As “smart grid” becomes more familiar in the global lexicon, hardware and software vendors, utilities, and nations are all vying for attention. Consider, for example, this small sample of claims about the smart grid—a modernized, digital communications–enhanced electricity grid:

- In early September 2009, U.S. utility Xcel Energy proclaimed “SmartGridCity becomes first fully functioning smart city in the world.”

- At GridWeek in September in Washington, D.C., a presentation by a representative of Italian utility Enel included a slide claiming that “Enel network is the largest Smart Grid in the world.”

- In October, one of Australia’s largest electric utilities announced a pilot project that it claimed will “feature the world-first use of many smart grid technologies—from fourth generation wireless communications, to smart sensors in substations, to fully-connected home area networks in households.”

- On Oct. 27, U.S. President Barack Obama announced 100 awards for smart grid projects to be financed by American Recovery and Reinvestment Act of 2009 funds totaling $3.4 billion—the largest grid investment in U.S. history. That night, when MSNBC host Rachel Maddow asked Google Chairman and CEO Eric Schmidt how that investment compares with what countries we’re competing with are doing, Schmidt answered: “China, who is the competitor here, has decided to become the world’s leader in all the piece parts and all of the necessary hardware and supplies to do this globally. To that end, they are spending more than $100 billion on the same thing that today, the largest awards we have done in America, the private sector plus the government will invest $8 billion. You can see the gap.” (Some estimates put China’s number much higher.)

So, which country’s grid is the smartest? It depends on what you’re measuring—dollars spent, percentage of customers affected, number of customers affected, number of technologies interconnected, or measurable results (in terms of reliability of service, megawatt-hours reduced, or something else).

Smart Grid Rationales and Definitions Differ

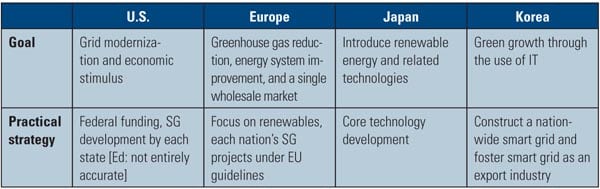

Each nation has a slightly different set of reasons for pursuing smart grid (SG) technologies and programs and a slightly different definition of what constitutes a smart grid. That’s inevitable, given the multiple technologies and infrastructure goals that have found a home under the SG umbrella.

One illustration of this can be seen in two sets of slides from presenters at GridWeek 2009, held last September in Washington, D.C. Table 1 consolidates the Korean view of the global smart grid picture presented at that event.

1. One view of the different national and regional smart grid goals and strategies. Source: GridWeek 2009

Another way of thinking about the differences came from a presentation by Dr. Rahul Tongia, who has affiliations with a Bangalore, India think tank and Carnegie Mellon University in Pittsburgh. Table 2 summarizes his view of the drivers for smart metering and smart grids in developed and developing nations.

2. Reasons for developing a smart grid differ. Source: GridWeek 2009

Tongia’s view of “Future (or even Subtle) Drivers” makes the contrasts even clearer, as summarized in Table 3.

3. Future (or even subtle) drivers of smart grid technologies. Source: GridWeek 2009

Can’t We All Just Get Along?

Despite the definitional and goal differences, and the natural international rivalry, there are a few organizations and partnerships that are trying to facilitate the sharing of SG lessons for the mutual benefit of all pursing SG goals. The U.S.-based GridWise Alliance is one. This group has a signed alliance with Smart Grid Australia and the Korea Smart Grid Association, and pending alliances with India, Brazil, and the European Union (which has its own EU-wide organization). Its membership also includes a raft of SG technology vendors plus research organizations, utilities, and other stakeholders in SG initiatives.

Another international collaborative force is the fact that many of the largest industry vendors and contractors have a global reach, which makes it in their interest to share best practices and develop international standards.

The tension between the desire to tout national (or corporate) achievements and supremacy in some aspect of SG development and to encourage/support/(control?) international cooperation—especially on such matter as interoperability standards—can be inferred from several of the GridWeek presentations even if you didn’t attend the actual event.

