India’s long-term annual economic growth rate is projected at over 7%, and the country is investing in its hydroelectric, nuclear, and renewable resources. However, the primary fuel used to produce electricity remains coal, and the government has ambitious plans to significantly increase coal-fired capacity. Those plans have been challenged by a number of unexpected factors that threaten to stifle India’s economic growth. India’s long-term annual economic growth rate is projected at over 7%, and the country is investing in its hydroelectric, nuclear, and renewable resources. However, the primary fuel used to produce electricity remains coal, and the government has ambitious plans to significantly increase coal-fired capacity. Those plans have been challenged by a number of unexpected factors that threaten to stifle India’s economic growth.

India has experienced impressive gross domestic product (GDP) growth rates exceeding 7% over the past few years. Although recent trends appear to indicate an economic slowdown, long-term 7%+ GDP growth is expected to continue through at least 2020. To support India’s expanding economy, large-scale power capacity additions in the range of 150 GW to 175 GW are projected over the next 10 years (Figures 1 through 3). (For additional information on the growth of India’s power industry, see “Powering the People: India’s Capacity Expansion Plans,” in POWER’ s May 2009 issue or online at https://www.powermag.com.)

|

| 1. Jharsuguda Sterlite, Orissa, India. This plant, owned by Sterlite Energy Ltd., is a 4 x 600-MW coal-fired plant that entered commercial operation in 2010. It features the first hybrid electrostatic precipitator with baghouse constructed in India. The four natural draft cooling towers are 150 meters tall; the two stacks are 275 meters. Courtesy: Shandong Electric Power Engineering & Consulting Institute Corp. |

|

| 2. Mundra Phase II, Gujarat, India. Units at this bituminous coal–burning 5 x 660-MW plant began operation from 2010 to 2012. The plant operator is Adani Power Ltd. Mundra Phase I (not shown) consists of 4 x 330-MW units. The completed project will include four separate development phases (Phase III, 2 x 660 MW; Phase IV, 3 x 660 MW). All the units operate at supercritical steam conditions. Courtesy: Shandong Electric Power Engineering & Consulting Institute Corp. |

|

| 3. Rosa Power Plant, Uttar Pradesh, India. This plant consists of 4 x 300-MW units that entered commercial service between 2009 and 2012. When Unit 1 was synchronized, it was the first coal-fired plant built by the IPP in North India. Courtesy: Reliance Power Ltd. |

Though these capacity additions are an impressive objective, in reality, there have been and will continue to be shortfalls in capacity additions due to a variety of factors, including fuel constraints, regulatory and tariff issues, shortages of skilled manpower and construction equipment, infrastructure issues, and bureaucratic delays in obtaining clearances and permits.

Contributing to the capacity addition shortfall is a shortage in domestic coal production, price volatility for higher-quality imported coals, and limited domestic sources of natural gas. Bureaucratic and government delays associated with obtaining permits and clearances for pre-bid activities such as land acquisitions, water allocation, environmental clearances, and commercially viable power purchase agreements also contribute to power generation capacity commissioning delays and shortfalls.

The lack of trained construction, commissioning, electrical, and instrumentation personnel in India accounts for a nearly 33% shortage in technically skilled manpower. Major efforts are under way to train local talent from villages in proximity to power projects, but this has led to nonavailability of and inadequate training procedures, which are contributing to delays in construction and commissioning. Additionally, major construction equipment—such as rolling stock, cranes, dozers, tunnel-boring equipment, and welding machines—is in short supply, and this has led to overworking of equipment, safety issues, and project delays.

The Indian government, national and state-run utilities, and independent power producers (IPPs) are all taking measures to address these critical infrastructure development roadblocks. The government expects (perhaps too optimistically) to find long-term workable solutions that will decrease the gap between power demand and capacity.

