India’s wind power potential of 45 GW in 13 states — and up to 100 GW with current technology — will remain relatively untapped.

13. Monsoon power. India’s wind-powered capacity has quickly grown to 9.8 GW, and it is set to double by 2012 per the 11th plan. Currently, 12 wind turbine manufacturers are vying for market share in this sector, including Suzlon, a home-grown—and now global—wind power equipment maker. Suzlon, which owns this 1.25-MW turbine in Gadag, Karnatak, is in the process of developing a 1,000-MW “windpark” near its headquarters in Dhule, Maharastra. Courtesy: Suzlon

The growth may have been fueled by federal tax incentives and tariff structures fashioned by state governments, but it has benefited exponentially from home-grown wind turbine manufacturers, including Suzlon. Having consistently maintained more than 50% of India’s wind power market, that company is now ranked the fifth leading wind equipment manufacturer worldwide. According to Shrenik Ghodawat, managing director of Ghodawat Industries, a relatively new company that began manufacturing wind turbines suited to the Indian market this January, foreign companies like Enrecon, Vestas, Gamesa, and GE have also quickly gotten into the game.

Ghodawat said that the largest constraint on the government’s renewable energy expansion plans is the weak grid (see sidebar "A Passage for India’s Power"). "But now the government and all wind sector players are jointly making corrective measures," he said. "Wind sector players are participating in the network strengthening and planning of [a] central transmission utility and state transmission utilities." The country is also actively training a workforce to support the projected growth, narrowing the gap considerably over the past few years, he said.

India’s renewable energy sector is also seeing increased interest in solar power. Though India is located in the equatorial sunbelt and experiences 250 to 300 days a year of sunny weather, installed grid-connected and off-grid capacity has so far sprouted only a paltry 5 MW, its growth stunted mainly by cost concerns. The Ministry of Power is looking to expand solar capacity tenfold by 2012.

According to the U.S. Commercial Service, which recently organized a 14-company solar delegation to India, this target is achievable — with foreign investment and international cooperation. The Indian government is encouraging foreign investment, it said, by offering solar developers who build, own, and operate projects financial incentives of about 30 cents for each kWh produced.

The opportunities are abundant: India currently has 19 manufacturers of solar photovoltaic (PV) modules, and several large investments are in the pipeline. "There is a lack of technical expertise in installation, operations, troubleshooting, and other aspects of clean energy implementation," the service said in a statement to POWER. "There is demand for thin-film solar cell technology, technology for megawatt-scale power generation, and improvements in crystalline silicon solar cell/module technology. Building integration for PV and solar thermal systems is also an area of opportunity."

India’s grid-connected biomass, cogeneration, and small hydro generation options are also slated to see significant increases by 2012. Because the government has pledged to connect all rural villages under its rural electrification program by 2012, off-grid projects will also see tremendous growth (see web supplement, "Fabulous Wealth and Fabulous Poverty" at www.powermag.com). "This should translate into a seven-fold market increase for renewable power generation — from $3 billion today to more than $21 billion by 2012," the U.S. Commercial Service said.

Financial Limitations

Through the 10th plan, until 2007, about $60 billion had been allocated for India’s power sector, and about $40 billion was actually invested in the sector. Most of the required funds had been raised in domestic financial markets, met through the Power Finance Corp. (PFC), a state-owned agency entrusted with the task of providing financial support to state and central power projects. The government’s more recent estimates indicate that $130 billion will be needed just for generation in the 11th plan — only a fifth of which the PFC is expected to cover — and $225 billion will be required for the entire sector. According to the International Energy Agency, longer-term investments (covering 2005 to 2030) will require $960 billion for the entire electricity sector, of which 45% will be for generation.

Raising these kinds of funds will pose a serious impediment to India’s expansion plans, says Dr. Saifur Rahman, a global energy expert and vice president of the IEEE Power & Energy Society, an organization dedicated to the advancement of technology. Despite ongoing reforms, state governments are in financial straits: In 2005, power utilities, which accounted for 60% of the nation’s generation, had losses of around $4.8 billion; nearly half recorded a negative rate of return on net fixed assets. Rahman points to the government’s populist policies — specifically, its push for free power for farmers — as a major part of the problem.

"Free power means that the supplying electric utility cannot get enough returns to maintain their system and infuse capital to improve the quality of supply. This financial weakness makes the electric utility a high-risk proposition to investors, which results in lack of funding availability and/or higher interest rates to secure funding because of high risk of inability to pay back the loan from commercial concerns," he told POWER.

"If the government wants to help farmers with electricity for irrigation, which is commendable social service, the government needs to set aside funds and buy down the cost of electricity to farmers. This will allow the electric utility to charge less for power to farmers but make up the loss from the government’s buy-down funds. Similar programs are available in the U.S., where governments subsidize the interest rates for capital improvements and energy efficiency measures."

The funding woes are serious, and they could trickle through to other basic requirements for a solid sector expansion, Rahman said. For example, even though India has skilled workers and the facilities to train new ones, to support the sector’s growth, "due to lack financial remuneration for these workers, many of them end up working in the Middle Eastern countries."

Other experts propose that because India does not have a large and liquid domestic debt market — and this market is dominated by government securities — the country will likely have to depend on foreign investment or grants to fund the expansion. India has been somewhat successful in this area, but experts agree that it still has a long way to go. Despite incentives and lucrative policy measures, foreign direct investment (FDI) in the sector for 2006 was $157 million — less than 1% of the nation’s total FDI. The primary obstacle for foreign investors is the poor commercial performance and near-bankruptcy of state electricity boards — a result of pervasive power politics. The prevalence of corruption, lack of corporate governance practices, and red tape (owing to the multi-regulatory system that involves both state and federal governments) are also major concerns. (See the web supplement "The Foreign Investment Factor" at www.powermag.com for more details.)

One thing is certain: As India’s continues on its economic trajectory and its population continues to increase, if its basic power infrastructure is not secured, the nation’s goal of empowering its people will remain unmet. So will its superpower aspirations.

—Sonal Patel is POWER’s senior staff writer.