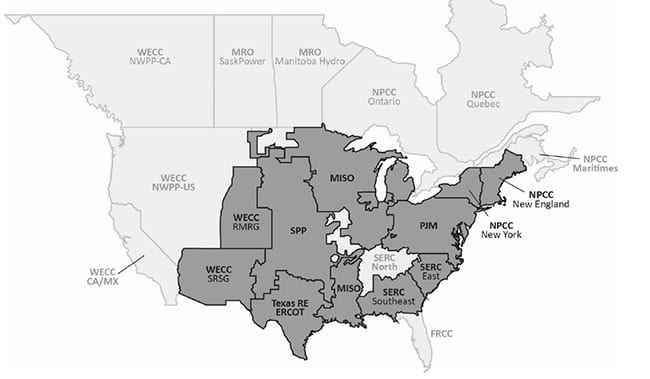

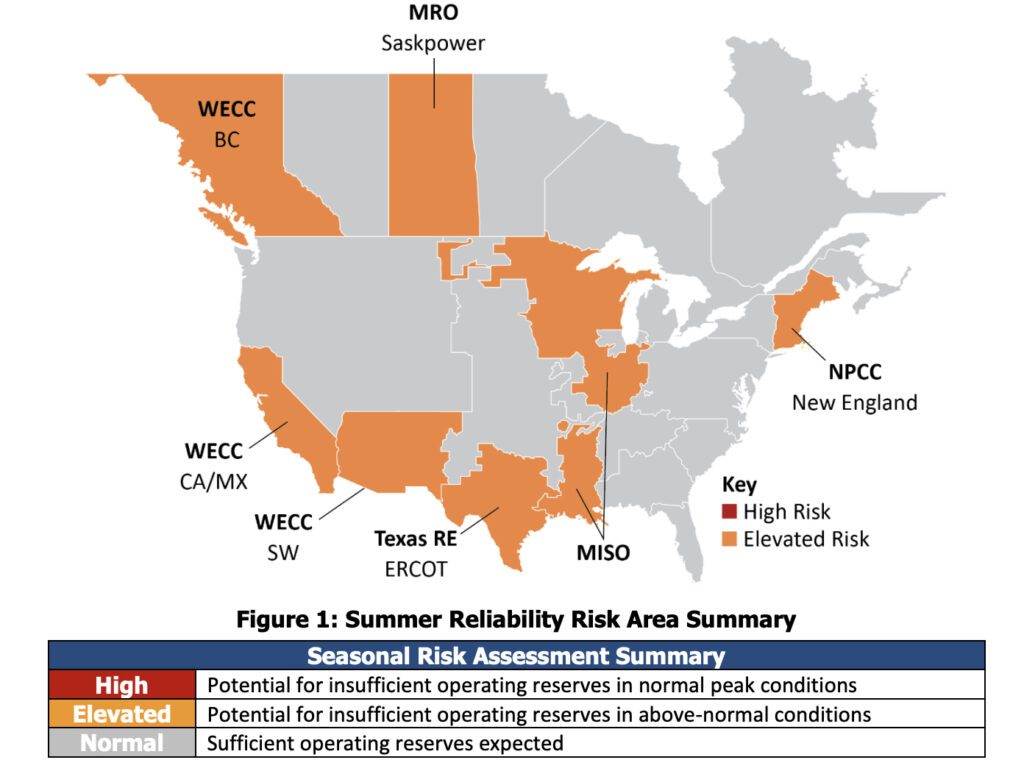

Significant and rapid changes that are reshaping North America’s power sector will likely leave Texas and Ontario, Canada, with supply shortfalls over the next decade, and energy deficiencies could also occur during off-peak conditions in the Midcontinent Independent System Operator (MISO) area and the Western Electricity Coordinating Council (WECC) region, the North American Electric Reliability Corp. (NERC) says in its newly released 2019 Long-Term Reliability Assessment.

