Wind and solar energy in India were once considered among the most exciting growth industries in the world, but policy uncertainty and abrupt changes in the macroeconomic framework governing the renewables sector have derailed them in the past two years. Corrective measures are now being taken to help wind and solar regain their lost glory.

Energy-starved India has been diversifying increasingly into renewable energy (RE), becoming in the process one of the world’s most vibrant markets for this sector. This bodes well for a country that has often seen its industrial and economic growth inhibited by a truncated supply of conventional power.

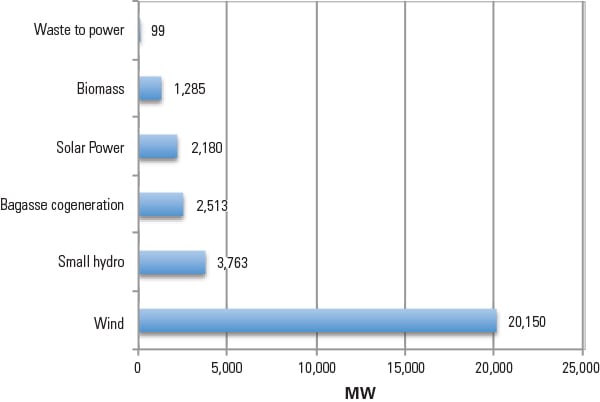

Grid-connected renewable power (there is yet very little off-grid renewable) accounted for as much as 29.463 GW—or 12.6%—of the country’s 233.939 GW of installed power capacity, as of December 31, 2013 (Figure 1). The share of wind was 20.150 GW (68.4%) and solar photovoltaic (PV), 2.2 GW (7.5%).

India is said to be the only country to have an exclusive ministry for renewable power, and its Ministry of New and Renewable Energy (MNRE) also provides various RE systems for decentralized generation of electricity that has electrified 10,752 of the country’s 640,867 villages so far. About 255,000 solar street lights, 993,000 solar home lighting systems, 939,000 solar lanterns, and 138 MW of distributed solar power plants have been installed. (See the May 2009 feature “Powering the People: India’s Expansion Plans” for details of the country’s goals to reduce poverty by increasing energy access.)

Coal-fired power, however, still has the major share—138.213 GW, or 59.1%—of India’s installed capacity (Table 1). Volatility in coal costs, wavering fuel linkages, and lack of policy clarity have, however, been causing prolonged turmoil in the Indian power generation sector, with work suspended on several thermal power plants across the country.

|

| Table 1. India’s installed capacity. Source: Central Electricity Authority |

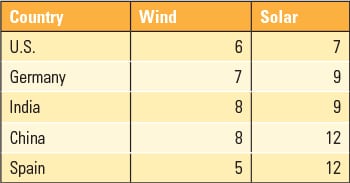

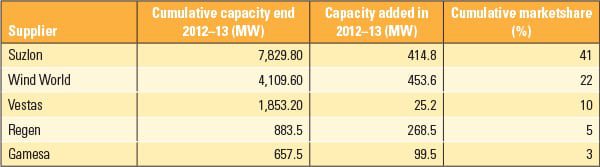

With unreliable coal and gas supplies thus denting capacity targets, solar, wind, and biomass energies have found increased favor. India has become the fifth-largest wind power producer in the world, after China, the U.S., Germany, and Spain. Its wind power industry has matured, being now equipped to provide direct-drive, stall-controlled, and pitch-controlled turbines ranging from 250 kW to 2.1 MW with hub heights and rotor sizes up to 100 meters (m). The manufacturers (Table 2), almost entirely from the private sector, have the capacity to produce over 9,000 MW per year and have more than 40 models on offer, including turbines designed to harness energy even in low and medium wind regimes.

|

| Table 2. Market share of wind turbine suppliers in India (as of March 31, 2013). Source: CLP India Pvt. Ltd. |

The country also crossed a major milestone in solar power last year when it added just over 1 GW of solar energy to its electrical grid, nearly doubling its overall solar capacity to 2.21 GW. The tally had been a mere 47 MW in 2010. After a slow start last year, solar installation picked up rapidly, striding towards the solar capacity targets of 10 GW by 2017 and 20 GW by 2022.

