Even though it enjoys sizeable coal and natural gas reserves, Indonesia struggles to provide electricity to its growing economy. Geography is its most obvious challenge. Others include evolving international markets and an energy sector that remains highly politicized.

A vast Southeast Asian archipelago of more than 17,500 islands that straddles the equator, Indonesia has become an established and crucial player in the world’s energy markets. It is endowed with some of the world’s largest reserves of fossil fuels, and in 2011, it was the world’s largest steam coal exporter and the eighth-largest natural gas exporter. Yet, today, energy security has become Indonesia’s paramount challenge. And it appears it will be the country’s preoccupation until at least 2020.

At the heart of the issue is that the economy of world’s fourth-most-populous country (after China, India, and the U.S.), with 243 million people, has been booming at an enviable annual rate of 6% since 2010. But so has its domestic energy consumption, which surged by more than 50% over the past decade on the back of an emerging consumer class. This consumption growth has forced the country to halt exports of oil, temper its natural gas exports, and redirect nearly a quarter of produced coal for domestic production of electricity.

On the other hand, compounded by its geographic complexity, without available electricity imports, and reluctant to rely on diminishing domestic oil supplies that fuel off-grid diesel generators on the nation’s 6,000 inhabited islands, the country has been stricken by a critical undersupply of power. Though it is one of Southeast Asia’s biggest economies, it has one of the lowest electrification rates in the region. This dilemma is underscored by forecasts suggesting that between 2009 and 2019, national electricity demand will increase by an average 9% per year and reach 328.3 TWh in 2020—more than double last year’s figure of 162.4 TWh.

The government’s solution is to seek massive power capacity increases, and it recently embarked on an ambitious plan to add at least 55.3 GW of new capacity and at least 49,299 kilometers of new transmission lines within the next decade. Can Indonesia bypass a number of hurdles and resolve its energy dilemma?

Addressing an Existing Crisis

It is important to note that the country has been long-steeped in a festering electricity crisis characterized by rolling blackouts lasting, on a national average, about 3.8 hours per day, according to 2009 figures. As Dr. Mika M. Purra of the Center on Asia and Globalization at the National University of Singapore points out, power shortages have been routine since Indonesia’s independence from the Netherlands in 1949. Moreover, Purra asserts that while modernization of the power sector has been a specific goal of the government since 1998, a “historical narrative reveals repetitive attributes that have continuously stalled any serious efforts to reform the sector, thus causing significant harm to the state, its economy and the general public.” ±±One pervading issue is that the governance structure is based on the dominance of state-owned enterprises, and until recently the government functioned on a constitutional mandate as the sole provider of electricity for the nation. Under the authoritarian regimes of former Presidents Sukarno (1945–1967) and Suharto (1967–1998), the principles of bureaucratization were reinforced and did little to change the structure of state-owned power entity Persero-Perusahaan Listrik Negara (PLN), which held an iron-grip monopoly on the country’s generation, transmission, and distribution.

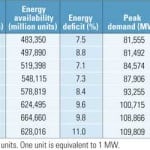

Only after the Asian financial crisis of 1997–98 and the fall of Suharto’s regime did fundamental changes in the power sector come, Purra says. The new era of democratization of political process achieved, among its most notable changes, passage of Energy Law No. 30 in 2009 (Figure 1). The landmark law allows independent power producers (IPPs) to generate and sell electricity to end users in the Indonesian market, ending PLN’s 60-year-long monopoly as the single electricity supplier in Indonesia.

|

| 1. Major players. In a power market regulatory upheaval, Indonesia’s Energy Law No. 30, passed in 2009, allowed independent power producers (IPPs) to begin generating and selling electricity. But state-owned power company Perusahaan Listrik Negara (PLN) generated about 75% of all power in 2012, remains heavily subsidized, holds a monopoly on transmission and distribution grids, and functions as the system operator. This chart shows the major players in Indonesia’s electricity system and how PLN generates revenues and receives subsidies. Source: Differ Group, “The Indonesian Electricity System—A Brief Overview,” differgroup.com/analysis, 2012 |

Trickling Change

The election of President Susilo Bambang Yudhoyono in 2004 ushered in more reforms, including policies to create an attractive climate for investment in energy infrastructure, to mitigate pollutant emissions, and to scale up renewables. But Purra isn’t convinced that the sector has been transformed enough. “Despite numerous and on-going attempts to reform, restructure and vitalize the sector, the sector continues to suffer from grave inefficiencies that bear on market participants’ profitability, hinders overall economic growth, and maintains an untenable and uncertain environment for foreign investors,” he points out.