The report released Dec. 19 from the entity tasked by the Federal Power Act to conduct periodic assessments of the North American bulk power system (BPS) also concludes the six North American regional entities that make up the Electric Reliability Organization (ERO) urgently need to gear up for more dramatic influxes of wind, solar, and natural gas resources between 2020 and 2029.

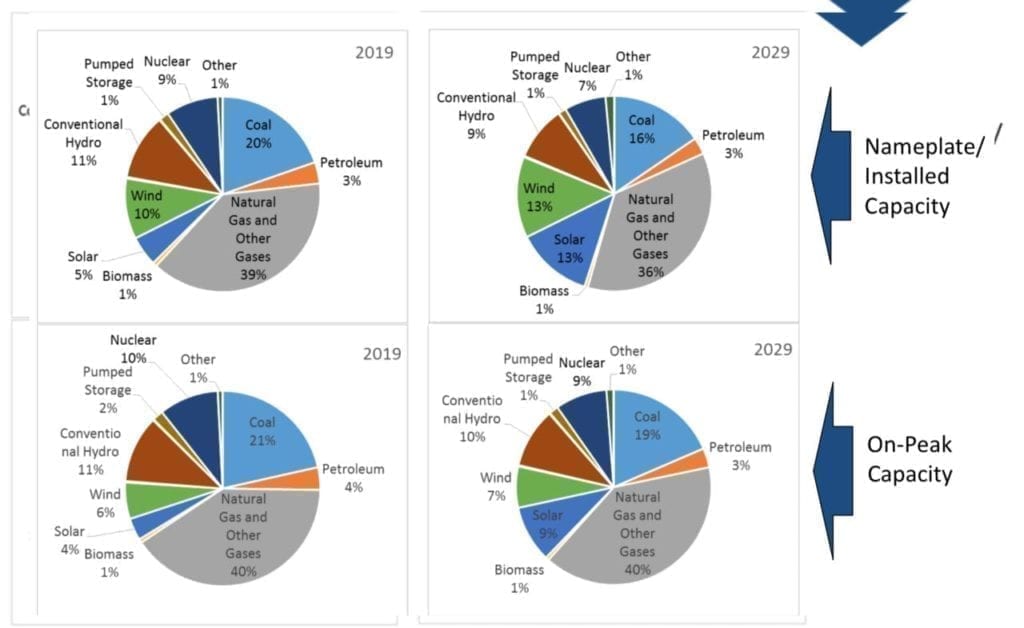

Based on data and narrative information collected from six regional entities in July 2019, NERC says more than 330 GW of installed capacity from solar and wind are planned through 2029—including 35 GW of distributed solar PV, which could come online as soon as 2024. By 2024, meanwhile, the BPS could also host 8 GW of grid-connected energy storage. “Increasing installations of DERs [will] modify how distribution and transmission systems interact with each other,” it says.

But while these new technologies will need to be integrated into the BPS, the challenges they pose are “not insurmountable,” as John Moura, NERC’s director of Reliability Assessment and Performance Analysis, told reporters in a call on Dec. 19. “I think that’s testament to the industry’s commitment to integrate and to ensure that we have a reliable and even clean energy system.”

Transmission Planning Should Begin Now

Moura, however, also pointed to concerns that could emerge over the longer term. The first is that “we’ve seen a bit of a valley in terms of transmission not keeping pace with the amount of utility-scale wind and solar resources,” he said. “Currently, we don’t believe this is a traditional reliability issue—that is, transmission is being built. Any reliability reasons or any deficits in meeting criteria are being addressed and transmission is certainly being addressed to maintain reliability standards. However, what we don’t see are large transmission projects, long transmission projects that are really going to be needed.”

Many new variable energy resources (VERs) will be located in areas remote from demand centers and existing transmission infrastructure, he said, and as the report notes: “In some areas, such as SPP and ERCOT, the level of VERs are reaching full subscription of the transmission network and exhaust current as well as planned transmission capacity.”