World-Class Growth Continues

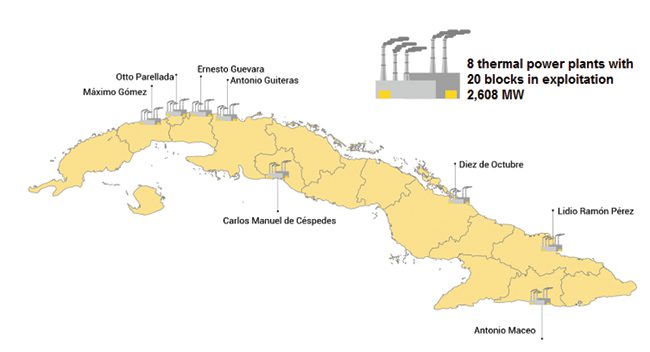

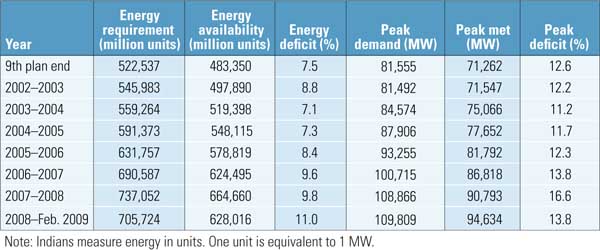

Current electricity generation capacity in India is approximately 200,000 MW. After the U.S., China, Japan, Russia, and Canada, India ranks sixth in the world in terms of total generation. Today, India is on the same threshold of power generation capacity as China was 11 years ago (Table 1).

|

| Table 1. Capacity growth over 21 years for China and India. Source: Krishnan & Associates Inc. |

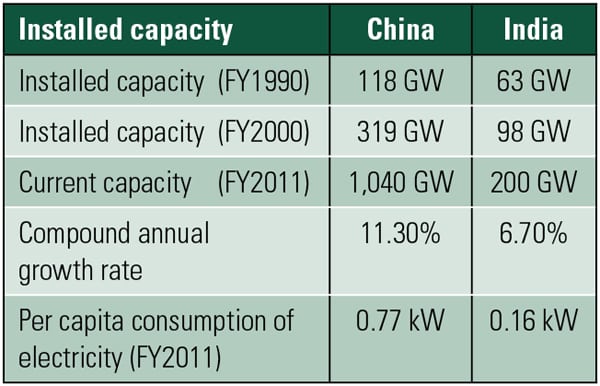

In India, fossil fuels account for about 65% of the total installed capacity; the remaining 35% is supplied by hydro, renewable, and nuclear resources. Among the fossil fuels, coal accounts for about 56% of the nation’s generating capacity; natural gas and oil account for 9% and ~1%, respectively (Figure 4).

|

| 4. King Coal lives. India relies on coal to supply about 56% of its electricity, and that percentage is expected to grow in the future. Source: Krishnan & Associates Inc. |

The central and state governments together own and operate approximately 73% of India’s installed power capacity. However, the participation of the private sector has been increasing over time due to power reforms.

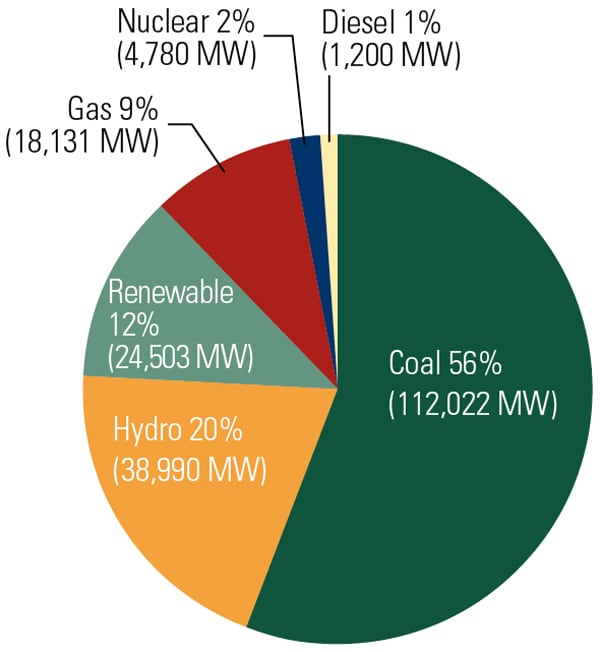

Since 1947 (the year of India’s independence from Great Britain), electric generating capacity has grown from 1,400 MW to approximately 200,000 MW. During the same period, India’s population has grown from 250 million to over 1.2 billion. A growing population, combined with India’s recent 7%+ economic growth rate and inadequate power supply and distribution infrastructure, have resulted in electricity shortages both in terms of peak demand and overall energy supply.