One gripe is that today PLN continues to be the sole purchaser of electricity and the second-largest state-owned enterprise in Indonesia. It still owns and operates about 75% of the country’s generating capacity, it has retained its monopoly on the transmission system, and it continues to function as its system operator (Figure 2). Moreover, the entity is responsible for the country’s electricity supply through the “right of first refusal” clause, and IPPs can only serve areas that have been declined by PLN and are not included in PLN’s plans for electrification. Decentralization following implementation of the new energy law has, meanwhile, increased the autonomy of regional authorities for the sake of increasing rural electrification, to ease the implementation of new projects, and to stimulate collaboration between regional authorities and private actors.

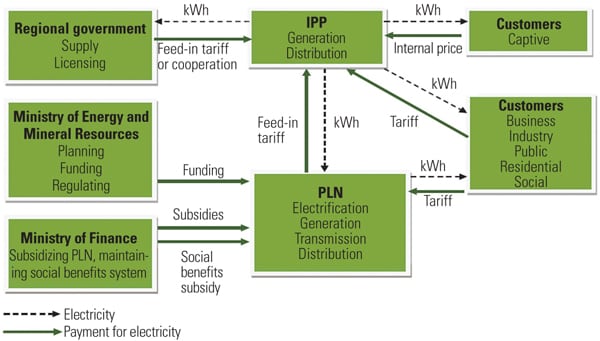

|

| 2. Indonesia’s power system today. In 2012, 41.5% of Indonesia’s 200,291 GWh was consumed by households. Industry and commercial users consumed a combined 52.4%. Source: PLN |

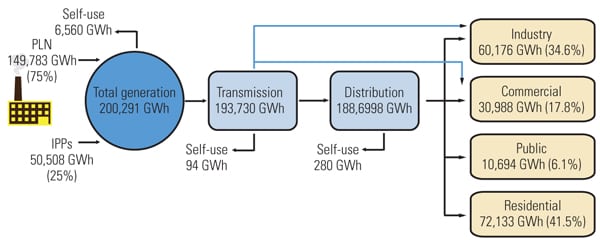

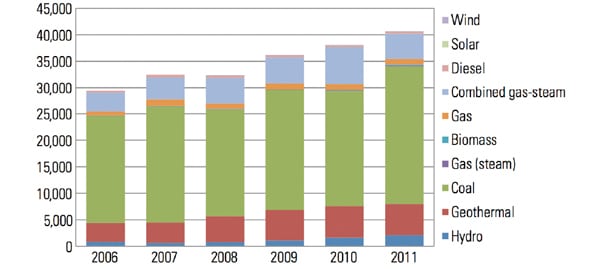

Some improvements are certainly apparent, however. In 2005, recognizing that PLN could not independently fund infrastructure growth because it heavily depends on government subsidies, and to attract private investment to the sector, the government enacted new Public Private Partnership (PPP) legislation. The following year, it announced stage 1 of a “fast-track” program that would be followed by a second program in 2010; each stage seeks to accelerate development of 10 GW of new capacity, and the second part is specifically geared to the growth of IPPs and renewable energy. Though stricken by debilitating delays and regulatory hurdles, both measures have been arguably successful. Compared with 2006, PLN increased its total annual generation by 37% in 2011 (Figure 3), while generation from IPPs also increased substantially (Figure 4).

|

| 3. An achievement. Between 2006 and 2011, PLN increased total annual generation from its power plants by 37%, to 142,739 GWh. Though solar, wind, and gas engines are included, their contribution to the total is too small to show up. Courtesy: Handbook of Energy and Economic Statistics of Indonesia (2012) |

|

| 4. PLN power purchases from captive power plants and IPPs. Also between 2006 and 2011, PLN increased the amount of power purchased from emerging independent power producers and captive power plants, for a total in 2011 of 183,419 GWh—a 38% increase compared with 2006. Courtesy: Handbook of Energy and Economic Statistics of Indonesia (2012) |

