IEA/NEA: Renewables, Nuclear, Hydrogen Gaining Cost Competitiveness

By 2025, the economics of low-carbon generation technologies are poised to disrupt conventional fossil fuel generation so dramatically, onshore wind could have the lowest levelized costs of electricity (LCOE) on average, and nuclear power could emerge as the dispatchable low-carbon technology with the lowest expected costs.

Those are key findings in the Dec. 9-issued 2020 edition of the Projected Costs of Generating Electricity, a report that the International Energy Energy (IEA) and the Nuclear Energy Agency (NEA) jointly publish every five years as a forward-looking measure to help policymakers assess power generation technology costs.

The 2020 edition presents an analysis by the Electricity Generating Costs (EGC) Expert Group, a broad multinational coalition of government, academia, and industry experts, of plant-level cost data for 243 power plants set to be commissioned in 2025. The power plant data, received from 24 countries—mostly from the Organisation for Economic Co-operation and Development (OECD), but also Brazil, Russia, India, China, and South Africa —comprises a diverse set of generating technologies, but the EGC computes their LCOE using a common methodology that is identical for all technologies and countries.

The majority of the plants, 52, of the 243 plants are solar PV, followed by onshore wind (44), hydro (30), natural gas (26), and offshore wind (23). Smaller responses were received for coal (18), combined heat and power (12), nuclear (8), and storage (8), and others (14).

The 2020 edition, notably, diverges from previous editions of the IEA/NEA report because it presents a “value-adjusted” LCOE (VALCOE) measure to account for the increasing importance of “system costs”—costs at an existing system level rather than just on plant-level technology—within the context of the growing share of variable renewable energy (VRE) technologies. “Other things equal and, in particular, at identical levels of security of electricity supply, the more variable a resource and the less correlated with demand its output, the higher are the additional profile costs that it imposes on the system as a whole,” the report explains.

Also for the first time, the 2020 edition surveys costs associated with storage, fuel cells, as well as long-term operation of nuclear plants, and it provides an in-depth analysis of “boundary issues,” including carbon pricing and zero-emission credits; the costs of existing and new nuclear; sector-coupling (including for transport and heating); and emerging uses for hydrogen in the power sector. Finally, the report’s data is accompanied by an LCOE “calculator,” which allows users to select variables such as the discount rate, carbon, heat, coal, and gas price.

Key Findings: Low-Carbon Technologies Making Gains

Because it provides a thorough overview of the myriad factors driving energy transitions worldwide, the report serves as a crucial glimpse of where market forces may lead power generating technology development over the short-term.

However, the report is studded with generalizations. The methodology, for example, calculates the LCOEs for coal, nuclear and CCGT gas plants at the same assumed capacity factor of 85%, while the LCOEs for open cycle gas turbine gas plants are calculated at a capacity factor of 30%. For all renewable and CHP plants, it uses plant-specific factors. It also assumes a carbon price of $ 30/ tonne of CO2 (tCO2, a figure that the report suggests “reflects the expected average social costs of emissions over the technology’s lifetime.”