The countries with perhaps the most at stake are the Asian-Pacific nations (China, Japan, India, and Korea), by virtue of their economic growth plans. And Korea wasn’t shy about claiming the flag. One slide title proclaimed “Korea, the Smart Grid Leader” and noted that the country is developing a global smart grid roadmap with Italy in the Major Economies Forum (MEF). (Note that this was in the session on collaboration.)

One of the most realistic assessments of the state of smart grids globally came from Dr. Tongia, who noted that “there is no SKU”—you can’t buy an off-the-shelf solution because every utility faces different legacy, regulatory, business, and skills issues. His insight after seven years working on smart grids and smart metering: The “Smart grid (like IT) is a process, not a product.”

Tongia noted that there are “an enormous number of stakeholders” and no group can tackle the issue alone. “International collaboration would be ideal,” he noted.

“No one has all the answers. They’re either lying or trying to sell you something.” Tongia asserted on another slide. (He advocated something he called the Smart Grid Maturity Model for managing SG strategically and tactically and for charting a course. He claimed it has been used by “some sixty utilities.”)

The rest of this article presents, in alphabetical order, snapshots of where several of the most active countries stand and where they hope to land with SG project implementations. Bear in mind that proposed projects may not materialize—at least not within their originally projected timeframe. (By way of preview, and for easy Command-F search in Print view, they are: Australia, Brazil, Canada, China, European Union, Germany, India, Italy, Japan, Netherlands, South Korea, Sweden, United Kingdom, U.S.)

Australia

Australia may have one of the better-integrated smart grid plans, simply by virtue of having organized Smart Grid Australia, “a non-profit, non-partisan alliance” that includes stakeholders from electric and telecom utilities, hardware and software vendors, investors, government agencies at all levels, plus research and nonprofit organizations. At least the Aussies have given themselves the opportunity to avoid working at cross-purposes. Some of this island nation’s initiatives follow.

In October, Australia announced plans to build the world’s largest solar energy plant. At 1,000 MW, it would be three times the size of the current record holder, in California (the combined 354-MW Solar Energy Systems plants in the Mohave Desert). Adding renewables to its generation portfolio would enable Australia to reduce its greenhouse gas (GHG) emissions (native coal is its primary fuel) but would also complicate grid management without “smart” features.

Also in October, EnergyAustralia—one of the largest electricity suppliers in the nation—announced that “Australia’s first smart grid suburbs will be created in Newington and Silverwater in a two-year trial by EnergyAustralia and Sydney Water to help households reduce their utility bills and carbon impact.” The trial will cost A$10 million. The utility said that “Total savings of more than $400,000 on household energy and water bills are expected over the two-year trial period, as well as a reduction in greenhouse gas emissions of almost 2,500 tonnes.” The $10 million, two-year trial is supported by $1.5 million from the New South Wales Government’s Climate Change Fund.

In May, EnergyAustralia committed a total of A$10 million in partnerships with the universities of Sydney and Newcastle to lead smart grid development in Australia and train the next generation of power engineers. This followed an Australian government announcement also in May that the government would invest up to A$100 million to transform its grid into a smart grid.

Brazil

Brazil, the ninth-largest electricity producer in the world, already gets a majority of its megawatts from renewables—chiefly, large hydro generation—so integrating new, variable renewable resources is less of a SG driver than it is in many other parts of the world. Along with the rest of Latin America, Brazil has made only tentative steps into SG waters. Last summer, the government approved installation of the first of 200,000 smart meters, by Landis+Gyr.

Perhaps the biggest smart grid news in this South American country is that the Nov. 10 blackout that affected more than a third of the nation’s population hit while the Smart Grid Latin America Forum was taking place in São Paulo. On Nov. 16, Energy Minister Edison Lobao said in a statement that short circuits in a substation, caused by bad weather, resulted in the disconnection of three high-voltage transmission lines connected to from the Itaipú hydro-electric plant, Brazil’s main power facility. However, weather scientists are disputing the likelihood of weather being involved.