Kick-starting this for 2014 was the launch on Feb. 26 of a 130-MW solar power plant, currently the largest in India, in the central Indian state of Madhya Pradesh. The plant has been built by Welspun Energy Ltd. (WEL), a leading independent RE player that is part of the $3.5 billion Mumbai-based Welspun Group. Set up on 305 hectares of land at a cost of Rs1,100 crore ($177.4 million), it will supply power at Rs8.05 ($0.13) per kWh.

India, in fact, is planning to build the world’s biggest solar PV power plant, of 4,000 MW, on 48 square kilometers of salt plains in the desert state of Rajasthan. Six public sector companies will partner in setting up this $4.4 billion project that will annually supply 6.4 GWh of energy. It will use PV modules based on crystalline silicon technology and will be developed in phases over seven years; the first, of 750 MW, is expected to cost $1.09 billion and be set up in three years.

MNRE has planned four more ultramega solar PV projects, of 500 MW each, for the coming fiscal year, 2014–15, one each in the adjoining states of Rajasthan and Gujarat and two in the state of Jammu and Kashmir in the north.

Legislative Backing Spurs Smaller Companies

The development of grid-connected renewable power took off in India with the coming into force of the Electricity Act of 2003. The legislation, which provides for regulatory interventions such as determining tariffs, specifying renewable purchase obligations (RPOs), facilitating grid connectivity, and developing the market, essentially spurred the advent of grid-connected wind energy. Solar power debuted only in January 2010 with the launch of the Jawaharlal Nehru National Solar Mission (JNNSM) that aims at promoting grid-connected solar power adequately enough to bring the cost of solar power to grid-parity levels.

But with wind power marred by several issues of late, the government is seeking wind’s uplift with the launch of the first National Wind Energy Mission (NWEM) by the middle of this year. The NWEM will act as a facilitator to incentivize investments, ease land clearances, and regulate tariffs, but unlike JNNSM, it will not involve bidding for projects. The NWEM came after the Solar Mission because wind energy had been progressing very well, while solar required a fillip. MNRE estimates the installable wind power potential in India for 50-m towers at 49,130 MW and for 80-m towers at 102,788 MW.

“The growth of RE has changed the energy business in India,” notes New Delhi–based policy research and advocacy group, Centre for Science and Environment (CSE), in its just released “citizen’s report” on the State of Renewable Energy in India. “It has in many ways democratized energy production and consumption in the country.” Before the renewable sector became a significant player, the energy business was all about fossil fuel–based big company and grid-connected power that dominates even today. But now there is an alternate energy market in which thousands of small companies, nongovernmental organizations, and social businesses are involved in selling RE products and generating and distributing renewable-based energy, it points out.

Unwelcome Changes

However, while wind and solar energy in India were once considered among the most exciting growth industries in the world, they have declined steadily over the past two years. While 6,761 MW of grid-connected renewable power was added during the 10th Five Year Plan (2002–07) against a targeted 3,075 MW and over 13,000 MW was added during the 11th Plan (2007–12) against a target of 12,230 MW, the decline has been visible from the year after 2011–12, the last year of the 11th Plan, when 4,943 MW of RE capacity was installed.

New RE capacity dropped to 3,163.17 MW in 2012–13, and in the nine months of the current 2013–14 fiscal year ending in December 2013, just 1,921.98 MW (44%) was commissioned against a full-year target of 4,325 MW. This included 1,097 MW of wind energy, or 47%, of a full-year target of 2,500 MW; 495 MW of solar, or 45%, of a targeted 1,100 MW; and 131 MW of small hydro, or 44%, of 300 MW.

The 12th Plan (2012–17) now aims for RE capacity additions of 29,800 MW, with 15,000 MW of wind, 10,000 MW of solar, 2,100 MW of small hydro, and 2,700 MW of biopower, including waste to energy (WTE). JNNSM is also looking to add 20,000 MW of grid solar power, 2,000 MW of off-grid solar applications, and 20 million m2 of solar thermal collector area by 2022.