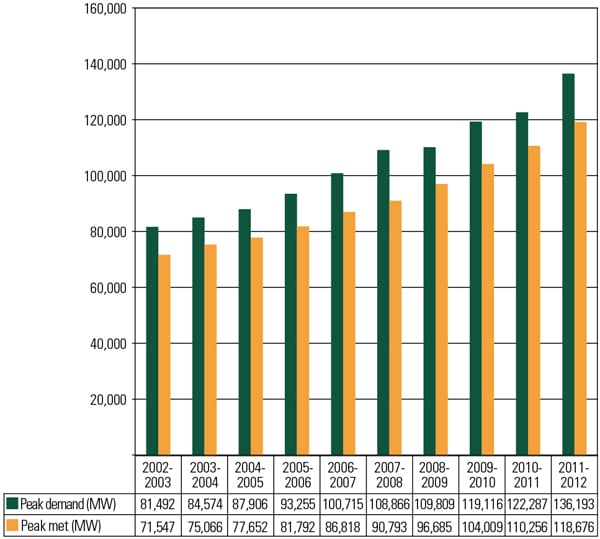

An overall average peaking shortage of about 12% has been typical on an all-India basis, as shown in Figure 5. The large energy deficits have resulted in low per-capita consumption. Clearly, additional generating capacity will be required to serve the country’s population and fuel economic growth. This has prompted the Government of India to embark upon an ambitious plan to increase power generation capacity to bridge the growing power demand/supply gap with low-cost power.

|

| 5. India’s peak demand gap. India is building many new coal plants to close the gap between peak demand and the portion of that peak demand met by power generation systems. Source: Krishnan & Associates Inc. |

Five-year plans established by the government’s Planning Commission lay out specific targets for new generation capacity. The 10th five-year plan (2002–2007) had a target of 41,100 MW of additional capacity. However, only 18,000 MW of new capacity were placed online during this period, representing a capacity increase slippage of 56%.

For the 11th five-year plan (2007–2012), the capacity slippage decreased considerably, as an estimated 63,000 MW were added against the plan’s target of 68,000 MW. For the 12th five-year plan (2012–2017), 83,000 MW of new capacity has been targeted. The expansion effort has and will continue to include supercritical and ultra-mega power projects (UMPPs) that are awarded based on tariff-based competitive bidding. Designed for low carbon emissions, with supercritical technology and 100% fly ash utilization, these UMPPs will be more environmentally friendly than the current fleet. (See “India Revs Up Capacity with Massive Coal Plants,” in the May 2012 issue of POWER.)

Limited Fuel Options

The primary fuel in India for power generation is coal, as domestic coal resources are available in abundance. However, India’s coal production has remained low in comparison to its reserves, presenting a key challenge that must be addressed before accelerating future power generation capacity additions.

India’s coal reserves may be enormous, but that doesn’t mean that coal is readily available to meet the burgeoning demand. In fact, recent coal availability and pricing issues (internal and international) have disrupted a number of new coal plant projects, as the next section explains.

Natural gas is in short supply in India, and gas supply to existing gas-fired power stations has been inadequate. Consequently, gas plants have been operating at around 58% to 60% load factor. Although India has identified a few domestic natural gas reserves and is in discussions with natural gas suppliers in Qatar, Iran, and Australia, gas is not expected to eradicate power generation deficits in the short term.

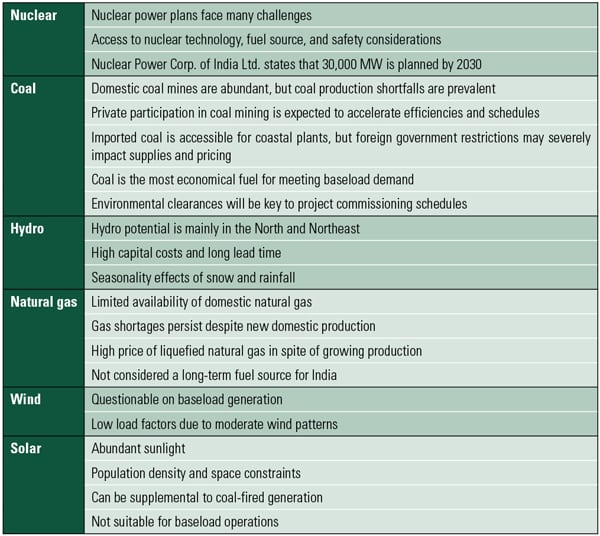

A qualitative comparison of all fuel alternatives is presented in Table 2.

|

| Table 2. India’s fuel options for power generation. Source: Krishnan & Associates Inc. |

Coal Availability and New Tariffs

Coal production within India is projected at 615 million metric tons, well below the 12th five-year plan requirement of 842 million metric tons.

