Larger changes in the power industry are shaking up the engineering, procurement, and construction (EPC) business in the U.S. and abroad. Experts explain how the industry is fielding business impacts, end-market diversification, a change in contracting models, and the digital transformation.

The rapid and relentless energy transition has affected all power stakeholders, but none, perhaps, with as much complexity as firms engaged in engineering, procurement, and construction (EPC) services. These firms, which typically carry out contracts with a large scope, have historically evolved into an industry standard for power plant construction, generally managing all aspects of a project for a developer, and defining relationships with a vast array of subcontractors and equipment vendors.

Contracts, which are always customized to a project and its scope, generally cover plant engineering and design, including initiation, implementation, planning and programming, and estimation and valuation. On the procurement front, an EPC firm will often conduct purchase, installation, performance, and warranty of all equipment, such as turbines, generators, and cooling towers. And on the construction front, EPC contractors must adhere to schedules, from ground-break to startup and commissioning, all while assuring quality.

The complexity of each of these tasks is exacerbated by numerous developments in recent years, driven primarily by the changing nature of the sector itself. Nearly all stakeholders POWER asked in December to outline key trends affecting the EPC business, for example, noted the changing profile of new construction projects. The most prominent shift is that industry is moving away from building larger, baseload power plants and toward smaller projects.

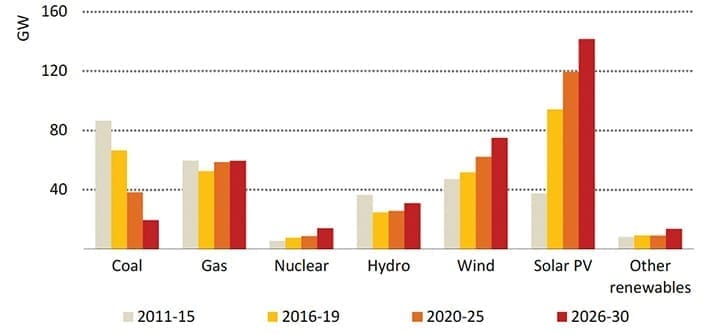

According to the International Energy Agency’s (IEA’s) World Energy Outlook 2020, under a “stated policies scenario,” solar PV is expected “to continue to be the favourite for new construction, bolstered by short construction times, very low levelised costs, ready availability of manufacturing capacity and the scope it offers to reduce pollution.” Wind is also set for strong growth (Figure 1), as the offshore wind industry matures and onshore development continues, spurred on by increasingly competitive pricing. The IEA suggests other sectors, including hydropower and nuclear, will see “modest growth.” Hydropower’s construction may be impacted by a scarcity of suitable sites for large-scale projects, and while optimism for the nuclear sector is tangible—with construction slated in new entrant countries—policy and investment may determine the build-out of future nuclear.

|

|

1. Power plant construction is continuing a shift away from larger, coal-fired projects toward solar PV, wind, and other renewable sources. “Other renewables” in this graph include concentrating solar power and geothermal. Courtesy: IEA (2020), World Energy Outlook 2020, OECD Publishing, Paris. |

The Investment Space Is Changing

As the IEA pointed out, 2020 was an extraordinary year. Owing to the global COVID-19 pandemic, investment in the global power sector—which had already been falling since 2016—was projected to fall to its lowest level in more than a decade in 2020. “This marks a dramatic break from the situation at the start of the year, when company expectations, capital expenditure planning and ongoing capacity expansion activities suggested a rise of around 2%,” it said. The pandemic also prompted physical restrictions and new uncertainties over equipment demand, causing delays and disruptions, especially to renewable supply chains in the first half of the year.

But even before the pandemic, financial investment decisions (FIDs) for large-scale dispatchable power—coal, gas, nuclear, and hydropower—totaled 86 GW, an 8% reduction compared with 2018 and almost 60% lower than in 2010. “This is the lowest level in a decade,” the IEA noted. “Among these sources, FIDs for gas-fired generation were the only ones to see an increase (for the first time since 2015), to over 55 GW,” it said. Meanwhile, FIDs for utility-scale renewables also decreased in spending terms by 2% in 2019, despite divergences between technologies. Utility-scale solar PV FIDs decreased by 20%, owing in part to higher regulatory uncertainty and more competitive pressure in developing markets, such as China and India. Although onshore wind FIDs remained flat, offshore wind FIDs increased by 70% and hit a record of $40 billion, with investors showing high appetite in China, Chinese Taipei, Germany, and the UK.

Another notable trend in the EPC business is that changing market profiles and financing mechanisms have opened new avenues for non-traditional players to make an entry into the global market. According to IHS Markit, this trend has played out especially in the solar PV sector, which is seeing “a new wave of consolidation and some reshuffling among the market leaders.” In 2019, the 30 largest EPC providers installed 28 GW of non-residential PV, representing 26% of the total market, the research firm said in October. “This increase from 21% in 2018 stems mainly from a growing concentration in the Chinese PV market, as well as integrator concentration in rapidly growing markets like Spain and Vietnam,” it said.

Finding New Avenues for Growth

For traditional EPC firms, the downturn in the conventional business and pandemic-related hurdles—to include increased material costs, contract extensions, and even extended schedules—generally exacerbated already thin margins. To address risk, some major firms have shifted their primary focus, while others have left the power space altogether.