The 12th Plan allocates Rs135,100 crore ($21.8 billion), or 9.84%, for RE—wind, solar, biomass, and small hydro projects—of the total outlay of Rs1,372,580 crore ($221.38 billion) for the energy sector. “This is not enough,” observes the CSE report. “Largely because of policy uncertainty—some say paralysis—within MNRE, the past two years were a complete washout for the RE sector in India, with investments dipping significantly from $13 billion in 2011 to $6.5 billion in 2012.”

This perception is shared by just about all stakeholders in the RE sweepstakes. They believe the decline has been brought about as much by the general recession as by policy uncertainty; an inattentive, even indifferent, MNRE; and the inexplicable withdrawal of incentives and abrupt changes in the macroeconomic framework governing the RE sector.

After successfully implementing Phase I of the Solar Mission, the needless delay in communicating Phase II until the beginning of 2014 created stagnancy in the solar industry. MNRE also flip-flopped on wind power, throwing the industry into disarray by abruptly revoking both the accelerated depreciation (AD) and generation based incentive (GBI) benefits at the beginning of the 12th Plan. Both benefits had been introduced in 2009 as being complementary to each other.

The GBI aimed at attracting large independent power producers (IPPs) and foreign direct investors to the wind power sector. It gave the wind power developers a benefit of 5 paisa (0.08 cents) for every kWh of electricity they sold to the distribution companies, with a cap of Rs1 crore ($161,290) per MW over four to 10 years. For solar, the GBI was intended to support small (below 33 kV) distribution grid-connected projects by providing Rs12.41 ($0.20) per kWh to state utilities on direct purchase of solar power from the project developers. Projects ranging between 100 kW and 2 MW and connected to the high-tension grid below 33 kV were also eligible for GBI. GBI is over and above the tariff approved by respective state electricity regulatory commissions (SERCs) and disbursed on a half-yearly basis through the Indian Renewable Energy Development Agency (IREDA).

The AD benefit, intended to promote wind capacity additions during the initial growth phase, and which is still available for solar power producers, had enabled wind farms to claim 80% depreciation of equipment cost in the first year. Following its repeal, they can now claim only the standard 15%. Heeding the resentment, the GBI was reintroduced a year ago, but AD, which had driven 70% of the wind installations, has not yet been reinstated, though MNRE has been persuading the Finance Ministry to do so.

Mahesh Makhija, director of business development (renewables) at CLP India Pvt. Ltd. (Figure 2), the wholly owned subsidiary of Hong Kong–based CLP Holdings, says AD, alongside the turnkey development model, had attracted many high-net-worth investors not directly in the business of electricity generation, but who contributed to the initial growth of the wind industry. They, however, dropped out after AD was withdrawn, and it was expected that IPPs would move in instead. But prolonged indecision on the continuation of the GBI deterred IPPs too. Makhija says these drawbacks retarded capacity additions, with several under construction and planned wind projects coming to a near standstill as their developers had factored the GBI in when finalizing their projects.

|

| 2. Headwinds. These wind turbines, owned by CLP India Pvt. Ltd., are located in Jaisalmer, in Rajasthan, as part of a 76-MW wind installation. Courtesy: CLP India Pvt. Ltd. |

Amit Kumar, executive director for Energy & Utilities, PricewaterhouseCoopers Pvt. Ltd. (PwC), based in Gurgaon, near New Delhi, says the high-net-worth beneficiaries of the AD scheme had been manufacturers of textiles, cement, steel, and automobiles who used RE as captive power for their power-intensive industries. They enjoyed the benefits on their host business and were less concerned about improving power generation and plant load factor (PLF).

A few other companies invested in wind turbines to avail AD benefits to minimize their income tax liabilities, and these included small investors with ownership of one or two wind turbine generator installations. “Projects were set up in areas of low wind density and this resulted in low generation,” he points out. “In short, the focus was more on earning profits and less on improving generation.”

A New Era?