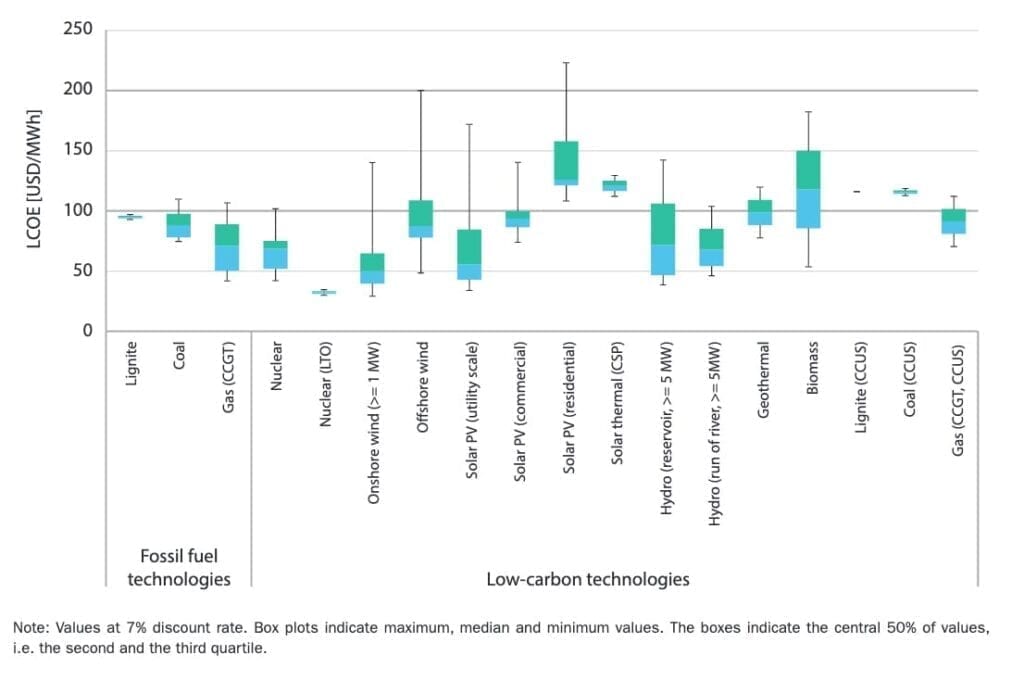

Still, its most prominent insight from the report is that LCOE of low-carbon generation technologies are falling—increasingly below the cost of conventional fossil fuel generation. “With the assumed moderate emission costs of $30/tCO2 their costs are now competitive, in LCOE terms, with dispatchable fossil fuel-based electricity generation in many countries,” it says.

However, the aggregated data “does not tell the whole story of levelised generation costs,” the report acknowledges. “Due to more or less favourable sites for renewable generation, varying fuel costs and technology maturity, costs for all technologies can vary significantly by country and region. In addition, the share of a technology in the total production of an electricity system makes a difference to its value, load factor and average costs,” it says.

Onshore wind, in particular, is expected to have, on average, the lowest LCOE of electricity generation in 2025. “Although costs vary strongly from country to country, this is true for a majority of countries (10 out of 14),” the report says. If deployed at large scales, solar PV could also be “very cost competitive,” and offshore wind, which is “now significantly below” $100/MWh is also “in a competitive range.” Both run-of-river and reservoir hydro can also provide competitive alternatives, “but costs remain very site-specific,” the report says.

Coal and gas units with carbon capture, utilization, and storage (CCUS)—the data came only from the U.S. and Australia—aren’t currently cost competitive with unmitigated fossil plants, nuclear, and some VRE at a carbon price of $30/tCO2. “CCUS-equipped plants would constitute a competitive complement to the power mix only at considerably higher carbon costs,” the report finds. For coal plants, CCUS units could become competitive at around $50 to 60/tCO2. For gas-fired CCGTs, only carbon prices above $100/tCO2 would make plants with CCUS competitive. “At such high carbon prices, renewables, hydroelectricity or nuclear are likely to constitute the least-cost options to ensure low-carbon electricity,” it says.

Optimism for Nuclear

In terms of dispatchable power, nuclear will have the lowest-expected costs of all low-carbon options in 2025, the report suggests. Large hydro reservoirs can provide “a similar contribution,” but they remain “highly dependent on the natural endowments of individual countries,” it says. Meanwhile, compared other fossil generation, nuclear plants will likely be more affordable than coal-fired plants, it suggests. And while gas-fired combined cycle gas turbines (CCGTs) are competitive in some regions, “their LCOE very much depend on the prices for natural gas and carbon emissions in individual regions.”

However, the results vary for different nuclear opportunities. The most cost-competitive option for now is through long-term operation (LTO) by lifetime extension. Expenses to prolong the lifetimes of nuclear reactors beyond the typical 40 years (for light water reactors [LWRs]) usually vary, because they involve replacement of heavier components during extended outages, and factor in labor and indirect costs, such as project management, regulatory and licensing costs, and initial engineering costs. However, in many regions, LTO has a LCOE ranging from $30–50/MWh, and according to one recent NEA expert group analysis, average overnight LTO investment could range from $450/kWe to $950/kWe. “It remains not only the least cost option for low-carbon generation—when compared to building new power plants—but for all power generation across the board,” the report says.

