Japanese firm JERA, a joint venture between TEPCO and Chubu Electric, on Oct. 13 issued a roadmap to achieve zero carbon emissions by 2050. The move is notable for the company whose business includes a sizable global liquefied natural gas (LNG) portfolio of five upstream projects, 20 fleet carriers, an LNG tank capacity that is equivalent to 30% of Japan’s tank capacity, and 11 LNG terminals in Japan. It also owns 27 thermal power stations in Japan, which have a total capacity of 70 GW, and another 30 power projects, including renewables, in more than 10 countries, which amount to about 9 GW.

Under its roadmap, JERA plans to shutter its entire 2.2 GW supercritical coal power generation fleet in Japan by 2030, and then gradually increase the ratio of mixed combustion of fossil fuels to ammonia and hydrogen at ultrasupercritical plants.

|

|

1. JERA’s 4.1-GW Hekinan Thermal Power Station is one of the world’s biggest coal plants. The plant houses five units. Units 1, 2, and 3 are 700-MW units that opened between 1991 and 1993, and Units 4 and 5, 1 GW each, opened in 2001 and 2002. Courtesy: JERA |

Co-Firing Planned at a 4.1-GW Coal Plant

That effort will begin within the next decade with projects to demonstrate ammonia co-firing at the 4.1-GW Hekinan Thermal Power Station in Aichi Prefecture (Figure 1), and a hydrogen co-firing demonstration at another power plant. Over the next decade, JERA also plans to promote offshore wind power projects and further improve the efficiency of LNG thermal power generation. In the first half of the 2030s, the company wants to achieve a 20% ammonia co-firing rate at all its coal plants, and it is seeking to shift to 100% ammonia by the 2040s. It notes, however, that its zero-carbon business strategy will depend heavily on “advances in decarbonization technology, economic rationality, and consistency with government policy.”

To that end, JERA is developing the decarbonization technologies it plans to use. Its ammonia plans stem from a collaboration with Japanese giants IHI Corp. and Marubeni Corp., along with Australian natural gas and LNG producer Woodside Energy. The companies launched a feasibility study with Japan’s New Energy and Industrial Technology Development Organization (NEDO) this March. Slated to wrap up in February 2021, the study will essentially involve a technical analysis to inform JERA’s demonstration for direct use of ammonia as a fuel source in pulverized coal boilers, as well as evaluate the economics of equipment costs, operational costs, and the costs of producing and transporting ammonia.