Kumar adds that there is a discernible shift from tax benefit–based investment to the IPP-based model for wind power that will represent the next generation growth phase for the sector. IPPs are keen now to invest in this matured market that also has access to proven technology and skill sets. They thus have much less riskier investment options and are now increasingly developing wind farms, each of an installed capacity of 50 MW and above. IPPs also have a choice of revenue models, including options with multiple revenue streams. They can be assured impressive returns on investments with the right kind of strategy and revenue model.

Ashwin Gambhir, senior research associate at Pune-based Prayas energy consultancy, also believes that India is entering the next phase of renewable power development, where installations will pick up mainly on economic considerations and not on incentives. “Strict RPO compliance will further help the industry,” he says. “However, wind power prices need to be discovered through competitive bidding, like it is done in solar, to discover true prices and help increase targets.” For wind, there is no competitive bidding involved, and developers are free to install projects with the feed-in tariff (FIT) or RE certification (REC) route as long as the utilities are willing to buy that power to meet their RPOs. For solar, most states and the central process select projects on the basis of competitive bidding for a pre-decided capacity.

Fund-raising too has become easier for both wind and solar. Financing had been a problem during the first phase of bidding under JNNSM in 2012, but with the country having since seen fair capacity additions, financial institutions have been more open to funding if the project developers have sound basics (see sidebar).

| Biggest Renewables Developers

With an investment of around $1 billion, CLP India is the largest investor in India’s wind sector, having built up a portfolio of 12 wind farms of a cumulative capacity of 1,051 MW. It will be investing an additional $1 billion to $1.2 billion to raise the total capacity to 2,000 MW by the end of 2016. Tata Power Solar is a fully owned subsidiary of Tata Power Ltd., India’s largest private sector power utility, with a gross generation capacity of 8,521 MW. Of this, hydro, wind, and solar account for 1,112 MW, a 13.1% share that is proposed to be extended to 20% to 25% from a mix of clean power sources like hydro, solar, wind, geothermal, and waste gas generation. |

Kumar maintains, however, that though the GBI has been reinstated, investments are still not very forthcoming, as there is no clarity on issues such as value, subsidy cap per MW, depreciation rate and term period, and maximum capacity for which the benefit is available. RPO enforcement too remains weak, he says. Lenders may now stop funding projects taking the REC route, unless the situation is rectified.

Makhija says that apart from the GBI and AD imbroglio, it has also been over five years since a National Action Plan on Climate Change document was released. Other setbacks, according to him, have been the mandatory forecasting for projects, with severe penalty for deviation from scheduled generation, increased credit risk due to delayed payments by state distribution companies, lower-than-expected increase in FITs in some states, severely capacity-limited transmission lines, and the steep rupee depreciation that has affected foreign currency borrowings and cost of turbines using imported components and raw material.

Moving with FITs and Starts

An RPO is a measure to mandate renewable procurement by state electricity boards (SEBs), open access consumers, and captive plants, coupled with FITs. CSE mentions that, while most states introduced their own RPO targets in 2010, none of them abided by them. States with insufficient renewable resources face difficulty in meeting their RPO targets. For instance, Rajasthan reduced its target from 8.5% to 6%. But Tamil Nadu reduced its target from 14% to 9%, despite drawing 9.5% of its electricity from renewables. CSE urges guidelines for states to fix their RPOs, as currently, different states have different rules of thumb on this issue.

Long-term FIT orders have been issued by SERCs to ensure financial obligations of RE developers, as a FIT is the world’s most successful policy mechanism for stimulating the rapid development of renewables. India’s FIT was introduced in 1995 when the Ministry of Non-conventional Energy Sources, the precursor of MNRE, specified uniform FIT of Rs2.25 (3.63 cents)/kWh, with an escalation of 5% per year for all types of RE sources. The National Tariff Policy empowers SERCs to determine preferential tariff for RE sources after taking into account their potential and impact on retail tariffs.

The regulation of RECs is notified by the Central Electricity Regulatory Commission (CERC), the certificate being a market-based instrument to promote RE and facilitate the RPO portfolio by interstate exchange of RECs. The REC mechanism seeks to address the mismatch between RE availability and utilities’ requirements to meet their RPO through a national-level market. One REC is treated as equivalent to 1 MWh.