Microgrid guru Kurt Yeager, who gave the keynote address at Smart Grid Latin America, told SmartGridToday that Brazilian utilities are primarily interested in grid modernization because they want to sell more power.

(For an overview of Brazil’s power sector, see the special report in the January 2009 issue of POWER.)

Canada

In 2006, Ontario—Canada’s most-populous province—mandated that all electricity customers have smart meters by 2010, and it looks as if it will meet that goal.

In June, Ontario’s HydroOne announced that it had installed 1 million smart meters and that 400,000 were on the way. According to the utility, “This is amongst the largest smart meter deployments by a utility in North America.” The company has already begun to transition to time-of-use (TOU) pricing, scheduled for 2010.

Toronto Hydro began shifting its customers to TOU rates in June 2009 and expects to have all customers on the new rates within 12 months. The utility claims that Toronto will be the first major city to have all of its customers on TOU rates. In May the utility announced a partnership with Google that will make it the eighth utility, and Canada’s first, to test Google PowerMeter, the search giant’s web-based energy management tool.

According to a Mar. 15 story at SmartMeters.com, “Overall Ontario, along with the state of California, is leading the way in smart grid technology development in North America. Hydro One spearheaded an effort to convince Industry Canada, the Canadian government entity responsible for business development, to dedicate a wireless communications spectrum for use by utilities to monitor their power grids. This forward-thinking move creates a standard throughout Canada. Standardisation is crucial for developers to have a development framework.”

At the federal level, Canada is facilitating standards development for the interconnection of distributed generation resources.

China

Most people who follow the power generation industry are aware of the blistering pace at which China has built new coal-fired plants to meet its increasing demand. What they may not realize is that, according to China Electricity Council, as reported in June at ShanghaiDaily.com, in 2008 the Chinese government spent more money on grid networks than on power generation. The percentage for 2009 was expected to be even higher.

A Frost & Sullivan press release from June 2009 noted that “The Eastern China Grid Corporation, a subsidiary company of the State Grid Corp of China (SGCC), started a feasibility research on ‘smart grid’ technology in October 2007.”

“According to Pinky Wang, consultant of Energy and Power System practice, Frost & Sullivan China, smart grid in China focuses more on the transmission side than the distribution side at present. Based on the fact that coal is the main energy source in China and coal mines are far away from the main load centers, it is the right choice that the power grid development be focused on the transmission network. China has been constructing a unified national power grid network. The project includes what is known as the ‘West-East Electricity Transfer Project,’ which includes three major west-east transmission corridors construction. The transmission capacity of each corridor will be 20 GW by 2020.”

As China seeks to lower its GHG emissions and tap more of its hydro sources, it has had to explore more efficient ways of transmitting and using electricity. One tool is ultra-high-voltage transmission lines. Siemens is involved in one such project, that, when it goes online in 2010, will transmit electricity 1,400 miles over 800,000-V lines from large hydro projects to huge population centers.

And an August smart grid story appearing in Peoples Daily Online reported that “In January 2009, the Southeast Shanxi-Nanyang-Jingmen extra-high voltage pilot project, which is a 1,000 kV UHVAC transmission project independently researched, designed and constructed by China, was formally completed and put into operation.”

In the June ShanghaiDaily.com article, Liu Zhenya, president of the State Grid Corp of China, is cited as saying that the development of SG technical standards would begin in 2009 with a goal of 2020 for grid completion. The article also cites a power analyst as saying that China may need to spend “up to 68 billion yuan (US$10 billion) annually on smart grids.”

European Union

Much of the SG activity in Europe is being guided by EU directives. A 2006 European parliament directive, for example, requires member states to install smart meters. And, whereas the EU’s European Strategic Energy Technology Plan goal is to accelerate development and deployment of low-carbon technologies to reach its 20/20/20 goals, smart grids are key to reaching those goals. Eighty percent of consumers are to have smart meters by 2020.