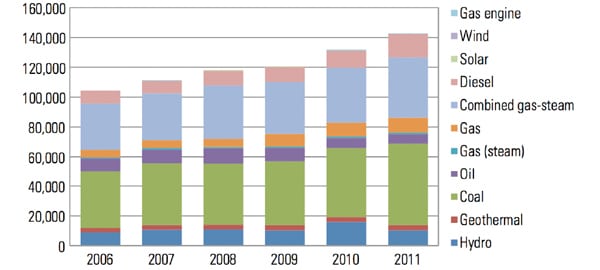

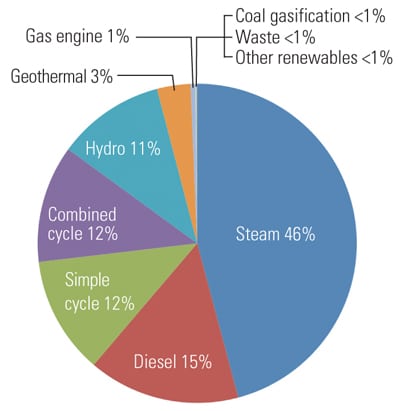

In 2011, meanwhile, coal, oil, and gas power plants made up 46% of Indonesia’s power capacity. Diesel, used to fuel off-grid capacity on remote islands, held the second-largest share at 15% (Figure 5).

|

| 5. Installed capacity, 2011. In 2011, Indonesia’s installed power capacity amounted to 39.9 GW, the bulk (16.3 GW) of which was steam (coal-, oil-, and gas-fired) power. The nation also had 5.5 GW of diesel capacity, more than hydro’s 3.9 GW share. About 1.25 GW of nameplate renewable capacity—including geothermal, wind, solar, and mini and micro hydro—had been installed. Source: Handbook of Energy and Economic Statistics of Indonesia (2012) |

Pressing Forward

Propelled by an ambition frequently reiterated by the decade-old administration of President Yudhoyono to transform the country into one of the world’s 10 major economies by 2025—and lift millions of its citizens out of poverty—Indonesia in 2011 published the “Master Plan for Acceleration and Expansion of Indonesian Economic Development.” It includes more than 500 projects throughout the country as well as six development corridors aimed at creating economic clusters in various industrial sectors. Among its key elements is a $96 billion injection to boost the country’s ailing power infrastructure. It calls for the installation of least 55.1 GW of new generation capacity and 49,299 km of new transmission lines by 2020 (Figure 6).

|

| 6. Banking on coal. To ensure economic growth, Indonesia projects it will need to develop at least 55.1 GW of new power plant capacity by 2020. State-owned utility PLN will add at least 31 GW, while independent power producers are expected to add another 24 GW. At least 65% of the new additions will be coal-fired, while about 12.2 MW will be from renewables. Source: PLN |

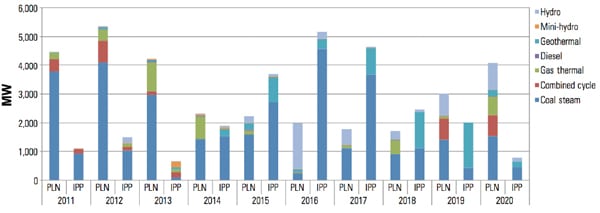

Modeled on the master plan, PLN later released its own business plan, outlining how the nation’s power supply could be more than doubled over the decade-long planning period. Significantly, it specifies that IPPs will contribute 43% of the total capacity needed: PLN will add 31.5 GW and IPPs will add 23.8 GW by 2020.

Coal. Sitting on at least 6.1 billion short tons of recoverable coal reserves—mostly bituminous or subbituminous and located primarily in Sumatra and East and South Kalimantan—Indonesia in 2011 overtook Australia to become the world’s largest exporter of coal by weight. Though the bulk of the country’s mined coal is exported, the government has encouraged coal-fired power generation by setting a 20% domestic market obligation for producers and touting use of its relatively abundant domestic supplies as one way to reduce dependence on expensive diesel and fuel oil.