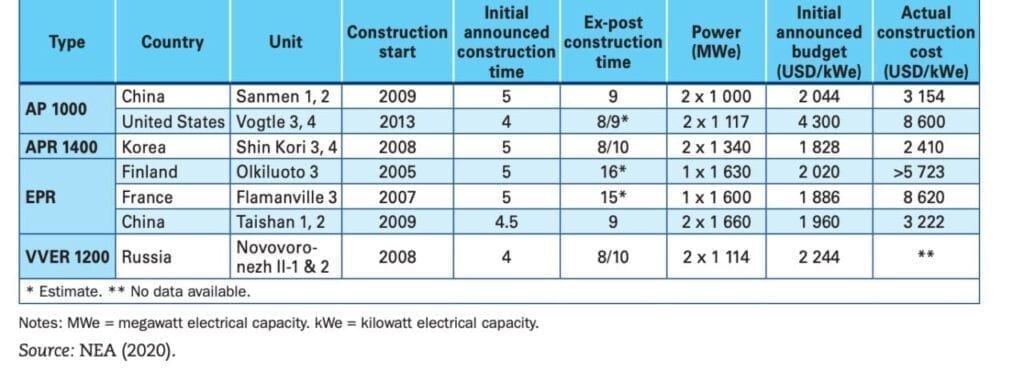

The report, which dedicates a chapter on the costs of existing and new nuclear power plants, also assesses costs for first-of-a-kind (FOAK) Generation III projects. Especially in most OECD countries, large FOAK nuclear projects have suffered cost overruns and delays, it notes, but “these issues are not present in countries that have been building plants continuously,” like China and South Korea. “If the nuclear industry in western OECD countries takes advantage of the accumulated experience and the lessons learnt from recent projects, nuclear plant construction can enter in a more rapid learning phase allowing it to deliver the next projects at lower cost and with significantly less uncertainties,” it concludes. Near-term overnight cost reductions of between 20% and 30% could be achieved, it suggests.

Citing a 2020 NEA study that focused on construction cost reductions, the report highlights eight drivers that could reduce risk for large Generation III reactor projects. These include design maturity—ensuring the detailed design is completed and ready for construction; project management; a predictable and stable regulatory regime; and serial construction, which helps build up supply chain capabilities. More active government intervention, meanwhile, could drastically reduce financing costs, “which can represent 80% of the total investment costs,” it says.

The report is also notably optimistic about costs for small modular reactors (SMRs), which span between 10 MWe and 300 MWe. It notes that while smaller cores can provide myriad benefits, they have a “negative effect on the on the economic competitiveness of the unit,” which is why reactor designers have traditionally scaled reactors up to take advantage of economies of scale. “To counterbalance the impact of diseconomies of scale, the business case of SMRs is supported by economies of series production, which in turn relies on design simplification, standardisation and modularisation,” it says.

Broadening the value proposition for SMRs will also require applications outside just providing baseload electricity, it suggests. Most advanced designs such as non-LWR SMRs that are designed to have higher operational temperatures could, for example, supply process heat for industrial sectors, be part of integrated hybrid energy systems, and provide flexibility or resilience in remote areas. “The construction of first prototypes may materialise some of the announced benefits of SMRs and thus accelerate their commercial viability,” the report concludes. “Government support is also essential on this front.”

Flexibility Provides Value and Storage

The report’s VALCOE analysis—which takes into account how system-specific characteristics interact with the technical and economic characteristics of different technologies, for example, their variability, dispatchability, response time, cost structure, and place in the merit order—is also revealing.

“The results illustrate that a technology’s plant-level generating costs can vary significantly from its value to the system,” the report says. “The importance of taking this into account is especially striking when considering variable renewables: solar PV units show a high correlation in the output of individual plants resulting, in the analysed scenarios, in a significant reduction of the generation value with increasing shares. Curtailment during hours of high production is an additional issue and may in practice reduce load factors and increase LCOE compared to reported values.”

The report suggests technologies that produce power only for a short period with very high prices provide an average higher value per unit of generation to the system. “Baseload plants, typically CCGTs (an exception is Europe, where they are mostly operating during hours with high residual load), coal and nuclear, that produce reliably over a high number of hours provide a value similar to the system average.”

Also notable is that the report introduces a levelized cost of storage (LCOS), but it is mainly based on inter-temporal energy arbitrage—or “buying electrical energy when it is cheap, storing it for a carefully determined time-period and selling it at a later moment at a higher price.” The LCOS, which the IEA eventually intends to refine into “a single coherent approach,” takes into account fixed capital investment for the storage and fuel costs (for the electricity used for charging). In the future, the IEA intends to cover other applications, ranging from ancillary services to facilitating seasonal storage. “The competitiveness of different storage, and in fact broader flexibility options, will depend on their costs and on the price dynamics, i.e. the market designs and load curves, for the different applications,” the report says.

Hydrogen’s Emerging Lucrative Place in Power

The report’s dedicated chapter on hydrogen provides a detailed overview of the gas’s potential uses and economics across a broad array of sectors. In the power sector—where hydrogen accounts for less than 0.2% of electricity generation today—hydrogen may open up new opportunities for linkages to other sectors, including road transport, domestic heat, and industrial high-temperature heat, it says.