Today, however, only about 15,000 circuit miles of new transmission is planned over the next six years—“considerably less than the nearly 40,000 circuit miles planned earlier this decade,” it says. One reason may be that transmission planners and operators may not have complete visibility and control of DERs, it says, forecasting that information and data will play a critical role in system planning, forecasting, and modeling as “growth becomes considerable.”

“We’re talking about [connecting] hundreds of gigawatts, and we really need to think about where we’re going to put these resources and what space we have to put them in,” Moura added. At the same time, transmission “takes a very long time, to plan, to coordinate, to site, and to work with all the jurisdictional and regulatory boundaries. We know we’ve got to get started now, so that we have transmission 10 to 15 years down the road,” he said.

To accommodate the new resources, solutions will also be required—and are currently being implemented—to inverter-based resource interconnection challenges. The BPS will also require more coordinated planning to accommodate natural gas growth, it suggests. Among other key recommendations, NERC also urges regional entities to embrace energy adequacy metrics; increase communication with state and provincial policymakers on reliability risks and challenges; and to publish reliability guidelines.

As significantly, NERC calls on industry to “identify, design, and commit flexible resources” needed to meet increasing ramping and variability requirements. Industry and regional entities should also work together to gather data as “early as possible” about the “aggregate technical specifications” of DERs connected to local distribution grids to help bolster system planning, load forecasting, and real-time situational analysis. “In areas with large or emerging DER penetrations, current operational models and system studies do not properly account for DERs. These models and studies will need to be improved to accurately represent the system’s behavior,” it says.

Retirements, New Demand, and Uncertainties

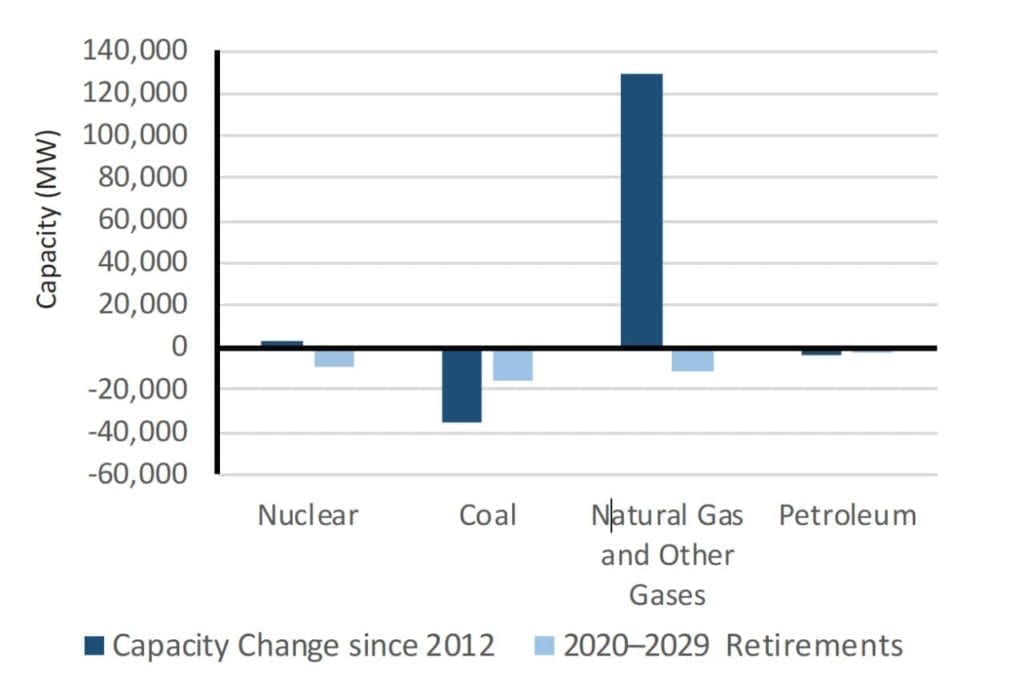

NERC also prominently highlights operating reliability risks owing to conventional generation retirements. Between the years 2012 and 2018, the BPS saw 43 GW of retirements. Of that, more than 32 GW was coal generation, and more than 7 GW was natural gas generation. Between 2020 and 2029, cumulative retirement will exceed 46 GW, it suggests. “In the next 10 years, we expect to retire basically the same amount that we retired over the past seven years,” said Moura. “And that’s expected to continue regardless of environmental regulations and more around economics, and the price of gas, and requirement of renewable portfolio standards in some states.”