However, most projects outlined by PLN’s plan to install at least 35.6 GW of new coal-fired capacity by 2020 have been plagued by delays. About 17 coal plants (almost 3 GW) are under construction. At least 10 of these 17 (a total of 1,700 MW), most in Kalimantan and the eastern part of the country, are expected to come online this year, while the remaining seven should be completed next year. Construction on another 10 coal-fired plants with a total capacity of 2.4 GW will also begin this year, PLN indicates, including those in Pacitan, East Java (630 MW); Pelabuhan Ratu, West Java (1,050 MW); Barru, South Sulawesi (100 MW); and Nagan Raya in Aceh (220 MW).

Last year saw the completion of two new 660-MW units at the Tanjung Jati B power plant in Central Java (a POWER Top Plant—see the October 2012 issue). The 815-MW PTLU Paiton Unit 3, a supercritical plant in East Java, also came online, making the 2,035-MW Paiton complex the biggest IPP project in the country, while Japan’s Marubeni Corp. recently completed the 660-MW supercritical Cirebon Electric Power station in West Java (Figure 7).

|

| 7. At the top of the heap. At least 17 new coal-fired power plants with a combined capacity of about 3 GW are under construction in coal-rich Indonesia. In July 2012, Japanese firm Marubeni Corp. and partners Indika Energy, Korea Midland Power Co., and Santan Co. began commercial operation of the single-unit 660-MW PT Cirebon Electric Power station, shown here. The $877 million plant in West Java was built under the independent power producer program. A second unit at the site is being discussed. Courtesy: Marubeni |

Among notable projects in the pipeline are foreign investment consortium PT Bhimasena Power Indonesia’s 2-GW ultrasupercritical plant in Central Java. That $4 billion project, the first procured under PPP regulations, is on track to come online by 2017, even though developers are struggling to acquire the approximately 226 hectares of land (they have acquired 186 hectares) the planned plant needs. Several local landowners have reportedly accused the government of using forms of violence and intimidation when acquiring their land. An official with the coordinating economic ministry was widely quoted this May as saying the government would do everything to ensure the project proceeds as planned, saying failure would deter prospective foreign investors that could boost Indonesia’s infrastructure.

Natural Gas. Indonesia is among the world’s five biggest natural gas producers and, with 141 trillion cubic feet of proven natural gas reserves (as of January 2012), it has emerged as a major exporter of pipeline and liquefied natural gas (LNG), more than half of which is relayed to Japan. Since 2004, however, domestic consumption of natural gas has more than doubled. Compounded by production problems, this has forced the country to buy spot cargoes of LNG to meet export obligations and has prompted the country to consider imposing a moratorium on gas exports. Meanwhile, policy makers last year initiated four studies to assess the nation’s shale oil and gas potential, though no blocks have been yet awarded to investors.

One reason for increased domestic gas consumption, which accounted for 42% of total production in 2011, is the country’s declining oil production and reliance on natural gas for transportation. Government policies also emphasize that the country’s gas resources should support the nation’s economic development and prosperity, and the government allocates gas supply in a hierarchical order, led by the petroleum operation sector, the fertilizer feedstock sector, and then the power sector. Additionally, plans suggest that future new generation will be largely dependent on coal instead of gas.

Even so, PLN’s plans for capacity growth call for at least 3.3 GW of new combined cycle power and 4.1 GW of gas thermal power. This March, Australian firm Energy World Corp. put into service the first of two 60-MW phases to expand the 255-MW Senkang Combined Cycle Power Plant in South Sulawesi.

Renewables. The primary reason coal- and gas-abundant Indonesia is looking to renewables is because the government predicts that in the “near future,” fossil fuel energy reserves “will run out and Indonesia will heavily depend on imported energy,” as Energy and Mineral Resources (EMR) Vice Minister Rudi Rubiandini said in a statement in December. The government had recently accelerated efforts to develop renewable energy sources, which had much potential but were vastly underdeveloped, he noted. A 2006 presidential decree, for example, mandates the increase of renewable energy production to 15% by 2025. Though the Master Plan outlines substantial growth for hydro, wind, and solar, geothermal and biomass are slated to see the most growth.