In October, AECOM sold its power construction business as part of an effort to execute a “transformation into a higher-margin, lower-risk Professional Services business.” And in December, Fluor told POWER it was no longer active in the power generation market “other than its investment in NuScale Power,” a small modular reactor. Meanwhile, in the fourth quarter of 2020, Black & Veatch (B&V), Siemens Energy, General Electric, and Toshiba Corp. all announced a departure from the new-build coal power market to focus on lower-carbon energy.

Others, like Kiewit Energy Group (KEG), are developing business in renewable markets to diversify revenue streams and customer options. “If we want to be solution providers for our power clients, we need to be able to do everything in their portfolio, and that includes all types of renewable energy projects,” Stephen Packard, who leads Kiewit’s efforts in renewables, said in September. “We believe right now that the biggest market we have is solar, with projected revenue of $500 million to $600 million in the next three years.”

A notable aspect of KEG’s strategy is that it plans to bring the EPC model to the renewables market, a prospect that has generated a lot of interest from clients and potential clients, it said. However, according to Jake Strickland, Kiewit solar business line manager, while there’s nothing complex about solar, it offers unique challenges. “Solar is a quantity problem. When you have 1.3 million solar panels on a 600-MW job and you’re off by two minutes a panel, it can scale up to millions of dollars,” said Strickland. “Every second, every minute counts in solar because of the quantity involved. It’s repetitive, but with massive quantities, and that’s the challenge.”

The Promise of Emerging Markets

Greg Brown, senior vice president of Global Sales and Marketing within B&V’s power business, told POWER that B&V is looking into potential opportunities within emerging markets, including for battery and alternative energy storage, as well as in distributed energy. Brown also pointed to potential growth related to renewables integration.

“Across the U.S., from the PJM Interconnection in the East to large utilities in the Midwest and major utilities out West, transmission-owning utilities and transmission organizations continue to see increases in transmission interconnection requests, most tied to remote utility-scale renewable generation. Such demand isn’t expected to decline any time soon, and it could be further enlarged should proposed offshore wind power projects off the East Coast move ahead to construction,” he said.

Another potentially lucrative prospect: hydrogen. “New power generation technologies harnessing green hydrogen produced through renewable power and more advanced battery storage show growing promise in the quest for global decarbonization,” Brown said. “There is growing interest in using or adapting existing infrastructure to employ hydrogen as a fuel source, given its potential in power generation and storage, advanced transportation and fuel-cell technology, and as a feedstock for green chemicals, as well as the processing of blue hydrogen with carbon capture technology.”

Meanwhile, Brent Bergland, market director for Energy Storage and Solutions at Mortenson, told POWER that his company sees growth in hybrid projects. Technology improvements and better international availability of major equipment could transform the EPC business in that space, he said. “In particular on solar + energy storage projects, we are seeing developers and independent power producers push greater integration responsibilities onto EPCs,” Bergland said.

The Allure of Advanced Technology and Digitalization

Beyond addressing their changing market prospects, many EPC firms are heavily invested in improving bottomlines through integrated efficiency and technology advancements that promise to transform engineering and construction. Emerging cost-saving solutions include modularization and prefabrication design, which could help save material and labor costs, and ensure better design and quality control, as well as shorten project schedules and minimize budget overruns.

Another is to use advanced construction materials, such as durable or high-strength concrete and self-healing materials. Advanced materials could increase up-front costs, but significantly reduce operating and maintenance costs. “This could become a key trend as the industry embraces more streamlined and connected approaches through the project life cycle, beyond Design-Build-Operate to better Own and Maintain as well (DBOOM),” said consulting firm Deloitte.

The industry has also seen an investment uptick in digital technology that could, for example, enable better collaboration, provide a greater control of the value chain, and allow for more data-driven decision-making. On the engineering front, automated parametric design and object libraries could transform the design process, while on the procurement front, digital supply networks that use machine learning and cognitive computing could help calibrate demand and supply of construction material and plant equipment.

Meanwhile, an assortment of technology is already widely in use to streamline construction, including digital twins and autonomous rovers and drones. However, while these innovations could change the way EPC firms approach operations, design, and construction, as well as engage with partners, they pose a specific, ongoing skills gap that can create a mismatch between the available employees and necessary skills, said Deloitte.

Legal and Policy Considerations

Reflecting the dynamic nature of power plant projects, meanwhile, are contracts that address emerging risks. Contracts, which are complex, multi-faceted documents, can take many structures, including a “full wrap,” which tasks the EPC contractor with handling every aspect of engineering, procurement, and construction, and a “partial wrap,” where the owner may purchase the major equipment.

As Michael Ginsburg, special counsel at Farella, Braun, and Martel, told POWER, there are also “lump-sum turnkey projects,” which cater to EPC contractors looking to approach smaller jobs as a cluster of projects for contract and negotiation purposes. “So, they will essentially negotiate a contract for use over multiple, smaller projects,” he explained.

Ginsburg said he is watching a number of developments that could affect EPC contracts. They include labor policies from the incoming Biden administration, which could alter union labor requirements, as well as draft legislation that bars the use of arbitration clauses in contracts. “That’s important to EPC contractors because, as a general matter, they want their contract disputes resolved by arbitration, as opposed to the court system, which tends to be slower.” Ginsburg said he is also watching how the Trump administration’s bulk power system equipment order and its potential constraints on equipment procurement from certain countries will play out. ■

—Sonal Patel is POWER’s senior associate editor (@sonalcpatel, @POWERmagazine).