Ajay Goel, CEO of Bangalore-based Tata Power Solar, says that solar projects, starting from JNNSM Phase I, have been auctioned via a reverse bidding mechanism (companies selected on the basis of quoting the lowest FIT), rather than a predictable FIT that is used all over the world and in India for wind energy projects. “Reverse bidding mechanisms have gained popularity even at the state level, with some notable exceptions,” he indicates. “For instance, Gujarat’s solar program was funded through a FIT mechanism and is considered by many as the most successful to date, and incentive systems should hence be made predictable for solar projects through FIT at both the central and state levels.”

Renewable Industry Growth Scenario

Venkataraman Rajaraman, director of infrastructure and project finance at Chennai-based India Ratings & Research (a Fitch Group company), says India has pushed ahead relatively successfully on RE. Most global original equipment manufacturers have set up manufacturing units in India, and land has not been a major constraint, as the different states help in its acquisition. But he says the sector is constrained by high costs of importing capital equipment, which is heavily debt funded. “Many developers have not hedged these exposures, thus exposing them to the vulnerability of exchange and interest rates,” he says. “Universally, solar power is expensive and unviable but for policy support from the governments, and availability of debt too is generally more difficult than for other renewables.”

Ramesh Kymal, chairman and managing director of Gamesa India, the subsidiary of Spain’s Gamesa Corporación Tecnológica SA, believes that boosting wind power can have a huge macroeconomic impact as it can reduce India’s foreign exchange burden by offsetting the high cost fuel imports. “Wind power is already competitive with new conventional power in some states and may become further competitive on issues like fuel availability and the incremental cost of imported fuel,” he explains. “In recent years, wind PLF has risen to 25% to 30%, primarily due to the new-generation large-capacity turbines and efficient wind park management strategies.”

He says that though constraints like land availability and grid infrastructure are more or less universal for wind, a comprehensive long-term policy framework in Europe ensures a common grid on the continent to be shared by power deficit and surplus countries. “The availability of attractive finance mechanisms and competitive interest rates for wind projects are specific to certain locations, in particular, India,” he adds.

According to Goel, there is a lot more interest in and acceptance of solar-powered products all over the world, including in India, where solar energy is destined to become a mainstream source of power generation. But he feels it is favorable strategies that will help augment installations. “The biggest difficulty in building solar capacities in India arises from a disinclination by companies to invest in manufacturing in the absence of long-term policy support that can make these businesses and capacities viable,” he told POWER. “Favorable policy support can also increase demand and access to financing options.”

Bikesh Ogra, president (solar) of Mumbai-based Sterling & Wilson, says India’s advantage is that its solar sector is incipient and hence has enormous potential for growth, whereas countries like Germany and Spain have reached maturity (Table 3). “Solar in India is, however, troubled by a slow and poor implementation of policies, and difficulty in accessing project financing,” he remarks. Sterling and Wilson, an associate company of the $2.5 billion 148-year-old Shapoorji Pallonji Group, is the largest solar engineering, procurement, and construction company in India and 20th globally. It has commissioned over 200 MW of solar projects in India and is building about 200 MW of solar PV across the world.

|

| Table 3. Installed solar PV capacities (GW). Values are approximate. Source: Sterling & Wilson |

Asset finance and the public market dominate RE financing in India, with venture capital and private equity transactions still limited due to risks associated with renewable technologies. Domestic commercial banks had been hesitant in lending to renewable projects, but this is changing owing to growing awareness and more favorable government policies and targets. State agencies IREDA, the commercial arm of MNRE, and Power Finance Corp. Ltd. have backed the industry as a stable market with assured offtake and no marketing challenges. As capital costs in India are also among the lowest, the country is emerging as a vibrant hub for the supply of towers, blades, generators, and convertors.

