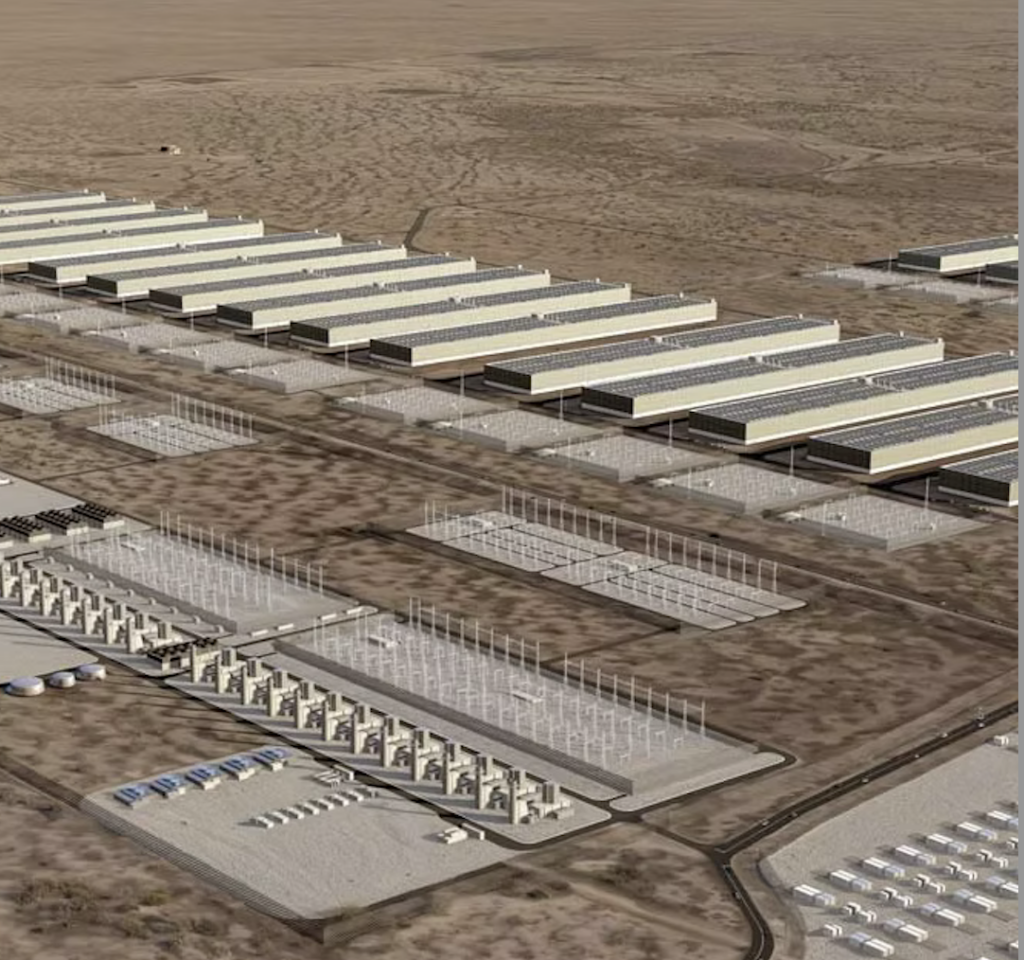

The race to lead when it comes to artificial intelligence (AI) is becoming more about securing the power necessary for data centers and other AI infrastructure. As POWER’s recent Data Center POWER eXchange event in Denver, Colorado, showed, demand for energy from the AI sector is impacting several fuel types, both thermal and renewable. Natural gas has emerged as a leading option to provide baseload power, as a buildout of gas-fired power plants already is underway.

Andrejka Bernatova is the founder, chairman, and CEO of Dynamix Corporation III, and managing partner of Dynamix Capital Partners, a group that is working to partner with proven, market-leading companies in energy, power, and digital assets. She works within the energy industry as both an operator and investor. Bernatova has helped raise more than $35 billion across energy and infrastructure. Bernatova led a SPAC (Special Purpose Acquisition Company) full-cycle with ESGEN, which merged with Florida’s largest solar installer to form Zeo Energy Corp. in 2024. In 2025, another SPAC she leads announced a business combination with The Ether Machine, an institutional-grade Ethereum investment vehicle. Bernatova also recently completed the initial public offering for Dynamix Corporation III, pursuing opportunities in energy, power, and the digital assets value chain.