Geothermal. Situated in the volcanic “Ring of Fire” that circles the Pacific Ocean, Indonesia has one of the world’s largest geothermal resource potentials, estimated at about 27.5 GW. Less than 5% of this potential has been developed so far, or about 1.2 GW, centered in six geothermal fields in Java (Figure 8), North Sumatra, and North Sulawesi. The government has outlined goals to install 9.5 GW of geothermal capacity by 2025, so that the resource will account for about 6% of the country’s energy consumption.

|

| 8. A mountain to climb. The 220-MW Wayang and Windu power station 200 km south of Jakarta is Indonesia’s biggest geothermal power producer. The plant in a volcanic region carpeted with tea and quinine plantations is named for Mt. Wayang and Mt. Windu in West Java. The power is sold into the state-owned power utility’s West Java high-voltage grid. Courtesy: Business Wire |

Four private sector–financed projects have so far managed to conclude power purchase agreements under the Fast Track II program. This April, U.S.-based Ormat Technologies became the fifth, as it began developing the three-phase 330-MW Sarulla geothermal power project in Tapanuli Utara, North Sumatra. The $254 million project will be the largest single geothermal contract when completed, as expected by the end of the decade.

Biomass. Biomass resources have an estimated production potential of 49,810 MW, but fewer than 1,000 MW have been developed to date. However, several companies have tapped into fast-growing crops such as cassava, jatropha, and sweet sorghum for biofuel development. GE, in partnership with PLN, has begun developing a pilot program that will use wood chips to fuel the U.S. company’s integrated biomass gasification technology to generate 1 MW. The project is expected to demonstrate the viability of biomass to generate power in remote areas such as Sumba and other islands.

Hydro. Indonesia’s mountainous island topography makes it ideal for large and small hydropower facilities, but though PLN estimates 75 GW of power potential for hydro, only 5 GW have been developed. While the Master Plan calls for at least 2.8 MW of new micro-hydro capacity by 2020, PLN last year identified 96 potential hydroelectric power sites that could offer at least 12.8 GW.

Several projects are now under construction, including the World Bank–financed 1,040-MW pumped storage plant at the catchment of the Upper Cisokan River in West Java. The $800 million plant is slated for completion in 2016. Chinese state-owned firms, in particular, are spearheading development of large-scale hydro plants such as the 110-MW Jatigede plant (Figure 9) in West Java. In late May, China Power Investment Corp. proposed a $17 billion, 7-GW hydroelectric plant in Indonesia’s North Kalimantan region, and work is expected to begin next year.

|

| 9. Streaming in. The 110-MW Jatigede Hydropower plant under construction on the middle reaches of the Cimanuk River in Sumedang Region, West Java Province, is expected to be completed in early 2014. China’s Sinohydro Corp. is building the $227 million plant under a concession loan from the China Exim Bank. Courtesy: Sinhydro |

Nuclear. Though nuclear capacity is not included in PLN’s plans, a 2006 presidential decree calls for four nuclear power plants to be built in Indonesia by 2025. The country already has three experimental nuclear reactors and at least two uranium mines. Despite the Fukushima accident in March 2011, the quake-prone country seems determined to build new “modern” (possibly thorium) reactors. According to media reports, the Indonesian government has $8 billion earmarked for the reactors that could be built in Central Java and Bangka Island, off the north coast of southern Sumatra.

Grid. Consisting of eight domestic interconnected systems and 600 isolated grids—all operated by PLN—Indonesia’s power grid is characterized by high transmission losses and electricity theft.

Meanwhile, plans are under way by leaders of the Association of South East Asian Nations (ASEAN), a geopolitical and economic organization, to develop a grid that will interconnect its 10 resource-rich Southeast Asian country members by 2020. The project consists of 14 links, at least two of which will link Indonesia to Peninsular Malaysia and to the Asian mainland.

A Need for Higher Power Tariffs

The EMR’s Rudi in December warned that along with minimizing the supply gap to avert a future energy crisis, the nation would have to push for energy efficiency measures. Rudi recognized that complicating Indonesia’s challenges is a government commitment to electrify 99% of the country by 2020—up from about 76% in 2012. Subsidizing energy “caused Indonesian behavior trends to be consumptive and wasteful on energy use,” he cautioned.

Several funding entities have echoed Rudi’s concerns, saying that PLN’s income from operations alone is “insufficient” to achieve Indonesia’s goal to extend electricity to nearly 20 million citizens. The problem’s cause is simple: Tariffs have been set low by the government for social reasons, but the “cost of generation is much higher than the average tariff,” notes the Asian Development Bank.