Underscoring the high investor interest in Indian solar, 68 companies vied for the latest tender issued under JNNSM Phase II by bidding for 122 projects of a cumulative 2,170 MW, oversubscribing almost three times the allocation target of 750 MW. They included the U.S.’s Azure Power (200 MW), South Africa’s SolaireDirect and India’s Welspun Energy Ltd. (160 MW), Infrastructure Leasing & Financial Services Ltd. (150 MW), and Essel Infra (100 MW). The tender, floated by state-owned Solar Energy Corp. of India (SECI), makes available capital grants from the government, or Viability Gap Funding. Winning bidders will be those who seek the least amount of funding for selling their power to SECI at a fixed tariff of Rs5.45/kWh and Rs4.75 with AD benefit.

Solar and wind tariffs in India are said to be highly competitive (Table 4), with solar PV down from Rs18.44/kWh five years ago to Rs5.45/kWh at present, while that for solar CSP has averaged Rs12-13/kWh. Wind power tariffs, as per orders of the central or state electricity regulatory commissions, range from Rs3.51 per kWh in Tamil Nadu for windmills commissioned after July 2012, to Rs5.92/kWh in Madhya Pradesh fixed for 25 years without any escalation.

Transmission Challenges

Another bugbear for both renewable and conventional power in India has been insufficient transmission capacity, whereas most countries have been promoting renewables by giving them priority grid access. The extremities in power surplus and deficit across India render it imperative for timely and complete transmission of the power generated.

Over a third of the nation’s grid electricity is lost to power theft and inefficiencies, and daily blackouts are a common occurrence. But while generation and distribution gained due focus, transmission, the critical link of power supply with no fall-back option, got downplayed. India has installed capacity of 234 GW yet is able to meet peak demand of only 123 GW, a key reason being lack of transmission lines.

To meet the planned 103 GW capacity addition during the 12th Plan period, the government has allocated Rs180,000 crore ($29 billion) for transmission, apart from Rs306,235 crore ($49.39 billion) for distribution. Overall, the plan requires an addition of 90,000 circuit kilometers of 765-220 kV lines, 154,000 MVA of substation capacity, and 27,350 MW of national grid capacity. Power Grid Corp. of India Ltd. (PGCIL) will be contributing 54% of the investment for transmission, while the balance 46% will be secured from private players.

Makhija points out that resource variability and grid connectivity have been common issues across the world for developing wind energy projects. “In some European countries, wind projects are also facing community issues such as flickering shadows, impact on landscape etc.,” he notes. “But in India, despite having policy provisions for ensuring grid connectivity to RE projects, utilities are unwilling to lay transmission lines due to their low utilization during lean periods and delays in getting budget approvals from the government.” During the high wind season in 2013, 2,200 million kWh or 40% of the total annual generation, were lost in Tamil Nadu due to transmission capacity constraints and backdown (ramping down) carried out by the utility.

The government has newly proposed a Rs43,000 crore ($7 billion) “green energy corridor” to synchronize 42 GW of incremental RE capacity with conventional power stations in the grid by 2016–17. Expected to be developed in three phases, the corridor will be made dynamic to handle the variations in voltage and supply of RE. Intrastate grid upgrading will be the purview of PGCIL, while state utilities will develop the interstate network.

Kymal indicates that the plan includes other related infrastructure such as dynamic reactive compensation, energy storage, smart grid applications, forecasting of renewable generation, real-time monitoring, establishment of RE management centers, electric vehicles, investment, and more. “If the proposed transmission corridor comes online as per the plan, it will remove all bottlenecks at intrastate as well as interstate transmission of RE,” says Makhija.

Balancing Factors

It would be unfair to discriminate against RE sources on the basis of low PLFs and high cost of production. The advantages and disadvantages of increased penetration of RE sources must be assessed vis-à-vis continuing with the conventional sources of energy generation by comparing both on parameters like energy security and independence, environmental effects, and, most importantly, life-cycle costs of electricity generation.

Renewable energy is hence destined to take its place alongside coal and gas in India and penetrate ever deeper into the country. Its unexploited resource availability has the potential to sustain its growth for years to come. After all, the nation’s, and its 1.2 billion people’s, energy security depends on it. ■

— Sarosh Bana (sarosh.bana@gmail.com) is executive editor of Business India.