Gas-Fired Generation: Key to North America’s Energy Transition

By Gianluigi Di Giovanni, Vice President, Gas Services North America, Siemens Energy

In 2022, North America marked a major milestone in its energy transition: U.S. power generation from all renewable sources — including wind, solar, hydro, biomass, and geothermal — surpassed coal-fired generation for the first time.[1] Still, as any power plant operator knows, the sun doesn’t always shine nor does the wind always blow. That variability is why the expansion of renewables in North America’s generation mix must include a continuing role for natural gas as a transition technology.

Natural gas can help the North American power industry find the right balance between affordability, reliability, and sustainability — the energy trilemma. In other words, with state-of-the-art gas-fired generation, power producers can achieve their net-zero goals in ways that meet growing demand without undermining reliability and affordability.

Service reliability is especially critical. Disruptions don’t just inconvenience customers; lives can be at stake, with consequences from public safety to healthcare delivery. Extended blackouts can also jeopardize process industries, such as pharmaceuticals, food, and beverage, where work-in-progress losses can mount to millions or even tens of millions of dollars.

Power industry complexities need dependable, gas-fired generation

While the North American power market spanning the U.S. and Canada is enormous — serving 375 million people — it’s enormously complex, too. Many utilities with large service areas must manage the dynamics of diverse regional geographies plus ever-evolving federal and state policies, demographics, user behaviors, fuel switching, and associated costs. Transmission and grid stability are big issues, as well.

All these factors can complicate the power industry’s transition to net-zero carbon emissions. For industry executives and planners, such issues can make the journey a non-stop juggling act fraught with financial and regulatory risks. On top of those uncertainties, the power industry faces other challenges, such as supply chain limitations, inflation, and skilled labor shortages. These issues could influence decisions to delay coal-fired plant retirements and hinder power producers from achieving their carbon emission reduction targets.

So, with more and more large-scale renewable projects in deployment or on the drawing boards, system planners must boost their gas-fired generation with new capacity or by enhancing their existing equipment to maintain sufficient spinning reserve margins and have dispatchable generation to meet peak demand. Either way, additional gas-fired generating capacity can give utilities the operational flexibility they need to better align variables in renewable-sourced power generation with fluctuating market demands. Early adopters can simultaneously benefit from margin improvements, accelerated investment returns, and a heightened competitive advantage.

Of course, the landmark U.S. Inflation Reduction Act (IRA) of 2022 with $370 billion in tax credits to boost the nation’s renewable energy[2] will boost North America’s energy transition in a significant way. Some industry observers estimate these credits will triple the amount of utility-scale green power in the U.S. from today’s levels to approximately 750 GW by 2030.[3] If anything, this forecast underscores the urgent need to maintain, upgrade, and modernize the North American power industry’s gas-fired capacity.

Natural gas + hydrogen, a solution for North America’s energy trilemma

For power producers intent on adding to or upgrading their current gas-generation capacity, they can now take advantage of advanced gas-fired turbine technology that is capable of mixed-fuel hydrogen combustion. Industrial-scale water electrolysis powered by renewables is making the onsite production of hydrogen a practical consideration for many utilities. The North American power industry can benefit from hydrogen R&D efforts going on in the USA and elsewhere in the world.

In Sweden, for example, the Zero Emission Hydrogen Turbine Center (ZEHTC) opened in 2021 to investigate hydrogen’s potential at scale as part of a natural gas fuel mix for turbines. This facility is an EU-funded project consortium of six partners, including Siemens Energy as the project coordinator and plant operator. The other partners represent both private and public sectors, including two international universities. It has served as a demonstration plant to explore how renewable energy and gas turbines can operate together to provide a stable, reduced emissions energy system.

At ZEHTC, an onsite solar field supplies electric power for electrolysis which in addition to the excess power from gas turbine testing done at the plant, is used to produce hydrogen. The hydrogen produced by the electrolyzer is then used as a fuel in gas turbines to enable demonstrations and further development of hydrogen combustion technology.

ZEHTC has already demonstrated the efficient operation of industrial-scale gas turbines fueled with 75 percent hydrogen or other fossil-free fuel sources, such as e-fuels (e.g., e-methanol, e-diesel, e-methane, and e-kerosene) or biofuels (e.g., bio-methanol, ethanol, or biodiesel).