Among emerging uses for hydrogen are for the integration of renewable power though electrolyzers, which can help absorb high renewables generation at times of low demand and support baseline technologies to avoid ramping. “However, these opportunities will only be realised if the resulting full load hours when surplus electricity is available are high enough to justify the investment of the electrolyser,” it says. The report notably also surveys efforts to demonstrate hydrogen production at nuclear plants.

Notably, interest in hydrogen is spurring rapid deployment of electrolysis technologies, both in the number of projects and their size. Numerous projects in the range of 1 to 6 MWe have been deployed since 2013 and a 10-MWe power-to-hydrogen project began operation in Japan this April. Looking ahead, “Up to 2.8 GW in large-scale projects have been announced to be deployed just in the next three years, what could bring the installed capacity to 3 GW by 2023,” the report says. “This could start creating economies of scale that will help to drive down capital costs and to scale up the supply chain of the electrolyser industry.”

Costs associated with hydrogen’s storage attributes, meanwhile, are also shifting. “Hydrogen and ammonia have relative low cycle efficiencies (around 40%), resulting in very high costs for short-term storage,” the report says. “However, the costs for the storage volume are very low, so that the costs when moving to longer storage periods and lower cycles increase only slightly. As a consequence of this, hydrogen and ammonia result in the lowest cost of storage when discharge duration reaches 20-80 hours or more, depending on the price of electricity. Moreover, it can become competitive against flexible power generation from natural gas with CCUS under certain natural gas prices.”

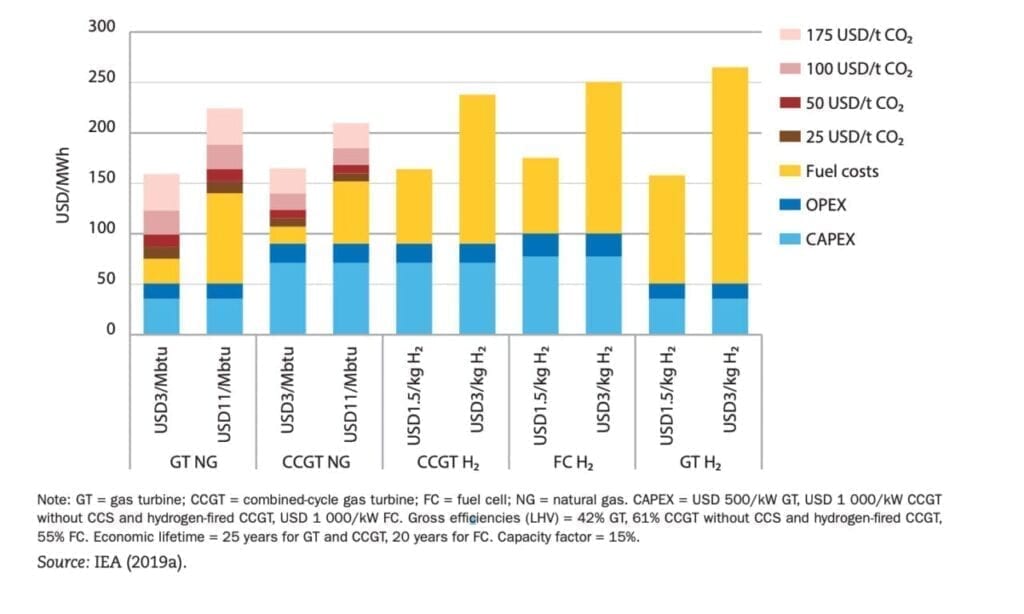

Using a hydrogen as a fuel for power generation, such as in gas turbines, combined cycle gas turbines, and fuel cells also holds promise. Though high-volume hydrogen gas turbines are still under development, interest is surging in stationary fuel cells, reflected by a rapid expansion of global installed capacity over the last decade. In 2018 almost 1.6 GW of capacity had been installed; most run on natural gas and only around 70 MW with hydrogen. Another emerging opportunity is to co-fire ammonia and coal, as has been demonstrated in Japan, it notes.

However, the economics for these technologies vary. “The competitiveness of hydrogen technologies against natural gas for flexible power generation (load balancing and peak load generation) depends on the hydrogen and gas prices and the potential application of carbon prices (or comparable policy measures penalising CO2 emissions),” the report says. At low a hydrogen price ($1.5/kg H2) and a high natural gas price ($11/MBtu), hydrogen technologies would require CO2 penalties in the range of $25-50/tCO2. But, in a scenario with low natural gas prices ($3/MBtu) these penalties will need to reach $175/t CO2 for hydrogen technologies to become competitive against natural gas, it says.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).