A major challenge facing the Indian government has been a campaign by various nongovernmental organizations, tribal and reservation areas, and local politicians to protect forest lands from coal mining. A large portion of the indigenous coal in India is trapped under the few remaining forests in central and eastern India currently classified as protected areas. The Ministry of Coal is looking to increase the amount of available coal-bearing land for mining, and this requires clearances from the Ministry of Environment and Forests (MoEF). The MoEF has, however, superimposed forest cover on 602 coal blocks in nine important coal fields and recommended that 47% of the blocks be kept “No Go,” or off limits to mining. The Ministry of Coal is seeking to designate all 602 blocks as minable or “Go” areas. This impasse is likely to be detrimental to power industry growth and the overall economy unless addressed immediately at the highest governmental levels.

Indian coal has high levels of ash (35% to 45%), silica, and alumina and is highly abrasive, with strong slagging characteristics. Given the high ash content and relatively weak coal transportation system in the country, Indian coal does not “travel economically.” Therefore, locating power plants close to mines (at “pit heads”) is common, as most of the pit head stations have their own coal transportation systems and do not depend upon the Indian railways.

All these factors have increased dependence on imported coal. Indian power producers have mitigated such challenges by strategically locating plants in coastal areas, eliminating the need for inland transportation of imported coal. In addition, power producers have secured imported coal resources from countries such as Indonesia, South Africa, Mozambique, and Australia.

In recognition of the changing fuel scenario, India’s Central Electricity Authority in 2011 advised that all power project developers and power equipment manufacturers incorporate fuel flexibility in boiler designs to utilize a blend of imported coal and low-grade indigenous coal in a ratio of 30%/70% (or higher). Although imports are expected to fulfill some of the country’s need for higher-quality coal, the bulk of coal for power generation will still have to come from domestic sources.

Rising Coal Prices Hurt Generators

By 2015, India could become the world’s largest importer of thermal coal. Indonesia is currently the single largest exporter of coal to India and supplies 8% of India’s coal requirements. (See “THE BIG PICTURE: Coal Demand Surges” in the May 2012 issue for a graphic showing current and projected leaders in coal exports and imports.)

The Indonesian government recently announced a 25% tax on exported coal and mandatory benchmarking of coal exports to international prices. That stiff rise in the price of imported coal has slowed a number of Indian power projects that had been aggressively bid in the tariff-based competitive bidding process based on long-term agreements and purchase arrangements that power producers had made for fuel sourced from Indonesia. Such arrangements, in some cases, factored coal pricing at US$26 to $30 per ton, less than one-half of current prices. Consequently, the substantial increase in the purchase cost of coal for Indian companies is a major stumbling block, as Indian power plants cannot be operated if they must rely on such expensive coal, which would make power unaffordable.

Some fuel supply options now being considered by the government are to ramp up domestic coal production, design equipment to burn a wider range of fuels, and change the fuel mix to emphasize renewable sources. Furthermore, various state governments that purchase power from IPPs will have to raise consumer tariffs for projects that were originally awarded at a fixed rate.

Raising consumer tariffs can be unpopular and politically sensitive and will have to be carefully timed by various state governments.

New Environmental Norms and Clearances

India’s priority is first to generate low-cost power and then observe environmental initiatives. Late in 2009, the government issued new norms for ambient air quality for the first time in 15 years. The new norms are stricter and more inclusive than the previous requirements and include specific pollutants to be monitored for the first time. Prior to 2009, the only pollutants monitored were NOx, SO2, PM10, lead, CO, and ammonia. The new norms include PM2.5, ozone, benzene, arsenic, nickel, and PAH benzo(a) pyrene. Areas throughout India are identified as attainment or nonattainment, much as in the U.S. Within the 12th five-year plan (2012–2017), emission limits for power plants likely will be formulated requiring the application of control technologies similar to those used in Western plants.