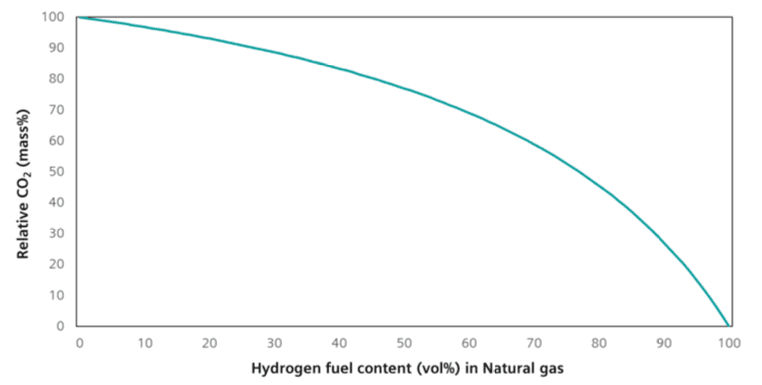

When mixed with natural gas to fuel gas turbines, higher concentrations of hydrogen can reduce CO2 emissions in a highly proportional way, as shown in the table above. What’s more, the advanced 3D printing of combustion components for ZEHTC has enabled significant acceleration of development and validation of these critical combustor parts to verify they provide maximum fuel flexibility and operational lifecycle.

All said, verifying hydrogen’s value as a practical and economic fuel is one thing, but delivering its benefits on utility scale will take time — and an assist from natural gas. Natural gas will remain the key to North America’s energy transition for these four reasons, as cited in a recently published Siemens Energy white paper:[4]

- Natural gas will continue to be a critical transition technology to help the North American power industry achieve its zero-carbon goals by 2050.

- Natural gas provides reliability at a reasonable price while increasing efficiencies with lower emissions.

- Existing gas turbines already connected to the grid can easily transmit additional power without impacting grid stability.

- Advanced gas turbines with mixed-fuel capabilities can fill the gaps between coal retirements and renewable additions. Additionally, alternative fuels such as hydrogen or e-fuels, can enable gas turbines to help meet net-zero targets sooner and potentially more cost-effectively than building new plants.

Infrastructure upgrades needed — in generation, transmission, and electrification

To help the North American power industry accelerate its energy transition, Siemens Energy is working with energy stakeholders across both public and private sectors to drive five top priorities:

- Make renewable power ever more practical and available. As renewable project deployments increase, their energy production variability must be accommodated, which gas-fired generation can help with, especially when mixed with hydrogen to reduce carbon emissions. Governments need to permit these projects much faster, working with power producers in the most collaborative ways possible with shared concerns for both the environment and surrounding communities.

- Boost energy-efficiency of both power producers and users. For generation, thermal efficiency upgrades and performance optimization of capacity are critical. Turbine flexibility is also important. On the usage side, further innovation is needed to drive more electrification of industrial processes and transportation. Synfuels can also be used for the latter, especially in the maritime and aviation industries.

- Enhance grid stability and reliability. As the proportion of renewables grows and electrification expands, aging North American transmission grids must be strengthened to connect supply and demand reliably and cost-effectively. The U.S. and Canada have more than 35 grid connecting points crossing their borders[5] and within each nation are patchworks that need upgrading.

- Modernize existing energy infrastructure. To prevent stranded capital assets, the North American power industry must make the most of existing infrastructure designed around traditional technologies.

- Ensure availability of critical supplies and expertise. To support these efforts, power producers must have access to a wide range of physical resources, so diligent supply chain management is needed. At the same time, the number of EPC (Engineering, Procurement and Construction) companies in North America with the expertise and scale to partner with utilities in their upgrades and greenfield buildouts is limited. For this reason, governments need to streamline the permitting of projects. That’s also why, as a longer-term solution to a growing skills shortage, Siemens Energy supports STEM education in K–12 grades as well as engineering programs across many needed disciplines in higher-education.

Gas-fired turbines will help power North America’s net-zero transition

Clearly, gas-fired turbines will be instrumental in North America’s transition to net-zero emissions. By finding the right balance between the energy trilemma of affordability, reliability, and sustainability, power producers can adapt to the changing energy landscape. Siemens Energy is committed to helping utilities upgrade their existing infrastructure, ensuring a cost-effective and reliable base load capacity and flexible spinning reserve margin as the industry navigates successfully through capacity concerns and shifting energy demands.

For more information on the power market trends in North America’s energy transition and the role of gas-fired generation, download an informative white paper from Siemens Energy.

[1] Renewable generation surpassed coal and nuclear in the U.S. electric power sector in 2022. U.S. Energy Information Administration. March 27, 2023.

[2] Here’s how the Inflation Reduction Act is impacting green job creation. World Economic Forum. March 2023.

[3] John Hensley. Inflation Reduction Act: It’s a Big Deal for Job Growth and for a Clean Energy Future. American Clean Power. August 2022.

[4] North American Energy Transition with Efficient and Flexible Gas-Fired Generation. Siemens Energy. 2023.

[5] Electricity Canada: U.S. Affairs. 2022.