The SmartGrids Technology Platform is a European Commission initiative for coordinating and advancing SG technology throughout the EU. Advanced metering infrastructure (AMI) manufacturers Iskraemeco, Itron, and Landis+Gyr announced in September that they had agreed on interoperable standards that will accelerate the deployment of smart meters.

For more country-specific details, see the entries for Germany, Italy, Sweden, and the UK.

Germany

Germany calls its smart grid strategy “E-Energy” and describes it this way: “The purpose of the E-Energy model projects is to develop an ‘Internet of Energy’ which monitors, controls and regulates the electricity system intelligently. An Internet of Energy interconnects the numerous stakeholders in the energy system, ranging from power generation and transportation companies to stakeholders in power distribution and consumption. This results in an integrated data and power network featuring completely new structures and functions. For instance, smart electricity meters known as ‘Smart Gateways’ connect private households with energy providers, thus permitting a continuous bidirectional comparison of the electricity supply and demand. In this way, the consumer becomes an active market participant.”

Six pilot projects have been selected, and integrating distributed (largely rooftop solar) renewable generation is one of their main goals. E-Energy’s overall objective are to contribute to solving energy and climate problems, create new jobs and open up new markets, speed innovative progress, and create a paradigm shift in the electricity industry.

The four-year E-Energy project will receive a total of €140 million from the federal government. The hope is that model projects “will quickly have a sweeping bandwagon effect and trigger follow-up investments. The aim here is to create a smart electricity system, which will extensively control itself and in which all energy-sector processes are optimally adapted to one another.”

E-Energy is not the only SG endeavor in Germany. A Fall 2009 Siemens publication quotes Rolf Adam, a principal at Booz & Co., as saying, “German utility companies alone plan to invest €40 to €50 billion in the modernization of the grids, with €15 to €25 billion of that going into smart grid technology.”

One unique approach by non-utility companies is the building and deployment of a new kind of distributed power generation. In September, Automaker Volkswagen teamed up with LichtBlick, a German renewable energy company, “to build up to 100,000 power stations for home use by spring 2010.

“Under the agreement, Volkswagen will produce the high-efficiency ‘EcoBlue’ CHP (combined heat and power) plant, which is to be driven by gas engines from Volkswagen. LichtBlick will be marketing the plants as ‘ZuhauseKraftwerke’ (home power plants) and will be using them for a new, intelligent heat and power supply scheme.

“The generators would run off natural gas-powered engines similar to the ones that currently drive some Volkswagen Golf cars. Exhaust heat from the engines would warm up water for showers and central heating in the homes.”

India

In February 2008, South Africa–based Grinpal Energy Management, a subsidiary of Saab Grintek, began installing the first smart meters in New Delhi. The prepaid electricity system includes a load limiter that sends a message to the customer to reduce electricity usage when demand is too high. It also prevents meter tampering. (You’ll recall that this was a concern raised by Dr. Rahul Tongia of the Bangalore think tank in his GridWeek presentation.) The goal was 500,000 installations by 2010. Since then, SG developments have included Tata Power’s launching the use of a GE outage management system.

The government is also planning to increase the percentage of power provided by renewables, specifically, 20 GW of solar generation capacity by 2020, 100 GW by 2030, and 200 GW by 2050. Distributed solar generation—including a million 3-kW-average rooftop systems by 2020—is part of the Solar India plan, according to a final draft dated Apr. 29, 2009.

India also has what blogger Lisa Margonelli calls a “DIY Totally Scrappy Unintentional Smart Grid.” She wrote in April: “Check out this article in the Times of India about the entrepreneurs who have gone into the business of making electrical inverters that enable people to charge batteries from the grid and then run their appliances on DC power from the batteries. India’s utilities spend much of the summer stressed out, aggressively “load shedding”—ie [sic] scheduling rolling blackouts to neighborhoods and businesses daily. To accommodate this, people have started installing batteries and inverters so that they can run their TV’s, lights, and fans during regular brownouts.”