Although current emission limits for coal-fired power plants apply to PM10 only (150 mg/m3 for existing plants and 50 mg/m3 for new plants), the current environmental clearance provisions for new coal-fired power plants are fairly comprehensive. Flue gas desulfurization (FGD) scrubbers are required on plants that burn imported fuels that typically have higher sulfur content than Indian coal; no FGD equipment is currently required for plants burning Indian fuels. Electrostatic precipitators (ESPs) are widely utilized, and many plants are upgrading their existing ESPs to meet more stringent PM requirements. Most new coal-fired power plants come equipped with low-NOx burners. However, a combination of combustion and other in-furnace controls and, potentially, selective catalytic reduction may be required for NOx control at some power plants in the future.

As typified in a 2011 MoEF clearance for a 2 x 685-MW supercritical coal plant burning Indian fuel, a number of environmental and social requirements are set forth. Specific conditions typically cited include:

- Stack height requirement of 275 meters; continuous online monitoring of SOx, NOx, PM10, and PM2.5; and a flue gas minimum exit velocity of 22 m/s.

- Provision for future installation of FGD.

- Possible periodic monitoring of mercury emissions.

- High-efficiency ESPs followed by fabric filters to ensure PM10 emissions do not exceed 50 mg/m3.

- Adequate dust extraction systems such as cyclones, bag filters, and water spray to be installed in dusty areas such as coal- and ash-handling points.

- Regeneration of any degenerated water bodies within 5 kilometers of the plant site.

- Sponsorship of a detailed study of water availability of the river adjoining the plant site covering all competing uses—drinking, agricultural, and industrial.

- 100% utilization of fly ash generated from the fourth year of plant operation.

- At least three of the villages nearest the plant shall be “adopted” with development of basic amenities, including roadways, drinking water supply, primary health care, and primary schools.

- Implementation of income-generating projects consistent with the traditional skills of the nearby village population, such as vocational training and the development of fodder farms and fruit-bearing orchards.

- Treated effluents must conform to prescribed standards or must be recirculated and reused within the plant.

- Provision of a sewage treatment plant with treated sewage utilization for raising greenbelt vegetation adjacent to the plant.

In the environmental clearance example above, the land requirement amounted to about 850 acres, and the land was already in possession of the utility. Of those 850 acres, about one-half are designated as “revenue land,” while the remaining half are classified as single- or double-crop land and waste land. Land acquisition remains a critical issue for power producers, thus favoring expansion of plants at sites where land is already owned.

Much Unrealized Potential

The Indian power sector has traditionally faced a range of challenges in expanding generation capacity. The country has added 81 GW in the past two five-year plans against a cumulative targeted capacity increase of 109 GW. The 27% shortfall was largely attributed to a shortage of boiler, turbine, and generator equipment manufacturing facilities.

Additional factors that have adversely affected capacity additions include shortages of both construction equipment and skilled manpower; unreliable fuel availability; project financing difficulties; inadequate railways, ports, and other infrastructure areas; project safety issues; and delays in environmental and governmental clearances.

In the past few years, however, several Indian boiler and turbine manufacturers have solidified alliances with major Western companies to add substantial subcritical and supercritical boiler manufacturing capacity. Previously, Bharat Heavy Electricals Ltd. was the only major equipment supplier to the power industry within India. With this relatively new boiler capacity addition, shortfalls in generating capacity additions should be substantially mitigated in the current five-year plan. The new added Indian manufacturing capacity will also reduce the country’s historical dependence on Chinese manufacturers.

Although short-term fuel and tariff issues will need to be addressed at the government level, and despite shortfalls resulting from factors both internal and external to India, future generation capacity additions are expected to be substantial. Capacity additions from 150 GW to 175 GW are slated over the next 10 years and are needed to address the country’s poverty alleviation agenda. India will represent the world’s highest growth opportunity for new power generation capacity expansions, given its growing appetite for electricity. The country will continue to be a robust market for power plant and environmental equipment and service providers through at least 2030.

—Ravi Krishnan (ravi@krishnaninc.com) is originally from India. His expertise includes marketing and business development for the global power industry. Krishnan & Associates initiates business development programs for U.S. and European original equipment manufacturers seeking market expansion in India. For the past three years, the company has published its comprehensive annual Indian Power Generation Market Review & Forecast.