Bernatova is an accomplished athlete who has completed the Marathon des Sables, a ~200-mile ultra-marathon race across the Sahara Desert. She also biked more than 600 miles across Tibet and Nepal to the Mount Everest Base Camp. She has volunteered in orphanages and construction projects in Kenya, Chile, Nepal, and Egypt. Bernatova has lived, worked, and studied across five continents, and speaks five languages.

Bernatova recently provided POWER with insight into her company’s business. and also discussed Dynamix’s belief that the energy and infrastructure industry is in the early phases of a decades-long transition to a low-carbon, sustainable future.

POWER: What are the targets for Dynamix when it comes to North American energy and infrastructure?

Bernatova: Our focus is very pragmatic. For Dynamix Capital Partners, the priority is assets that sit at the intersection of power, energy security, and scale, particularly generation and infrastructure that can support the next wave of demand driven by AI, data centers, and grid resiliency. We’re targeting cash-flowing, industrial-scale platforms that can be part of the solution over the next five to 10 years.

We’re currently in the process of completing the deSPAC for our most recent business combination with The Ether Machine, announced this past summer. We view digital assets through the same lens as energy and infrastructure, and Ethereum is an energy-efficient major blockchain. This aligns directly with our focus on scalable infrastructure that improves efficiency rather than exacerbating strain, making the transaction a natural extension of our core focus. (Editor’s note: De-SPAC refers to a business deal where a private company goes public by merging with a SPAC.)

POWER: You’ve talked about “Disruptive Decarbonization.” What does that mean?

Bernatova: Disruptive decarbonization is about reducing emissions in a way that actually works within real-world constraints. The fastest way to decarbonize at scale today is not by waiting for perfect technologies, but by replacing dirtier fuels with cleaner ones that already exist and can be deployed immediately, particularly natural gas. If you can cut emissions by 50-60% today rather than promise 100% reduction in 10 years, that’s true impact. Disruption comes from pragmatism, not from chasing headlines.

POWER: How has your previous experience as an operator and company builder at PennTex Midstream, Enchanted Rock, and Goodnight Midstream helped with the energy deals you work on today?

Bernatova: Being an operator changes how you see risk. At PennTex, Enchanted Rock, and Goodnight, I was responsible for execution, contracts, capital allocation and capital raising, and operating through cycles, which forces discipline. It teaches you where models break, where assumptions fail, and where value is actually created. Today, when we look at deals, we focus heavily on operational reality: Can this be built? Does this business have a sustainable commercial and customer backbone? Can it be financed? Can it survive volatility? Does it generate cash flow? That mindset is invaluable.

POWER: What are the primary factors you consider when assessing a potential deal for energy infrastructure?

Bernatova: First, cash flow visibility and contract structure, because, without that, nothing else matters. Second, scalability, or whether the asset grows alongside demand without relying on speculative technology shifts. Third, resiliency and relevance to the grid, because assets that improve reliability will always matter. And finally, capital structure. Too many deals fail because they’re built on overly engineered or toxic financing. We’re extremely disciplined about balance sheets and alignment from day one.

POWER: What should startup energy companies be looking at as they devise strategies for their business in today’s highly competitive market?

Bernatova: They need to focus on commercialization and profitability much earlier. Energy is not software; it is large-scale infrastructure and asset deployment. You cannot rely on perpetual funding rounds or subsidies. Startups must be brutally honest about whether their technology can scale economically and generate EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). If your business only works under perfect regulatory conditions or continuous government support, it’s not a business. The companies that survive will be the ones that understand cost, execution, and customer demand from the outset.

POWER: You’ve held investment roles at some of the world’s largest banks, including Credit Suisse and Morgan Stanley, and you’ve also worked at The Blackstone Group. What have been the most important lessons you’ve learned from that experience, particularly as it relates to structuring energy deals?

Bernatova: Structure matters as much as the asset itself. I’ve learned that bad capital can destroy a good business. The best deals are simple, aligned, and built for durability, rather than optimized for short-term financial engineering. Energy assets live through cycles, so your capital structure has to survive those cycles. Alignment between sponsors, management, and investors is critical. If incentives are misaligned at the start, the deal is already broken.

POWER: How has your experience as an ultra-marathoner impacted your career? Does the discipline required to excel in that sport translate to your work in business?

Bernatova: Ultra-marathons teach you how to operate under sustained pressure, manage energy, make decisions when conditions are far from ideal, and be able to live through periods of long-term pain. Business, especially in this industry, is not a sprint. It’s about endurance, discipline, and staying rational when others panic. You learn to respect process, prepare for adversity, and keep moving forward even when progress is incremental. That mindset translates directly to how I approach investing and building companies.

—Darrell Proctor is a senior editor for POWER.