Indians, it appears, aren’t waiting for the government or utilities to integrate battery energy storage into the grid!

Italy

Italy’s largest electric utility, Enel (at the time state-owned) began introducing smart meters in 2001, and smart meters have been compulsory for all electricity providers since 2006. The government’s timetable is for 95% of customers of the approximately 100 electricity companies to be on smart meters by 2011.

At GridWeek 2009, Livio Gallo—chief operating officer of Enel’s Infrastructure and Networks Division, and executive chairman of Enel Distribuzione, the major Italian electricity distribution company—included in his presentation a slide that proclaimed “Enel network is the largest Smart Grid in the world.” The company has 32 million customers using automatic meter management, more than 100,000 substations are remotely controlled, and automatic fault-clearing procedures have been implemented, among other advances. Enel’s total investment has been over €2.5 billion, according to the presentation, and has resulted in a “dramatic reduction of cash-cost per customer.” Quality of service and key performance indicators (such as reduced energy consumption, reduced peaks, and reduced electricity bills) have also improved dramatically. Among its future SG goals is collaboration with Google to develop web applications.

Japan

Japan’s SG focus is on a bidirectional power and communication system, with emphasis on the distribution and customer side. Much of its SG activity is sponsored by its New Energy and Industrial Technology Development Organization (NEDO).

Japan has already conducted several SG demonstration projects, including those deploying grid stabilization technologies (at least some of them battery-based) for large-scale photovoltaic (PV) and wind generation. Given that the country is planning for high penetration of PV after 2010, SG technology is needed to integrate this variable generation.

GridWeek presentations noted that Japan and the State of New Mexico are working together on green grid projects and that Japan has been introducing its manufacturers to the U.S. market. The country’s Ministry of Economy, Trade and Industry is in the process of identifying a potential country with which to “establish a cooperative partnership.”

Netherlands

Smart meter rollouts have not gone smoothly everywhere. Though the Netherlands has had some smart meters since 2005, in April 2009, an NRC Handelsblad story reported that smart meters would not be compulsory. That decision by Minister of Economic Affairs Maria van der Hoeven was influenced by consumer groups raising privacy concerns. Although a 2006 EU directive requires the introduction of smart meters, van der Hoeven had planned to make their installation compulsory. Refusal to install them, the paper reported, would be “punishable with a fine of up to 17.000 euros or six months in prison.”

Meanwhile, Amsterdam is planning to use SG technologies to make itself more eco-friendly. Projects related to the three-year $1 billion effort are to start coming online in 2012. According to Spiegel Online International, the plan is estimated to cost $410 per household over 15 years to install smart grid technology alone.

South Korea

The Republic of Korea is one of the 10 largest energy-consuming countries. It is also dependent on foreign sources for 97% of its energy, as a GridWeek presentation by Han-koo Yeo, director at the Climate Change Policy Division, Korea Ministry of Knowledge Economy, pointed out. SG drivers in Korea are the desire to meet the climate change challenge and to improve its energy security and, consequently, its balance of trade by reducing its dependence on fossil fuels.

With its manufacturing strengths and IT savvy (the same GridWeek presentation claimed the country has deployed broadband Internet to 80.6% of the nation), it has designs on being the world’s first “national smart grid” by 2030, though it would appear that Sweden and Italy have a considerable lead in that competition.

An August Asia Power story quoted the state-run electricity company, Korean Electric Power Corp. (KEPCO), as saying, “‘The consumer-side smart grid is aimed to be completed in 2020, and is expected to become nationwide by 2030. This technology is part of the US$103 billion initiative of Korea to increase its generation of green technology to 11 percent in the next two decades, from the current 2.4 percent,’”

Meanwhile, KEPCO is planning a US$100 million SG demonstration project, according to Han-koo Yeo, for residents of Jeju Island that is scheduled to be operational by 2011. His GridWeek presentation claimed that the Jeju project would be “the most advanced and biggest test bed in the world” and would integrate “smart” places, transportation, renewables, power grid, and electricity market.