According to the assessments, all projected nuclear retirements for the 10-year period occur by 2024, totaling over 10 GW of capacity. The other projected retirements mostly consist of 19 GW of coal and 13.5 GW of natural gas, it says. It warns that unless retirements that are specifically near large load centers and have limited transmission import capability are replaced with new plants in the same vicinity, these load centers will require power imports and dynamic reactive resource replacement.

“If the transmission links between an area and generation sources are relatively weak, voltage instability can be the result; dynamic reactive power must be provided to prevent voltage collapse,” it adds. Solutions to preventing voltage instability could range from extensive transmission improvements to optimal placement of static VAR compensators, synchronous condensers, locating new generation in the load pocket, or local energy storage. Meanwhile, “Retiring generation units in a generation ‘pocket’ might cause the remaining units to become ‘reliability must run’ units that often require additional actions or investments (e.g., transformers, shunt capacitors) in equipment to maintain voltage stability,” it says.

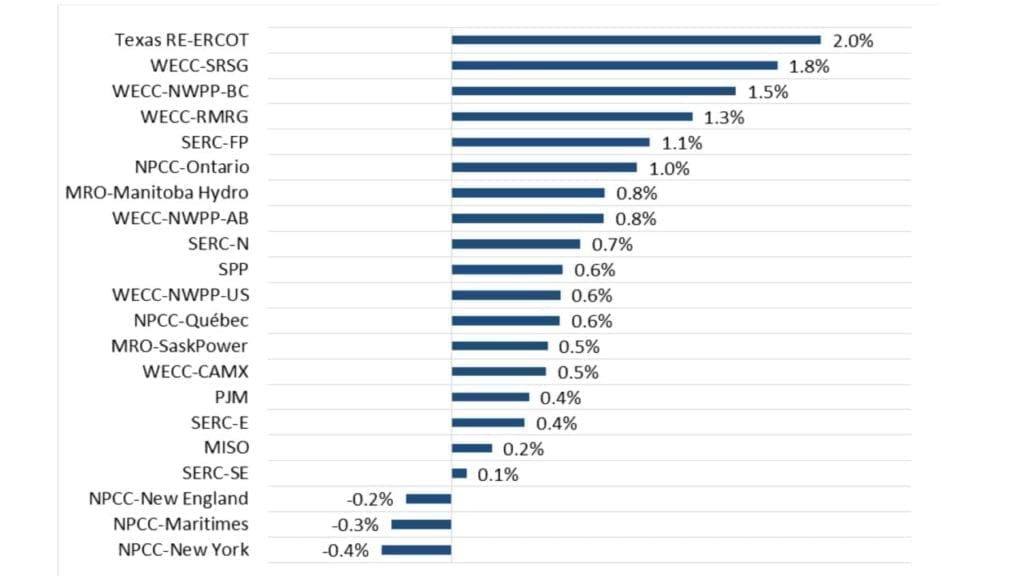

Another notable change in the new assessment is that peak demand—which has stayed flat and even declined in some regions since the 2008 economic recession—is set to tick upwards slightly. “We see, for the first time in 15 years across North America—if you look at the whole footprint of North America—a slight increase in peak demand. Just above half a percent per year for both summer and winter,” Moura said. “And that’s important not only because we have to build resources to offset retiring generation, but we need to build resource to account for an accommodate the new load on the system.”

ERCOT will lead demand growth among regions, followed by regions in WECC, but a few regions will actually see negative growth, Moura noted.