To bridge the deficit, the Ministry of Finance (MoF) provides funding to PLN, which is referred to as the Public Services Obligation (PSO). But because the PSO is critical to PLN’s solvency, that means for IPPs like Japan’s Marubeni—which recently built the Cirebon supercritical plant—arranging long-term dollar-denominated project finance requires “certain government guarantee/support to be issued from the MoF to assure PLN’s payment obligations,” a spokesperson told POWER. Analysts note, however, that government support is now only available for projects within the “fast track” Stage II or PPP programs.

Change is under way, albeit slowly. Recognizing the burden on progress posed by artificially depressed power tariffs, the House of Representatives has made good on efforts to increase tariffs by 15% this year, starting with a 4.3% increase in January and an additional increase every three months. This hasn’t boosted PLN’s bottom line yet, however. As the Jakarta Post reported in April, the utility reported a 41% drop in net income last year, losing $330 million on foreign exchange losses, increased operating expenses, and rising fuel costs. Though it saw a revenue hike of about 12%, about 44% of PLN’s revenue came from state subsidies, the newspaper reported.

Land Acquisition and Finance Hurdles

Nevertheless, reforms to encourage foreign investment in the country’s power sector seem to have been successful. Currently, no “major” regulatory or legal impediments involve foreign investment in the power sector, experts claim, though they outline a list of hurdles that must be overcome beyond that. Among them, as a recent analysis from the U.S. Embassy in Jakarta notes, are “[a]ccess to financing, protracted land acquisition processes and legal uncertainties,” which “can still cause bottlenecks in infrastructure projects in the sector and serve as a deterrent to doing business in Indonesia.”

These are serious issues that are hindering even PLN from gaining ground on its fast-track program. The company’s construction director, Nasri Sebayang, told the Jakarta Post this April that at least 36 out of 52 geothermal projects in the second stage of the program are lagging and would not meet the projected 2016 deadline. Six plants with a total capacity of 360 MW are delayed because they are located in conservation forests, while 16 other projects with a capacity of 1,510 MW face technical issues. Of the 9.9 GW projected for the first stage of the first-track program, only about 45% are in operation, while just 46% (about 4.7 GW) of the second stage was on track to come online on time.

Attracting IPPs has been Indonesia’s most vital challenge as it tackles the growing demand for power, the strain on the cost structure system, and the underutilization of energy resources. In 2010, a presidential regulation (amended in 2011) established the Fast Track II program, which consists of 44 coal, gas, geothermal, and hydropower power projects totaling 10.1 GW—3 GW of which have been reserved for IPPs. Some IPP projects are procured under the country’s 2011-amended PPP framework, which could provide infrastructure guarantees and may provide fiscal and nonfiscal government support to improve their feasibility.

Recent liberalized laws also allow power generators to sell electricity to entities other than PLN, though a 2010 regulation stipulates that foreign ownership of any power project above 10 MW is limited to 95%; Indonesian entities or individuals must own the remaining 5%.

Other factors that could temper enthusiasm for developing power projects in the country involve land acquisition and permitting. PLN generally expects developers to acquire all land needed for a plant site and transmission lines needed to connect to the nearest substation (a corridor typically 20 km to 40 km in length) before the financial closing date. However, the process of land acquisition can be complicated, given that Indonesian law broadly recognizes numerous forms of unregistered land, including Adat (or native title), which sometimes makes it difficult to ascertain the identity of land owners. And because the law forbids foreign-owned companies to hold unregistered land, converting rights to registered land can be a lengthy and expensive process.

Among the permits required—which are prone to delay or blockage—are those from the Ministry of Forestry to “borrow” forest area to build power projects. Then a variety of permits are required from government departments or ministries, including the approval of an environmental impact assessment, a business license, an electricity business license, and a certificate of operation worthiness.

Nevertheless, several experts agree that Indonesia’s economic fundamentals and emerging regulatory framework are beginning to synchronize. Some even express “renewed optimism” in the investment sector.

But others decry the high degree of politicization of the system, pointing to a failure to reform PLN, which, as Purra describes it, has become an “untouchable behemoth that is allowed to continue to dictate the future direction of Indonesia’s electricity sector.”

— Sonal Patel is POWER’s senior writer.