Sweden

Along with Italy, Sweden was among the first of the European nations to conduct smart metering pilot projects, in 2001. Since then, Swedish investments in SG work have proceeded even faster than required by law, and in October 2009, Sweden became the first country in the world in which every customer has a smart meter.

Also in October, ABB announced a partnership with the utility Fortnum to design and install a large-scale smart grid in a new district of the city of Stockholm. The project will “develop a variety of solutions to ensure that excess power generated from renewable energy sources in the district itself (from sources such as rooftop solar panels) can be fed into the power grid; to enable electric vehicles to draw electricity from the grid or feed it back in; to store energy; and to provide more flexibility and transparency in the distribution grid, helping to lower consumption and emissions.”

United Kingdom

In 2008, the UK set 2020 as its goal for having all customers equipped with smart meters, and smart grids are seen as essential to reliably integrating the large amounts of variable renewable generation already installed and planned.

Pilot smart meter projects have already been running, but on May 11, 2009, the UK government unveiled a plan requiring all 26 million homes in the UK with smart meters by the end of 2020. The plan could cost an estimated £8.11 billion ($12.3 billion). The Department for Energy and Climate Change claimed it would be the largest smart meter project in the world. Though the rollout is expected to cost as much as £340 per household, “The Energy Retail Association—which represents the major electricity and gas companies—said that smart meters will be ‘cost-neutral’ to customers because the savings to its members will part-fund the roll out,” The Guardian reported. The first of the meters is expected to be installed in 2012.

The UK’s first smart grid was scheduled to become operational in late 2009 in the Orkney Islands archipelago in northern Scotland. A primary goal is to facilitate the integration of variable renewable generation. Greenwise reported that “The Government has pledged to invest £6 billion in smart grid and the technology is expected to be more in demand as further renewable energy devices are connected to the grid to meet the UK’s 2020 emissions targets.”

The Office of the Gas and Electricity Markets, which regulates the UK grid, plans to create up to four smart grid cities on the model of SmartGridCity—Boulder, Colorado. Funding to the tune of £500 million will be spread over five years, The Guardian reported.

U.S.

Smart grid projects in the U.S. derive from a mix of utility-initiated, state-legislated, and federally supported efforts. For details of some of the major U.S. smart grid developments, see the companion January issue web-exclusive stories “U.S. Smart Grid Forecast: Flurries of Activity” and “What Do Consumers Expect from the Smart Grid?”

And the Winner Is…

No fully functional smart grid of any meaningful scale exists yet. At this point, the easiest quantifiable metric for measuring SG development progress is the number of smart meters installed, because these devices are typically seen as the prerequisite for making many smart grid promises come true. Using that basis, it seems that Italy and Sweden are essentially tied. Italy appears to have the highest number of advanced meters installed, but Sweden (with a smaller population than Italy) has deployed the devices throughout the entire country.

By way of summarizing recent SG activity and putting all the global players in context, consider one industry analyst’s perspective.

In a Nov. 4 Infrastructurist interview, David Leeds, an analyst specializing in grid technology at Greentech Media (and author of a free 145-page report, "The Smart Grid in 2010"), had this to say about the late 2009 U.S. federal smart grid funds: “these matching grants will lead to a direct investment of $8.1 billion in the near term, an amount that slightly exceeds all of the venture capital that flowed into greentech last year—a major shot in the arm for the electric power sector in a recessionary period. On the other hand, while $8 billion does represent a substantial down payment on the upgrade of our nation’s grid, groups like the Electric Power Research Institute have estimated the cost of building out the smart grid at $165 billion over the next two decades—which comes to approximately $8 billion per year. So perhaps we are just doing the bare minimum, and ‘the silicon valley of smart grid’ may well end up in countries like China or India.”

Leeds said he expects “in five years time to have a majority of the U.S. population familiar with both the concept of smart grid, and using applications that sit on top of it. The same can be said of Europe, and many other population centers around the globe.”

—Gail Reitenbach, PhD is POWER’s managing editor.