But NERC also highlights concerns about “significant unanticipated electricity demand growth,” such as from a rapid growth of transportation-related or industrial demand. “Plug-in electric vehicles (EVs) are projected to account for as much as half of all United States new car sales by 2030. The electricity required to charge these vehicles will increase demand on BPS,” NERC says. However, while NERC’s scenario analysis takes EV growth into account, it doesn’t provide a blanket statement on how much EV growth could affect demand. Asked about it, Moura replied that on a whole, the impact was “not a lot—at least not in the five to 10 years.” He explained: “Its not going to be the kind of change in the way that we’ll need to procure capacity or be a significant demand component to future demand profiles in the next five to 10 years, at least.”

Texas and Ontario Will Be Hardest Hit

Among the regions that could be hardest hit by these new complexities are ERCOT and NPCC-Ontario.

identified as “adequate” through 2024. While NPCC-Ontario shows only a very small shortfall, TRE-ERCOT shows a shortfall of over 4,000 MW. Source: NERC 2019 Long-Term Reliability Assessment (December 2019)

NERC’s assessment projects that the anticipated reserve margin (ARM) in ERCOT will fall below a reference margin level (RML) of 13.75% in most of the first five-year period, though new Tier 2 resources (capacity that has been requested but not yet approved) under development could provide “more than sufficient” relief as they come into service. NERC projects the region’s ARMS could increase above the RML in 2021, but fall again below the RML until 2029. The region’s troubles will be rooted in a projected surge in summer peak demand of an average 1.3 GW from 2019 though 2023, as well as owing to the retirement of the 470-MW Gibbons Creek coal plant, starting in October 2018, and the cancellation of two planned natural gas plants worth a total 1.4 GW and the 324-MW Bethel Compressed Air Energy Storage project. Wind projects totaling more than 2.1 GW have also recently been canceled it says.

ERCOT appears optimistic even as it continues to warn that the region “continues to experience above-normal growth in peak electricity demand due to strong load growth in Far West Texas and along the coast where new industrial facilities are being constructed.” On Dec. 5, as it released its December Capacity, Demand and Reserves (CDR) Report, which includes planning reserve margins for the next five years, the grid entity that serves most of Texas raised its planning reserve margin for summer 2020 to 10.6%. That’s 2% higher than the 8.6% reserve margin ERCOT reported as it entered the peak demand season this summer, when, critically short of supplies, ERCOT warned that it could resort to emergency alerts if demand surged.

ERCOT’s most recent capacity report suggests new capacity additions from planned projects for summer 2020 total 7,633 MW. “Based on ERCOT’s current interconnection queue, the majority of new generation projects are renewable and small, flexible gas-fired resources,” the grid entity said.

In NPCC-Ontario, NERC projected a shortfall beginning in 2023, when the ARM falls below the RML to 15%, but rises to 17% in 2024, driven by nuclear retirements and refurbishments. The region’s RML for the summer peak varies over the 10-year period from 19% to 26%. The region will also need more reserves in 2020 “to account for the risk that nuclear refurbishments are not completed on schedule,” NERC says. However, it adds: “This risk varies from year-to-year. More reserves are needed when nuclear resources are off-line due to nuclear’s high availability compared to the other resources that will need to replace it. The Independent Electricity System Operator’s (IESO’s) long-term planning forecast anticipates there will be sufficient energy to meet demand and a limited need for new domestic capacity if existing Ontario resources are reacquired when their contracts expire.” NERC also notes that IESO is evolving its capacity market from the existing demand response to a capacity auction. Over the coming years, the auction could allow additional resources to participate, including off-contract generators.

MISO and WECC-CAMX (which focuses on California), meanwhile, resource changes and other factors are beginning to affect resource adequacy, and the regions are seeing signs of “potential energy deficits in the next five years.” NERC notes that in contrast to traditional risks, which are typically observed during the summer and winter peak conditions, “potential risk is being observed during shoulder and off-peak periods when solar and/or wind output is low.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

Updated (Dec. 19) with comments from call with John Moura, NERC’s director of Reliability Assessment and Performance Analysis. Slides from NERC’s call with reporters are here.