Interest in Ammonia Is Growing

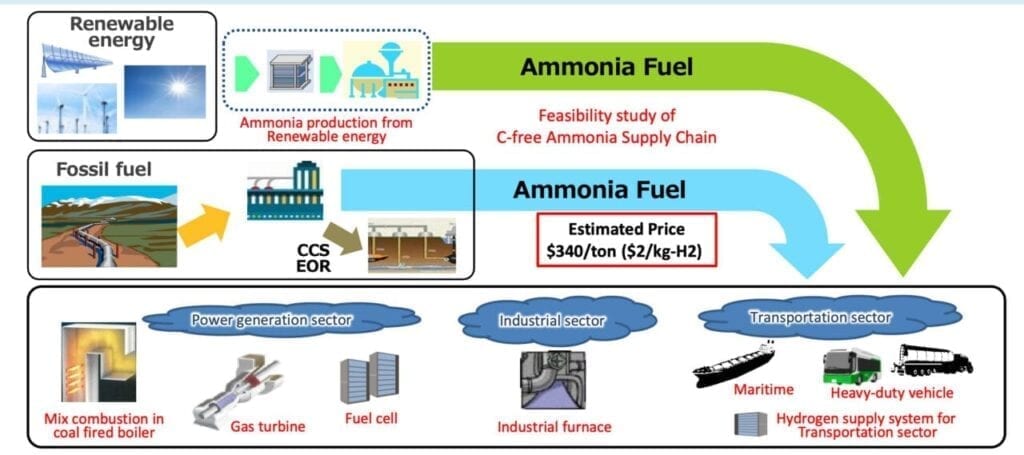

Ammonia—a compound of nitrogen and hydrogen—“can efficiently transport and store hydrogen at low cost and in addition to its role as an energy carrier, it can be directly used as fuel in thermal power generation,” the companies explained. According to the Ammonia Energy Association (AEA), interest in exploring the gas as a decarbonizing fuel has soared of late because it does not emit carbon dioxide when it is burned. To date, the 2004-established industry coalition has 76 members. Its power generating members include AES, Arizona Public Service, ENGIE, ITM Power, Nebraska Public Power District, Origin Energy, Shell, Total, and Tri-State Generation and Transmission.

IHI, JERA, and Marubeni, notably, are board members on Japan’s Green Ammonia Consortium, and their emphasis on ammonia is backed by Japan’s International Resource Strategy, which the Ministry of Economy Trade and Industry (METI) issued in March. The strategy explicitly calls for demonstration projects to promote ammonia as a fuel. Japan, notably, also announced on Oct. 28 it will seek to be carbon neutral by 2050, a shift that will require a fundamental revision of its policy on coal plants.

But as the AEA noted, much progress has already been achieved in Japan, led mainly by IHI, which is already developing a broad portfolio of ammonia fuel technologies, including a solid oxide fuel cell, gas turbine, industrial boilers, and co-fired thermal power boilers. Ammonia-coal co-firing has also already been demonstrated, first by Chugoku Electric in July 2017 at its 156-MW Mizushima Thermal Power Station Unit 2 with a fuel mix composed of 0.6% to 0.8% ammonia, and then by IHI in March 2018 at a “large-capacity combustion facility” in Aioi City, with a fuel mix composed of 20% ammonia. As Bunro Shiozawa, a senior associate at Sumitomo Chemical Co., wrote in an AEA blog post this October, IHI’s demonstration, which involved a coal-ammonia burner that can be attached to an existing coal plant, confirmed that at 20% ammonia co-firing carbon emissions decreased 20%, and while nitrogen oxide could be largely reduced, the boiler’s heat rate did not change significantly.

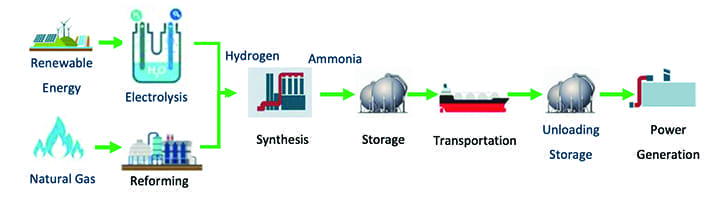

Under the study with NEDO, four companies plan to survey the full ammonia-coal lifecycle from ammonia production to power generation (Figure 3). IHI plans to evaluate the thermal efficiency of ammonia co-firing using a numerical analysis, but the company will also study ammonia storage and supply facilities, as well as ammonia co-firing burners.

|

|

3. A March 2020–launched feasibility study being conducted by three major Japanese coal generators and an Australian gas producer, in collaboration with Japan’s New Energy and Industrial Technology Development Organization, will evaluate all aspects of ammonia-coal co-firing from production to power generation. Courtesy: JERA |

JERA’s role in the feasibility study involves identifying and resolving challenges related to the application of ammonia co-firing in commercial coal plants. It will also study specifications on ammonia storage, vaporizers, and evaluate necessary costs and capital investments. Marubeni will look into methods to tamp down the carbon footprint of ammonia, and to improve its transportation efficiency, including by using larger-sized vessels to reduce costs. Finally, Woodside will study challenges related to realizing large-scale ammonia production plants and assess ways to reduce production costs.

Other notable industry initiatives to explore ammonia power associated with the Green Ammonia Consortium include Mitsubishi Power’s agreements with Indonesia’s Bandung Institute of Technology in May to “probe new fuel technologies using ammonia and hydrogen to reduce greenhouse gas emissions, and to enhance technologies for diagnosing the operation of Indonesia’s power plants through use of artificial intelligence (AI) and big data analysis.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).